Due diligence checklist How we document the green and

advertisement

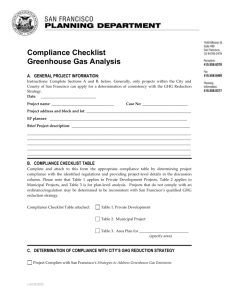

Green Investment handbook Green due diligence checklist Green Investment Handbook Green due diligence checklist Contents Key Parties and Project Summary ................................................................................................................................................................................................................... 4 Table 1: GIB DD Tools ..................................................................................................................................................................................................................................... 5 Table 2: Equator Principles Applicability .......................................................................................................................................................................................................... 6 Table 3: Performance against the Green Investment Policy:........................................................................................................................................................................... 7 Section 4.1 & 4.2 .............................................................................................................................................................................................................................................. 7 Sector Specific Performance against the Green Investment Policy: Section 4 ............................................................................................................................................... 8 Section 4.3 Offshore Wind ............................................................................................................................................................................................................................... 8 Section 4.4 Waste .......................................................................................................................................................................................................................................... 10 Section 4.5 Energy Efficiency ........................................................................................................................................................................................................................ 13 Section 4.6 Biomass....................................................................................................................................................................................................................................... 15 Section 4.7 Onshore Wind ............................................................................................................................................................................................................................. 18 Section 4.8 Hydropower ................................................................................................................................................................................................................................. 20 Table 4: Performance against the Green Investment Policy:......................................................................................................................................................................... 22 Section 5 & 6 .................................................................................................................................................................................................................................................. 22 Table 5: Performance against the Responsible Investment Policy ................................................................................................................................................................ 23 Annex 1: Document Checklist ........................................................................................................................................................................................................................ 25 Annex 2: Summary of Key Project/Client Engagement (including significant telecons) ................................................................................................................................ 26 2 Green Investment Handbook Green due diligence checklist Project Sector Primary Author Version/Date Author Confirmation I confirm that these due diligence notes fairly represent the transaction as I understand it. Signed [INSERT ELECTRONIC SIGNATURE OF AUTHOR] Reviewer Confirmation I confirm that I have read these due diligence notes and that I agree with the assessment of the transaction or, where not in agreement, that this is highlighted below and in the relevant Investment Committee papers. Signed [INSERT ELECTRONIC SIGNATURE OF GREEN CONTROL FUNCTION] Reviewer Summary [Summarise comments from review] Executive Summary [Compliance with GIB’s Green Investment Policy and Responsible Investment Policy] [Material expectations and safeguards/mitigation] [Green risks] [Green ratings] Green Control Function Summary [Senior control review confirming above (or otherwise)] Material expectations and safeguards/mitigation 3 Green Investment Handbook Green due diligence checklist Key Parties and Project Summary Entity Role in transaction [Sponsor] [Insert role e.g. controlling interest in the transaction] [The main organisation that GIB is