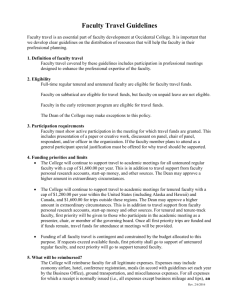

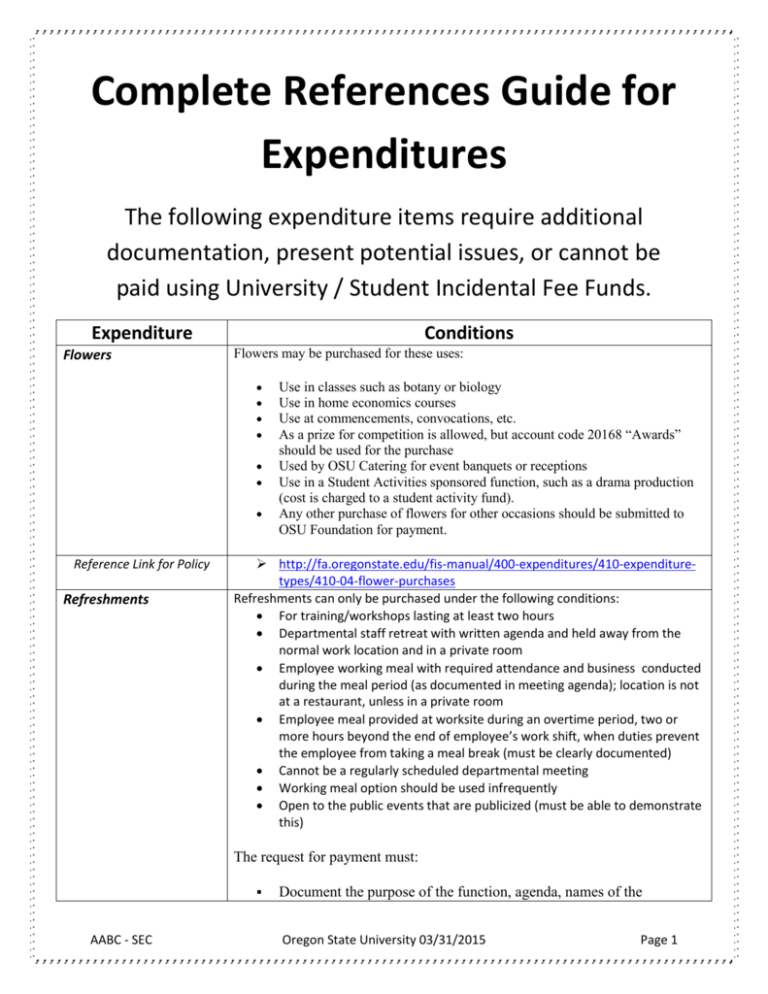

Complete References Guide for Expenditures

advertisement

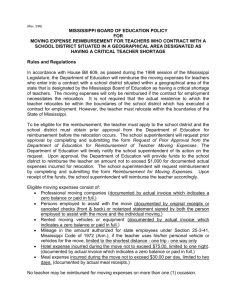

Complete References Guide for Expenditures The following expenditure items require additional documentation, present potential issues, or cannot be paid using University / Student Incidental Fee Funds. Expenditure Flowers Conditions Flowers may be purchased for these uses: Reference Link for Policy Refreshments Use in classes such as botany or biology Use in home economics courses Use at commencements, convocations, etc. As a prize for competition is allowed, but account code 20168 “Awards” should be used for the purchase Used by OSU Catering for event banquets or receptions Use in a Student Activities sponsored function, such as a drama production (cost is charged to a student activity fund). Any other purchase of flowers for other occasions should be submitted to OSU Foundation for payment. http://fa.oregonstate.edu/fis-manual/400-expenditures/410-expendituretypes/410-04-flower-purchases Refreshments can only be purchased under the following conditions: For training/workshops lasting at least two hours Departmental staff retreat with written agenda and held away from the normal work location and in a private room Employee working meal with required attendance and business conducted during the meal period (as documented in meeting agenda); location is not at a restaurant, unless in a private room Employee meal provided at worksite during an overtime period, two or more hours beyond the end of employee’s work shift, when duties prevent the employee from taking a meal break (must be clearly documented) Cannot be a regularly scheduled departmental meeting Working meal option should be used infrequently Open to the public events that are publicized (must be able to demonstrate this) The request for payment must: AABC - SEC Document the purpose of the function, agenda, names of the Oregon State University 03/31/2015 Page 1 attendees, and why that time of day requirement (if a meal). Include the average per person cost on the first line of TEXT in the Banner document and may not exceed the current OUS per diem. The cost includes the price of the meal, delivery and tip. Use account code 28611 Refreshments and Food – Departmental to process invoice payments or reimbursements. NOTE: Meals and refreshment costs cannot be paid with Petty Cash funds or departmental purchasing card. Reference Link for Policy Graduation Event Expenses Reference Link for Policy Personal / Professional Services http://fa.oregonstate.edu/fis-manual/400-expenditures/410-expendituretypes/410-07-refreshments-or-meals-unit-functions Should be paid directly by the OSU foundation Send invoices to the OSU Foundation without entering into the OSU Banner system If catering is provided by OSU Catering, these costs can be charged to FSxxxx indexes and reimbursement requested from the OSU Foundation. o The appropriate account code is 28613 – Public Relations. Cap and gown rental is an appropriate charge to the general fund if the faculty or staff member is required to attend the graduation ceremony as part of his/her official duties. o The appropriate account code is 28613. http://fa.oregonstate.edu/fis-manual/400-expenditures/410-expendituretypes/410-09-graduation-event-expenses Companies and individuals are hired and paid for their services using one of the following documents: Formal contract generated as a result of an RFP or Invitation to Bid initiated by Purchasing or Facilities Services. Personal/Professional Services Contract (PSC) approved by Business Services Contracts Office prior to service. Personal Services Invoice (PSI) for all personal or professional services that are $5000 or less. A Personal Services Invoice is not to be used for architectural or engineering services. Purchase order prepared by Purchasing or at the Department level. Informal purchase order (PO) for local retail businesses. See AutoPay Vendor List on Business Affairs website. Account Codes Used For Payments: AABC - SEC Incorporated companies with federal tax ID numbers should be paid using the appropriate account code for the services they have provided (review account codes 245xx through 24616). University-wide, long-term contracts with employment agencies such as St. Vincent dePaul should be paid using account code 24530 – Contract Personnel Services. Bands and music groups giving a public performance should be paid using account code 24505 – Performance Fees. Account code 24599 should be used when paying an instructional related activity, such as an accompanist for a music class. Oregon State University 03/31/2015 Page 2 “Consultants”, seminar speakers, athletic officials, and others doing “Other Professional Services” should be paid on account code 24599 – Other Professional Services. However, “consultants” does not apply to professional services for architectural or engineering services. Those contracts are handled separately through