Behavioural Economics for Psychologists

advertisement

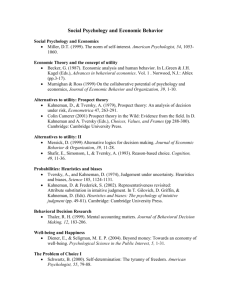

Behavioural Economics for Psychologists Course programme Instructor – Alexis Belianin, PhD ICEF NRU HSE, 26 Shabolovka str. Office 3427 phone (+7495) 772 9590 *26085 mail: icef-research@hse.ru Goals and objectives The course aims at getting the students familiar with the main approaches and problems of contemporary behavioural economics – a relatively new, interdisciplinary area which stems from the basic paradigm of economic science (rational behaviour), extending it towards a greater descriptive accuracy in the light of the achievements of contemporary psychology. Topics studied within this discipline cover various aspects of individual and interactive decision making in laboratory and real settings, and are closely connected with experimental studies at all levels – from cognitive neuroscience to field experiments. At the end of the course, students are expected to understand the basic principles of economic analysis of human behaviour, be familiar with the key theoretical and experimental papers in the area, and be able to analyse individual behaviour in the light of this literature in various laboratory and real-life circumstances. Prerequisites working knowledge of English as necessary to communicate and read scientific literature working knowledge of mathematics (calculus and probability theory) knowledge of the basics of cognitive psychology and economic theory (microeconomics) Grading Home assignment – 20% Course project – 20% Classroom experiments – 10% Final exam – 50% Pass grade is 34%. Excellent grade is 70% and above. Literature A single text that is most relevant for the course is Wilkonson, Nick and Klaes, Matthias. (2012). An introduction to Behavioural Economics. Palgrave Macmillan Most of the material is contained in this text, although in a somewhat different form. Students are required to follow the lectures, consult the slides and references contained therein, as well as read original research literature, much of it is contained in the following sources: Kahneman, D., Slovic, P., & Tversky, A., eds. (1982). Judgment Under Uncertainty: Heuristics and Biases. New York: Cambridge University Press. (рус.пер. Принятие решений в условиях неопределенности: Правила и предубеждения. — Харьков: Гуманитарный центр, 2005. — 632 с. — ISBN 966-8324-14-5) Kahneman, D. & Tversky, A., eds. (2000). Choices, values and frames. Cambridge: Cambridge University Press. Kahneman, D. & Tversky, A. (1984) Rational choice, values and frames // American Psychologist., vol. 39, No. 4, pp. 341-350. (рус.пер. Канеман Д., Тверски А. Рациональный выбор, ценности и фреймы // Психологический журнал. — 2003. — Т. 24. — № 4. — С. 31−42. Kahneman D. Thinking fast and slow. Farrar, Straus and Giroux, 2011 (рус.пер. Канеман Д. Думай медленно… Решай быстро. — М.: АСТ, 2013. — 625 с.) Camerer C., Loewenstein G., Rabin M., eds. (2004). Advances in Behavioural Economics. Princeton: Princeton University Press. Plous, Scott (1993). The Psychology of Judgment and Decision Making. New York: McGraw Hill. Gigerenzer, Gerd, and Selten, Reinhard, eds. (2002) Bounded Rationality: The Adaptive Toolbox. Cambridge: Cambridge University Press. Kagel J. and Roth A. (1995) Handbook of experimental economics. Princeton: Princeton University Press, 1995. Camerer, Colin. (2003) Behavioural Game Theory: Experiments in Strategic Interaction. Princeton University Press. Plott C. and Smith V. (2008) Handbook of experimental economics results, Vol.1. Amsterdam: Elsevier. The following collection of electronic resources contains many materials relevant