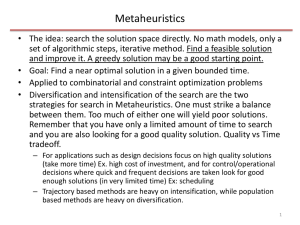

Predicting bankruptcy using Tabu Search in the Mauritian Context

advertisement

Predicting Bankrupty using Tabu Search in the Mauritian Context Paper Presenter: Kawthur Lallmamode Authors: Kawthur Lallmamode, Jayrani Cheeneebash, Ashvin Gopaul In this paper we apply the Tabu search variable selection model (ref) to a group of both public and private firms to predict bankruptcy. This algorithm is an extremely efficient means for selecting a subset of variables from the whole set of explanatory variables under consideration and it can be applied to problems in finance. Bankruptcy is the state of a firm or corporation being unable to repay its debts whereby it legally declares its inability to continue business. The occurrence of business failure all round the world is in constant rise, whereby statistics shows that in US itself, there are more than thirty companies which go out of business every week. Being able to predict bankruptcy, if ever it is to occur, for any firm, is of great importance to the enterprise and other related enterprises. Different bankruptcy and scoring models have tried to better illustrate the concept of predicting business failure since the literature about bankruptcy prediction and scoring models is very extensive. Some of them is, the cash flow models, the Altman Z-score models, the loss on default bank loans, the credit scoring and the Lehman Brothers mortgage default model. In order to predict bankruptcy the Tabu search method is applied. Tabu search is defined as a meta-heuristic that guides a local heuristics procedure to explore the solution space beyond local optimality. It is also viewed as a mathematical optimization method belonging to the class of local search technique whereby it enhances the performance of a local search method from the usage of memory structures. It is based on the premises that problem solving in order to be qualified as intelligent must include both adaptive memory and responsive exploration. The adaptive memory feature suggests the importance of analyzing current alternatives in relation to previous ascents of similar situation allowing the implementation of procedures that are capable of searching the solution space effectively. On the other hand, the responsive exploration integrates the basic principles 1 of intelligent search while exploiting good solution feature from exploring new promising regions. Tabu search has its application in many field namely, scheduling design, telecommunications, logic and artificial intelligence, routing, graph optimization and financial analysis. The Tabu search for multiple regression analysis requires seven definitions and parameters elaborated below. Firstly, one criteria for the selection of independent variables with the lowest significance level for the correlation coefficient R 2 , for the subset selected from among all possible subsets. The significance level can be calculated by the F-probability distribution using the following formula F p ,n p 1 R p2 p (1 R p2 ) (n p 1) , p being the number of independent variables, n being the number of observations, R 2 R Rnp , where R is the determinant of the correlation matrix including the independent variable and the denominator represents the determinant of the correlation matrix of p independent variables. Secondly, a definition of the neighborhood is required. The neighborhood of the current solution is defined as all subsets of the current solution with one additional variable, one variable less and those subsets for which one current variable is swapped by one not in the current solution set of variable. Given a total of k independent variable under consideration and p k , a current (solution) subset of p independent variable has a neighborhood size equal to k p possible additions, plus p possible removals plus p(k p) possible replacements equating to a total size of k p (k p ) subsets. Thirdly, the starting solution is obtained by applying an algorithm, which resembles the maximum R 2 improvement approach. Following the starting solution, we have the tabu list and tabu size. The tabu list contains a list of variables, which are not permitted to be used in a move, whereby a move is adding, removing or swapping a variable. Whenever the length of the tabu list exceeds 2 the tabu size, the original member of the tabu list is discarded in a First In First Out manner. We always start with an empty tabu list and with a new best solution obtained the tabu list is emptied. Next to the tabu list, a