Overview

advertisement

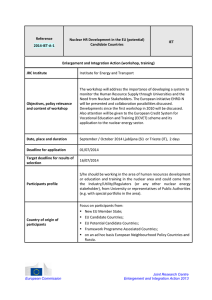

THE ECONOMICS OF NUCLEAR POWER IN LIBERALIZED MARKETS Pedro Linares, IIT - Universidad Pontificia Comillas, +34915406257, pedro.linares@upcomillas.es Adela Conchado, IIT - Universidad Pontificia Comillas, +34915422800, adela.conchado@upcomillas.es Overview One of the key issues regarding the renaissance of nuclear power in Europe is its economics. Some studies argue that nuclear power is cheaper than other sources, whereas others condemn it as excessively expensive. This paper assesses the economic viability of new nuclear power plants in liberalized electricity markets, as a contribution to this debate. Instead of using a traditional levelized-energy-cost (LEC) analysis as previous studies, we use a simulation model to determine the maximum investment cost – which represents more than 75% of the total cost of electricity from nuclear – that nuclear plants should achieve in order to be profitable within a liberalized electricity market, under different scenarios (price of gas and coal, renewable energy policy, interest rates, and carbon prices). We believe that this approach corrects some of the shortcomings of the traditional LEC analysis, basically the need to assume operation hours (which are endogenous to the problem), and also allows for better representing simultaneously all alternative technologies, the power system constraints, and the impact of carbon or fuel prices on marginal power plants, among others. The analysis is carried out for the Spanish electricity system, which is quite representative for European power markets. In order to keep the analysis as straightforward as possible, it does not include any considerations of environmental impacts (other than carbon emissions during operation), radioactive waste management, dismantling, or nuclear proliferation issues, which should be addressed separately. Methods The assessment is carried out with a long-term, generation expansion model for liberalized electricity markets (Linares et al, 2008). This model represents the investment and operation decisions made by electric utilities in order to maximize their profit. The model is able to simulate oligopolistic behaviour, and also different renewable energy policies and carbon policies. In order to account for the uncertainty regarding some key parameters, different scenarios have been constructed combinining different values for gas prices, renewable energy policies, interest rates, realiability of nuclear, building times, demand growth, and carbon prices. The model is run iteratively for each scenario with different investment costs for nuclear, until the maximum cost which makes it profitable is found. This cost should be compared then with the current estimates for investment costs of nuclear power plants. In order for this comparison to be consistent, all calculations have been made with overnight costs, excluding financing. Results The results obtained depend of course on the scenario chosen. For our central scenario (WACC 9%, gas price $7/MMBtu, 85% reliability for nuclear, 1% annual demand growth, $25/tCO2, and 6 years building time for nuclear), the maximum cost for nuclear should be 2,900€/kW, overnight cost. In the following table we show the results (in €/kW) obtained for the different scenarios (again, in overnight cost). Scenario Demand WACC CO2 price Gas price Renewable policy Reliability Building time Lower level 2752 2260 2626 1798 2747 2730 2565 Upper level 2909 3280 3182 3173 2909 3041 2934 As might be expected, the higher allowable costs for nuclear correspond to scenarios with higher gas and carbon prices, with higher reliability, and with shorter building times. When combining the different scenarios we obtain a most favourable figure for nuclear of 3,700€/kW, and a least favourable one of 1,200 €/kW. This most favourable figure also corresponds to an “extreme” scenario of $140/tCO2 and $20/MMBtu gas price. These figures should be then compared with the current investment costs for new nuclear power plants, which range from 2,600 to 3,600 €/kW, according to the recent MIT study (MIT, 2009). In fact, Du and Parsons (2009) choose as a reference overnight cost 3,000€/kW. There are some caveats to reveal about the results: we have not considered intermittency in renewable energy production – which would be unfavourable for nuclear --, and we have not considered volatility in fossil fuel prices – which would be favourable for nuclear --. Conclusions Under the reference scenario, the cost that nuclear should attain is in the lower end of the current range, and this assuming that there are no large budget deviations (which have been quite common in industry, see e.g. MIT, 2003), and no large delays in building times (which again are rather frequent). If we look at the different scenarios, we see that there are more scenarios for which the current cost of nuclear is too high compared to more favourable ones. Therefore, our first conclusion is that economics in itself is not a favourable element for the nuclear renaissance, but rather a hindrance. If nuclear is considered as an interesting option for other reasons (due e.g. to strategic considerations), the construction of new nuclear power plants would require either a renewed technological effort to reduce costs, or a public support system (which can be implemented in many ways: premiums, guaranteed loans, PPAs, etc.). A second conclusion is that these results are very much dependent on the variation of the relevant parameters, and therefore imply a large degree of uncertainty. We might also say the same for gas, but here the shorter building times and lower capital cost make it easier to manage this uncertainty. For nuclear, the building decision becomes very much a risk management one, in which both the portfolio of the utility (against which nuclear may be hedged) or the risk perception of the investor will become the more relevant decision parameters. In any case, transparency along this process should be a must for a well-informed societal decision. References Du, Y., J.E. Parsons (2009). Update on the cost of nuclear power. CEEPR Working Paper 09-004. Linares, P., F.J. Santos, M. Ventosa, L. Lapiedra (2008). Incorporating oligopoly, CO2 emissions trading and green certificates into a power generation expansion model. Automatica, 44: 1608- 1620. MIT (2003). The Future of Nuclear Power. MIT (2009). Update on the cost of nuclear power.

![The Politics of Protest [week 3]](http://s2.studylib.net/store/data/005229111_1-9491ac8e8d24cc184a2c9020ba192c97-300x300.png)