Business Services and Procurement & Construction Contracting. Payment for services (245xx-24999 account codes) using a nonincorporated entity should have either a PSC or PSI attached. Most common services in this area are editing, publishing and web design. Except for seminar speakers, direct departmental billing is not allowed for airfare, lodging or meals. The PSC/PSI should include any travel-related expenses, either as part of the hourly/daily rate or separately identified. When processing a payment for separately identified travel, pay as a lump sum using the appropriate taxable account code. DO NOT ATTACH RECEIPTS. These payments are taxable income of the contractor, and the contractor must keep their receipts. Personal Services Invoices (PSI’s) can be processed for payment no earlier than 20 days prior to service, with the check pickup within one week of the services rendered for speakers, referees, and entertainers. This is for one-time service agreements, where the person or group being employed is at the University location only for that event and is then departing. This option is not allowable for Personal Services Contracts (PSC’s) under a long-term contract. To process a payment, Business Affairs Accounts Payable office must have the following: Original vendor invoice with copy of the PSC, or the original. Banner “I” document number with the appropriate index, account code, signatures, and department approvals. Personal Services Agreements with Foreign Nationals – See Government Publication 901 for a list of countries with whom the US has treaties. The list of countries can be found on pages 35 through 47. For persons from non-treaty countries, the university must take a 30% withholding. For further information regarding the payment of foreign nationals, contact Business Affairs/Accounts Payable at 737-4262. See Procurement and Contract Services website for downloadable contracts and forms. See the PaCS 401: Employee v. Independent Contractor for the Guidelines on Determining if a Worker is an Employee or Independent Contractor. See the General University Policy for Employees Doing Business with Oregon State University. Reference Link for Policy AABC - SEC http://fa.oregonstate.edu/fis-manual/400-expenditures/410-expenditure- Oregon State University 03/31/2015 Page 3 Gift Certificates Reference Link for Policy types/410-25-payments-services All gift certificates purchased by Oregon State University must be authorized in advance and exhibit appropriate use of university dollars. A check will be issued to the vendor from whom the gift certificate will be purchased. No charges are to be made for the purchase of gift certificates from Oregon State University direct pay vendors, including the OSU Bookstore. See FIS 1402-07: Gift Certificates for more information. http://fa.oregonstate.edu/fis-manual/400-expenditures/410-expendituretypes/410-27-gift-cards-or-certificates Travel, Motorpool use, etc. Reference Link for Policy Reimbursements http://fa.oregonstate.edu/fis-manual/400-expenditures/411-travel 407 Employee Reimbursements Although use of a Departmental Procurement Card or OSU’s Auto Pay Vendors is preferable, there are instances when employees need to use personal funds for OSU business purposes, and subsequently get reimbursed by the university. Listed below are various options for payment of employee reimbursements for goods & services and travel. All reimbursements must be submitted for payment within 9 months of incurring the cost and in the appropriate fiscal year for the expense. 1. Reimbursement Request Form or Travel Reimbursement Form. When using the Reimbursement Request form it is preferable to hold individual small receipts and submit as a larger amount. Special attention should be paid to the date limitations for submission of the request as shown above. 2. Petty Cash fund. Most departments have a petty cash fund. A department with a petty cash fund of less than $100 can request that the amount increased. See FIS 1402-10: Petty Cash Policy. 407-01 Travel Reimbursements For all claims and for travelers not stationed on campus, submit a Travel Reimbursement Request Form through TRES. For details, see the Travel Policies and Procedures manual. 1. Employees - Expenses are reimbursed with appropriate documentation, as per OSU Travel Policy. Per Diem is available only while the employee is in “travel status” (official university business requiring an overnight stay away from the employee’s official station). When employees travel together, it may be expedient for one employee to pay and claim reimbursement for certain expenses of other employees. Reimbursement for multiple employees is only allowed when actual expenses are being reimbursed and are supported by receipts. Employees involved cannot request reimbursement for such expenses paid on their behalf to another claimant. 2. Employees on Leave - Reimbursement for expenses incurred during sabbatical or other types of leave is warranted only in exceptional AABC - SEC Oregon State University 03/31/2015 Page 4 3. 