class - Withers & Co Ltd

advertisement

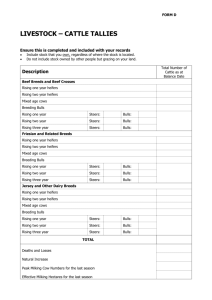

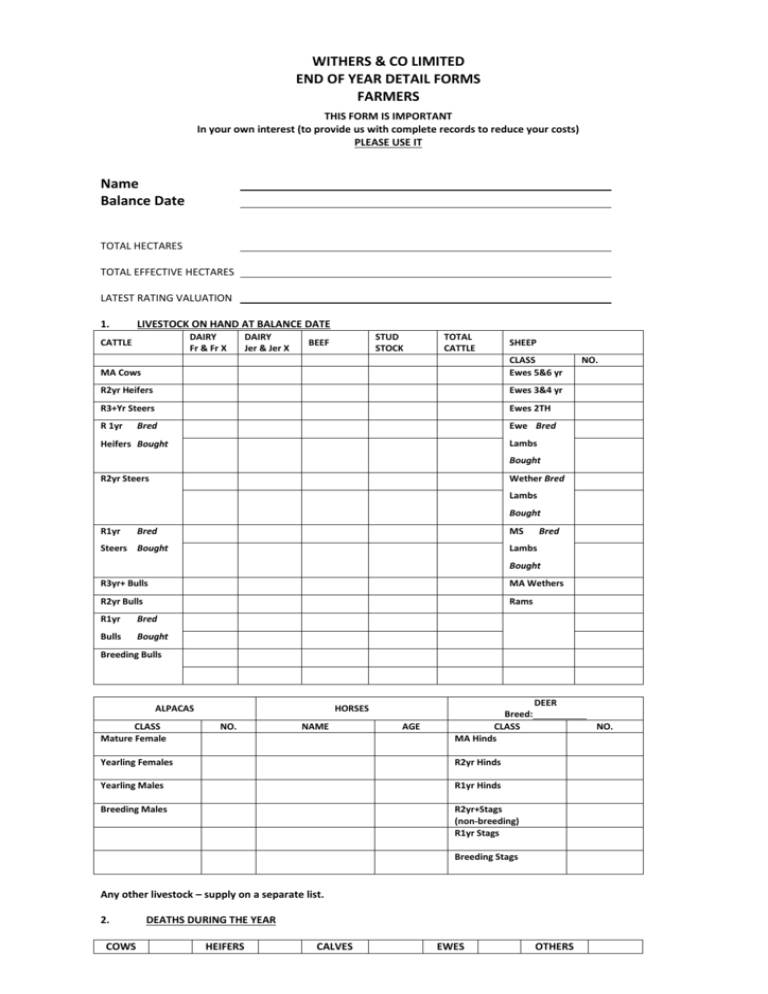

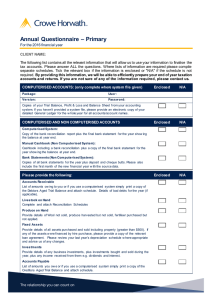

WITHERS & CO LIMITED END OF YEAR DETAIL FORMS FARMERS THIS FORM IS IMPORTANT In your own interest (to provide us with complete records to reduce your costs) PLEASE USE IT Name Balance Date TOTAL HECTARES TOTAL EFFECTIVE HECTARES LATEST RATING VALUATION 1. LIVESTOCK ON HAND AT BALANCE DATE DAIRY Fr & Fr X CATTLE DAIRY Jer & Jer X STUD STOCK BEEF TOTAL CATTLE SHEEP MA Cows CLASS Ewes 5&6 yr R2yr Heifers Ewes 3&4 yr R3+Yr Steers Ewes 2TH R 1yr Ewe Bred Bred NO. Lambs Heifers Bought Bought R2yr Steers Wether Bred Lambs Bought R1yr Bred MS Steers Bought Bred Lambs Bought R3yr+ Bulls MA Wethers R2yr Bulls Rams R1yr Bred Bulls Bought Breeding Bulls ALPACAS CLASS Mature Female DEER HORSES NO. NAME AGE Breed: CLASS MA Hinds Yearling Females R2yr Hinds Yearling Males R1yr Hinds Breeding Males R2yr+Stags (non-breeding) R1yr Stags NO. Breeding Stags Any other livestock – supply on a separate list. 2. COWS DEATHS DURING THE YEAR HEIFERS CALVES EWES OTHERS 3. RETENTION OF TITLE CLAUSE Please advise if any or your stock is subject to a retention of title clause. 4. WOOL ON HAND - in woolshed, wool store Number of Bales: Value 5. $ SECURITY FOR MONIES BORROWED We are now required to show details of security given for loans. These will include bank overdrafts, mortgages, term loans etc. Please advise details of security given in the space below (an example is included). LOAN TYPE Bank Overdraft SECURITY 1st Mortgage over land - (Lot 12 DP 6042) 6. DEBTORS A list of amounts owing to you at balance date. eg. goods or services you sold before balance date, but did not receive payment for until after balance date. Mark any debts likely to be bad. See attached form. 7. CREDITORS A list of any goods or services you bought in before balance date, but did not pay until after balance date. Include PAYE. For each figure we require: NET, GST, TOTAL. See attached form. 8. CHANGES OF PLANT, VEHICLES, INVESTMENTS OR PROPERTY We need solicitors statements, cost details. Vehicle trade price or private sale proceeds. PURCHASE SOLD *Note: Assets costing $500 (GST excl) or less can now be claimed as an expense ‘Low Cost Assets’. 9. HIRE PURCHASE FINANCE Supply the agreements, purchase invoices. PURCHASED MONTHLY COST TERM (months) 10. DETAILS OF BUILDINGS ERECTED OR RENOVATED DURING YEAR TYPE COST 11. CHECK LIST Please Supply: (a) Bank Statements – full 12 months including cheque butts (b) Deposit Books – full record of all bankings (c) Stock Co/Dairy Co – statements and invoices (full 12 months) (d) Savings Bank Books – with interest made up, must have RWT statement of gross interest, and RW Tax deducted 12. 13. 