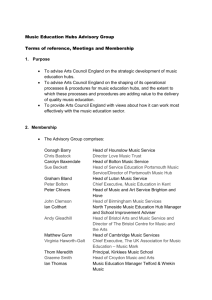

ABI Commission to Study the Reform of Chapter 11 Advisory

advertisement

ABI COMMISSION TO STUDY THE REFORM OF CHAPTER 11 Advisory Committee on Executory Contracts and Leases Executive Summary Regarding Section 365 Issues Section 365 was intended as a general, flexible framework to govern the treatment of ongoing contracts and leases. Generally, this time-tested approach has worked well. With respect to many of the questions posed by the Commission, the Advisory Committee recommends no substantive changes. However, three major areas of concern emerged from the Advisory Committee’s research and analysis: • First, the undefined concept of “executoriness” has proven to be a poor method of distinguishing between contracts that should come within the ambit of §365 and those that do not. The Advisory Committee recommends eliminating the term “executory” in favor of adopting the Functional Test which allows the trustee or debtor in possession (collectively here, “debtor”) to keep beneficial contracts and reject burdensome ones based solely upon benefit/harm to the estate. • Second, contracts and leases come in so many varieties that, over the years, the section has been minced into numerous smaller chunks, some of which have been enacted in response to special interest pressure. In particular, many subsections have been added piecemeal to assure that rejection does not disturb the nondebtor party’s nonmonetary rights under state law with respect to a specific type of contract. It may be possible to eliminate the need for such balkanization by adoption of an express statement of the general principle that consequences of rejection should be consistent with applicable state law, unless a specific Bankruptcy Code provision provides otherwise. The Advisory Committee’s specific recommendations also include the elimination of certain existing differentiation as unfair and unnecessary, but also the addition of a separate category for intellectual property licenses that would resolve, among other 1 problems, the conflicting case law regarding the “hypothetical” test precluding assumption, post-rejection treatment, and effect of sales. • Third, recurring problems regarding debtors’ failure to perform during the limbo period before assumption or rejection require an effective remedy that will appropriately rebalance the competing rights and obligations of debtors and nondebtor counterparties without impairing the effectiveness of the reorganization process. The Advisory Committee proposes that, although the court would retain the flexibility to defer immediate payment if necessary, both contract and lease counterparties should be entitled to seek adequate protection for cause, under the same kinds of procedures as apply to motions for relief from stay. • Fourth, although the Code states explicitly that rejection constitutes “breach” rather than “termination,” the case law reflects continuing confusion on this point. Therefore, the Advisory Committee recommends that the Code should replace the term “reject” with the term “breach.” I. GUIDING PRINCIPLES A. General consistency with nonbankruptcy law: Unless specific bankruptcy policy reasons override, the outcomes for contracts and leases should respect and align with state law and other applicable nonbankruptcy law. This is consistent with the principles of Travelers Casualty & Surety Co. v. Pacific Gas & Electric Co., 549 U.S. 443 (2007), and Butner v. United States, 440 U.S. 48 (1979), that emphasize the importance of giving effect to state law in defining the underlying claims and interests being impacted in a bankruptcy case. B. Mutual performance during the case: Although flexible breathing space should be given to debtors, as a matter of fairness, counterparty rights to receive post-petition 2 performance should be enforced, or they should be excused from rendering their own performance. C. General uniformity of treatment of different types of contracts: Unless inconsistent with other bankruptcy policies, contracts and leases should receive uniform bankruptcy treatment, even though outcomes may differ due to underlying differences in the applicable nonbankruptcy law for the various types of agreements. II. MAJOR RECOMMENDED CHANGES A. Delete “executory”: The concept of "executoriness" causes unnecessary litigation. The Functional Test should be endorsed and the term "executory" deleted from the Code. B. Address IP license directly: IP protections should be expressly set forth and made consistent with applicable IP law. 1. Patents copyright and trademark licenses should not be assignable by debtors without the consent of nondebtor counterparties, but prepetition consents and waivers should be enforceable to the same extent as under nonbankruptcy law. 2. The hypothetical test should be eliminated in favor of a rule supporting assumption by a reorganized debtor, absent direct harm to the IP licensor. 3. Trademarks and foreign patents should be included within the definition of “intellectual property” set forth in §101(35A), and thus protected by §365(n). C. Allow for adequate protection: Relief from stay or adequate protection should be available to contract and lease counter parties if debtors commit post petition breaches. 3 1. As a matter of fairness and commercial predictability, debtors should not be able to compel performance from counterparties without rendering their own performance. 