Solution to Sample Questions for Midterm Exam #1

advertisement

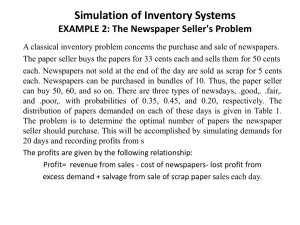

Solution to Sample Questions #1 Let xS acres of soybeans to plant xC = acres of corn to plant xO = acres of oats to plant C = number of cows to purchase H = number of hens to purchase T = number of hours to work in town Maximize 600x S 900x C 450xO 1000C 5H 6T subject to land: xS xC x O 1.5C 125 acres funds: 1200C 9H $40,000 labor: 70x S 105xC 50xO 100C 0.9H T 7500 hours barn: C 32 chicken house: H 3000 and xS , xC , xO ,C, H,T 0. #2 a. b. c. d. Pro = 1000, College = 200, High School = 0. Profit = $4200. The solution will change (outside of allowable decrease). Profit will decrease. The solution will not change (inside of allowable increase). Profit increases $2000. ∆Z = (Shadow Price)(∆RHS) = ($0.40)(+1000) = +$400 (Note: shadow price valid because inside of allowable increase). This is less than the leasing cost, so they should not lease the sewing machine. e. ∆Z = (Shadow Price)(∆RHS) = (–$3)(–100) = +$300 (Note: shadow price valid because inside of allowable decrease). Thus, profit increases by $300. The solution will change to generate this extra profit. f. The allowable decrease should be 4000. The shadow price is zero because there is slack in this constraint. The shadow price will remain zero so long as there is slack. The righthand-side can be reduced up to 4000 before there is no longer slack. g. The change is outside of the allowable decrease, so the shadow price is not valid, and we can not determine exactly how much this will cost them. On the other hand, the shadow price is valid for the first 3000 minutes of decrease. For just these 3000 minutes lost, the cost will be ∆Z = (Shadow Price)(∆RHS) = ($0.40)(–3000) = –$1200. Thus, they will lose at least $1200. Since they will lose at least $1200, they would clearly be better off to spend $1000 to replace the sewing machines. #3 a) They should purchase the 21-Day advance ticket, with an expected cost of $695. Full Fare 900 900 900 0.5 Can be reissued 2 0.4 Meeting changes 695 575 75 0 987.5 575 0.5 Can not be reissued 21-Day Advance 1400 900 500 1400 695 0.6 Meeting doesn’t change 500 0 500 b) 20% of the time, the schedule will change. Of these, half can be reissued, so a total of 10% will need to be reissued, and a total of 10% will need to be repurchased (full fare). The expected cost of reissue/repurchase = (0.1)($75) + (0.1)($900) = $97.50. Let T be the cost of the ticket. The total expected cost will be T + $97.50. Since T+$97.50<$695 when T<$597.50, this is the most you should be willing to pay. #4 a) They should go to high capacity at the start of year 1. Expected payoff = $512,000. 0.8 Y2 Demand Low (20,000) 320000 Stay Low Capacity (20,000) 0 320000 0.4 Y1 Demand Low (20,000) 200000 320000 0.2 Y2 Demand High (40,000) 320000 200000 320000 1 200000 320000 0.8 Y2 Demand Low (20,000) 240000 Expand Capacity (40,000) -80000 280000 200000 240000 0.2 Y2 Demand High (40,000) 440000 Low Capacity (20,000) -80000 400000 368000 440000 0.2 Y2 Demand Low (20,000) 320000 Stay Low Capacity (20,000) 0 320000 0.6 Y1 Demand High (40,000) 200000 320000 0.8 Y2 Demand High (40,000) 320000 200000 320000 2 200000 400000 0.2 Y2 Demand Low (20,000) 