Inequality and Top Incomes Groups in Uruguay: a comparison

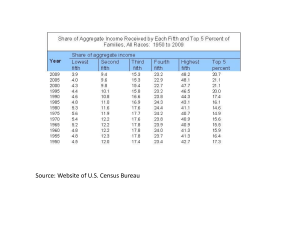

advertisement