Annual Report 2012-2013 - Moretele Local Municipality

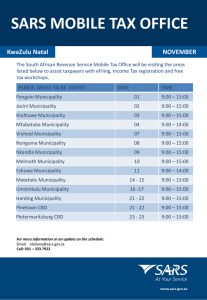

advertisement