supporting via its investment and the principal subject of investigation vs. the RI Policy] [Operator] [insert role e.g. O&M contractor] [The party which will control Operations and Maintenance day to day and therefore de facto the party that will manage ESG issues] [EPC contractor] [insert role e.g. EPC contractor] [The party which will build the project and therefore have day to day control of ESG matters during the construction phase of the project] [Technical Advisor] 4 Green Investment Handbook Green due diligence checklist Table 1: GIB DD Tools Test Reference All sectors Responsible Investment – External Factors Review Project Risk Assessment Add Brief Summary [hyperlink/reference document] Add Brief Summary [hyperlink/reference document] OSW GHG calculator Green Impact note Add Brief Summary [hyperlink/reference document] Add Brief Summary [hyperlink/reference document] Waste Residual waste availability – sensitivity Add Brief Summary [hyperlink/reference document] Energy Efficiency EE calculator (not mandatory) Add Brief Summary [hyperlink/reference document] Biomass GHG savings calculation Add Brief Summary [hyperlink/reference document] Onshore Wind and Hydro GHG savings calculation Add Brief Summary [hyperlink/reference document] 5 Green Investment Handbook Green due diligence checklist Table 2: Equator Principles Applicability Project Project Scope for EP appraisal EP Applicability Criteria Does the project include the following criteria? 1 Yes/No GIB Rationale Project Finance: with total Project capital costs of US$10 million or more. Project-Related Corporate Loans, where all four of the following criteria are met: i. The majority of the loan is related to a single Project over which the client has Effective Operational Control (either direct or indirect). 2 ii. The total aggregate loan amount is at least US$100 million. iii. GIB’s individual commitment (before syndication or sell down) is at least US$50 million. iv. The loan tenor is at least two years. Bridge Loans: with a tenor of less than two years that are intended to be refinanced by Project 3 Finance or a Project-Related Corporate Loan that is anticipated to meet the relevant criteria described above. Existing facilities only: While the Equator Principles are not intended to be applied retroactively, GIB will apply them to the expansion or upgrade of an existing Project where changes in scale or scope may create significant environmental and social risks and impacts, or significantly change the nature or degree of an existing impact. Note Summary If no to all of the above (project is not applicable for EP purposes) If yes to any the above (complete the separate EP compliance checklist) [State Equator Principles Categorisation: A, B, C] 6 Green Investment Handbook Green due diligence checklist Table 3: Performance against the Green Investment Policy: Section 4.1 & 4.2 s. 4.1 Mandatory Legal Requirements Requirement Investment will comply with all environmental and planning laws, regulations and permits in all material respects. Compliance with all the sustainability requirements imposed by the relevant regulations providing economic incentives for the project financial base case as presented to us (such as those set out in the relevant Renewables Obligation Orders), to the extent those regulations apply to the relevant project. Comment Legal doc reference ☐ ☐ s. 4.2 Quantification of green impact In each case, where reference is made to the quantification of green impact, this is to be made in accordance with our latest applicable Green Impact Reporting Criteria. ☐ 7 Green Investment Handbook Green due diligence checklist Sector Specific Performance against the Green Investment Policy: Section 4 Section 4.3 Offshore Wind s. 4.3 Appraisal vs. Offshore Wind Criteria: In considering whether any loan or investment in this sector would make a contribution to achieving any of the Green Purposes set out below, we will evaluate (and, so far as practicable, quantify) the extent to which the relevant project is likely to have the corresponding positive Green Impact set below. NB: We will consider if a project contributes, or is reasonably likely to, contribute in the UK to any one or more of five green purposes, i.e. a project does not need to meet all of these criteria. The reduction of GHG emissions A positive contribution to GHG savings, as estimated in accordance with GIB’s latest applicable Green Impact Reporting Criteria. Based on due diligence conducted to date, the project’s anticipated contribution to reduction of GHG emissions is: [●] t CO2e/annum based on a lifetime emissions saving of [●] tCO 2e (assuming a project lifetime of [●] years). ☐ The advancement of efficiency in the use of natural resources A positive contribution to renewable electricity generation. Based on due diligence conducted to date, the project’s generation of renewable electricity (attributable to GIB) is: [●] GWh/annum based on a lifetime emissions saving of [●] GWh (assuming a project lifetime of [●] years). ☐ The protection or enhancement of the natural environment The presence of improvements to or the avoidance or satisfactory mitigation of any adverse impacts on the natural environment beyond minimum legal requirements, including but not limited to: Adverse impact on visual amenity of the land or seascape; Noise pollution affecting populated areas together with any other loss of amenity; Adverse impact on the marine or coastal environment; ☐ ☐ ☐ 8 Green Investment Handbook Green due diligence