for the course: http://danariely.com/ – Dan Ariely, professor at Duke University, author of many bestsellers on behavioural sciences, notably Predictably Irrational (2007) and The Upside of Rationality (2010) (both translated into Russian). http://timharford.com/ - Tim Harford, aka The undercover economist – columnist of Financial Times, BBC and popular behavioural scientist, author of many books and papers, including The Logic of Life (2008). http://www.freakonomics.com/ - website of a famous book by Stephen Dubner (journalist) and Steven Lewitt (economist at Chicago), also translated into Russan, and containing many examples of applications of economics to various aspects of human life. http://fastandfrugal.com – Website of the Max Planck institute on behavioural and bounded rationality, held by Gerd Gigerenzer and his colleagues. http://epee.hse.ru – website of the laboratory for experimental and behavioural economics of HSE, contains a few insights into the subject-matter of the discipline and some hopefully helpful references. Course contents Compulsory literature is marked (**). 0. Introduction ** Frey, B. S. & Benz, M. (2002). From Imperialism to Inspiration: A Survey of Economics and Psychology. In: John B. Davis, Alain Marciano, and Jochen Runde (Editors). Elgar Companion to Economics and Philosophy. Northampton, Massachusetts: Edward Elgar Publishing Limited, 2004 http://www.bsfrey.ch/articles/410_04.pdf. (See also Frey B.S and Stutzer A. Economics and psychology: from imperialistic to inspired economics, Philosophie Economique, 2001/2, no.4, p.5-22, http://www.bsfrey.ch/articles/362_01.pdf. ** Rabin M. (1998) Psychology and economics. Journal of Economic Literature, v.36, no.1, p.11-46. http://www.nyu.edu/econ/user/bisina/rabin_survey.pdf – Not the most recent, but still very accurate survey from one of the key academics in the discipline. Earl P. (1990) Economics and psychology: a survey. Economic Journal, v.100, no 402, p.718-755. http://teaching.ust.hk/~mark329y/EconPsy/Economics%20and%20psychology%20%20A%20survey.pdf – a more psychological, but also a bit outdated survey :( 1. Rationality Psychology and economics of behaviour. Economic way of thinking. Rational decision making: standard vs behavioural approach. Axioms of rational preferences. Generalized binary (preference) relations. Choice functions, revealed preferences. ** Канеман Д., Тверски А. Рациональный выбор, ценности и фреймы // Психологический журнал. – 2003. – Т. 24. - № 4. - С. 31-42. http://selfmoney.narod.ru/kanem.htm ** Simon H.A. (1978) Rationality as the process and as a product of thought. American Economic Review, v.68, no.2, p.1-16. (рус.пер.: THESIS, 1993, №3) http://ecsocman.hse.ru/data/629/779/1217/3_1_2simon.pdf Sen A.K. (1987) Rational behaviour. In: J.Eatwell, M.Milgate, P.Newman eds. The New Palgrave. A Dictionary of Economics. London: Macmillan. Daniel Kahneman. Maps of Bounded Rationality: Psychology for Behavioral Economics. The American Economic Review, Vol. 93, No. 5 (Dec., 2003), pp. 1449-1475 ** Белянин А.В. Нобелевская премия за чувство реальности. Вопросы экономики, 2003, №1. 2. Heuristics and biases Heurisitcs and biases paradigm: examples, explanations, experimental evidence. Reasons behind heuristics: are they always erroneous? Implications of heuristics and biases for decision analaysis Kahneman, Daniel & Shane Frederick (2002). "Representativeness Revisited: Attribute Substitution in Intuitive Judgment". In Thomas Gilovich, Dale Griffin, Daniel Kahneman. Heuristics and Biases: The Psychology of Intuitive Judgment. Cambridge: Cambridge University Press. pp. 49–81. Tversky, A. & Kahneman, D. 1986. Rational choice and the framing of decisions. Journal of Business. v. 59, S251-S278. ** Tversky, A. & Kahneman, D. 1974. Judgment under uncertainty: Heuristics and biases. Science. 