The Bankruptcy Abuse Prevention and Consumer Protection Act

advertisement

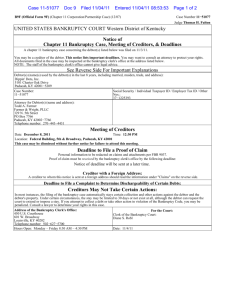

COLLECT HANDLING BANKRUPTCY CASES TODAY: What Government Collectors Need to Know Jeffrey A. Scharf Taxing Authority Consulting Services, P.C. Several Factors to Consider • The Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) of 2005 – Championed primarily by commercial creditors to limit what they saw as rampant abuses of the discharge provisions of the law. – Effective as to bankruptcies filed on or after October 17, 2005 so there are still some cases in the system operating under the old laws • The Daily Grind • “It’s the economy stupid!” (with apologies to James Carville) What Did it do ? • Many provisions affecting the handling of bankruptcy cases by governments were enacted • Some of the new requirements for debtors include: – mandatory credit counseling – “means test” • determine debtor’s ability to repay their debts • Based on median income and expenses for the State • It “means” you aren’t as bad off as you thought…. What Did it do ? • The net result of these requirements was to force more debtors into Chapter 13 payment plans. • This actually may delay collections for governments as otherwise nondischargeable debt is paid over time rather than becoming subject to administrative collection upon the grant of a Chapter 7 discharge. Good News/Bad News • Most of these changes did not have any major impact on the day to day operations of the government collector – Even with regard to handling new bankruptcy cases • They did, however, impact how the government claim will be treated and paid • Bankruptcies are like shopping for your wife’s birthday… Way too many possibilities and few of them are likely to be right… Even the choices that may have been appropriate the last time around! Dallas Parker, Deputy Treasurer James City County, Virginia THE NEW PROVISIONS How They Are Working in Practice and Other Things Government Officials Might Want to Know Designation of Address • The law provides the ability for tax creditors to designate a particular address for bankruptcy filings. If you do not designate an address, the debtor may use any address that is valid for the filing of returns or to contest an assessment. §505(b)(1)(A) • The Code also permits a government entity to file a notice to be effective with all Bankruptcy Courts to receive notifications of all cases filed under Chapter 7 or Chapter 13 in which the taxing authority is a creditor. §342(f). • It is still not clear how this notification requirement is playing out. – Register at www.ncrsuscourts.com Termination of Automatic Stay • A debtor that files a case after having one dismissed in the last year is only granted a 30 day stay of action by creditors unless the court grants the debtor additional time. • If the debtor has had two or more cases dismissed in the last year (either filed singly or jointly), the automatic stay does not apply at all. §362(c)(3)(A)-(4)(A). • Debtors in these situations are typically filing a Motion to Extend/Implement the Stay along with their petition • Creditors seem unwilling to take action and risk violating the stay without a determination by the court that the stay is not in effect Return Filing Requirements • Chapter 13 debtors are required to file all tax returns for the past 4 years by §341 meeting. – If they fail to do so, the court can convert the case to chapter 7 or dismiss it. §1308(a). – The filing of all tax returns is also required for Chapter 13 plan confirmation. §1325(a)(9) • A taxing entity can request the court to convert or dismiss the case for the failure of a debtor to file a post-petition return. • If the return is not filed within 90 days after motion the court MUST convert or dismiss the case. §521(j). • The US Trustee or Chapter 13 Trustee may be able to help. Priority Taxes • In computing the time limits for determination of priority taxes, the time is suspended for any time in which collection was suspended or which the automatic stay was in effect, plus an additional 90 days. §507(a). Chapter 11 Payment Requirements • Plan payments in Chapter 11 cases must be made within 5 years of the bankruptcy filing date. • This payment requirement also extends to secured claims that would also be qualified as priority claims if they were not otherwise secured. • Debtors must make regular payments. This section originally read “regular and