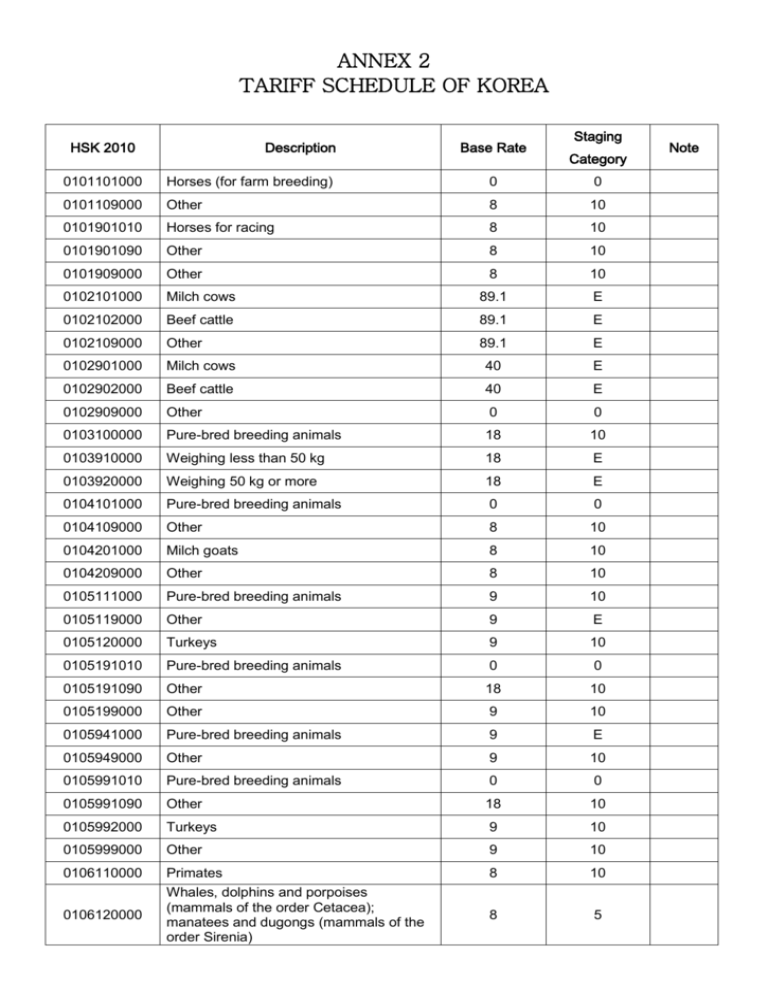

Korea`s Schedule

advertisement