240000 Expand Capacity (40,000) 200000 240000 2 512000 -80000 400000 0.8 Y2 Demand High (40,000) 440000 400000 440000 0.8 Y2 Demand Low (20,000) 0.4 Y1 Demand Low (20,000) 200000 320000 280000 200000 280000 0.2 Y2 Demand High (40,000) 480000 High Capacity (40,000) -120000 400000 512000 480000 0.2 Y2 Demand Low (20,000) 0.6 Y1 Demand High (40,000) 400000 640000 480000 200000 480000 0.8 Y2 Demand High (40,000) 680000 400000 680000 #4 b) Assign the highest payoff ($680,000) a utility value of 1. Assign the lowest payoff ($240,000) a utility value of 0. $6 80,0 00 (U=1 ) p $2 40,0 00 (U=0 ) 1-p x For each other final payoff in tree (from part a), what does p need to be so that I’m indifferent between that payoff (x) and the above lottery with probability p of $680,000 (and probability 1-p of $240,000). Then U(x) = p. For me: when x = $280,000, p must be 0.15, so U($280,000) = 0.15. When x = $320,000, p must be 0.3, so U($320,000) = 0.3. When x = $440,000, p must be 0.6, so U($440,000) = 0.6. When x = $480,000, p must be 0.7, so U($480,000) = 0.7. (These answers will vary.) This leads to the following utility function graph, which is risk-averse. Utility 1.0 0.8 0.6 0.4 0.2 0 240 280 320 360 400 440 480 Payoff ($000) 520 560 600 640 680 #4 c) 0.8 Y2 Deman d Lo w (20,0 00) 0.3 Sta y Low Capa city (20,0 00) 0 20 0000 0.3 0.4 Y1 Deman d Lo w (20,0 00) 0.3 0.2 Y2 Deman d High (40,000) 0.3 20 0000 0.3 1 20 0000 0.3 0.8 Y2 Deman d Lo w (20,0 00) 0 Expan d Capa city (40,0 00) -80 000 20 0000 0.12 0 0.2 Y2 Deman d High (40,000) 0.6 Lo w Ca pacity (20 ,000 ) -80 000 40 0000 0.408 0.6 0.2 Y2 Deman d Lo w (20,0 00) 0.3 Sta y Low Capa city (20,0 00) 0 20 0000 0.3 0.6 Y1 Deman d High (40,000) 0.3 0.8 Y2 Deman d High (40,000) 0.3 20 0000 0.3 2 20 0000 0.48 0.2 Y2 Deman d Lo w (20,0 00) 0 Expan d Capa city (40,0 00) 20 0000 0 2 0.668 -80 000 0.48 0.8 Y2 Deman d High (40,000) 0.6 40 0000 0.6 0.8 Y2 Deman d Lo w (20,0 00) 0.4 Y1 Deman d Lo w (20,0 00) 20 0000 0.26 0.15 20 0000 0.15 0.2 Y2 Deman d High (40,000) 0.7 High Capacity (4 0,00 0) -12 0000 40 0000 0.668 0.7 0.2 Y2 Deman d Lo w (20,0 00) 0.6 Y1 Deman d High (40,000) 40 0000 0.94 0.7 20 0000 0.7 0.8 Y2 Deman d High (40,000) 1 40 0000 1 #5 a) Jerry should open a large shop, with an expected payoff of $25,000. 0.5 Market Favorable 80 Large Shop 80 0 25 80 0.5 Market Unfavorable -30 -30 -30 0.5 Market Favorable 50 1 Small Shop 50 50 25 0 20 0.5 Market Unfavorable -10 -10 -10 No Shop 15 15 15 b) With the information, Jerry would open a large shop with a favorable prediction, and open no shop with a negative prediction, with an expected payoff of $34,250. EVSI = $34,250 – $25,000 = $9250 (This is the most Jerry should pay for the information). 0.727273 Market Favorable 80 Large Shop 0 80 50 80 0.272727 Market Unfavorable -30 -30 0.727273 Market Favorable 0.55 Predict Favorable 50 1 0 -30 Small Shop 50 50 50 0 33.636 0.272727 Market Unfavorable -10 -10 -10 No Shop 15 15 15 0.222222 Market Favorable 34.25 80 Large Shop 0 80 -5.556 80 0.777778 Market Unfavorable -30 -30 0.222222 Market Favorable 0.45 Predict Unfavorable 50 3 0 -30 Small Shop 50 50 15 0 3.3333 0.777778 Market Unfavorable -10 -10 -10 No Shop 15 15 15 c) EVPI = 0.5($80,000) + (0.5)($15,000) – $25,000 = $22,500.