equal” to avoid mere token payments with a large balloon payment to be made years later. The “equal” language was dropped and courts have already allowed some creative payment schemes. §1129(a)(9)(C). Discharge in Chapter 13 • There is no longer a super discharge in Chapter 13 cases. – Included all debts not paid through the plan • Debts that are discharged are treated as they would be in a Chapter 7 case. • This closes the loophole that permitted the discharge of liability for unfiled, late filed and fraudulent tax returns. §1328(a)(2). • This change also establishes that responsible officer assessments for trust fund liabilities are also not discharged. BAPCPA Summary • Substantial changes made to substantive bankruptcy law • No real day-to-day effect on handling new bankruptcies • Changes to (among others): – Automatic Stay – Plan Requirements – Discharge Provisions The Daily Grind Improving Recovery in Bankruptcy Jeffrey Scharf Taxing Authority Consulting Services, P.C. Citizen says: “I filed bankruptcy” • • • • Where did you file? Which court? What’s your case number? Who’s your attorney? Easy to Verify – VCIS • Case No. • SSN • Name – PACER Develop a Process • Create a methodology to approach bankruptcy case – Coding Accounts – Preparing Claims – Tracking and Review • Use flowcharts, worksheets and other documented tools – This is tricky stuff • Claim Filing • Discharge A NEW CASES Update AR (court, case #, trustee name, chapter, filing date, claim date) Add to Spreadsheet (AR data, plus attorney name, address & phone & trustee address & phone) SORT by Chapter CHAPTER 7 (No assets) CHAPTER 7 assets CHAPTER 11 Are there Nonfilers? Calendar 6 months (or until discharge/ dismissal) Is there a business associated? No No D Yes Send Nonfiler letter File claim through CACS-G Yes Mail to Court Responsible officer assessment? Calendar prior to bar date, if one, or 6-12 months Update spreadsheet with amount and date filed Responsible officer assessment? Check case on VCIS or PACER Responsible officer assessment? File Estimated Claim? Calendar next work date, 9-12 months Calendar next work date, 3 months D CHAPTER 13 Pre-petition debts vs. Post-petition Debt • Bankruptcy only protects a Debtor from Pre-petition debts – Debts incurred before bankruptcy is file • Does not protect debtor on post-petition debt – To be paid in the ordinary course of business – Failure to pay post-petition obligations may be grounds for conversion/dismissal of case Citizen says: ”I filed bankruptcy and got a discharge….you can’t collect” • Do you have a copy of the discharge entered by the court? • Take a look at it: – It says: “The debtor is granted a discharge” “SEE THE BACK OF THIS ORDER FOR IMPORTANT INFORMATION” Citizen says: “I filed bankruptcy and got a discharge….you can’t collect” • Do you have a copy of the discharge entered by the court? • Take a look at it: – It says: “The debtor is granted a discharge” “SEE THE BACK OF THIS ORDER FOR IMPORTANT INFORAMATION” • Now flip it over and take a look at the back: – It says “Debts that are not discharged” • Debts for most taxes • Debts for fines, penalties and criminal restitution • Debts not properly listed Once they are discharged, let them know what is still due… Know the substantive discharge rules Do not write off debts that remain collectible Debtor even more likely to pay them now that many other debts have actually been discharged No court determination required Effect on Statute of Limitations Immediately inform the taxpayer It’s the Economy Stupid!!!! A Few Things To Do To Improve Recovery in Bankruptcy Jeffrey Scharf Taxing Authority Consulting Services, P.C. Automatic Stay 11 U.S.C. §362 Automatic Stay (in part) (a) Except as provided in subsection (b) of this section, a petition filed under…this title…operates as a stay… (b) The filing of a petition under…this title…, does not operate as a stay— (9) under subsection (a), of— (A) an audit by a governmental unit to determine tax liability; (B) the issuance to the debtor by a governmental unit of a notice of tax deficiency; (C) a demand for tax returns; or (D) the making of an assessment for any tax and issuance of a notice and demand for payment of such an assessment… Exceptions to the Stay • Exceptions are still in existence to permit: – Criminal actions §362(b)(1) • Police and regulatory powers • Including where the goal is restitution – An audit by a government unit §362(b)(9)(A) – A