move within the neighborhood is admissible if the variables involved in the move are not in the tabu list, thus the admissible set. Finally we have the search parameters and the stopping criterion. The search parameters are the tabu size which is set in advance. The tabu size is calculated as being greater than 10% of the neighborhood size, thus giving a tabu size of 7. The stopping criterion is set to a number of 30 iterations. The procedure ends when 30 consecutive tabu search does not produce a new best solution. The prediction of bankruptcy using Tabu search is applied in the Mauritian context. Data for twenty companies was collected from the Registrar of companies. For confidentiality purpose neither the 20 company names, nor the years for which data was taken, will be given. The data collected consisted of 10 bankrupt companies. The year of reference is set to a general T value and data collected is done for T-1 and T-2 years, that is, for one year prior to bankruptcy T-1 and two years prior to bankruptcy T-2. The following information was required from each company’s annual report: 1.CURRENT ASSETS 2. CURRENT LIABILITIES 3. INVENTORIES 4. RECEIVABLES 5. INTESREST CHARGES 6. DEBT (LOAN) 7. SALES 8. RETAINED EARNINGS 9. CAPITAL 10. PRICE PER SHARES 11. NET PROFIT MARGIN AFTER TAX 12. OPERATING EXPENSES 13. EARNINGS PER SHARES 14. SHARE CAPITAL 15. RETURN ON TOTAL ASSETS 16. DEBT DUE (LOAN WITHIN ONE YEAR) 17. MARKET PRICE PER SHARE 18. TOTAL ASSETS 19. BOOK VALUE PER SHARE 20. SHARES OUTSTANDING 21. MARKET VALUE OF EQUITY 22. SHAREHOLDER'S EQUITY 23. RETURN ON EQUITY 24. NET FIXED ASSETS (NONCURRENT ASSETS) 25. EARNINGS BEFORE INTEREST AND TAX 3 The following panel represent the initial set of independent variable which is required as to obtain those variable selected by the Tabu search needed to create the Tabu prediction score equation. The Tabu code is run for all the T-1 and T-2 years for both the bankrupt and nonbankrupt firms with 40 observations and the following two variables was selected: (i) ALT5 = TOTAL ASSETS TURNOVER and (ii) INV X = INVENTORY TURNOVER. 1 SIZE : MARKET VALUE OF EQUITY 2 ALT1 3 4 ALT2 ALT3 : BASIC EARNING POWER 5 6 7 ALT4 ALT5 : TOTAL ASSETS TURNOVER CR : CURRENT RATIO 8 9 10 11 12 QR : QUICK RATIO INV X : INVENTORY TURNOVER DSO : DAYS SALES OUTSTANDING FAT : FIXED ASSETS TURNOVER CAP REQ : CAPITAL REQUIREMENT 13 14 15 16 DEBT : DEBT RATIO TIE : TIMEINTEREST EARNED NOPAT : NET OPERATING PROFIT (MARGIN) AFTER TAXES PM : PROFIT MARGIN ON SALES 17 ROA : RETURN ON TOTAL ASSETS 18 ROE : RETURN ON EQUITY SHARES OUTSTANDING * PRICE PER SHARES WORKING CAPITAL / TOTAL ASSETS RETAINED EARNINGS / TOTAL ASSETS EBIT / TOTAL ASSETS MARKET VALUE OF EQUITY / BOOK VALUE OF DEBT SALES / TOTAL ASSETS CURRENT ASSETS / CURRENT LIABILITIES (CURRENT ASSETS INVENTORIES) / CURRENT LIABILITIES SALES / INVENTORIES RECEIVABLES / (ANNUAL SALES / 360) SALES / NET FIXED ASSETS OPERATING CAPITAL / SALES TOTAL DEBT / TOTAL ASSETS EBIT / INTEREST CHARGES EBIT ( 1 - T) / SALES EBIT / SALES NET INCOME AVAILABLE TO SHAREHOLDERS / TOTAL ASSETS NET INCOME AVAILABLE TO SHAREHOLDERS / COMMON EQUITY 4 PE : PRICE EARNING RATIO CD OBL : CURRENT DEBT OBLIGATION 19 20 21 MB : MARKET-TOBOOK RATIO PRICE PER SHARE / EARNINGS PER SHARE DEBT DUE IN ONE YEAR / SIZE MARKET PRICE PER SHARE / BOOK VALUE PER SHARE We note that the dependent variable is a dummy variable set to 0 for non-bankrupt firms and 1 for bankrupt firm. The same data set with T-1 under consideration for both bankrupt and non-bankrupt with 20 observations for each variable produces the following selected five variables: (i) ALT2 = RETAINED EARNINGS / TOTAL ASSETS, (ii) QR : QUICK RATIO, (iii) DSO : DAYS SALES OUTSTANDING, (iv) DEBT : DEBT RATIO, and (v) PE: PRICE EARNING RATIO. For T-2 year of reference for both type of firms with 20 observations the following 5 variables was selected: (i) ALT1= WORKING CAPITAL / TOTAL ASSETS, (ii) ALT2 = RETAINED EARNINGS / TOTAL ASSETS, (iii) INV X = INVENTORY TURNOVER, (iv) DSO : DAYS SALES OUTSTANDING, and (v) DEBT: DEBT RATIO. Through out this analysis the Tabu prediction score was compared with the Altman Zscore prediction value, and it proves to be a better predictor of bankruptcy. The Tabu search proves to be an efficient and effective way of selecting variable for scoring and bankruptcy models in corporate, personal and real estate finance. Moreover, the attractiveness behind the use of Tabu search is that its implementation is quite straightforward and the results are outstanding. 5