Issue Paper #1 - Funding Options

advertisement

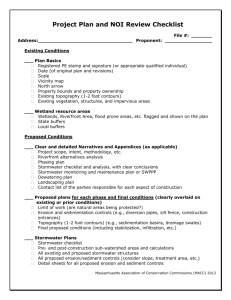

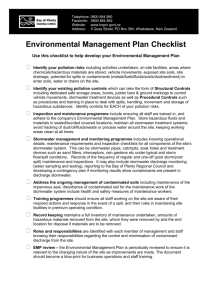

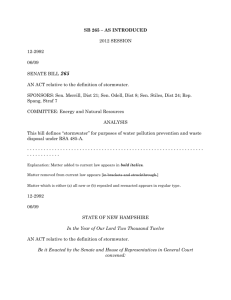

ISSUE PAPER #1 FUNDING OPTIONS Issue On September 29, 2010, Lane County’s Board of County Commissioners directed staff to begin a process of investigating the feasibility of a stormwater utility. According to a staff report from October 8, 2010, the purpose of the utility would be to provide “a secure, adequate, flexible, and equitable funding mechanism to enable the County to meet its anticipated future stormwater expenses.” Two issues are of particular concern. First, the County pays for its stormwater programs through the County Road fund, and this funding source is facing significant reductions due to the loss of fed eral “Secure Rural Schools” money. Second, the County’s stormwater expenses are increasingly unrelated to roads and therefore cannot be paid from Road Fund monies. This paper analyzes funding options for county stormwater programs in Oregon and provides a recommendation based on that analysis. Alternatives Funding options that are most relevant to county stormwater programs in Oregon are listed below: Road Fund General Fund Utility charges Permanent rate property tax Local option property tax System development charges Local improvement districts Reimbursement districts General obligation bonds Revenue bonds Grants and loans We briefly analyze these options below. Analysis County Government vs. County Service District Which funding sources are available depends partially on the entity that serves as the stormwater management agency. Currently, stormwater services are provided by the County. Alternatively, a county service district could be formed to perform this function instead of the County itself. A county service district can be viewed as a geographically and financially flexible form of municipal utility. A county service district is geographically flexible because ORS 198.720 affords great latitude in setting the district’s boundaries. Cities, however, must consent to their inclusion. A county service district is financially flexible because of the variety of revenues that it is allowed to collect. These revenues are enumerated in ORS 451.490, but the two major categories are user charges and property tax. FCS GROUP 1 www.fcsgroup.com Lane County ISSUE PAPER # 1 –FUNDING OPTIONS 09/29/2011 User charges can take many forms, including monthly fees, one-time fees, and system development charges. While monthly fees can be a substantial source of revenue, counties typically do not have a billing mechanism in place that would allow such fees to be implemented without significant county-wide investment. Formation of county service districts is governed by ORS 198.705 to 198.845 and ORS Chapter 451. The process can be initiated in one of three ways: (1) petition of 15 percent of electors (ORS 198.800), (2) petition of all landowners within the boundaries of the proposed district (ORS 198.830), or (3) county board’s own motion (ORS 198.835). However the process is initiated, the next step is a first public hearing held by the county board. If the county board is inclined to form the district after the first public hearing, it will schedule a second public hearing. If the county board both (1) receives written objections from fewer than the lesser of 15 percent or 100 electors within the boundaries of the proposed district by the second public hearing and (2) does not intend to levy any form of property tax, the county board may order the formation of the district without an election. If both conditions are not met, then voter approval would be required. Clackamas County provides a case study for the use of county service districts to provide stormwater services. Among the entities with an MS4 permit within this county are two that are organized as county service districts: Clackamas County Service District #1 and the Surface Water Management Agency of Clackamas County. These districts do not collect property tax but rely instead on user charges that include monthly fees, planning fees, and system development charges. Road Fund Lane County can (and currently does) use its Road Fund to fund road-related portions of its stormwater program. However, any portion of the stormwater program that is not road-related must be funded from another source. General Fund The General Fund can be used to fund any part of a stormwater program, but these monies tend to be the most scarce in a local government. Utility Charges It is common for cities to establish stormwater utilities by passing a stormwater ordinance and charging a stormwater fee. This fee is usually added to an existing bill for water and/or sewer services. However, we know of no counties in Oregon that have established a stormwater utility by ordinance. Before exploring this option further, the County should secure a legal opinion regarding (1) its authority to establish a stormwater utility and (2) the relationship of that utility to existing municipal stormwater utilities within the county. County service districts, on the other hand, routinely use utility charges in the same manner as municipal utilities. Permanent Rate Property Tax ORS 451.547 allows county service districts to vote on the establishment of a FCS GROUP 2 www.fcsgroup.com Lane County ISSUE PAPER # 1 –FUNDING OPTIONS 09/29/2011 permanent property tax rate. Though such a funding source may be politically problematic, it would offer the greatest stability and administrative ease of all potential revenues. According to data obtained from the Oregon Department of Revenue, 25 service districts (a “service” district being just one type of special district) have a permanent property tax rate. Among these, the median permanent rate is $0.075 per $1,000 of assessed value. However, many of these districts are educational in nature, and none is a stormwater utility. Local Option Property Tax Although Section 11(3)(b), Article XI of the Oregon Constitution prohibits the County from raising its permanent tax rate to fund a stormwater utility (or for any other reason), the County can raise operating funds from a local option operating levy under Section 11(4) of the same article. Such levies can be imposed for up to five years for operating expenses or up to ten years for a capital project. Although a local option levy is a form of property tax, revenue derived therefrom is more risky than revenue derived from a permanent rate. When overlapping tax rates exceed the Measure 5 limits for any individual property, local option levies are the first tax rates to be compressed (to zero, if necessary) before any permanent rates are reduced. This funding source is also available to a county service district, whether or not it has a permanent tax rate. Capital-Only Funding Options Additional funding options are available for the capital (but not operational) needs of a stormwater utility. FCS GROUP System development charges (SDCs). ORS 223.297 to 223.314 allows local governments (however organized) to impose SDCs for capital improvements related to stormwater. SDCs are one-time fees imposed on new development or certain types of “major redevelopment.” They are intended to recover a fair share of the costs of existing and planned facilities that provide capacity to serve growth. Consequently, SDC revenues may only be used as a funding source for projects that add capacity to the system. SDCs cannot be used for operation or routine maintenance. Local improvement districts (LIDs). ORS 223.387 to 223.401 provides jurisdictions in Oregon the statutory authority to establish LIDs and levy special assessments on the benefited property to pay for improvements. LIDs result in upfront or annual payments from affected property owners within a district. LIDs are payable in annual installments for up to 30 years. LIDs are generally used for capital improvement projects that benefit numerous large tenants and/or private property owners. The future revenue stream generated by LIDs can be used by local governments to obtain financing through the use of loans (e.g., Oregon Public Works Trust Fund) or bonds (e.g., issuance of revenue bonds). Reimbursement districts. Similar to LIDs, jurisdictions can negotiate public/private advance financing arrangements with developers, where a 3 www.fcsgroup.com Lane County ISSUE PAPER # 1 –FUNDING OPTIONS 09/29/2011 developer agrees to front capital improvements/investment (such as a new local park or traffic signal) within a designated zone of benefit district (ZBD). The local jurisdiction that adopts a zone of benefit applies a special development impact fee that is charged based on a proportional benefit to properties for the capital infrastructure. The developer is then partially reimbursed as new land use development approvals are granted within the ZBD over a period that usually extends 10-15 years. However, there is no guarantee that future revenues will be as steady and reliable as with the LID or property tax assessments. General obligation bonds. The County (or its service district) can use general obligation bonds to finance capital improvements. This method of financing requires voter approval. Revenue bonds. If user charges produce a reliable revenue stream, revenue bonds may be an option. Revenue bonds do not require voter approval, but they do require adherence to covenants such as minimum debt service coverage ratios. Grants and loans. Some state- and federally administered grant and loan opportunities, such as the Federal 319 Program, are available for capital funding. For convenience, we have compiled selected information and analysis about funding sources below. The following table reflects three important considerations. First, some revenues must be spent on capital, while others may be spent on operations. Second, most funding sources are available to the County itself (except a new permanent rate property tax), and many are also available to a county service district. Third, any revenue source collected through property taxes requires voter approval. May Be Spent on County Requires County Service Voter Operations Capital Government District Approval Funding Source Recommendation FCS GROUP May Be Imposed by Road Fund (existing) General Fund (existing) Utility charges ? Permanent rate property tax Local option property tax System development charges Local improvement districts Reimbursement districts General obligation bonds Revenue bonds Grants and loans We recommend that the County establish a stormwater utility as a county service district. We further recommend the use of more than one of the funding options as needed to meet the County’s objectives. 4 www.fcsgroup.com