14. (e) Details of Loan Money – personal funds, banked (f) Attached Personal Income – exemptions form completed (g) GST and FBT Returns – copies filed to IRD and you workings (h) Log Books – for vehicles (i) Fringe Benefits – to your staff, shareholders, are these paid? (j) Term Loans – statements of amount owed at balance date COMPANIES (a) Your accounts are required within 5 months of balance date at Inland Revenue The Financial Reporting Act requires that the directors complete the financial statements within 5 months of balance date. Please ensure that this questionnaire is completed promptly. (b) Statutory Records Various statutory records (eg Share Register, Register of Directors) are required to be kept by the Companies Act 1993. There are significant fines for not keeping these records. We keep these records for companies for which we are the Registered Office. Please ensure your company is maintaining these statutory records if we are not the Registered Office. CONTINGENT LIABILITIES / FUTURE CAPITAL COMMITMENTS Please advise if you have either of the above. (a) Contingent Liability A liability which may arise in the future, which is contingent on a present event or upcoming event, eg court case. (b) Future Capital Commitments Where a contract to expend money in the future exists at balance date. POST BALANCE DATE EVENTS Please advise of any events occurring after balance date which may be relevant to the accounts. AUTHORISATION – PLEASE SIGN We are hereby authorised to obtain information from Inland Revenue Department, our bankers, solicitors and finance companies on our behalf in order to obtain such further information as you may require to carry out the above assignments. This information may be obtained by phone, internet, fax or e-services. Further we hereby authorise the Inland Revenue Department to provide you with all the information you may require, in respect to all tax types, to enable you to carry out these assignments, and we authorise you, when required, to sign, returns on our behalf for all tax types. _______________________________ Signed ____________________________ Date COMPLETE THIS FORM AND BRING IT IN WITH YOUR BOOKS DEBTORS as at (balance date) (money owing to me/us by other people, for goods and services sold to them at any time before balance date, but paid to me/us after balance date). NAME TOTAL TOTAL INCLUDING GST $ ¢ COMPLETE THIS FORM AND BRING IT IN WITH YOUR BOOKS STOCKS (make and supply a list) total $ (excluding GST). CREDITORS as at (balance date) (money owing by me/us to other people, for goods and services bought by me/us at any time before balance date, but paid to them after balance date). NAME NATURE OF GOODS OR SERVICES CODE (office use only) NET $ GST ¢ $ TOTAL ¢ $ ¢

![저기요[jeo-gi-yo] - WordPress.com](http://s2.studylib.net/store/data/005572742_1-676dcc06fe6d6aaa8f3ba5da35df9fe7-300x300.png)