23 July 2015

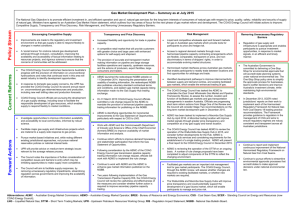

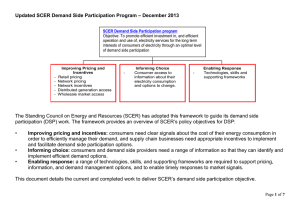

advertisement

COAG Energy Council Reform Agenda Implementation Plan – Progress Report Issue Date: 23 July 2015 NOTE: This Plan covers the Council’s current strategic priorities only – it is not intended to reflect the Council’s full work program Key Theme Generation Key Objective + Outcome for Consumers Reducing Investment Uncertainty To provide certainty to market participants and consumers about the Energy Council’s policy of maintaining the existing market design, where generators are paid for the electricity they produce, and confidence that this market design will deliver least cost electricity over the long term to consumers Wholesale Market Monitoring To ensure the market is flexible and responsive to changing circumstances (such as government policy, increases or decreases in prices and entry or exit of generation plants) by monitoring the wholesale market to identify and quantify the costs of inefficiencies Key Actions Key Milestones and Status Delivery Timeframe 1. Make a strong public commitment to the energy only market in the National Electricity Market (NEM) and to not pursuing policies which add unnecessary regulatory or policy risk, and to not entertaining proposals for consumers or governments to provide financial assistance to support closure a. Statement of policy intent (COMPLETED) a. Dec 2014 2. Introduction of an explicit wholesale market monitoring function for the Australian Energy Regulator (AER) by amending the National Electricity Law a. Draft bill of amendments to the National Electricity Law (for consultation) (IN PROGRESS) a. Aug 2015 b. Final bill of amendments to the National Electricity Law to be considered by the Energy Council c. Sep 2015 c. Explanatory paper setting out how submissions were incorporated in the bill’s drafting process b. Sep 2015 d. TBC d. Final bill of amendments to the National Electricity Law as introduced into South Australian Parliament Generator Reliability Performance To provide confidence that generators are maintaining equipment to deliver a reliable and secure electricity supply despite lower electricity prices Barriers to Generators Exiting the Market To ensure that generators are not facing any barriers in the National Electricity Law and Rules (regulatory arrangements) that would prevent them from exiting the market in response to market price signals, while ensuring the electricity system continues to operate in a reliable and secure manner Power System Security and Reliability To ensure the National Electricity Rules provide the market operator with the capacity to maintain system security and reliability for consumers in light of the increase in intermittent renewable energy generation Networks Strategic Assessment of Network Regulation – Scenario Analysis To assess the effectiveness of the current arrangements for setting electricity network businesses’ revenues in light of changes in technologies and use patterns to make sure consumers will not be faced with paying more than necessary for a reliable and secure supply of electricity Network Tariff Reform To ensure network tariff reform is seen by stakeholders as a key priority for Ministers to support the efficient utilisation of the network by consumers, enable the efficient integration of new technologies and lower future network costs To ensure consumers understand the benefits of tariff reform and how they can respond to maximise those benefits and better manage their energy bills 3. Increase monitoring of generator reliability performance in light of the oversupplied market a. Australian Energy Market Operator (AEMO) to provide ongoing advice on reliability outcomes (ONGOING) Ongoing 4. Request AEMO to advise whether current regulatory arrangements are sufficient to ensure the potential exit of generators does not jeopardise power system security and reliability a. AEMO to provide advice on current regulatory arrangements (COMPLETED) a. Jun 2015 b. AEMC to provide advice on current regulatory arrangements (COMPLETED) c. End 2016 5. Request the AEMC to advise whether there are any material barriers in the regulatory arrangements that might reasonably constitute barriers to exiting the market c. Advice to the Energy Council on a potential future reform programme (if necessary) (NOT STARTED) 6. Examine whether there is a need to improve the Rules under which system security is achieved a. AEMO to provide advice on the adequacy of existing Rules a. Sep 2015 b. Advice to the Energy Council on a potential future reform programme (if necessary) b. End 2015 7. Undertake a strategic assessment of the likely performance of the existing network economic regulatory model against potential future scenarios to test the adequacy of the