2. Where appropriate, adequate protection rather than immediate payment or performance by the debtor may be provided. D. Adopt “accrual” rule for rent: The split in case law regarding calculation and timing of payment of post-petition rent for real estate leases should be resolved in favor of the accrual rule: 1. Calculations should be based upon accrual, not payment date. 2. Accrued “stub” rent should be payable on the first regular payment date after the filing of the petition. E. Extend deadline for leases: The time limit for nonresidential real property leases should be extended from 210 days to 365 days in the interests of enhancing prospects for reorganization. III. OVERVIEW OF ANALYSIS BY TOPIC A. Topic #1: The concept of “executory” as the prerequisite for the application of Section 365. The Advisory Committee concluded that the “executory” concept should be eliminated, as the difficulties in definition of the term creates more problems than the use of the term solves. The courts have consistently had difficulty in applying the Countryman Test as a standard to define executory contracts. Instead, the Advisory Committee recommends use of the Functional Analysis as set forth by Professor Jay L. Westbrook, which has already been adopted by many courts. Although the Countryman Test was a helpful construct when introduced, it 4 often leads to results that are contrary to the bankruptcy policy of maximizing estate value, because strict adherence to the material breach analysis results in the debtor being unable to assume certain valuable agreements. Rather, assumption and rejection should merely reflect the trustee’s decision to perform or breach a pre-bankruptcy contract under applicable law, like any other party to a contract. In contrast, the Functional Approach focuses specifically on the benefits to the estate, i.e., the trustee can make the decision whether to assume or reject any contract on the basis of whether the contract is beneficial or harmful to the estate, thereby fulfilling the policy of value maximization. By side-stepping questions about whether “material” performance remains on both sides, the Functional Approach treats unsecured creditors equally regardless of the stage of performance of their contracts at the moment of bankruptcy. Moreover, consistent with its overall analysis of proposed reforms of Section 365, the Advisory Committee has concluded that the consequences of breach should be as provided in applicable law, except where bankruptcy rules and principles produce a different result. The Advisory Committee considered, but rejected, two competing considerations. First, such a shift from the current status could be viewed as likely to be costly or disruptive because of the large body of existing case law regarding the treatment of executory contracts. But that body of law is in disarray, undercutting any advantage to preserving the status quo. Second, a shift to the use of the Functional Analysis generally has the effect of emphasizing state law, especially state law contractual remedies. In contrast, the amorphousness of the “executoriness” concept has afforded bankruptcy courts a way to override such state law in the service of federal bankruptcy policies, such as the fresh start. Abandoning this concept might reduce flexibility for bankruptcy courts. On balance, however, the disarray, unpredictability, and costly litigation arising from the “executory” concept outweigh these concerns. ______________________________________________________________________________ 5 B. Topic #2: Adequate Assurance of Future Performance The Advisory Committee recommends no significant change in the standards for adequate assurance of future performance. The current standard appears to be easily understood and applied. Commercial standards are a common metric for a myriad of issues, and judges are comfortable applying them. Adequate assurance of future performance of nonmonetary contract provisions should continue to be governed by the substantial performance, rather than the strict performance standard. The burden of proof should remain the preponderance of the evidence standard or “the more likely to perform than not” standard. Application of these standards as demonstrated in case law show some judicial discretion is required to make these fact-intensive determinations and to fashion adequate assurance of future performance in an appropriate manner suitable to the particular litigants and the specific contracts at issue. Two points of clarification are recommended. 1. Protect contracts in §363 sales: The requirement of adequate assurance of future performance should not be subject to avoidance by a § 363 sale. Section 363 sales of contracts, leases, or designation rights should be explicitly subject to § 365 requirements, without the need for a court order to that effect. Section 363(f) should not permit the sale of estate property free and clear of interests that are protected by § 365. Thus, the counterparty’s right to adequate assurance of future performance should be binding on any buyer. 2. Require factual findings of relative interests: The standard for adequate assurance of future performance should be more specifically defined to require factual findings regarding the balance of the estate’s interest and the nondebtor’s interest in the contract at issue. The court should determine the harms which may be imposed on a party opposing the assumption or assignment in relation to the benefit to be obtained by the estate’s creditors. In this regard, the court should consider: (i) the likelihood of the success of the estate’s or 6 assignee’s future performance; (ii) public policy considerations such as the preservation of community employment or the economic conditions of area to be effected. ______________________________________________________________________________ C. Topics 3/10: Assignability and IP Law Issues Bankruptcy Code §365 provisions regarding assignability of contracts have generated circuit splits and extensive litigation, most of which relates to the treatment of intellectual property ("IP") licenses. To resolve these problems, the Advisory Committee recommends changes with respect to IP-related contracts, primarily to align bankruptcy outcomes with applicable nonbankruptcy law and increase flexibility within bankruptcy. No other major changes are recommended with respect to other assignability issues, but one minor change is suggested: even though loan commitments should generally remain nonassignable and nonassumable, debtors should be allowed to assume prepetition loan agreements with the consent of the lender as part of a DIP loan under §364, thereby formally recognizing the common practice of prenegotiating DIP loans. The case law concerning IP licenses has struggled to distinguish between performance obligations under IP licenses that rise to the level of “materiality” for purposes of determining applicability of §365. The Advisory Committee’s recommendation to eliminate the “executoriness” concept will eliminate litigation over these issues in IP licenses. 