checklist Disturbance and long-term damage to the quality of the land or seabed. ☐ The protection or enhancement of biodiversity The presence of improvements to, or the avoidance or satisfactory mitigation of, any adverse impacts on biodiversity beyond minimum legal requirements, including but not limited to: Impact on biodiversity (including bird life, sea mammals and other sea life) resulting from the construction or operational and decommissioning phases including the construction of on and off-shore installations and access points to the coast; Any other effect which demonstrably reduces net loss and improves net gain to biodiversity arising from the project. ☐ ☐ The promotion of environmental sustainability Commitment to continual improvement through good industry practice. ☐ Additional benefits which may contribute to the transition to a green economy including the potential for the future life-extension of the green infrastructure. ☐ Reviewer Comments 9 Green Investment Handbook Green due diligence checklist Section 4.4 Waste s. 4.4 Appraisal vs. Waste Criteria: In considering whether any loan or investment in this sector would make a contribution to achieving any of the Green Purposes set out below, we will evaluate (and, so far as practicable, quantify) the extent to which the relevant project is likely to have the corresponding positive Green Impact set below. NB: We will consider if a project contributes, or is reasonably likely to, contribute in the UK to any one or more of five green purposes, ie.e a project does not need to meet all of these criteria. The reduction of GHG emissions A positive contribution to GHG savings, as estimated in accordance with GIB’s latest applicable Green Impact Reporting Criteria. Based on due diligence conducted to date, the project’s anticipated contribution to reduction of GHG emissions is: [●] t CO2e/annum based on a lifetime emissions saving of [●] tCO2e (assuming a project lifetime of [●] years). ☐ The advancement of efficiency in the use of natural resources A positive contribution to advancing the circular economy through improvement of each of: Re-use of products; and Collection, sorting and reprocessing of materials for recycling. A positive contribution to additional energy recovered from waste and associated additional renewable energy production generation, including R1 efficiency Otherwise a high level of efficiency in line with industry practice The deployment of combined heat and power technology, or the future potential to do so, to further improve the efficiency of conversion of energy. ☐ ☐ ☐ 10 Green Investment Handbook Green due diligence checklist The protection or enhancement of the natural environment A positive net contribution to additional waste diverted from landfill, including both biodegradable and nonbiodegradable waste, together with a suitable plan to minimise waste to landfill to the extent practicable. The presence of improvements to or the avoidance or satisfactory mitigation of any adverse impacts on the natural environment beyond minimum legal requirements, including but not limited Levels of pollution of controlled substances to the air (including the performance against regulatory permitted air emissions limits); Noise, dust or odour impacts arising from plant operations or transportation of waste, or other loss of amenity; Levels of soil, surface water and groundwater pollution; Volume of water used, in particular from local groundwater and surface water resources. ☐ ☐ ☐ ☐ ☐ The protection or enhancement of biodiversity The presence of improvements to, or the avoidance or satisfactory mitigation of, any adverse impacts on biodiversity beyond minimum legal requirements, including but not limited to: Impact on biodiversity resulting from the construction or operation of the plant and associated infrastructure; Any other effect which demonstrably reduces net loss and improves net gain to biodiversity arising from the project. ☐ ☐ 11 Green Investment Handbook Green due diligence checklist The promotion of environmental sustainability Commitment to continual improvement through good industry practice. ☐ Additional benefits which may contribute to the transition to a green economy including the potential for the future life-extension of the green infrastructure. ☐ Reviewer Comments 12 Green Investment Handbook Green due diligence checklist Section 4.5 Energy Efficiency s. 4.5 Appraisal vs. EE Criteria: In considering whether any loan or investment in this sector would make a contribution to achieving any of the Green Purposes set out below, we will evaluate (and, so far as practicable, quantify) the extent to which the relevant project is likely to have the corresponding positive Green Impact set below. NB: We will consider if a project contributes, or is reasonably likely to, contribute in the UK to any one or more of five green purposes, i.e. a project does not need to meet all of these criteria. The reduction of GHG emissions A positive contribution to GHG savings, as estimated in accordance with GIB’s latest applicable Green Impact Reporting Criteria. Based on due diligence conducted to date, the project’s anticipated contribution to reduction of GHG emissions is: [●] t CO2e/annum based on a lifetime emissions saving of [●] tCO2e (assuming a project lifetime of [●] years). ☐ The advancement of efficiency in the use of natural resources A positive contribution to reduced energy demand, as estimated in accordance with GIB’s latest applicable Green Impact