current regulatory framework a. Advice to the Energy Council on the need for further work (IN PROGRESS) a. Jun 2015 8. Make a public commitment to the ongoing need for network tariff reform to support better price signals for energy consumers, winding back of cross subsidies and integration of new technologies, while conveying a clear expectation to industry that it take leadership in moving early to more cost reflective tariffs a. Public commitment via Energy Council communique (COMPLETED) a. Dec 2014 9. Support effective communication on the benefits of tariff reform to support faster transition and take up of new tariffs a. Engage with energy market bodies, industry stakeholders and consumer advocates on communication requirements and role of government(s) (IN PROGRESS) a. Apr 2015 b. Jun 2015 b. End 2015 b. Report to the Energy Council on the outcomes of actioning the further work and a report on the progress of longer term work (IN PROGRESS) b. End 2015 Page 1 of 7 Key Theme Key Objective + Outcome for Consumers Key Actions Key Milestones and Status Delivery Timeframe b. Officials to develop and implement agreed communication activities/strategies Optional Firm Access Design and Testing To ensure the regulatory arrangements are delivering least cost electricity for consumers by optimising investment in generation and transmission to facilitate an efficient wholesale market National Framework for Reliability Standards To ensure consumers are not paying for a higher level of network investment than is necessary by setting reliability requirements in a way that reflects the value customers place on reliability 10. Engage with the AEMC as it tests and further develops the proposed optional firm access model, undertake timely assessment of this work and determine the need for further reform of transmission frameworks, if necessary a. AEMC’s final report/AEMO advice (COMPLETED) a. Jun 2015 b. Policy response to AEMC/AEMO (IN PROGRESS) b. Sep 2015 11. Progress next steps included in the Energy Council’s response to the AEMC’s Review of the National Framework for National Distribution Reliability and Review of the National Framework for Transmission Reliability a. Jurisdictions to report to the Energy Council on their position on applying the high-level principles for setting distribution and transmission reliability requirements (IN PROGRESS) c. Submit a rule change request (if needed) b. Advice on consistent reliability standard setting processes (COMPLETED) c. Advice on a national reference template for transmission reliability standards (COMPLETED) d. Advice on the process by which jurisdictions could transfer administration of their reliability requirement setting processes to the AER in the future (COMPLETED) a. Jul 2015 b. Jul 2015 c. Jul 2015 d. Jul 2015 e. Jul 2015 f. Mar 2015 g. End 2015 e. Advice on compliance monitoring and enforcement arrangements (COMPLETED) f. Submit a rule change request around adoption of common definitions for distribution reliability measures (COMPLETED) g. Estimations for value of customer reliability (ONGOING) Review of Limited Merits Review To look into evidence from the outcomes of appeals under the reformed limited merits review framework to determine whether the Australian Competition Tribunal was able to deliver the policy intent – Council to initiate review of the Tribunal’s role by 1 December 2016 Retail National Energy Customer Framework (NECF) Implementation To progress energy market reforms through to completion to ensure consumers receive the full benefits Review of Derogations and Differences To ensure consumers in all jurisdictions are provided the same level of protection irrespective of where they reside National Energy Customer Framework (NECF) Review To maintain a NECF that is flexible and responsive to changing circumstances, ensuring consumers are protected as levels of consumer choice and engagement increase and new product offerings become available Retail Energy Price Reporting To review the existing retail energy reporting frameworks to ascertain whether these are still designed appropriately for the current retail market within the NEM Deregulation of Retail prices To ensure efficient and competitive retail energy markets for the benefit of consumers and the energy sector alike 12. Assess whether the amendments to limited merits review framework delivered the policy intent a. Finalise Review Terms of Reference a. Sep 2016 b. Review final report b. May 2017 c. Develop recommendations c. Oct 2017 13. Publish clear timelines for completing application of the National Energy Customer Framework (NECF) a. Seek advice from the Victorian and Northern Territory Governments as to NECF implementation timelines Ongoing 14. Assess opportunities for harmonisation of jurisdictional differences