May 15, 2014 - Peter M. Wells Business Group

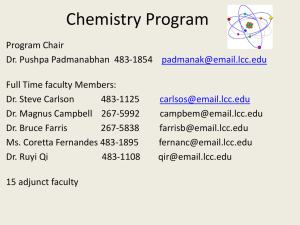

advertisement

Peter M Wells Business Group, LLC 1111 N. Marshall Street Suite 304 Milwaukee, WI 53202 262-347-6091 petermwells@peterwells.us May 15, 2014 To: Insurance Underwriting & Claims Executives Business Development Team Leaders From: Peter M Wells Business Group (Wells Group) Re: Insurance Innovation and Earnings Improvement Homeowners’ InsuranceWriters Learn New Ways to IdentifyMaintenance Behavior in Books of Property Business. Insurers Use Life-Cycle Cost (LCC) Data to Determine Maintenance Trends Reducing Claims Exposure(s) While Helping Policyholders Understand Maintenance Needs. For years homeowners’ writers use non-construction variables like credit to help identifytrends towards non-catastrophic building claims, suggestingpersonal investment is central to ongoing home maintenance. In one scenario it is assumed that lower credit scores align with a tendency to under-finance maintenancebecoming drivers of certain kinds of dwelling claims. Research by The Wells Group,however, suggests that less than 30% of homeowners actually have poor creditscores and the more than 60%with good scores also regularlyincurcomponent failure claims regardless of their ability to invest. Because homes naturally age and key systems deteriorate,Wells research demonstrates that it is first a condition of construction that needs to be consideredbefore non-related notional concepts since too many homeowners lack even thebasic knowledge about their home’s maintenance needs to have the credit discussion. It is this lack of insight that more often than not leads to component neglect. It is not clear what individual owners would do if they actually had the up-to-date knowledge required to stay current on key home systems that are about to fail. The New Home Maintenance Database Until recently there was no home maintenance databasethat owners and insurance companies could access that explainsthe ongoing maintenance needs for homes individually.Dwellings are unique and the life cycle trends for key systems,especially those that also affect insurance loss,had not been studied. More often than not then even ordinary maintenance has too often been a mystery and that by itself leads to neglect . . . yet,all this is changing. Now, using the detailed component-based approach of Life-Cycle Cost (LCC) dataanalytics from The Wells Group, owners and their insurance partners finally access at the click of the mouse full webenabledmaintenance reports that show the annual maintenance needs for any residential structure, with property specific scores insurers also access that rate the degree of seriousnessas affects specific loss perils. As important, LCC data can be combined with other data in the underwriting process to also identify on a construction specific basis those owners whose properties are likely to go to failure vs. those that proactively replace or repair. Using this analytic, LCC data is hugely instructional identifying at the property component level when owners need to take action so maintenance occurs, yet with fresh insight as to what the maintenance behavior pattern is for the book, individual owners and for various other market segments or variables. Information Bulletin Q2 – 2014 Page 2 Understanding Behavior in the Book . . . Component deterioration occurs in all homes which trends are different depending upon the specific property systems involved, the location of homes and other key variables. Uninformed or unprepared owners can incur claims as easily as those who under-fund repairs. Looking at the analytic we prepared working with more than 27 million property records the insurance industry provided, it is clear that losses occur across the book as much from ignorance as from a potential lack of funding, but there are degrees of behavior that smart underwriting can better understand and manage. In the home insurance market, incidents of maintenance related failures make up a significant portion of losses, the average claim now exceeding $9,000. Regardless of deliberate neglect or simple ignorance, construction life cycles are important to understanding and remediating exposures and no home is exempt. For improving profitability in the insurance equation, knowing which peril-related components in each home need attention and exactly whenis easily the best knowledge from which to take action – which smart insurance providers can share with policyholders who need to understand as well. Where Business Stands Today Since this kind of insight is new to the market, property business hasnot been exposed to this level of scrutiny before. When business reviews occur, it is often revealing the high maintenance concerns hidden in each book which danger may be masked by otherwise solid earnings. At the same time, carriers have not yet implemented outreach programs to policyholders although large numbers of recent advertising campaigns hint at the magnitude of the loss problem, but without a property specific solution. Lifting the roof to see the components that need maintenance is now possible with LCC data analytics. Information Bulletin Q2 – 2014 Page 3 Introducing LCC data to the underwriting process allows property writers to now dig in to find the challenges in books to improve risk selection, pricing and mitigation strategies that ultimately eliminate loss. Managing this concern and eliminating only 15% of property claims exposures yields savings industrywide exceeding $5 billion annually. LCC analytics defines the maintenance requirements and the seriousness of potential component failures in dwellings, and by also adopting our behavior analytics, insures now evaluate the rate to which business is likely to go to failure. Score Typical Book Of Business – Policies with Actionable LCC Scores – Pre-qualified Need For Inspections >90 Average - 30% of Policies Fall Into the Inspection Zone. Now Carriers Know Which Ones and Why. 80 70 Finding In Advance Through LCC Scores Those Properties with Component Issues That Need Inspection Review. Gain Financial Advantage. 60 50 Eliminate Properties From Inspection That Don’t Have Issues. Reduce Unnecessary Inspection Costs. 40 30 20 Average 25% of Policies Fall Into the Area of Limited Structural and Maintenance Exposure. 10 Armed with this newinformation, insurance companies are now seeing in advance of losses what the drivers are to then understand behavior in the book – go to failure maintenance or active remediation. Either way carriers can now influence the outcome to change the business paradigm to their advantage. 0 LCC Scores Based on the tens of millions of case studies already performed, virtually 90% of the non-catastrophic claims are identified in the predictive LCC analytic scores. Here is another important side benefit of adopting LCC technology. For the first time, necessary underwriting questions unique to each home can be articulated on the fly, tailored to individual properties based on insight found in LCC summary reports. Companies and agents now define probable exposures at the click of the mouse, eliminating one size fits all questioning that is time consuming and retards the sales process. Running LCC models on entire books of property business generates a new financial outlook of the business in ways never seen before that improves each year. For more information, or to learn how to implement LCC data in your business, please contact: Peter M. Wells Peter M. Wells Business Group, LLC 262-347-6091 petermwells@peterwells.us