1. Recommended Changes for IP Licenses: Generally, contractual nonassignment provisions are not enforceable in bankruptcy by operation of §365(c), on the ground that debtors should be able to assume and assign their rights under contracts to third parties, if doing so maximizes their value to the estate. However, contracts that are not assignable by operation of applicable nonbankruptcy law are excluded by §§ 365(c) and (e), on the grounds that counterparties cannot legally be forced to accept performance from anyone other than the debtor and, historically, trustees supplanted debtors in all bankruptcy cases. IP 7 Law is generally but not universally interpreted as qualifying as applicable nonbankruptcy law within the meaning of these provisions, but the circuits are sharply split as to whether debtors can assume IP licenses that they cannot assign, with most circuits following the “hypothetical” test, and a minority adopting the “actual” test. To resolve these and other IP-related issues, the Advisory Committee makes the following recommendations: a. Expand the definition of IP: Section 101(35A) should be amended to include trademarks, foreign patents and applications within the protections of §365(n). Trademarks were originally excluded due to the haste with which §365(n) was enacted to legislatively overrule the Lubrizol decision and concerns that inclusion of trademarks might present unintended consequences. The Advisory Committee concluded that no principled justifications exist for continued exclusion. Foreign patents and applications were apparently omitted by oversight. By incorporating trademarks, this change would unambiguously bring franchise agreements within the fold of protected IP licenses, thereby resolving existing circuit splits on the subject of trademarks. b. Align Bankruptcy Code with applicable nonbankruptcy IP law to give appropriate weight to competing concerns as to IP owners' rights: The Advisory Committee recommends that two changes should be implemented to reconcile the “property” aspects of IP licenses with their status as contracts. i. For debtors as IP licensees: The statute should be clarified to underscore that, consistent with applicable IP law, IP licenses are nonassignable absent the consent of the licensor/owner, unless the contract at issue is an exclusive license that is the equivalent of a sale of all rights and attributes of IP ownership, in which case the debtor should be treated as the IP owner, not licensee. This general nonassignability is consistent with patent, copyright and trademark law, and with most bankruptcy cases. As a corollary, contractual provisions allowing assignment 8 without further consent should be enforceable in bankruptcy to the same extent as under IP law. This would be a change from most case law that prepetition contractual consents to assignment are not generally enforced in bankruptcy. ii. For debtors as IP owner/licensors: Section 365(n) should be clarified to protect prior licenses conferred by debtor or prior owners of the IP, just as federal patent law in particular protects those who have been granted licenses by the current or prior patent holder. Under IP law, subsequent patent transfers or assignments are subject to the conditions of any licenses or other rights previously conferred by the patent holders, and thus prior licenses constrain Debtors' IP rights as of petition date. Previously granted license/property rights in a debtor/licensor’s IP should not be allowed to be stripped off in bankruptcy. c. Eliminate the “hypothetical” test and permit reorganized debtors to assume IP licenses within limits: Debtor/licensees should be allowed to assume IP licenses and government contracts that they could retain outside of bankruptcy, subject to contractual change of control and similar restrictions that are enforceable under applicable nonbankruptcy law. d. Amend Section 363(f) to make any sale of IP-related assets automatically subject to existing IP licenses: Prior licensees, who often may not have received notice of a proposed sale, should not have to appear or object. 2. Competing Considerations: The Advisory Committee considered but rejected the alternative of eliminating all restrictions on the assumption and assignment of IP licenses to maximize the estate. Such a change, however, would effectively transfer economic value associated with the right to control the use of the IP from the owner of the IP to the other creditors of the estate. That result does not square with the basic principles of federal IP law. Conversely, the Advisory Committee considered but rejected endorsement of the “hypothetical” test. Even though the “hypothetical” test may be the proper reading of the current statute, 9 retention of this absolutist test is hard to justify with respect to IP licenses, except that it protects nondebtor licensors from being compelled to accept a hostile force or competitor as licensee. Finally, the Committee rejected the possible elimination of §365(n), because such a stance cannot be squared with the principles underlying §541(a) that limit the rights that become part of the “estate” upon filing to those that exist at that time that debtors acquired their interests. 