a. Individual jurisdictions to report on their NECF derogations a. Late 2015 b. Report on opportunities for harmonisation b. Mid 2016 15. Assess whether the NECF requires enhancement in light of the ongoing change taking place in competitive energy markets particularly as it regards the introduction of new technologies, products and services a. Assess issues raised in the new products and services consultation (refer action 20 below) a. Late 2015 16. Officials to further consider the proposed rule change request to allow the AER to undertake retail energy price reporting for jurisdictions with deregulated retail energy prices and those that opt into such reporting. Officials to consider the scope, including costs and benefits, of the price reporting function, which jurisdictions may choose to adopt. a. Consultation (COMPLETED) a. May 2015 b. Advice to the Energy Council b. Jul 2015 17. Jurisdictions to work towards effective competition where it does not exist to allow greater opportunities for innovation in and choice of retail offers, and provide advice to the Council on the current state of competition and policy settings to fulfil this commitment a. Jurisdictional transition plans on price deregulation a. Ongoing – being progressed at jurisdictional level b. Mid 2016 b. Advice to the Energy Council on the need for further work Page 2 of 7 Key Theme Key Objective + Outcome for Consumers Residential Electricity Price Trends To provide information on the drivers of potential movements in prices in order to facilitate consumers understanding and engagement in the electricity market Power of Choice Review – Council Actions To ensure consumers can effectively engage with the energy market to make informed choices which maximise the benefits of their energy use decisions Key Actions Key Milestones and Status Delivery Timeframe 18. AEMC to prepare annual report providing information on the supply chain components expected to affect the trends in residential electricity prices for each state and territory of Australia over a rolling three year period. a. Annual Report a. Ongoing – report to be published by end of given reporting year 19. Progress actions with industry and energy market bodies to improve consumer experiences with the energy market including enhanced switching procedures, improved data access and development of effective decision making tools a. Finalise two draft rule change requests to give effect to the recommendations in the AEMC’s review of customer switching arrangements in the NEM to improve the timing and accuracy of the customer transfer process a. Sept 2015 b. Jul 2015 b. Advice to the Energy Council on the need for further work (including potential rule changes) Demand Side Participation Third Party Regulation Review To consider whether the regulatory frameworks in the National Electricity Market (NEM) will enable customers to benefit from innovative products and services while ensuring that appropriate consumer protections and safeguards for the operation of the electricity market and networks are in place Demand Response Mechanism (DRM) To support greater competition in demand response services and allow demand response to compete with generation in balancing the market Smart Meter Rollout To ensure the governance arrangements are in place for the effective rollout of smart meters and consumer access to demand side services to help them better manage their energy bills 20. Review of how new products and services in the electricity market should be regulated, particularly when they are offered by parties not currently covered by the national energy laws a. Consultation process (COMPLETED) a. Dec 2014 – Feb 2015 b. Officials to develop position paper for Energy Council (IN PROGRESS) b. Jul 2015 21. Introduction of a DRM and changes to existing rules to allow for the unbundling of ancillary services a. Submission of rule change request to AEMC (COMPLETED) a. Mar 2015 b. AEMC rule change process commences b. Pending c. AEMC draft determination c. TBC d. AEMC final determination d. TBC a. Australian Energy Market Commission (AEMC) draft determination on competition in metering rule change (COMPLETED) a. Mar 2015 22. Complete the regulatory framework for the competitive market-led rollout of smart meters and consumer access to demand side services to help them respond to cost reflective network tariffs c. Jul 2015 c. Agreement to next steps b. AEMC final determination on metering rule change and advice on implementing shared market protocol (IN PROGRESS) b. Nov 2015 c. Mar 2016 c. Submit a rule change request on shared market protocol National Smart Meter Consumer Protections To develop rules to provide additional consumer protections for customers who have a smart meter installed 23. Amend the National Energy Retail Rules to implement the National Smart Meter Consumer Protections a. Second exposure draft of the National Energy Retail Rules amendment a. Sep 2015 b. Stakeholder consultation on second exposure draft c. Mar 2016 b. Sep 2015 c. Finalise NERL amendment rule Energy and Carbon Policy Improving the Alignment of Carbon and Energy Policy Settings To maximise the benefits of greater alignment of carbon mitigation and energy policy settings and the benefits of greater harmonisation in promoting efficient outcomes for energy businesses and consumers. 