Chp 5 Applying Consumer Theory

advertisement

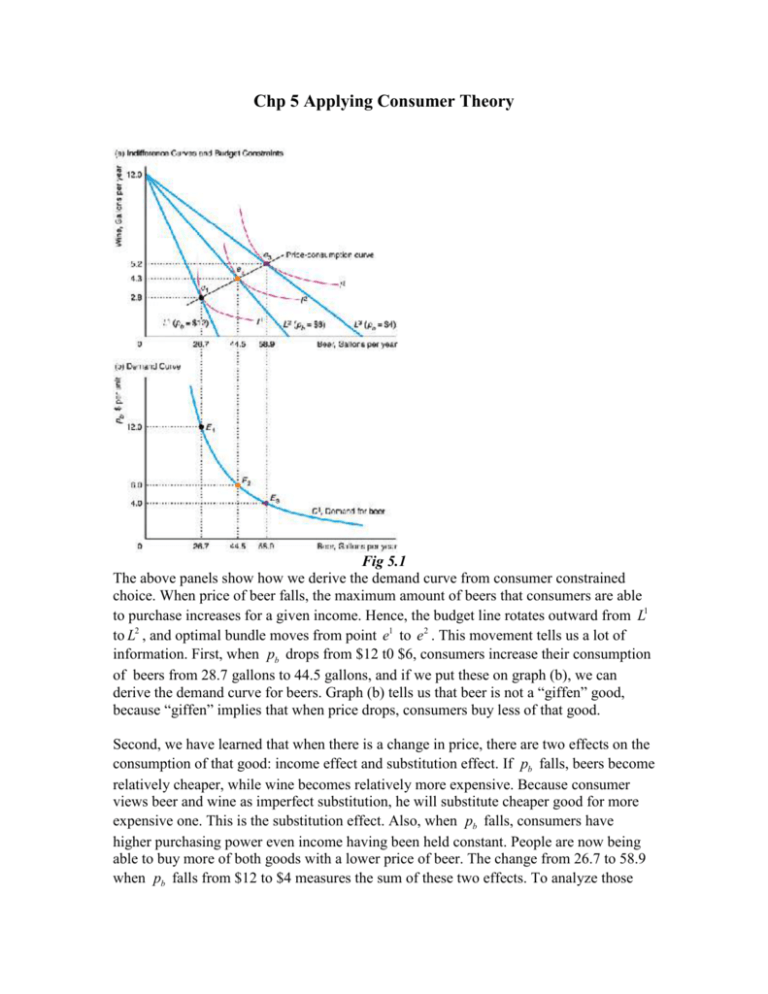

Chp 5 Applying Consumer Theory Fig 5.1 The above panels show how we derive the demand curve from consumer constrained choice. When price of beer falls, the maximum amount of beers that consumers are able to purchase increases for a given income. Hence, the budget line rotates outward from L1 to L2 , and optimal bundle moves from point e1 to e 2 . This movement tells us a lot of information. First, when pb drops from $12 t0 $6, consumers increase their consumption of beers from 28.7 gallons to 44.5 gallons, and if we put these on graph (b), we can derive the demand curve for beers. Graph (b) tells us that beer is not a “giffen” good, because “giffen” implies that when price drops, consumers buy less of that good. Second, we have learned that when there is a change in price, there are two effects on the consumption of that good: income effect and substitution effect. If pb falls, beers become relatively cheaper, while wine becomes relatively more expensive. Because consumer views beer and wine as imperfect substitution, he will substitute cheaper good for more expensive one. This is the substitution effect. Also, when pb falls, consumers have higher purchasing power even income having been held constant. People are now being able to buy more of both goods with a lower price of beer. The change from 26.7 to 58.9 when pb falls from $12 to $4 measures the sum of these two effects. To analyze those two effects, we have to learn how to decompose the effect of a price change into income effect and substitution effect. Fig 5.2 Def of Substitution effect: If utility held constant, as the price of the good increases, consumers substitute other, now relatively cheaper goods for that one. Def of income effect: An increase in price reduces a consumer’s buying power, effectively reducing the consumer’s income and causing the consumer to buy less of at least some goods. Suppose that we can take away some income from this consumer such that the budget line will shift inward to L , an imaginary line tangent to I 1 . The tangent point is e . The change from e1 to e in horizontal direction measures the substitution effect. Consumer stays at the same utility level. However, with a relatively cheaper pb , the consumer will increase his consumption of beer from 26.7 gallons to 30.6 gallons. The shift from L to L2 shows an increase in the consumer’s income. His optimal bundle moves from e to e2 , which measures the income effect on consumption of both goods. The consumer now consumes 58.9 gallons of beer instead of 30.6 gallons. SE 30.6 26.7 3.9 IE 58.9 30.6 28.3 TE SE IE 32.2 58.9 26.7 The above example shows us how to decompose the effect of a price change into income effect and substitution effect for a normal good. How do we know that is a normal good case? From the income effect. A normal good says when the income increases, people are going to buy more of that good, while less for an inferior good. So how do we decompose for an inferior good? The substitution effect is always the same. The only difference is the income effect. Fig 5.3 This graph is a different example. Movie is an inferior good in this case. Price of movies falls, and causes an outward rotation of the budget line. e1 to e still measures the substitution effect. e to e2 measures the income effect. Since movie is an inferior good, when income increases, the consumer actually goes less often to see the movies. SE (e e1 ) M 0 IE (e2 e ) M 0 TE SE IE 0 if | SE || IE | , i.e., SE dominates IE. 0 if | SE || IE | , i.e., IE dominates SE (“Giffen” good). “Giffen” good says when price of the good falls, people actually buy less of that good, which also implies that the demand curve for the good is upward sloping. Practice I: What would the value of the substitution effect be for two goods that are perfect complements? Use a graph to demonstrate your