3. Transitional Issue: Impact upon existing contracts: Current contracts assume the continued existence of the current interpretative effect of existing "hypothetical" test case law and current Code provisions. Economic expectations could be adversely affected by these changes. Consideration of application to existing, as opposed to future, contracts should be given, or else some sort of grandfather clause may be advisable. ________________________________________________________________________ D. Topic #4 – Time Periods for Assumption and Rejection 1. No preconfirmation assumption/rejection deadline should be required, other than for non-residential real property leases. The well-established current practice under §365(d)(2), which does not set a pre-confirmation deadline for assuming or rejecting contracts other than non-residential real property leases, strongly favors deferring virtually all assumption/rejection decisions until confirmation. The Advisory Committee did not identify any need for a change with respect this practice with respect to contracts. Moreover, to the extent that this deferral has imposed uncertainties and risk upon the nondebtor counterparties, the Advisory Committee submits that its proposals in relation to Topic 5 (Post-Petition, Pre-Decision Performance and Protection) will provide sufficient protections during the chapter 11 case administration such that no change to the current time frame for assumption or rejection is needed. 10 2. The deadline to assume/reject non-residential real property leases should be extended to 365 days with further extensions only with landlord consent. The Advisory Committee recommends that §365(d)(4)’s time frames be modified to provide debtors with 365 days in which to determine whether to assume or reject a lease of non-residential real property. Any further extensions of this time period would require landlord consent, and during the 365day period, landlords would retain the right to seek to have the statutory period shortened for cause. This change is recommended because §365(d)(4)’s current time period of a maximum of 210 days does not appear to be providing sufficient time for debtors to evaluate leases and capture any resulting value for the estate. However, to balance the needs of landlords for clarity as to when decisions to assume or reject will be made, §365(d)(4) should continue to maintain a hard-stop deadline by which such decisions must be made. a. Alternatives considered regarding commercial leases: In reaching this conclusion, the Advisory Committee examined the following other proposals: i. Alternative #1: Eliminate §364(d)(4)’s current deadline in favor of treating commercial leases with the same flexibility as other contracts and leases. This change would restore greater uniformity to treatment, as well as maximum flexibility for debtors. Landlords would, of course, protest the reinstatement of the “bad old days,” in which they would lack the ability to maximize the use of the space and find new tenants given the lead times required. ii. Alternative #2: Extend deadline to 365 days but allow further discretionary extensions. Like the proposal that was adopted, §365(d)(4)’s deadline would be extended to 365 days. Unlike the adopted recommendation, the Bankruptcy Court would have the discretion to award a further extension for cause subject to (i) a presumption against such further extension, and (ii) a maximum further extension of 90 days. This option would provide greater flexibility if, for example, a 11 debtor needed more time for a holiday sales period to enhance plan feasibility. Nevertheless, a majority of the Advisory Committee believed that a fixed deadline was necessary for predictability for landlords, and feared that if the statute provided for the possibility of an extension, even with a high hurdle to show cause, extensions eventually would be routinely granted, thereby wholly undermining the principle of a fixed deadline. iii. Alternative #3: No change to §365(d)(4)’s 120/90-day deadline. Enacted at the behest of commercial landlords, §365(d)(4) has given rise to widespread complaints and demands for reform from debtors’ counsel and other advocates of estate maximization. In particular, the stringent 120/90 day deadlines have made retail reorganizations impossible, forcing debtors into premature going-out-ofbusiness sales without having an effective opportunity to evaluate their lease portfolios. Thus, in light of this concern, the Advisory Committee concluded that the current statute should be amended. b. Minority Report: A minority on the Advisory Committee reject the contention that the stringent §365(d)(4) deadlines adopted in 2005 have had any significant negative impact on Chapter 11 cases, arguing that (a) the reports of interference with reorganization are anecdotal and inconclusive, and (b) the real causes of the increase in liquidating sales arise from the general economic conditions confronting distressed retailers since 2005. The minority view provides examples of recent chapter 11 cases such as Fresh & Easy and Furniture Brands, which it contends illustrate that an extension of the time in §365(d)(4) is not necessary. 