demand for tax returns, §362(b)(9)(C) – Making an assessment; and issuing a notice and demand for payment, §362(b)(9)(D) – Setoff of income tax refunds, §362(b)(26) • Effectiveness of the Stay (only as to debtor) – Jointly liable/assessed parties – Responsible officer assessments Responsible Officer Assessments § 58.1-3906. Liability of corporate officer or employee, or member or employee of partnership or limited liability company, for failure to pay certain local taxes. (in part) A. Any corporate, partnership or limited liability company officer who willfully fails to pay, collect, or truthfully account for and pay over any local admission, transient occupancy, food and beverage, or daily rental property tax administered by the commissioner of revenue or other authorized officer, or willfully attempts in any manner to evade or defeat any such tax or the payment thereof, shall, in addition to other penalties provided by law, be liable for a penalty of the amount of the tax evaded or not paid, collected, or accounted for and paid over, to be assessed and collected in the same manner as such taxes are assessed and collected. Responsible Officer Assessments The automatic stay only applies to the debtor. Some Tax liability (trust taxes?) can be immediately assessed against the responsible officer and collection action taken. Provides leverage in the bankruptcy case. Filing Claims § 502. Allowance of claims or interests (in part) (a) A claim or interest, proof of which is filed under section 501 of this title, is deemed allowed, unless a party in interest, including a creditor…objects. Filing Claims Only way to assert a debt is owed against the bankruptcy estate Understand the claim filing rules Understand the effect of a lien in your jurisdiction and assert your secured rights For taxes, these are quite cumbersome, and are dependent upon such factors as tax year, tax type, due date, and can even result in different treatments for taxes vs. tax penalties Allowed unless objected to Always file Late claims (especially in Ch. 7) Estimated claims Amended Claims Administrative Claims (monitor the case) Plans of Reorganization § 1129. Confirmation of plan (in part) (a) The court shall confirm a plan only if all of the following requirements are met: (1) The plan complies with the applicable provisions of this title. (9) Except to the extent that the holder of a particular claim has agreed to a different treatment of such claim, the plan provides (C) with respect to a claim of a kind specified in §507 (a)(8) …regular installment payments in cash— (i) of a total value, as of the effective date of the plan, equal to the allowed amount of such claim; (ii) over a period ending not later than 5 years after the date of the order for relief…; and (iii) in a manner not less favorable than the most favored nonpriority unsecured claim provided for by the plan… Plans of Reorganization § 1322. Contents of plan (in part) (a) The plan shall— (1) provide for the submission of all or such portion of future earnings or other future income of the debtor to the supervision and control of the trustee as is necessary for the execution of the plan; (2) provide for the full payment, in deferred cash payments, of all claims entitled to priority under section 507 of this title, unless the holder of a particular claim agrees to a different treatment of such claim; Plans of Reorganization Code requirements for Plan language are all “unless otherwise agreed” You are deemed to have agreed by silence If you don’t object the debtor can: Lower the interest rate Pay you over an exceeding long term Pay you only token amounts with a balloon payment Even pay you in pennies The Plan constitutes a contract Plans of Reorganization Don’t go silently into “that good night” Review Plans and File Objections Ask and you shall receive Interest rate Timely and regular payments Default provisions Carve outs for taxes from other plan requirements YOU HAVE TO DEMAND… TREAT ME RIGHT!!!! REVIEW There are several ways to get additional revenue out of the bankruptcy process You need to have someone with knowledge of the substantive laws able to follow the case step by step and jump through the “hoops” Always file and defend your claims Participate, because it’s the squeaky wheel that gets the grease SO GO AHEAD AND SQUEAK!! Jeffrey Scharf Taxing Authority Consulting Services, P.C. (703) 425-7751 jeff@taxva.com www.taxva.com