Chapter 12

advertisement

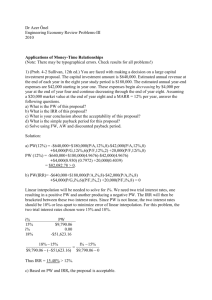

CHAPTER 12 CAPITAL BUDGETING ALLOCATION/INVESTMENT OF SCARCE CAPITAL TO LONG-TERM (USUALLY FIXED) ASSETS. THE ASSETS (INVESTMENT OPPORTUNITIES) ARE ALSO REFERRED TO AS PROJECTS. A. INDEPENDENT PROJECTS DO NOT AFFECT EACH OTHER’S CASH FLOWS AND ARE EVALUATED INDEPENDENTLY WITHOUT A NEED FOR RANKING. B. NON-INDEPENDENT PROJECTS AFFECT EACH OTHER’S CASH FLOWS. THEY MAY HAVE TO BE COMBINED BEFORE RANKING AND EVALUATION C. MUTUALLY EXCLUSIVE PROJECTS ARE EXTREME CASES OF NON-INDEPENDENT PROJECTS. FROM A SET OF MUTUALLY EXCLUSIVE PROJECTS ONLY ONE CAN BE ACCEPTED. FOR EVALUATION THEY HAVE TO BE RANKED. PROJECT VALUATION The valuation of a real asset (project) is similar to the valuation of a security. VALUE OF A PROJECT = ∑CFt/1+k)t FOR t = 1 THRU n Where CFt = Expected risky cash flow in period t K = Risk-Appropriate Required rate of Return n = The project’s cash Flow Producing Life AS IN THE CASE OF SECURITY VALUATION, THE VALUE OF A PROJECT COMPUTED AS ABOVE IS COMPARED TO ITS REQUIRED CAPITAL ALLOCATION THAT IS, ITS COST (PRICE) AND AN ACCEPT/REJECT (INVEST/DO NOT INVEST) DECISION IS MADE METHODS OF PROJECT EVALUATION 1. ACCOUNTING RATE OF RETURN (ARR) 2. PAYBACK PERIOD (PAYBACK)/ DISCOUNTED PAYBACK 3. NET PRESENT VALUE (NPV) 4. INTERNAL RATE OF RETURN (IRR)/ MODIFIED INTERNAL RATE OF RETURN (MIRR) 5. PROFITABILITY INDEX (PI) THE NPV, IRR AND PI METHODS ARE KNOWN AS DISCOUNTED CASH FLOW (DCF) METHODS WE WILL USE THE FOLLOWING EXAMPLE TO ILLUSTRATE THE ABOVE METHODS CAPITAL PROJECT EVALUATION (EXAMPLE) NET AFTER-TAX CASH FLOWS (DOLLARS) YEAR 0 PROJECT A (100,000) PROJECT B (100,000) 1 40,000 10,000 2 40,000 20,000 3 40,000 40,000 4 40,000 70,000 5 40,000 90,000 FOR SIMPLICITY IT WILL BE ASSUMED THAT BOTH PROJECTS WILL BE DEPRECIATED ON A STRAIGHT LINE BASIS OVER 5 YEARS TO ZERO SALVAGE VALUE. NOTE: LATER, IN CHAPTER 13, WE WILL LOOK AT A COMMONLY USED DEPRECIATION METHOD, MODIFIED ACCELERATED COST RECOVERY SYSTEM (MACRS). FOR SUCH PROJECTS THE FIRM USES BENCHMARK ARR OF 28%; BENCHMARK PAYBACK OF 3.5 YEARS; BENCHMARK DISCOUNTED PAYBACK OF 4.25 YEARS AND COST OF CAPITAL OF 15%. IT IS ALSO ASSUMED THAT THERE IS NO CAPITAL RATIONING WE WILL DISCUSS CAPITAL BUDGETING UNDER CAPITAL RATIONING LATER. ACCOUNTING RATE OF RETURN (ARR) ARR = AVERAGE NET INCOME / AVERAGE INVESTMENT WHERE NET INCOME = AFTER-TAX CASH FLOW – DEPRECIATION STRAIGHT-LINE DEPRECIATION =(INITIAL COST–EXPECTED SALVAGE VALUE)/(EXPECTED USEFUL LIFE) AVERAGE INVESTMENT = (INITIAL COST + EXPECTED SALVAGE VALUE)/ 2 IN OUR EXAMPLE, AVERAGE INVESTMENT AVERAGE INVESTMENT DEPRECIATION FOR A DEPRECIATION FOR B FOR A = (100000+0)/2 = 50000 FOR B = (100000+0)/2 = 50000 = (100000-0)/5 = 20000 = (100000-0)/5 = 20000 PROJECT A NET INCOME = 40000 – 20000 = 20000 EACH YEAR AVERAGE NET INCOME = 20000 AVERAGE INVESTMENT = 50000 ARR = (20000/50000) = 40% PROJECT B NET INCOME = -10000; 0; 20000; 50000; 70000 FOR YEARS 1 -5 AVERAGE NET INCOME =(-10000+0+20000+50000+70000)/5 = 26000 AVERAGE INVESTMENT = 50000 ARR = (26000/50000) = 52% DECISION RULE USING ARR: ACCEPT IF ARR > BENCHMARK ARR REJECT IF ARR < BENCHMARK ARR INDIFFERENT/NEUTRAL IF ARR = BENCHMARK ARR SINCE BENCHMARK IS 28%, ACCEPT BOTH A AND B, IF THEY ARE INDEPENDENT (ARR OF A AND B > 28%) ACCEPT B, IF A AND B ARE MUTUALLY EXCLUSIVE (ARR OF B IS LARGER) PAYBACK PERIOD THE PAYBACK PERIOD IS THE TIME IT TAKES TO RECOVER A PROJECT"S INVESTMENT FROM ITS NET AFTER-TAX CASH FLOWS. IT IS COPUTED AS FOLLOWS: PROJECT A YEAR 0 1 2 3 NET AFTER-TAX CASH FLOWS (100,000) 40,000 40,000 40,000 CUMULATIVE NET AFTER-TAX CASH FLOWS (100,000) ( 60,000) ( 20,000) 20,000 PAYBACK PERIOD = 2+ (20,000/40,000)= 2.5 YEARS THE ABOVE RESULT CAN ALSO BE FOUND AS FOLLOWS: PAYBACK PERIOD = 100000/40000 = 2.5 YEARS PROJECT B YEAR 0 1 2 3 4 NET AFTER-TAX CASH FLOWS (100,000) 10,000 20,000 40,000 70,000 CUMULATIVE NET AFTER-TAX CASH FLOWS (100,000) ( 90,000) ( 70,000) ( 30,000) 40,000 PAYBACK PERIOD = 3+(30,000/70,000)= 3.4286 YEARS DECISION RULE USING PAYBACK PERIOD: ACCEPT IF PAYBACK < BENCHMARK PAYBACK REJECT IF PAYBACK > BENCHMARK PAYBACK INDIFFERENT/NEUTRAL IF PAYBACK = BENCHMARK PAYBACK FOR PROJECTS A AND B, ACCEPT BOTH, IF THEY ARE INDEPENDENT (PAYBACK OF A AND B < BENCHMARK PAYBACK 3.5 YEARS) ACCEPT A, IF THEY ARE MUTUALLY EXCLUSIVE (SHORTER PAYBACK) DISCOUNTED PAYBACK PERIOD THE DISCOUNTED PAYBACK PERIOD IS THE TIME IT TAKES TO RECOVER A PROJECT’S INVESTMENT FROM ITS NET AFTER-TAX CASH FLOWS DISCOUNTED AT COST OF CAPITAL. IT IS COPUTED AS FOLLOWS: PROJECT A YEAR NET AFTER-TAX CASH FLOWS 0 1 2 3 4 (100,000) 40,000 40,000 40,000 40,000 NET DISCOUNTED CASH FLOWS CUMULATIVE NET DISCOUNTED CASH FLOWS (100,000) 34,783 30,246 26,301 22,870 (100000) ( 65,217) ( 34,971) ( 8,670) 14,199 DISCOUNTED PAYBACK PERIOD = 3+ (8670/22,870)= 3.3791 YEARS PROJECT B YEAR 0 1 2 3 4 5 NET AFTER-TAX CASH FLOWS (100,000) 10,000 20,000 40,000 70,000 90,000 NET DISCOUNTED CASH FLOWS CUMULATIVE NET DISCOUNTED CASH FLOWS (100,000) 8,696 15,123 26,301 40,023 44,746 (100000) ( 91,304) ( 76,181) ( 49,880) ( 9,857) 34,889 DISCOUNTED PAYBACK PERIOD = 4+ (9857/44746)= 4.2203 YEARS DECISION RULE USING DISCOUNTED PAYBACK PERIOD: ACCEPT IF DISCOUNTED PAYBACK < BENCHMARK DISCOUNTED PAYBACK REJECT IF DISCOUNTED PAYBACK > BENCHMARK DISCOUNTED PAYBACK INDIFFERENT/NEUTRAL IF DISCOUNTED PAYBACK = BENCHMARK FOR PROJECTS A AND B,ACCEPT BOTH, IF THEY ARE INDEPENDENT (DISCOUNTED PAYBACK OF A AND B < BENCHMARK DISCOUNTED PAYBACK 4.25 YEARS) ACCEPT A, IF THEY ARE MUTUALLY EXCLUSIVE (SHORTER DISCOUNTED PAYBACK) NET PRESENT VALUE (NPV) THE NET PRESENT VALUE OF A PROJECT IS DEFINED AS: PV OF CASH INFLOWS - PV OF CASH OUTFLOWS WHERE PVS ARE COMPUTED USING THE COST OF CAPITAL PROJECT A NPV =-100,000+ 40,000 + 40,000 + 40,000 + 40,000 + 40,000 -------------------------2 3 4 1.15 (1.15) (1.15) (1.15) (1.15)5 = 34,086.2039 NPV can be more easily computed using a financial calculator. PROJECT B NPV =-100,000+ 10,000 + 20,000 + 40,000 + 70,000 + 90,000 -------------------------1.15 (1.15)2 (1.15)3 (1.15)4 (1.15)5 = 34,887.8082 NPV can be more easily computed using a financial calculator. DECISION RULE USING NPV: ACCEPT IF NPV > 0 REJECT IF NPV < 0 INDIFFEREN/NEUTRAL IF NPV = 0 FOR PROJECTS A AND B, ACCEPT BOTH, IF THEY ARE INDEPENDENT (NPV >0) ACCEPT B, IF THEY ARE MUTUALLY EXCLUSIVE (HIGHER POSITIVE NPV) INTERNAL RATE OF RETURN (IRR) THE IRR OF A PROJECT IS THE DISCOUNT RATE THAT MAKES PV CASH INFLOWS = PV CASH OUTFLOWS, THAT IS, NPV = 0 IT IS THE EXPECTED RATE OF RETURN OF THE PROJECT COMPUTATION OF IRRS CAN BE BY 1. TRIAL AND ERROR USING INTERPOLATION, BUT IT IS TEDIOUS 2. USING NPV PROFILES (COMPUTE NPVS AT DIFFERENT DISCOUNT RATES AND PLOT THESE NPVS AGAINST THE RATES AS A GRAPH (NPV PROFILE). THE INTERSECTION OF THE NPV PROFILE WITH THE X-AXIS IS THE IRR. 3. USING A FINANCIAL CALCULATOR (EASY) PROJECT A USING A FINANCIAL CALCULATOR, IRR = 28.6493% PROJECT B USING FINANCIAL CALCULATOR, IRR = 24.8059% DECISION RULE USING IRR: ACCEPT IF IRR > COST OF CAPITAL REJECT IF IRR < COST OF CAPITAL INDIFFERENT/NEUTRAL IF IRR = COST OF CAPITAL FOR PROJECTS A AND B, ACCEPT BOTH, IF THEY ARE INDEPENDENT (IRR > COST OF CAPITAL 15%) ACCEPT A, IF THEY ARE MUTUALLY EXCLUSIVE (HIGHER IRR OF 28.65%) MODIFIED INTERNAL RATE OF RETURN TO OVERCOME THE CONFLICT BETWEEN NPV AND IRR WHEN PROJECTS ARE MUTUALLY EXCLUSIVE, A MODIFIED INTERNAL RATE OF RETURN CAN BE CALCULATED AND COMPARED WITH THE PROJECTS’ COST OF CAPITAL. THE MIRR APPROACH HELPS IN SITUATIONS WHERE CONFLICT IS DUE TO TIMING OF CASH FLOWS. STEPS TO COMPUTE MIRR 1. FIND THE FUTURE VALUE OF EACH INTERMEDIATE (TIME 1, 2, 3 ETC) CASH FLOWS AT THE END OF THE PROJECT USING THE COST OF CAPITAL 2. SUM ALL THE FUTURE CASH FLOWS IN STEP 1 AND CALL THE SUM TERMINAL VALUE (TV) . DO NOT CONFUSE TV WITH TERMINATION CASH FLOWS WHICH OCCUR UPON TERMINATION OF THE PROJECT. OF COURSE TERMINATION CASH FLOWS WILL BECOME PART OF TV 3. FIND THE IRR OF THE PROJECT WITH INITIAL INVESTMENT AT TIME 0 (PV) AND TV AT THE END OF THE PROJECT (FV). THIS IS THE MIRR. MIRR OF PROJECT A: TV= 40000*(1.15)4+ 40000*(1.15)3 +40000*(1.15)2 +40000*(1.15)1 + 40000 =269,695.2500 PV=-100,000 MIRR=21.9480% MIRR OF PROJECT B: TV= 10000 *(1.15)4+ 20000 *(1.153+40000*(1.15)2+ 70000* (1.15)1 + 90000 =271,307.5625 PV=-100,000 MIRR=22.0935% UNLIKE IRR, THE MIRR OF PROJECT B IS GREATER THAN THAT OF PROJECT A, JUST LIKE NPV OF PROJECT B IS GREATER THAN THAT OF PROJECT A. THUS, IF PROJECTS A AND B ARE MUTUALLY EXCLUSIVE, BOTH NPV AND MIRR WILL FAVOR PROJECT B OVER PROJECT A, THUS ELIMINATING A CONFLICT. PROFITABILITY INDEX (PI) PI = (PV OF CASH INFLOWS/PV OF CASH OUTFLOWS) WHERE THE DISCOUNT RATE USED TO FIND THE PVS OF CASH INFLOWS AND OUTFLOWS IS THE COST OF CAPITAL OF THE PROJECT PROJECT A PI = 134086.2039/ 100000 = 1.3409 PROJECT B PI = 134887.2039/ 100000 = 1.3489 DECISION RULE USING PI: ACCEPT IF PI > 1 REJECT IF PI < 1 INDIFFERENT/NEUTRAL IF PI = 1 FOR PROJECTS A AND B, ACCEPT BOTH, IF THEY ARE INDEPENDENT (PI > 1) ACCEPT B, IF THEY ARE MUTUALLY EXCLUSIVE (HIGHER PI OF 1.3489) SUMMARY OF CONCLUSIONS ASSUMPTIONS: 1. NO CAPITAL RATIONING 2. PROJECTS ARE INDEPENDENT METHOD PROJECTS A BENCHMARK ACCEPT B ARR 40% PAYBACK 2.5 YEARS DISCOUNTED PAYBACK 3.3791 YEARS NPV 34,086.2039 IRR 28.6493% MIRR 21.9480% PI 1.3409 52% 28% 3.4286 YEARS 3.5 YEARS 4.2203 YEARS 4.25 YEARS 34,887.8082 0 24.8059% 15% 22.0935% 15% 1.3489 1 BOTH BOTH BOTH BOTH BOTH BOTH BOTH ASSUMPTIONS: 1. NO CAPITAL RATIONING 2. PROJECTS ARE MUTUALLY EXCLUSIVE METHOD PROJECTS A ARR 40% PAYBACK 2.5 YEARS DISCOUNTED PAYBACK 3.3791 YEARS NPV 34,086.2039 IRR 28.6493% MIRR 21.9480% PI 1.3409 BENCHMARK ACCEPT B 52% 3.4286 YEARS 4.2203 YEARS 34,887.8082 24.8059% 22.0935% 1.3489 28% 3.5 YEARS 4.25 YEARS 0 15% 15% 1 B A A B A B B THUS, CONFLICTS MAY ARISE IF PROJECTS ARE MUTUALLY EXCLUSIVE BECAUSE OF THE NEED TO RANK AND EVALUATE. HOWEVER, THERE ARE NO CONFLICTS, IF PROJECTS ARE INDEPENDENT, SINCE THERE IS NO NEED TO RANK AND EVALUATE. REASONS FOR CONFLICT AND BEST METHOD IF THERE IS A CONFLICT CONFLICTS MAY ARISE DUE TO 1. SCALING DIFFERENCES (ONE PROJECT COSTS MORE THAN THE OTHER) 2. TIMING DIFFERENCES (CASH FLOWS OCCUR EARLIER OR LATER) WHEN A CONFLICT ARISES , USE NPV METHOD. WHY? NPV METHOD IS SUPERIOR, BECAUSE 1. IT USES COST OF CAPITAL FOR DISCOUNTING (REINVESTING) 2. IT GIVES ABSOLUTE CHANGE IN WEALTH 3. IT IS EASIER TO CALCULATE IRR METHOD IS INFERIOR, BECAUSE 1. IT USES IRR FOR DISCOUNTING (REINVESTING) 2. IT GIVES % CHANGE IN WEALTH 3. IT IS DIFFICULT TO CALCULATE (MULTIPLE IRRS, ETC.) PI IS ALSO INFERIOR, BECAUSE IT IS A RATIO, THAT IS, A RELATIVE MEASURE OF WEALTH CHANGE USING MIRR RESOLVES THE CONFLICT BETWEEN NPV AND IRR, IF THERE ARE ONLY CASH FLOW TIMING DIFFERENCES. HOWEVER, MIRR MAY NOT RESOLVE THE CONFLICT, IF THERE ARE SCALING DIFFERENCES. THEREFORE IT IS ALWAYS BETTER TO USE NPV.