185(4157), p.1124-1131. http://psiexp.ss.uci.edu/research/teaching/Tversky_Kahneman_1974.pdf Tversky, A. & Kahneman, D. 1973. Availability: A heuristic for judging frequency and probability. Cognitive Psychology. 5(2). 207-232. Gerd Gigerenzer, Peter M. Todd, and the ABC Research Group (1999). Simple Heuristics That Make Us Smart. Oxford, UK, Oxford University Press. Fischhoff B. and Beyth R. ‘I knew it would happen’ - remembered probabilities of once-future things. Organizational Behaviour and Human Decision Processes, 1975, v.13, p.1-16. Grether D.M. and Plott C.R. (1979) Economic theory of choice and the preference reversal phenomenon. American Economic Review, v.69, no.5, p.623-638. Arkes, Hal; Blumer, Catherine (1985). "The Psychology of Sunk Cost". Organizational Behavior and Human Decision Process 35: 124–140. Read, Daniel, and George Loewenstein. 1995. "Diversification Bias: Explaining the Discrepancy in Variety Seeking between Combined and Separated Choices." Journal of Experimental Psychology: Applied 1:34-49 Langer, E. J. (1975). The illusion of control. Journal of Personality and Social Psychology, 32(2), 311328. Moore, D. A., & Healy, P. J. (2008). The trouble with overconfidence. Psychological Review, 115(2), 502-517. 3. Choice under risk and uncertainty Representation of preferences under risk and uncertainty: historical and contemporary perspective. Expected utility theory: axioms and experimental tests. Derivation of utility function. Generalizations: prospect theory and its properties. Empirical results. Allais M. (1953) Le comportement de l’homme rationnel devant le risque: critique des postulates et des axioms de l’ecole americaine. Econometrica, v.21, no.4, p.503-546. (рус.пер.THESIS 1994, #5) Farquhar P.H. (1984) Utility assessment methods. Management Science, v.30, no.11, p.1283-1300. ** Kahneman D. and Tversky A. (1979) Prospect theory: an analysis of decision under risk. Econometrica, v.47, p.263-291. http://www.hss.caltech.edu/~camerer/Ec101/ProspectTheory.pdf ** Schoemaker, P. J. H., “The Expected Utility Model: Its Variants, Purposes, Evidence and Limitations,” Journal of Economic Literature, Vol. 20, June 1982, pp. 529-563. ((рус.яз.: http://igiti.hse.ru/data/409/313/1234/5_1_2Schoe.pdf) Starmer, Chris. "Developments in Non-Expected Utility Theory: The Hunt for a Descriptive Theory of Choice under Risk," Journal of Economic Literature, Vol. XXXVIII (June 2000) pp. 332–382. 4. Intertemporal preferences Dynamic decision making: principles of analysis and dynamic (in)consistency. Exponential and hyperbolic discounting. The multiple selves model and its explanatory power. Methods of measurement of time preferences. Contraversies and limitations. Bikhchandani S., D. Hirshleifer, I. Welch (1992) A theory of fads, fashion, custom, and cultural-change as informational cascades, Journal of Political Economy, Vol.100, No.5, 992-1026. Thaler, Richard, 1981. "Some empirical evidence on dynamic inconsistency," Economics Letters, Elsevier, vol. 8(3), pages 201-207 Strotz, R. H., “Myopia and Inconsistency in Dynamic Utility Maximization,”Review of Economic Studies 23 (1956), 165–80. Mischel, W., Ebbeson, E.B. and Zeiss, A.R., 1972. Cognitive and attentional mechanisms in delay of gratification. Journal of Personality and Social Psychology 21, pp. 204–218. Rubinstein A. “Economics and Psychology”? The Case of Hyperbolic Discounting. International Economic Review, 2003, Volume 44, Issue 4, p.1207–1216. ** Frederick, Shane, George Loewenstein, and Ted O'Donoghue. 