3. Applicability of §365(d)(4) deadlines to franchise and other agreements that integrate commercial leases and other elements: The recent case of In re FPSDA I, LLC, 450 B.R. 392 (Bankr. E.D.N.Y. 2011), presented the question of whether franchise agreements integrated with leases are controlled by the §364(d)(4) deadlines. Upon review, the Advisory 12 Committee concluded that no changes are necessary at this time, as the FPSDA holding was limited and its impact minor to date. The Advisory Committee notes that the issue presented in FPSDA would be ameliorated if the recommendation to extend the deadline to 365 days were adopted. ______________________________________________________________________________ E. Topic #5: Post-petition, pre-decision performance The Advisory Committee recommends a material change to the approach for post- petition performance obligations and enforcement: nondebtor counterparties should be entitled to reciprocal performance from the debtor, if they are going to be required to perform themselves. Amendments providing for adequate protection and the equivalent of motions for relief from stay would be necessary to implement the recommendations. More specifically, the Committee recommends: 1. Adoption of a statutory requirement for debtors' contractual performance during the case: A nondebtor counterparty to an unexpired lease or contract is generally required to perform its obligations during the post-petition, pre-decision period (the "pendency" period) unless the bankruptcy court excuses such performance. Debtors similarly should be required to render timely reciprocal performance. During the pendency period, the bankruptcy court should have the authority to excuse counterparties' performance (in whole or in part) for cause, including debtor's failure to perform post-petition or to provide adequate protection. 2. Authority to compel counterparty performance prior to assumption: Bankruptcy courts should have the ability to compel counterparties' performance during the pendency period. The unexcused failure of a nondebtor counterparty to perform its contractual obligations during the pendency period should constitute a post-petition breach of the contract or lease for which the debtor should be entitled to recover damages, notwithstanding any pre13 petition default. The bankruptcy court should have the power and the discretion to impose additional remedies when necessary to protect the bankruptcy estate, including the ability to compel performance prior to assumption, to award actual damages, to award costs and attorney’s fees, and to impose punitive damages. The nondebtor counterparty should have no right of recoupment on account of any prepetition default by the debtor. 3. Authority to compel debtor performance prior to assumption: The nondebtor counterparty to a lease or contract should be entitled to receive adequate protection during the pendency period similar to that provided under §361 of the Bankruptcy Code for actions under §§362, 363, and 364 of the Bankruptcy Code, using the same kind of procedure as motions for relief from stay currently available to secured creditors under §362. This adequate protection should include, in addition to the right to petition the bankruptcy court to shorten the time for assumption or rejection, the right to obtain adequate assurance that the debtor will render reciprocal post-petition performance as appropriate if the debtor has failed to timely perform post-petition. While immediate payment or performance by the debtor may not always be required, reasonable assurance should be afforded to preserve the status quo and to ensure, to the extent possible, the debtor's ultimate performance. A corresponding change should be made to §507(b) to encompass claims of contract or lease counterparties under §507(a)(2) arising from forced post-petition performance in exchange for court-ordered adequate protection that ultimately proves to be insufficient. 4. Section 506(c) should be non-waivable: To address situations where the nondebtor counterparty may be forced to perform in exchange for court-ordered adequate protection that may prove to be insufficient due to an administratively insolvent estate, the provisions of §506(c) should not be waiveable. Additionally, §506(c) should be enforceable by parties in interest other than the debtor/trustee, for cause, to ensure that the counterparty has 14 some available avenue for redress against a secured lender that has benefitted from the coerced performance of a contract. 5. Adopt a statutory definition as to when post-petition obligations arise: The Code should specify that the debtor’s post-petition obligation to perform commences and accrues from the petition date, unless the bankruptcy court excuses performance of the contract during the pendency period (in which event the nondebtor counterparty’s post-petition performance would also presumably be suspended). A nondebtor counterparty should be entitled to receive an administrative claim under §507(a)(2) for any unexcused post-petition breach by the debtor. The amount of the claim entitled to administrative expense priority should presumptively be the consideration required by the contract, but the bankruptcy court should have the discretion to order otherwise, except, that with respect to rent, the contract rate would be conclusive. 6. Adoption of "accrued" vs. billing date approach for post-petition obligations: Consistent with the recommendations relating to Topics #4 and 11, the fairest approach and the one subject to the least amount of manipulation is to use the accrual method rather than the billing date method for the determination as to the start of the pendency period. ______________________________________________________________________________ F. Topic #6: Cure Requirements The Advisory Committee recommends no change in the underlying principles of the current cure requirements. However, some changes are recommended, including clarification of cure obligations in the context of assignment to a third party and establishment of a presumptive deadline for cure payments to reduce litigation. 15 1. The full cure of contract or lease defaults should continue to be required as a condition of assumption. Being entitled to full payment as “cure,” counterparties to assumed contracts are treated more favorably than other unsecured creditors merely holding claims. The Advisory Committee concluded that this distinction is warranted because only such contract counterparties are forced to continue doing business with the debtor or assignee, while other creditors can “walk away.” When contracts are assumed, the debtor, reorganized debtor or assignee keeps the benefits of the contract and binds the counterparty creditor to continued performance. Therefore, the debtor or assignee should be required to meet its own obligations to pay for the continuing benefits, and not simply discharge them while taking advantage of the counterparty’s performance. 