Ch. 9 Study Guide Assisted Solutions

advertisement

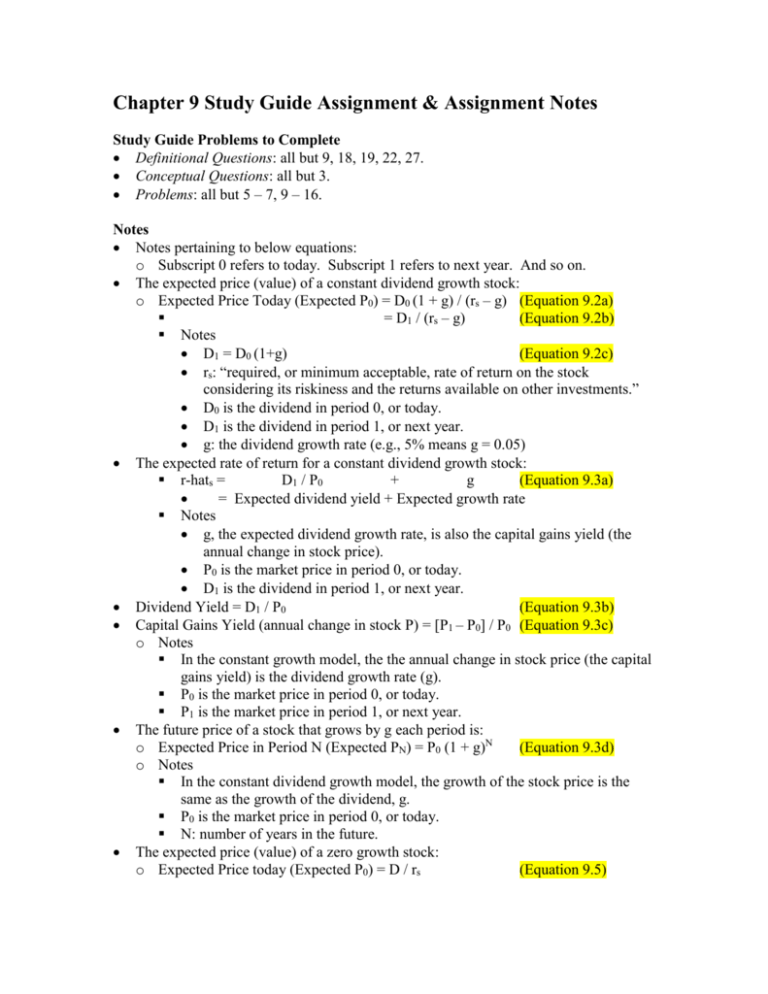

Chapter 9 Study Guide Assignment & Assignment Notes Study Guide Problems to Complete Definitional Questions: all but 9, 18, 19, 22, 27. Conceptual Questions: all but 3. Problems: all but 5 – 7, 9 – 16. Notes Notes pertaining to below equations: o Subscript 0 refers to today. Subscript 1 refers to next year. And so on. The expected price (value) of a constant dividend growth stock: o Expected Price Today (Expected P0) = D0 (1 + g) / (rs – g) (Equation 9.2a) = D1 / (rs – g) (Equation 9.2b) Notes D1 = D0 (1+g) (Equation 9.2c) rs: “required, or minimum acceptable, rate of return on the stock considering its riskiness and the returns available on other investments.” D0 is the dividend in period 0, or today. D1 is the dividend in period 1, or next year. g: the dividend growth rate (e.g., 5% means g = 0.05) The expected rate of return for a constant dividend growth stock: r-hats = D1 / P 0 + g (Equation 9.3a) = Expected dividend yield + Expected growth rate Notes g, the expected dividend growth rate, is also the capital gains yield (the annual change in stock price). P0 is the market price in period 0, or today. D1 is the dividend in period 1, or next year. Dividend Yield = D1 / P0 (Equation 9.3b) Capital Gains Yield (annual change in stock P) = [P1 – P0] / P0 (Equation 9.3c) o Notes In the constant growth model, the the annual change in stock price (the capital gains yield) is the dividend growth rate (g). P0 is the market price in period 0, or today. P1 is the market price in period 1, or next year. The future price of a stock that grows by g each period is: o Expected Price in Period N (Expected PN) = P0 (1 + g)N (Equation 9.3d) o Notes In the constant dividend growth model, the growth of the stock price is the same as the growth of the dividend, g. P0 is the market price in period 0, or today. N: number of years in the future. The expected price (value) of a zero growth stock: o Expected Price today (Expected P0) = D / rs (Equation 9.5) Chapter 7 Study Guide Assisted Solutions Definitional Questions Do all but 9, 18, 19, 22, 27. See the study guide for solutions. Conceptual Questions 1) Do. 2) Do. 3) Do not do. 4) Do. 5) Do. Problems 1) Do. a) See study guide solution. b) For a zero growth stock, use equation 9.5 above, or use equation 9.2a and substitute in 0 for g. c) Equation 9.5: i) Expected Price today (Expected P0) = D / rs ii) = $4.00 / 0.12 = $33.33 2) Do. 3) Do. a) Dividend Yield i) Equation 9.2c: (1) D1 = D0 (1 + g) ii) Equation 9.3b: (1) Dividend