4. 5. 6. 7. 8. circumstances. These costs must be pre-approved by the department head before the leave is taken. New Employees - New employees may be reimbursed for house hunting and moving expenses when reimbursement is necessary to employ qualified personnel. The maximum total cost being paid must be indicated in the new employee’s letter of offer. New employees teaching summer session only, may be reimbursed for travel expenses associated with one round trip when reimbursement is necessary to employ qualified personnel. See FASOM section on Compensation -- Fringe Benefits -Moving Expenses. Students - Students who travel as employees or officially designated representatives of OSU may be reimbursed for travel expenses. Team/Group - An OSU employee, such as a coach or group leader, can pay for the travel expenses of the team or group members. Non-employee expenses should be kept separate from employee expenses. Detailed itemization of expenses is required and must be supported by receipts. When team/group members are provided cash to buy their own meals, a list of the individuals’ names, their signatures, and the amount disbursed is required. Unpaid Members of Advisory Committees - May be reimbursed for actual and reasonable meal expenses and mileage. Original itemized receipts are required. Employees of Other State & Federal Agencies - Employees of other agencies are to be reimbursed for travel expenses by their own agency. OSU will reimburse their agency when invoiced for expenses. Official Guests - Official guests can be, but are not limited to: faculty candidates, research collaborators, visiting scientists or lecturers, seminar or workshop speakers, observers, etc. Pre-approval by appropriate program personnel is required prior to extending an invitation. A clear benefit to OSU must be provided when requesting payment of invited guest expenses. Faculty candidate spouse - payment of expenses require prior approval from the Provost. Guest Speakers not receiving compensation - airfare and lodging can be direct billed to departments. Official Guests not receiving compensation - expenses such as airfare, lodging, meals, and vehicle rental can be reimbursed to the guest when supported by original itemized receipts. Meal per diem and mileage can be reimbursed to the guest at current OUS mileage and per diem rates. Official Guests receiving compensation - all incurred expenses (including meals, lodging, transportation, etc.) are incorporated in the PSI/PSC payment amount and should be coded as appropriate to the expense; not travel account codes. 9. Other Non-employees AABC - SEC Non-OUS Participant expenses (286xx) should be coded as Oregon State University 03/31/2015 Page 5 appropriate to the funding source. Travel expenses reimbursed on account code 28635 require receipts for all expenses, except mileage. Mileage is reimbursed at the OUS rate. Travel expenses not documented with receipts are reimbursed using account code 28636. Individuals on a Fellowship, and not taking classes toward a degree (i.e.: post-docs) are reimbursed using 28636, because the transactions are 1099 tax reportable. Volunteers are eligible to receive per diem only when travel is an assigned duty and indicated as such on their condition of volunteer service. 407-02 Personal Reimbursements These payment requests are normally for claims of $100 or more. The department prepares the employee’s request with receipts/documents showing proof of payment, and clear business purpose, enters into Banner, and sends to Business Affairs Accounts Payable office for final review and processing. Reimbursement for calling to another cell phone with the charge of a long distance call to the caller is not allowed unless the staff member is able to establish that there was no alternative form of communication available. The form is located on the Business Affairs Forms website. See also: FIS 1402-02: Cash Out Policy. FIS 410-29: Meals on One Day Trip (no overnight stay) FIS 410-07: Paying for Meals and Refreshments Served at Intra-departmental Funct 407-03 Web Purchases – See FIS 407-03: Personal Reimbursement for Web Purchases 407-04 Corporate Travel and Entertainment Card The Oregon University System has an agreement with a banking institution to provide corporate VISA cards to employees of OSU. This Visa card is to be used only for authorized OSU reimbursable expenses. Misuse of the card may result in disciplinary action, up to and including termination of employment. OSU assumes no liability for this card, the cardholder is totally liable for all charges made against this account and for any other obligations arising from use of this card. 407-05 Cell Phone and Pagers – See FIS 1402-03: Communications: Internet Services, and other Mobile Devices Reference Link for Policy AABC - SEC 407-06 Telecommuting – See Telecommuting Policy (pdf format) on the OHR Website. http://fa.oregonstate.edu/fis-manual/400-expenditures/407-personalreimbursements Oregon State University 03/31/2015 Page 6