2. Prompt cure should continue to be required. The Advisory Committee considered but rejected the possibility of providing an extended period for payment of cure amounts that would effectively place assumed contract counterparties and lessors on a more equal footing with secured creditors, whose contracts may be largely indistinguishable in many cases. In addition to more similar treatment, the major advantage of cure stretch-out would be to make reorganization more feasible in some cases. However, if such an extension was to be allowed, (a) it would result in greater rights to reorganizing debtors under chapters 11, 12 and 13 than liquidating debtors; (b) any cure extension would need to be limited to the lesser of the plan term and the contract term, to avoid cure obligations continuing after the contract has expired; and (c) any such amendment would need to include provisions for determining whether a shorter cure period is appropriate under the circumstances. 3. When contracts are assumed and assigned, immediate cure should be required. The Advisory Committee recommended clarification that full cure must be provided at the time of assignment to a third party, without any installment payments. Permitting deferred cure payments would benefit debtors but impose inappropriate risks on counterparties left with 16 uncured defaults, thereby divorcing the cure payment from the contract rights and obligations. Deferring or bifurcating cure obligations could also substantially impair the counterparty’s state law remedies if the assignee obtained the contract free and clear of the cure obligation, left behind with the debtor. As a practical matter, the consideration paid by a contract assignee for its acquisition of contract rights includes the amount needed to cure defaults. Ensuring that such value is actually paid to the counterparty instead of used for other plan or operating purposes is fair to all parties. 4. The cure period should be presumptively the shorter of 90 days or the remaining term of the contract, absent cause shown for additional time. “Promptness” has proven to be too highly variable. Although flexibility is warranted, the variety of cure periods in reported cases shows that the concept of a “prompt” cure is frequently litigated. A presumptive period of promptness, that courts could alter when the circumstances warrant, should provide parties and judges with a benchmark that would be used in most cases and reduce litigation over that issue. The Advisory Committee has concluded that 90 days from the effective date of the assumption order would be an appropriate compromise period that enables debtors to fund a cure in most cases without imposing too great a burden on creditors, as long as that period does not extend past the expiration date of the contract or lease, and that immediate cure is required when the assumed contract or lease is assigned. 5. Assumption should nullify any potential preference claims. Despite nearly-uniform holdings barring such claims, debtors, trustees and liquidating trusts continue to assert preference claims against contract counterparties to assumed contracts and leases. This is highly burdensome on counterparties and courts; a statutory amendment should definitively preclude such claims. 17 6. Section 365(k), providing that assignment of an assumed contract relieves the trustee and estate from any liability for a post-assignment breach of the contract, should not be modified. The debtor should continue be relieved of responsibility for the consequences of an assignee’s contract default. However, relief under Bankruptcy Rules 9023 and 9024 should not be foreclosed if the facts show that the assignment was improper. 7. Cure payments should be subject to the applicable contractual interest rates and include contractual penalty provisions, subject to court review if excessive or punitive. Case law with respect to the obligation to cure penalty provisions, including default interest for monetary defaults, is in disarray in the contexts of contract cures. In accord with the Advisory Committee’s guiding principles, consistency with state law and contract rights is important unless strong bankruptcy policies warrant otherwise. A presumption in favor of contractually agreed upon interest rates in the cure context, matching the presumption in the context of claim allowance, would help to avoid unnecessary litigation, but should remain subject to the right of debtors and other parties to challenge default interest rates that would meet standards of unconscionability or usuriousness under state law, or otherwise be so excessive as to be punitive. This proposed standard should apply in all chapters of the Code and for all contract assumptions, whether early in a case, in conjunction with a Section 363 asset sale, or under a reorganization plan. Section 365 should be the exclusive provision that governs whether default rates or other penalties are payable when curing a default under a contract or lease. Thus, not only should Sections 365(b)(1)(A) and 365(b)(2)(D) be amended, but Sections 1123(d), 1222(d) and 1322(d) should simply cross-reference Section 365 cure requirements. ______________________________________________________________________________ G. Topic #7 – Defaults Subject to Cure The Advisory Committee recommends (a) the relaxation of §365’s present requirement that all nonmonetary defaults (aside from those in nonresidential real property leases) be cured 18 and (b) the adoption of the assumption date, rather than petition date, as the relevant cure date; and (c) continuance of the current policy that cure of defaults by third-parties should not be a condition of assumption. 