Reporting Criteria. In the case of an investment in combined heat and power, utilisation of technology that is certified under the CHP Quality Assurance programme (CHPQA) as having met the efficiency criteria for high efficiency CHP. ☐ ☐ The protection or enhancement of the natural environment The presence of improvements to, or the avoidance or satisfactory mitigation of, any adverse impacts on the natural environment beyond minimum legal requirements, including but not limited to: Impact on visual amenity of the built environment; and Noise, dust or odour impacts or other loss of amenity. ☐ 13 Green Investment Handbook Green due diligence checklist The protection or enhancement of biodiversity The presence of improvements to, or the avoidance or satisfactory mitigation of, any adverse impacts on biodiversity beyond minimum legal requirements, including but not limited to: • Impact on biodiversity resulting from the installation or retrofit of energy efficient equipment and its subsequent operation; and Any other effect which demonstrably reduces net loss and improves net gain to biodiversity arising from the project. ☐ ☐ The promotion of environmental sustainability Commitment to continual improvement through good industry practice. ☐ Additional benefits which may contribute to the transition to a green economy including the potential for the future life-extension of the green infrastructure. ☐ Reviewer Comments 14 Green Investment Handbook Green due diligence checklist Section 4.6 Biomass s. 4.6 Appraisal vs. Biomass Criteria: In considering whether any loan or investment in this sector would make a contribution to achieving any of the Green Purposes set out below, we will evaluate (and, so far as practicable, quantify) the extent to which the relevant project is likely to have the corresponding positive Green Impact set below. NB: We will consider if a project contributes, or is reasonably likely to, contribute in the UK to any one or more of five green purposes, i.e. a project does not need to meet all of these criteria. The reduction of GHG emissions A positive contribution to GHG savings, as estimated in accordance with GIB’s latest applicable Green Impact Reporting Criteria. A biomass feedstock procurement strategy which demonstrates the following characteristics: Based on due diligence conducted to date, the project’s anticipated contribution to reduction of GHG emissions is: [●] t CO2e/annum based on a lifetime emissions saving of [●] tCO 2e (assuming a project lifetime of [●] years). Based on due diligence conducted to date, the project’s feedstock procurement strategy demonstrates the following characteristics: [For power: it enables the generation of renewable electricity with a GHG emissions intensity of [●] kg CO2e/MWh [which is less than the 200 kg CO2e/MWh required by 2020 under ROCs]] [For heat: it enables the generation of renewable heat with a GHG emissions intensity of [●] kg CO2e/MWh [which is less than the 125.28 kg CO2e/MWh required by the RHI] It secures a positive contribution to GHG savings by focusing on appropriate, sustainable fuel sources ☐ ☐ The advancement of efficiency in the use of natural resources A positive contribution to renewable electricity generation. A quantifiable level of efficiency of conversion of primary energy to output electricity and/or heat, including the capacity to deploy combined heat and power technology or the future potential to do so. ☐ ☐ 15 Green Investment Handbook Green due diligence checklist The protection or enhancement of the natural environment The presence of improvements to, or the avoidance or satisfactory mitigation of, any adverse impacts on the natural environment beyond minimum legal requirements, including but not limited In respect of biomass feedstock supplies, compliance with good industry practice such as sustainable agricultural or forestry standards which help protect soil quality, ground and surface water and otherwise protect forests and crops from natural harms such as storms (wind throw), fire and disease, together with compliance with the land criteria set out in the relevant Renewable Obligation Orders or Renewable Heat Incentive Scheme Regulations which prohibit use of material from high biodiversity sources such as grasslands. In respect of the biomass plant: Levels of pollution of controlled substances to the air (including the performance against regulatory permitted air emissions limits); Noise, dust or odour impacts arising from plant operations or transportation of waste, or other loss of amenity; Levels of soil, surface water and groundwater pollution; Volume of water used, in particular from local groundwater and surface water resources. ☐ ☐ ☐ ☐ ☐ 16 Green Investment Handbook Green due diligence checklist The protection or enhancement of biodiversity The presence of improvements to, or the avoidance or satisfactory mitigation of, any adverse impacts on biodiversity beyond minimum legal requirements, including but not limited to: In respect of biomass feedstock supplies: compliance with good industry practice such as sustainable agricultural or forestry standards which protects biodiversity originating in forest or on land used as the source of biomass; In respect of the biomass plant: all biodiversity impacted by the construction or operation of the plant and associated infrastructure; and Any other effect which demonstrably reduces net loss and improves net gain to biodiversity arising from the project. ☐ ☐ ☐ The promotion of environmental