24. Explore how the national energy market bodies can provide input into the development and implementation of carbon mitigation policies in relation to their impact on the energy markets and the National Electricity and Gas Objectives a. Officials’ paper to Energy Council setting out specific recommendations following consultation with the energy market bodies. a. Late 2015 25. Develop clear and consistent frameworks for the deployment of solar-battery storage products and identify and address inefficient barriers to their update a. To be implemented in accordance with the actions and timeframes for the Strategic Work Programme (see actions 41 and 42 below) N/A 26. As part of developing the National Energy Productivity Plan, to publish a summary of existing energy market reforms and energy efficiency activities that have or will contribute to efficient decarbonisation of the energy sector a. To be implemented in accordance with the actions and timeframes for the National Energy Productivity Plan (see action 27 below) N/A 27. Request that AEMO expand the scope of the Power System Security and Reliability work (see action 6 above) to develop and consider scenarios in which the emissions intensity of generators influences the distribution and timing of generator exit a. AEMO to provide advice a. Late 2015 28. Ensure that the possibility of an accelerated deployment of solar-battery products, the Commonwealth Renewable Energy Target (RET) and jurisdictional schemes to promote increased investment in large-scale renewable energy, are a. AEMO to provide advice a. Late 2015 Page 3 of 7 Key Theme Key Objective + Outcome for Consumers Key Actions Key Milestones and Status Delivery Timeframe reflected in AEMO’s transmissions planning work and its advice Energy Productivity National Energy Productivity Policy Framework To provide national coordination across both energy efficiency policy and energy market reform to assist consumers (householders and business) to be engaged and empowered in relation to their energy use and costs to make better decisions Equipment Energy Efficiency To reduce energy bills for households and businesses in a cost effective way by driving improvements to the energy efficiency of new appliances and equipment sold; to improve the energy efficiency of new appliances and equipment that use energy and to also improve the energy performance of products that have an impact on energy consumption; and to reduce appliance and equipment related greenhouse gas emissions through a process which complements other actions by jurisdictions National Energy Efficiency Building Project Phase 2 To improve energy efficiency through greater compliance with the energy efficiency requirements in the building code in order to help reduce running costs and greenhouse gas emissions 29. Develop a new energy productivity policy framework, considering the way forward for national coordination holistically across both energy efficiency policy and energy market reform (including many measures listed in this Progress Report), building on the Australian Government Energy White Paper and to replace the National Strategy on Energy Efficiency a. Draft policy framework presented to Energy Council – seek authorisation for development of new and refinement of existing collaborative measures (IN PROGRESS) 30. Complete an independent review of the Inter-Governmental Agreement for the Greenhouse and Energy Minimum Standards (GEMS) Legislative Scheme no later than the third anniversary of the commencement of the GEMS Act a. Undertake review including stakeholder consultation (COMPLETED) a. Jul 2014 b. Review recommendations and draft response to be considered by Energy Council (IN PROGRESS) c. Dec 2015 b. Develop measures for consideration of Energy Council a. Jul 2015 b. Aug – Oct 2015 c. Dec 2015 c. Seek Energy Council approval of final policy framework and proposed measures b. Jul 2015 c. Implement agreed recommendations (NOT YET STARTED) 31. Deliver visible and practical pilot projects that respond to key recommendations of the National Energy Efficiency Building Project Phase 1 across the areas of building approval compliance checking, building approval document management, alterations and additions and consumer protection and