answer. Bonus (5pt): Sarah allocates her income of $5.00 between the consumption of donuts and coffee. Her tastes and preferences are indicated by the indifference curves shown in Figure 5.1. The price of donuts is $.50 each. Initially the price of coffee is $1.00 per cup. Subsequently, the price of coffee falls to $.50 per cup. On the graph below, show the initial utility maximizing position, the new utility maximizing position, and separate the income and substitution effects. For Sarah, is coffee a normal or inferior good? Deriving labor supply curve Labor supply curve is the relationship between wage and quantity supplied of labor. From the labor supply curve, we can tell how much one consumer is going to work for a given wage. Most of supply curves come from producers’ side, i.e., firms’ side. However, since labor supply is a decision made by consumers, we can apply consumer theory to derive the labor supply curve. So the question transforms to how much consumer want to consume the labor for every given wage. But this question looks weird. Let’s put it this way: Everyone has a fixed time endowment of 24 hours; among these 24 hours, people work and enjoy leisure. Here, we denote all other kinds of activities except for work as leisure. Now, we can rephrase the question: For a given wage, how much is the leisure demanded by consumers? We let N denote the time spent on leisure, H the time spent on working. Then we have the following relationship: H 24 N . Assume an individual has a preference: U (Y , N ) and his budget line is Y Y wH Y w 24 N , where Y is any income other than labor-income. Y can be thought of all other goods. Here, we let Y be zero. Fig 5.4 The intercept on x-axis means when consumer use all 24 hours on leisure, his income is 0, which implies he cannot consume any other goods. Intercept on y-axis means when he works full time (24 hours), he achieves his maximum income at 24w , and his leisure is 0. The slope of budget line is w . Note that wage w is viewed as the price of leisure. That is because to get 1 unit of leisure, people have to give up 1 unit time of labor, i.e., income of w . If wage rate increases, intercept on x-axis does not change, while the intercept on y-axis will be larger. Budget line rotates outward from L1 to L2 . Corresponding to the change of the budget line, optimal consumption moves from e1 to e 2 . Initially, consumer is enjoying 16 hours of leisure, while only works for 8 hours. But after the wage rate has been increased, consumer now wishes to work more, 12 hours, and enjoy less of leisure, 12 hours also. So, if we put these on the demand curve for leisure, we can see it is a downward sloping curve. And we can derive the supply curve of labor by the formula H 24 N . Fig 5.5 Now let’s decompose TE into IE and SE: (when leisure is a normal good) Fig 5.6 SE: when w increases, leisure becomes more expensive, so consumers wish to work more, enjoy less leisure. They are going to substitute labor for leisure. e1 to e measures the SE. IE: Wage increase causes income to increase, thus cause the shift of budget line from L to L2 . Accordingly, optimal bundle moves from e to e 2 . Because leisure is a normal good, consumer is going to increase his consumption of leisure. SE: N 0 , IE: N 0 Commonly, TE=SE+IE>0, i.e., when wage increases, people decrease their consumption of leisure, and work more. Normally, when wage is quite low, leisure is viewed as an inferior good. And when wage is sufficiently high, leisure becomes as a normal good. Fig 5.7 Then we have this backward supply curve. When people start with a low wage, they want to work to earn income so that they consume other goods. So for them, they would like to work more when wage increases. However, when they become richer, they have had enough wealth. Leisure becomes normal good. They want to enjoy leisure even wage is quite high. So, when wage increases, they will supply less labor.