1. Recommendation: Section 365 should exempt historical nonmonetary defaults from cure requirements for all contracts. The current rule requiring cure unduly restricts a debtor’s ability to assume potentially valuable contracts, particularly where a historical, incurable nonmonetary default has occurred. In effect, the amendment to protect real estate leases from forfeiture for incurable nonmonetary defaults would be extended to all contracts for the same reasons the statute was changed for leases. This change would be consistent with the Advisory Committee’s guiding principle favoring uniform bankruptcy treatment. In reaching this conclusion, the Advisory Committee considered but rejected three alternative approaches: a. Alternative A: Nonmonetary defaults should be exempt from cure requirements: Exempting all nonmonetary defaults from the cure requirements would be an easily administered bright-line test that would grant debtors the greatest flexibility to assume profitable contracts and, in turn, enhance the likelihood of a successful reorganization and maximize the value of the estate. However, such a change would potentially give debtors too much control over which contracts and leases can be assumed, and would arguably deprive counterparties of the benefit of their bargain. This alternative fails to adequately balance the rights and interests of the contract counterparties. b. Alternative B: Only “material” nonmonetary defaults should be subject to the cure requirements. To avoid a debtor being deprived of a profitable contract based on a minor or insignificant default, some courts have differentiated between material and nonmaterial defaults. While the word “material” does not appear in §365, several cases postBAPCPA have implemented a materiality requirement, and have excused debtors from the obligation to cure nonmaterial defaults. The apparent benefit to codifying a materiality 19 requirement for cure is that debtors would not lose profitable contracts based on minor or insignificant defaults. However, this approach is likely to generate litigation and inconsistent case law regarding the definition of “materiality. c. Alternative C: Adoption of a “balancing of the equities” standard in determining whether a debtor should be required to cure a nonmonetary default. Such an approach might decrease instances whereby debtors are prevented from assuming profitable or essential contracts necessary to their successful reorganization based on insignificant defaults. Such an approach also would protect counterparties, as a bankruptcy judge may not permit assumption of a contract when it would be grossly unfair or prejudicial to the contract or lease counter-party to do so. However, this approach also risks litigation and inconsistent application of such a vague standard. 2. Ancillary recommendation: Cure should be measured as of the proposed date for assumption, rather than petition date. Consistent with the Advisory Committee’s other proposals (specifically, Topic #5), after the petition date there should be a presumption that a debtor will comply with the terms of the contract or lease during the administration of the case, including compliance with any nonmonetary default provisions. The Advisory Committee submits that the failure to comply with such terms should give rise to the right of the counterparty to seek prompt relief from the Bankruptcy Court. 3. Recommendation of no change: Cure of defaults by nondebtors should not be a condition of assumption of a contract or lease. Few cases involving cross-defaults by third parties have been reported. In general, the issue arises where the underlying agreements are part of a single, integrated transaction. Existing state law provides sufficient guidance to courts as to when contracts are sufficiently related to warrant making cure of a nondebtor’s default a prerequisite to assumption. ______________________________________________________________________________ 20 H. Topic #8: Calculation of Rejection Damages The principal controversy regarding the calculation of rejection damages concerns longterm contracts, primarily the “landlord cap” provision §502(b)(6) that limits damages for loss of future rent under commercial real estate leases to “the rent reserved . . . for the greater of one year, or 15 percent, not to exceed three years, of the remaining term of such lease.” The Advisory Committee recommends as follows: 1. Clarify the base for the §502(b)(6) calculation: The courts have split as to how those amounts should be calculated. The Advisory Committee concluded that §502(b)(6) needs to be clarified: the cap should be calculated based on the greater of the following amounts: (i) the average annual amount of rent during one year of the remaining term of such lease (not the rent for the next year), or (ii) 15% of the total amount of obligations, not to exceed three times the average annual amount. 2. Clarify the definition of rent: Consistent with the Advisory Committee’s guiding principles, the Committee considered but rejected the possibility of establishing a federal standard for calculation of landlords' damages in favor of relying on state law. However, case law is currently highly inconsistent with respect to interpretation of the term “rent” under the Code. This nonuniformity should be resolved by amendments that clarify that: a. Definition of “rent”: "Rent" under §502(b)(6) should not be limited to items so labeled by the lease, but should be based on recurring monetary obligations of the tenant; b. Rejection, not termination: Consistent with the principle that rejection does not equal termination, rejection damages should include future rent subject to the §502(b)(6) cap, notwithstanding nonbankruptcy law in some jurisdictions that may cut off entitlement to future rent upon termination of a lease. 