Egypt Ministry of Finance - Documents & Reports

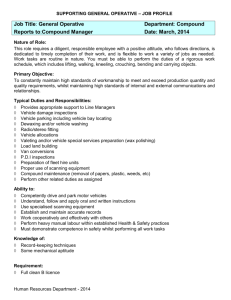

advertisement