2002. "Time Discounting and Time Preference: A Critical Review." Journal of Economic Literature, 40(2): 351-401. http://www.cmu.edu/dietrich/sds/docs/loewenstein/TimeDiscounting.pdf 5. Behavioural game theory Main concepts of game theory, Nash equilibrium, dominant strategies, extensive form games. Examples: social dilemmas, coordination, ultimatum game etc. Divergence of experimental evidence and theoretical predictions. Explanations and behavioural theories. Andreoni, J. and Miller, J. (1993) ‘Rational Cooperation in the Finitely Repeated Prisoner’s Dilemma: Experimental Evidence’, Economic Journal, 103, 570–85. Babcock, Linda and Loewenstein, George (1997) ‘Explaining Bargaining Impasses: The Role of Selfserving Biases’, Journal of Economic Perspectives, 11, 109–26. Babcock, L., Loewenstein, G., Issacharoff, S. and Camerer, C. F. (1995) ‘Biased Judgments of Fairness in Bargaining’, American Economic Review, 85, 1337–43. Bush, R. and Mosteller, F. (1955) Stochastic Models for Learning, New York, John Wiley. Camerer, C. F. (2003) Behavioral Game Theory: Experiments on Strategic Interaction, Princeton, NJ: Princeton University Press. Camerer, C. F. and Lovallo, D. (1999) ‘Overconfidence and Excess Entry: An Experimental Approach’, American Economic Review, 89, 306–18. Costa-Gomes, M., Crawford, V. and Broseta, B. (2001) ‘Cognition and Behavior in Normal-form Games: An Experimental Study’, Econometrica, 69, 1193–235. Crawford, V. (1997) ‘Theory and Experiment in the Analysis of Strategic Interactions’, in D. Kreps and K. Wallis (eds), Advances in Economics and Econometrics: Theory and Applications, Seventh World Congress, Vol. i, Cambridge University Press. Erev, I. and Roth, A. (1998) ‘Predicting How People Play Games: Reinforcement Learning in Experimental Games with Unique, Mixed-strategy Equilibria’, The American Economic Review, 88, 848–81. ** Kahneman, D. (1988) ‘Experimental Economics: A Psychological Perspective’, in R. Tietz, W. Albers and R. Selten (eds), Bounded Rational Behavior in Experimental Games and Markets, New York, Springer-Verlag, 11–18., http://cemi.ehess.fr/docannexe.php?id=1951 Kaufman, H. and Becker, G. M. (1961) ‘The Empirical Determination of Game-theoretical Strategies’, Journal of Experimental Psychology, 61, 462–8. McKelvey, R. D. and Palfrey, T. R. (1992) ‘An Experimental Study of the Centipede Game’, Econometrica, 60, 803–36. Nagel, R., Bosch-Domenech, A., Satorra, A. and Garcia-Montalvo, J. (2002) ‘One, Two, (Three), Infinity: Newspaper and Lab Beauty-contest Experiments’, American Economic Review. Schelling, T. (1960) The Strategy of Conflict, Cambridge Mass Harvard University Press. Selten, R. (1978) ‘The Chain Store Paradox’, Theory and Decision, 9, 127–59. Smith, V. L., Suchanek, G. and Williams, A. (1988) ‘Bubbles, Crashes and Endogeneous Expectations in Experimental Spot Asset Markets’, Econometrica, 56, 1119–51. Van Huyck, J., Cook, J. and Battalio, R. (1997) ‘Adaptive Behavior and Coordination Failure’, Journal of Economic Behavior and Organization, 32, 483–503. ** K.Binmore and A.Shaked 'Experimental economics: what next?', JEBO 2010 and its three rejoinders in the same volume, all available at http://www.wiwi.uni-bonn.de/shaked/rhetoric/ 6. Experimental methods Experimental methods: problems, hypotheses, statistics, properties of experimental design with application to research project Siegel S. and Castellan N.John (1988). Nonparametric Statistics for The Behavioral Sciences. McGraw Hill. Angrist, J.D., and Pischke J.-S. (2009). Mostly Harmless Econometrics: An Empiricist's Companion. Princeton University Press.