Timesheets_Info_Packet

advertisement

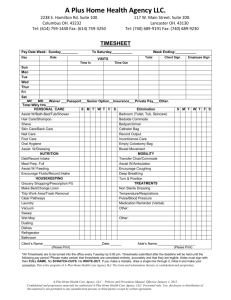

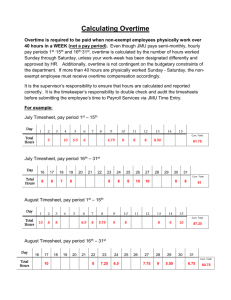

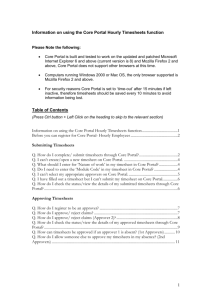

Timesheets: The Who, Why, When and Where Q & A’s Q. Who is required to fill out timesheets? A. All non-exempt employees are required by Federal and State law to track their hours worked. Employers must compensate non-exempt employees for all hours worked over 40 hours in a work week at the overtime rate. Q. What is a non-exempt employee? A. Non-exempt employee is one who is entitled to the minimum wage and/or overtime pay protections of the FLSA. There are specific qualifications for exempt employees. If an employee does not qualify under the exempt requirements, they must be classified as nonexempt. More information regarding these classifications can be found at http://www.dol.gov/whd/regs/compliance/fairpay/fs17a_overview.htm Q. Why are we required to fill out this timesheet now? A. There are two main reasons we are implementing timesheets: 1. Compliance with Federal and State Law 2. To make sure you are compensated for any overtime you are working. Please note, the purpose of implementing timesheets is not to reduce your pay or hours. Your pay will not be reduced unless you are absent and have exhausted any paid time off you may have. We will be monitoring your hours in excess of 40 in a week Sunday through Saturday. Q. What will I get paid for overtime hours? A. The rate of pay for any hours over 40 in one week Sun. through Sat. is Rate x 1.5. Q. When will I get paid for my hours? A. Pay for hours turned in will be paid at the next month’s pay day (usually the 20th). For example, September pay period hours will be paid on November 20th. Q. Who do I contact if I have questions? A. You can talk to your building administrators or see page 4 for additional contact information. Q. Where can I find more information? A. Here are some websites you can visit to find more information www.dol.gov www.labor.mo.gov 1 Instructions 1. Fill out your timesheet daily. Do not wait until the end of the week to fill it out to avoid missed hours or incorrect hours. 2. Fill out the timesheet in its entirety. Please have the appropriate administrators or supervisors sign your timesheet before sending it to Central Office. If any timesheet is received and missing information, the timesheet will be returned to you for completion and may cause delays. 3. At the end of the pay period, collect all of your regular timesheets (see the attached Pay Periods sheet), and attach any additional timesheets (Banquet, Homebound) and absence vouchers. 4. Once you have collected all of your timesheets at the end of the pay period, staple them together and make sure your building principal or supervisor has signed and approved them. Timesheets will need to be sent to Krystal Allen at the Central Office. 5. Deadline for turning in timesheets is the 10th of the following month. For example, for February hours, timesheets within the February pay period must be turned in by March 10. 2 Pay Periods for 2012-2013 School Year (You will receive a new Pay Periods sheet for 2013-14 in July) Payday is listed first with days included in that month listed below: July Pay Period (Pay date August 20, 2012) July 1 – August 4 (5 weeks) August Pay Period (Pay date September 20, 2012) August 5 – September 1 (4 weeks) September Pay Period (Pay date October 19, 2012) September 2 – September 29 (4 weeks) October Pay Period (Pay date November 20, 2012) September 30 – November 3 (5 weeks) November Pay Period (Pay date December 20, 2012) November 4 – December 1 (4 weeks) December Pay Period (Pay date January 18, 2013) December 2 – December 29 (4 weeks) January Pay Period (Pay date February 20, 2013) December 30 – February 2 (5 weeks) February Pay Period (Pay date March 20, 2013) February 3 – March 2 (4 weeks) March Pay Period (Pay date April 19, 2013) March 3 – March 30 (4 weeks) April Pay Period (Pay date May 20, 2013) March 31 – May 4 (5 weeks) May Pay Period (Pay date June 20, 2013) May 5 – June 1 (4 weeks) June Pay Period (Pay date July 19, 2013) June 2 – June 29 (4 weeks) 3 Who to Contact Krystal Allen, x2151, kallen@bolivarschools.org Pay Insurance Deductions Direct Deposit Taxes Timesheets and Stipend Requests Employment verification Garnishments Kelly Holt, x2111, kholt@bolivarschools.org Employment letters and contracts Salary schedule Rate of pay Budget questions Teresa Griffits, x2118, tgriffitts@bolivarschools.org P-cards Purchase Invoices Substitute pay Board Bills Reimbursement pay Mileage 4