develop a 5 year national strategy a. Project 1 – Pilot energy efficiency compliance audits for residential buildings under construction (IN PROGRESS) a. Jul 2015 b. Project 2 – Pilot Electronic Building Passport Documentation affecting energy efficiency in new residential buildings (IN PROGRESS) c. Jul 2015 c. Project 3 – Identifying pathways to improve compliance and consistency in the application of energy efficiency to alternations and additions (IN PROGRESS) b. Jul 2015 d. Dec 2015 e. Sep 2015 d. Project 4 – Enabling Consumer Protection organisational knowledge and responsiveness to residential built energy efficient non-compliance e. Project 5 – 2020 Steps, 5 year priority strategy for improving compliance with the energy efficiency provisions of the National Construction Code Nationwide House Energy Rating Scheme (NatHERS) 32. Management and strategic development of NatHERS To provide a useful, flexible and nationally consistent mechanism for governments to identify and promote energy efficient homes and set minimum building standards for designers, assessors, certifiers and builders to apply. A centrally administered national program can minimise regulatory costs and improve regulatory consistency. An easily identifiable, consistent energy rating empowers consumers to make appropriate choices when choosing a home Gas Australian Gas Market Vision To establish a liquid wholesale gas market, with a supportive investment and regulatory environment where an efficient reference price is established, that best serves the needs of participants, and provides market signals for investment and supply Australian Gas Market Development Plan To maintain an updated Australian Gas Market Development Plan that sets forth gas market specific reform actions that reflect the Energy Council’s vision for Australian gas markets, and improves the visibility and accountability of the work priorities of the Council a. Accreditation of all three software tools b. Impact assessment of integrating new climate files into the NatHERS Chenath Engine a. Ongoing – 1st stage Aug 2015 b. Sep 2015 c. House Energy Efficiency Inspection Project c. Jul 2015 d. Introduction of a Certificate IV as a minimum qualification for NatHERS assessors d. Jul 2015 33. Release an Energy Council vision for Australian gas markets which outlines the key areas for future gas market reform and development action a. The Energy Council identified four specific policy work streams that will comprise the next phase of gas market reform and development. The work streams have been incorporated into an updated Australian Gas Market Development Plan Ongoing 34. Release an updated Australian Gas Market Development Plan a. The Australian Gas Market Development Plan is updated biannually to reflect the ongoing developments to the Energy Council’s gas policy work stream Bi-annually Page 4 of 7 Key Theme Key Objective + Outcome for Consumers AEMC East Coast Wholesale Gas Market and Pipeline Frameworks Review To consider the role and objectives of the facilitated gas markets currently in operation on the east coast and set out a road map for their continued development in order to meet the Energy Council’s vision for Australian gas markets Gas Transmission Pipeline Capacity Trading To improve transparency and reduce transaction costs to facilitate gas transmission pipeline capacity trading and ultimately increase transmission capacity utilisation and deliver more gas to the market Unconventional Gas Reserves, Resources and Production To facilitate the responsible development of unconventional gas resources by bringing together a variety of measures already underway within jurisdictions Governance Review of Governance Arrangements for Energy Markets To consider the performance of current governance arrangements for energy markets and provide advice on potential areas of improvement to the institutions and their oversight by the Energy Council to ensure governance arrangements that support market outcomes that are in the long term interests of consumers, as stated in the National Electricity Objective, the National Gas Objective and the National Energy Retail Objective Review of Enforcement Regimes To ensure that enforcement regimes within the national energy laws operate effectively, represent current best practice, protect the long term interests of consumers, and support the efficient and fair operation of energy markets Key Actions Key Milestones and Status Delivery Timeframe 35. Task the AEMC to review the design, function and roles of facilitated gas markets and gas transportation arrangements with a report to be delivered to the first Energy Council meeting in 2015 and considered in light of actions that can be implemented to strengthen the structure and competitiveness of the east coast gas market