sustainability Commitment to continual improvement through good industry practice. Additional benefits which may contribute to the transition to a green economy including the potential for the future life-extension of the green infrastructure. ☐ ☐ Reviewer Comments 17 Green Investment Handbook Green due diligence checklist Section 4.7 Onshore Wind s. 4.7 Appraisal vs. Onshore Wind Criteria: In considering whether any loan or investment in this sector would make a contribution to achieving any of the Green Purposes set out below, we will evaluate (and, so far as practicable, quantify) the extent to which the relevant project is likely to have the corresponding positive Green Impact set below. NB: We will consider if a project contributes, or is reasonably likely to, contribute in the UK to any one or more of five green purposes, i.e. a project does not need to meet all of these criteria. The reduction of GHG emissions A positive contribution to GHG savings, as estimated in accordance with GIB’s latest applicable Green Impact Reporting Criteria. Based on due diligence conducted to date, the project’s anticipated contribution to reduction of GHG emissions is: [●] t CO2e/annum based on a lifetime emissions saving of [●] tCO 2e (assuming a project lifetime of [●] years). ☐ The advancement of efficiency in the use of natural resources A positive contribution to renewable electricity generation. Based on due diligence conducted to date, the project’s generation of renewable electricity (attributable to GIB) is: [●] GWh/annum based on a lifetime emissions saving of [●] GWh (assuming a project lifetime of [●] years). ☐ The protection or enhancement of the natural environment The presence of improvements to, or the avoidance or satisfactory mitigation of, any adverse impacts on the natural environment beyond minimum legal requirements, including but not limited to: Adverse impact on visual amenity of the landscape and, if applicable, seascape; Noise pollution affecting populated areas together with any other loss of amenity; Disturbance and long term damage to the quality of the land or water environment including consideration of impacts on peatland where appropriate. ☐ ☐ ☐ 18 Green Investment Handbook Green due diligence checklist The protection or enhancement of biodiversity The presence of improvements to, or the avoidance or satisfactory mitigation of, any adverse impacts on biodiversity beyond minimum legal requirements, including but not limited to: Impact on biodiversity resulting from the construction or operation and decommissioning of the plant and associated infrastructure. Any other effect which demonstrably reduces net loss and improves net gain to biodiversity arising from the project. ☐ ☐ The promotion of environmental sustainability Commitment to continual improvement through good industry practice. ☐ Additional benefits which may contribute to the transition to a green economy including the potential for the future life-extension of the green infrastructure. ☐ Reviewer Comments 19 Green Investment Handbook Green due diligence checklist Section 4.8 Hydropower s. 4.8 Appraisal vs. Hydropower Criteria: In considering whether any loan or investment in this sector would make a contribution to achieving any of the Green Purposes set out below, we will evaluate (and, so far as practicable, quantify) the extent to which the relevant project is likely to have the corresponding positive Green Impact set below. NB: We will consider if a project contributes, or is reasonably likely to, contribute in the UK to any one or more of five green purposes, i.e. a project does not need to meet all of these criteria. The reduction of GHG emissions A positive contribution to GHG savings, as estimated in accordance with GIB’s latest applicable Green Impact Reporting Criteria. Based on due diligence conducted to date, the project’s anticipated contribution to reduction of GHG emissions is: [●] t CO2e/annum based on a lifetime emissions saving of [●] tCO 2e (assuming a project lifetime of [●] years). ☐ The advancement of efficiency in the use of natural resources A positive contribution to renewable electricity generation. Based on due diligence conducted to date, the project’s generation of renewable electricity (attributable to GIB) is: [●] GWh/annum based on a lifetime emissions saving of [●] GWh (assuming a project lifetime of [●] years). ☐ The protection or enhancement of the natural environment The presence of improvements to, or the avoidance or satisfactory mitigation of, any adverse impacts on the natural environment beyond minimum legal requirements, including but not limited to: Adverse impact on visual amenity of the landscape together with any other loss of amenity, including fishing and other recreational activities; ☐ 20 Green Investment Handbook Green due diligence checklist Adverse impacts, both upstream and downstream, on the local surface water, ground water or soil environment, including impacts on water flow or quality (including oxygenation and temperature), including those arising directly or indirectly from pollution/siltation, and alteration to hydrodynamics or geomorphology. ☐ The protection or enhancement of biodiversity The presence of improvements to, or the avoidance or satisfactory mitigation of, any adverse impacts on biodiversity beyond minimum legal requirements, including but not limited to: Impact on biodiversity, both upstream and downstream, resulting from the construction or operation of the plant and associated