21 c. Mitigation: Landlords should be required to make reasonable efforts to mitigate damages if required to do so by state law, but §502(b)(6) claims should be reduced only by the net effect of mitigation. d. Allowability of other damages: The §502(b)(6) cap should not limit any landlord claims, other than from the rejection itself, for the tenant's acts and omissions, resulting in damage to the premises, waste, trespass, contamination and costs of remediation. 3. Possible caps on rejection damages for other long-term leases: The Advisory Committee concluded that the same considerations that justify the §502(b)(6) cap on future rent damages might also justify similar limitations on damages for rejection of other longterm or high-value contracts or leases. Such limitations might be valuable, particularly where damages can be mitigated and a cap might remove a disincentive to mitigate. ________________________________________________________________________ I. Topic #9: Rejection principles The Advisory Committee recommends clarification but no significant substantive change in the concept of rejection. 1. Rejection should continue to be a breach, not a termination. The question about breach vs. termination arises because, even though the Code expressly provides that rejection constitutes a breach, some cases still appear to equate the two. The Committee was persuaded by the arguments in the earlier reports of the National Bankruptcy Conference and the National Bankruptcy Review Commission which, at length, considered and rejected the suggestion that rejection should result in termination. To eliminate this problem entirely, the Committee recommends a change in terminology, as proposed by law review articles by Mike 22 Andrew, Jay Westbrook and others: the Code should replace the term “reject” with the term “breach.” 2. Leases or contracts that are not assumed or reject should deemed rejected. The Advisory Committee found no problems with the current practice in this regard, and thus no reason for change. 3. Contract counterparties should have the right to vote on plans whenever a contract or lease has been rejected or the filed plan does not provide for assumption. This recommendation was prompted by concern for the nondebtor party whose contract or lease will , under the plan, be rejected or deemed rejected as of the effective date of the plan. That nondebtor party may have a significant claim and should not be disenfranchised. ______________________________________________________________________________ J. Topic #10: Issues Relating to Intellectual Property Licenses The analysis of this topic so significantly overlapped Topic #3 on Assignability that a single report was prepared, as set forth under that topic above. ______________________________________________________________________________ K. Topic #11: Commercial Real Estate Leases Although issues regarding commercial real estate leases cut across a number of other topics, the high level of litigation regarding these issues led the Advisory Committee to focus separately on the specific impact of §365 on leases of non-residential real property. The principal issues relate to post-petition performance. The Code currently requires debtors to timely perform “all of the obligations of the debtor” under any unexpired lease of non-residential real property until the lease is assumed or 23 rejected. Prior to 1984, a commercial landlord had the burden to prove that rent and other postpetition charges were actual and necessary expenses of preserving the estate. The response was the enactment of the 1984 amendments adding § 365(d)(3), which specifically requires the debtor to perform all obligations post-petition, ‘notwithstanding section 503(b)(1).” Generally speaking, the case law has been supportive and has not challenged the rationale of this section, nor found its application troublesome. The Advisory Committee recommends no change in this basic policy. However, several circuit splits have developed regarding the details of the application of this provision, resulting in unproductive litigation that could be eliminated by statutory clarification. Accordingly, the Committee recommends: 1. Clarification of the various kinds of non-monetary obligations that are embraced within § 365(d)(3). As a matter of principle, most such obligations should be included. 2. Adoption of the “accrual” vs. the billing date rule. The circuit split on the meaning of whether an obligation arises post-petition should be resolved by more clearly adopting a rule that follows the general contours of the accrual rule, as now followed in the Seventh Circuit, and overruling In re Montgomery Ward Holding Corp., 268 F.3d 205 (3rd Cir. 2001), and the billing date line of cases. 3. Clarification that lease obligations under d§ 365(d)(3) do not have superpriority status over other administrative expenses. Although lease obligations must be paid currently in the case, whereas other administrative expenses may not be, disputes have arisen as to whether this timing obligation creates a priority as well. This is consistent with the majority rule in existing case law. This clarification may best be implemented by amendment to §507. 4. Provision for adequate protection if lease payments are deferred during the first 60 days of the case or otherwise. This recommendation is consistent with the recommendations set forth for Topic #5. The definition of adequate protection in §361 should be 24 expanded to include requirement of explicit provision for payment in the budgets for DIP financing orders. 5. Provision for meaningful sanctions for failure to comply with §365(d)(3). Landlords should be entitled to seek, and the court to grant sanctions for failure to pay rent, including adequate protection, immediate payment, contempt sanctions or fines, turnover of the property to the landlord, shortened notice hearings on motion to compel rejection, or relief from the automatic stay to permit eviction suits in state court. December 2013 Respectfully submitted, Hon. Kevin Huennekens, Chair Advisory Committee on Executory Contracts & Unexpired Leases Prepared by Lisa Hill Fenning, Reporter 25