a. Phase 1 report to the Energy Council (COMPLETED) a. Jun 2015 b. Draft Phase 2 report to the Energy Council ahead of its end of year meeting b. Dec 2015 36. Officials to submit a rule change request requiring the provision of enhanced pipeline capacity trading information in accordance with the Gas Transmission Pipeline Capacity Trading Decision Regulation Impact Statement (agreed by the Energy Council in December 2013) a. Officials to submit rule change request to AEMC (COMPLETED) a. End Mar 2015 b. AEMO to commence associated procedural change process c. TBC 37. Develop an annual and nationally consistent report on unconventional gas reserves/resources and production, including new well drilling rates a. Annual report to Energy Council for endorsement 38. Develop a Council (unconventional) gas supply strategy designed to facilitate the responsible development of gas resources, which will enable gas supply to respond flexibly to market conditions a. Develop draft strategy a. Mid- 2015 b. Seek Council agreement to strategy b. Dec 2015 39. Undertake a Review of Governance Arrangements for Energy Markets examining the broad energy market institutional structure created by the Council of Australian Governments as well as the legislative framework that establishes and assigns functions to institutions a. Terms of Reference (COMPLETED) a. Dec 2014 b. Engage Review Panel and commence review (COMPLETED) b. Feb 2015 c. Public consultation on Issues Paper (COMPLETED) c. Apr-May 2015 d. Progress Report to the Council (COMPLETED) d. May-Jun 2015 e. Draft Report to advisory committee (EWG) e. Jul 2015 f. Public consultation on the Draft Report f. Aug 2015 g. Final Report to the Energy Council g. Sep 2015 h. Release of Energy Council's response to the Final Report h. Dec 2015 a. Finalise project plan for agreed recommendations (COMPLETED) The plan will include capacity for: a. Jun 2015 40. Implement recommendations outlined in the Review of Enforcement Regimes under National Energy Laws as agreed by the Energy Council at the December 2014 meeting: b. End Mar 2016 c. AEMO to collect and publish enhanced data on its National Gas Bulletin Board website Annually b. Annual report published on Energy Council website I. A COAG consultation Regulation Impact Statement (RIS) for appropriate recommendations (a number of recommendations have been given an exemption from the RIS process) II. The development of a legislative amendments package which will include consultation a. Officials to implement recommendations 1 and 3 to 12 b. Officials to further investigate legal and policy options for recommendations 2 and 13 b. Jul and Dec 2015 c. End 2016 b. Provide a progress report to the Energy Council on the status of implementation, including advice on further work for recommendations 2 and 13 c. Finalise implementation of agreed recommendations Adoption of National Frameworks To minimise duplication of regulations that could increase burdens for market participants and, consequently, prices for consumers, by, to the extent appropriate, making sure the national legislation is able to by applied fully in all adopting states and territories 41. Examining barriers to the adoption of the national frameworks, where appropriate, in the non-NEM state and territory a. Advice on whether changes to the National Electricity Law (and National Gas and National Energy Retail Laws) are required to allow jurisdictions with non-interconnected systems applying the national frameworks a. End 2015 If necessary b. Draft bill of amendments to the National Electricity Law (and National Gas and National Energy Retail Laws) (for consultation) c. Final bill of amendments to the National Electricity Law (and National Gas and National Energy Retail Laws) to be considered by the Energy Council Page 5 of 7 Key Theme Key Objective + Outcome for Consumers Key Actions Key Milestones and Status Delivery Timeframe d. Explanatory paper setting out how submissions were incorporated in the bill’s drafting process e. Final bill of amendments to the National Electricity Law (and National Gas and National Energy Retail Laws) as introduced into South Australia National Energy Market Financial Market Resilience To confirm the nature of risks to the efficient functioning of the market from financial instability and to identify whether any additional measures may be required to manage those risks in order to minimise the disruptions to consumers and maintain the financial stability of the market and public confidence Strategic Work Programme To consider the direction of future energy policy in light of rapid changes to the energy sector and the primary aim of contributing to the achievement of the national energy objectives Resources Development Developing secure and competitive markets To improve Australia’s