Yield = D1 / P0 iii) Plug equation 9.2c into equation 9.3 and solve for the dividend yield. (1) Dividend Yield = D0 (1 + g) / P0 (2) = 1.50 (1 + .05) / 15.75 (3) = 1.50 (1.05) / 15.75 = 0.10 or 10% b) Capital Gains Yield i) Since the expected growth rate of the stock price is 5%, plug (P0 x 1.05) in for P1 in the capital gains yield equation (Equation 9.3c) above: ii) Capital Gains Yield = [P1 – P0] / P0 iii) = [15.75 x 1.05 – 15.75] / 15.75 iv) = [16.5375 – 15.75] / 15.75 = 0.05 or 5% 4) Do. a) See study guide solution. b) Use Equation 9.2a to solve for the expected price in period 0. Since dividends are expected to decline by 5% the dividend growth rate is -5%. Thus, plug in -0.05 for g in equation 9.2a. i) Expected Price Today (Expected P0) = D0 (1 + g) / (rs – g) ii) = $2.00 (1 + -0.05) / (0.15 – (-0.05)) iii) = $1.50 (0.95) / 0.20 iv) = $1.90 / 0.20 = $9.50 c) Note that in the constant dividend growth model, the dividend growth rate, g, is also the annual change in the stock price (the capital gains yield). Therefore, use g = -0.05 and N = 3 in equation 9.3d above to solve for the stock price in 3 years. i) Expected Price in Period N (Expected PN) = P0 (1 + g)N ii) Expected Price in Period 3 (Expected P3) = P0 (1 + g)3 iii) = $9.50 (1 + -0.05) 3 iv) = $9.50 (0.95) 3 v) = $9.50 (0.8574) = $8.15 5) Do not do. 6) Do not do. 7) Do not do. 8) Do. a) Equation 9.2c: i) D1 = D0 (1 + g) b) Equation 9.3a: i) r-hats = D1 / P0 + g c) Plug equation 9.2c into Equation 9.3a and solve for g. i) r-hats = D0 (1+g) / P0 + g ii) Now, plug the numbers in from the problem: iii) 0.16 = 2.50 (1 + g) / 45.83 + g iv) Subtract g from both sides to get v) 0.16 – g = 2.50 (1 + g) / 45.83 vi) Multiply both sides by 45.83 to get vii) 45.83 (0.16 – g) = 2.50 (1 + g) viii) Multiply out to get ix) 7.33 – 45.83 g = 2.50 + 2.50 g x) Add 45.83 g to both sides and subtract 2.50 from both sides to get xi) 7.33 – 2.50 = 2.50 g + 45.83 g xii) 4.83 = 48.33 g xiii) Divide both sides by 48.33 to get xiv) 4.83 / 48.33 = g xv) g = 0.10 or 10% 9) Do not do. 10) Do not do. 11) Do not do. 12) Do not do. 13) Do not do. 14) Do not do. 15) Do not do. 16) Do not do. 17) Do. a) Use equation 9.2b to solve for Expected P0 (the expected price today). i) Expected Price Today (Expected P0) = D1 / (rs – g) ii) = $2.25 / (0.11 – 0.04) = $32.14 b) Then use equation 9.3d to solve for Expected P4 (the expected price in five years). i) Expected Price in Period N (Expected PN) = P0 (1 + g)N ii) Expected Price in Period 5 (Expected P5) = P0 (1 + g)5 iii) = $32.14 (1 + 0.04)5 iv) = $32.14 (1.04)5 v) = $39.11