infrastructure, including the impact on fish (including migratory behaviour), other water-borne life and wildlife connected to the river and depleted reach (such as riparian mammals, plants – particularly bryophytes – and birds). Any other effect which demonstrably reduces net loss and improves net gain to biodiversity arising from the project. ☐ ☐ The promotion of environmental sustainability Commitment to continual improvement through good industry practice. ☐ Additional benefits which may contribute to the transition to a green economy including the potential for the future life-extension of the green infrastructure. ☐ Reviewer Comments 21 Green Investment Handbook Green due diligence checklist Table 4: Performance against the Green Investment Policy: Section 5 & 6 s. 5.1 Application of Green Criteria ☐ Application of the relevant criteria set out in section 4 s. 5.2 Evaluation Process ☐ Evaluation process will be based on the following principles: Consistency, Proportionality, Completeness, Transparency, Accuracy and Prudence s. 5.3 Evaluation of Green Impact on the Economy ☐ Eg Financial market development =/technology costs/wider effects s. 5.4 Evaluation of Green Risk Evaluation of Green Risk undertaken [insert reference to risk register and radar] ☐ s. 5.5 Alignment with Government Policy Transaction aligned with Government Policy ☐ Covenants s. 6.1 Application of effective covenants, monitoring and engagement ☐ Reviewer Comments 22 Green Investment Handbook Green due diligence checklist Table 5: Performance against the Responsible Investment Policy Requirement Notes 1.1 Comply with Equator Principles 1.2 Investment analysis and due diligence: ESG matters included in due diligence 1.3 Disclosure: Appropriate disclosure of relevant ESG matters from investee Legal Doc Ref Status ☐ ☐ Notes Legal Doc Ref ☐ Status Requirement 1.4 Active Ownership: Comply with the Equator Principles, where applicable, Comply with all applicable environmental and social laws and regulations, Operate, maintain and manage the project in accordance with good industry practice, Report on ESG issues on a periodic basis/promptly any materially adverse environmental or social issues, Independent adviser may have access to the project to monitor and report on environmental and social matters, Comply with such other specific conditions and undertakings relating to responsible investment matters as may be appropriate. ☐ ☐ ☐ ☐ ☐ ☐ ☐ 23 Green Investment Handbook Green due diligence checklist Section 2 2.1 Environmental responsibility: compliance with GIP 2.2 Social responsibility: compliance with laws 2.3 Governance: corporate governance framework 2.3 Governance: compliance with other relevant GIB policies 2.3 Governance: ESG policies ☐ ☐ ☐ ☐ ☐ Reviewer Comments 24 Green Investment Handbook Green due diligence checklist Annex 1: Document Checklist Information requested from the Client Documents Reviewed by GIB Key Comments Environmental Management Responsible Investment 25 Annex 2: Summary of Key Project/Client Engagement (including significant telecons) Attendees Correspondence type Date Location Focus/relevant summary e.g. Green Team/IB team e.g. meeting e.g. 2 Nov 2013 e.g. conference call e.g. review of project documentation, identified counterfactual for GHG calculations Copyright © UK Green Investment Bank plc Disclaimer: The information in this workbook and any accompanying material (“the Document”) is confidential and commercially sensitive. This Document is provided to each recipient on a confidential basis solely for information purposes only. No reliance can be placed on this Document by any recipient or any other person. This Document and its contents are confidential to the person to whom it is delivered and must not be reproduced or distributed, either in whole or in part, nor its contents disclosed by such persons to any other person without the prior written consent of UK Green Investment Bank plc. Except as required by law, neither UK Green Investment Bank plc nor any of its connected persons accepts any liability or responsibility for the accuracy or completeness of, or makes any representation or warranty, express or implied, with respect to the information contained in this Document or on which this Document is based or any other information or representations supplied to the recipient. UK Green Investment Bank plc will not act and has not acted as your legal, tax, accounting or investment adviser. This Document does not constitute or form part of any offer or invitation to sell, or any solicitation of any offer to purchase, any investment and UK Green Investment Bank plc does not arrange investments for/introduce parties as a result of sharing the information set out in this Document. UK Green Investment Bank plc is a public company with limited liability, registered in Scotland with the number SC424067 and is wholly owned by HM Government. Registered Office: Atria One, Level 7, 144 Morrison Street, Edinburgh, EH3 8EX. UK Green Investment Bank plc is wholly owned by HM Government. The company is not authorised or regulated by the Financial Conduct Authority or the Prudential Regulation Authority. A wholly owned subsidiary, UK Green Investment Bank Financial Services Limited, is authorised and regulated by the Financial Conduct Authority. Use subject to the terms at: http://www.greeninvestmentbank.com/terms-and-conditions/ 26

![Assumptions Checklist [Word File]](http://s3.studylib.net/store/data/005860099_1-a66c5f4eb05ac40681dda51762a69619-300x300.png)