ability to compete for global investment to develop our mineral and energy resources and grow national prosperity 42. AEMC to undertake public consultation with market participants and stakeholders 43. Examine the regulatory frameworks applying in the energy sector in the context of new products and services a. AEMC second interim report (COMPLETED) a. Aug 2014 b. Final report to the Energy Council (COMPLETED) b. Mar 2015 c. Energy Council response (IN PROGRESS) c. Dec 2015 a. Advice to Energy Council about future direction of energy policy a. Dec 2015 b. Mid 2016 b. Develop implementation plan 44. Progress further work identified in the Strategic Assessment of Network Regulation and New Products and Services work streams (Actions 7 and 20 above) a. Commence work on immediate priorities a. Aug 2015 b. Update to the Energy Council on progress b. Dec 2015 c. Advice to the Energy Council on specific reforms (short term) c. Mid 2016 d. Advice to the Energy Council on specific reforms (long term) d. End 2016 45. Investigate means to improve transparency in the assessment, approval and regulation of resources development, including mining, petroleum and unconventional gas across jurisdictions a. Undertake transparency workshop with government agencies, industry and other key stakeholders (COMPLETED) a. May 2015 46. Implement the Mineral and Energy Resources Program of Work a. Develop implementation plan (IN PROGRESS) a. Jul 2015 b. Bi-annual reporting to the Energy Council (ONGOING) b. Ongoing 47. Annual report on implementation of the Multiple Land Use Framework (MLUF) a. First MLUF annual report to Council (COMPLETED) a. Dec 2014 b. Annual report on implementation of the harmonised framework for natural gas from coal seams (ONGOING) b. Ongoing c. Dec 2015 c. Second MLUF annual report to Council Petroleum Regulatory Reform To progress consistent upstream petroleum administration and regulation standards ( including through the establishment of a National Offshore Petroleum Regulator and responding to the Productivity Commission Review of Regulatory Burden on Upstream Petroleum Sector) Exploration and Investment Gas Emergency Response Mineral Exploration Investment To promote Australia internationally as the preferred destination for investment in mineral exploration and reverse the decline in Australia’s share of global mineral exploration expenditure National Gas Emergency Response Protocol To maintain the integrity of the gas supply system in the event of gas supply shortages that affect two or more jurisdictions and to mitigate their effect 48. Transitional arrangements and implementation of petroleum regulatory reform a. Update of Joint Authority Protocols to reflect current operational processes (COMPLETED) a. Jul 2015 49. Implement the National Mineral Exploration Strategy and UNCOVER initiative in order to discover major new economic mineral deposits beneath post-mineralisation cover a. UNCOVER Roadmap Phase I Report Launch (COMPLETED) a. Jul 2015 b. Phase II Planning b. End 2015 50. Implement the Mineral Exploration Investment Attraction Plan including the annual international promotion program for Australia Minerals a. Korea-Australia Mineral Exploration Investment Seminar a. Oct 2015 b. Japan-Australia Mineral Exploration Investment Seminar b. Oct 2015 c. China-Australia Mineral Exploration Investment Forum c. Oct 2015 d. China Mining Booth and Seminar d. Oct 2015 e. Prospectors and Developers Association of Canada Pavilion and Seminar e. Mar 2016 a. 23rd NGERAC Meeting (COMPLETED) a. May 2015 b. Conduct and report on Gas Supply Shortfall Emergency Management Mobilisation Exercise (COMPLETED) b. Jun 2015 51. Provide advice to the National Gas Emergency Response Advisory Committee on avenues available to manage the security of gas supply and curtailment during emergencies c. Jun 2015 c. Update Gas Contingency Planning Report (COMPLETED) Page 6 of 7 Key Theme Oil Security Key Objective + Outcome for Consumers National Liquid Fuel Emergency Response Plan To ensure that in the event of a severe national shortage of fuel, available fuel supply is managed, fuel is allocated in the most efficient and fair way and the impacts of any shortage on fuel users is minimised Key Actions 52. Provide advice to the National Oil Supplies Emergency Committee on ways to improve the National Liquid Fuel Emergency Response Plan (NLFERP) and emergency preparedness Key Milestones and Status Delivery Timeframe a. Monitor Review of Competition Law for implications on protocols and arrangements (COMPLETED) a. Jun 2015 b. Develop policy for the utilisation of fuel outside normal Australian standards for inclusion in the NLFERP (COMPLETED) c. Jun 2015 b. Jun 2015 c. Monitor impact of changes in liquid fuel markets and identify key implications (COMPLETED) Page 7 of 7