Assignment 1 - Design Computing

advertisement

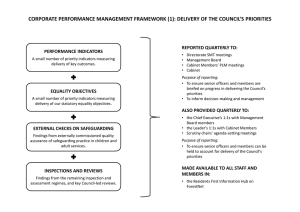

Strategies for IT Adoption in the Cabinet Making Industry (Final Report) Yan Zhang 1. Overview of the selected Industry Sector 1.1 Scope of industry sector As assumed in the background of the assignment, this assignment is a proposal for “XX industry association”. Here I will first define the concern of my “XX industry association” as “Cabinetmaking”, which is primarily engaged in specialized residential, office and special wooden cabinet making technology within building industry area, and work for builders and general contractors under subcontract or directly for owners. Based on the wide browse of the companies specialized in related areas, I think this sector could be viewed as a group of establishments that use similar processes and have similar business activities, having similar specialized human resources (evaluate against the definition of industry by NAICS), thus make our research in disclosing the similarity and comparing variety of business process within this industry meaningful and valid. Although in office and laboratory sector the steel product is more popular, we constrain our research in wooden cabinet because steel products require totally different process thus do not fit in one industry. This industry has close relationship with both building industry and wood making industry; therefore, its IT adoption, business processes and structures should be examined under the big background of both industries. As a sector of building carpentry industry, it collaborates with architects, builders and owners, delivering well-specified product – cabinets. It might deal with project of single-family houses or apartment buildings. On the other hand, mainly dealing with wood cabinets, it could be looked as one kind of wood-making industry, adopting technology developed in wood making industry and following the conventions in it. 1 1.2 Scale of industry sector According to the data from Freedonia Market Research, The US Cabinet shipments in 2001 were $10.7 billion. Freedonia Market Research also predicted that the demand is expected to grow almost 7% per annum from 2001 through 2006 to more than $15 billion. While foreign trade plays a fairly small role in the US cabinet industry because of high transportation costs, most of the demands are satisfied by domestic cabinet industry. It is also stated that since Kitchen cabinets have traditionally dominated US cabinet shipments and will continue to account for over four-fifths of total production through 2006. These cabinets will benefit from the increasing size of kitchens, as well as from the continued popularity of kitchen remodeling projects. Moreover, shipments of kitchen-type cabinets will benefit from rising utilization in other rooms of the house (e.g. laundry rooms and bedrooms). Shipments of bathroom cabinets will also see good growth prospects through 2006, stimulated by design trends such as larger bathrooms and a greater number of bathrooms per house, as well as by repair and improvement activity. Figure 1. US Cabinet Shipment 2 1.3 Associations in this industry Investigation of associations in the industry could serve two purposes: The associations might help in promoting the application of IT techniques The scope of associations demonstrate some routine group relations inside the industry Several associations found in this industry are introduced in the following: 1.3.1 Kitchen Cabinet Manufactures Association1 As shown in figure1, Residential cabinet making is the dominate portion (about 85%) in the cabinet making industry. As a voluntary non-profit industry trade association originally founded in 1955, Kitchen Cabinet Manufacturers Association (KCMA) is a national trade association that serves and represents kitchen, bath and other residential cabinet manufacturers and suppliers. The purpose of this association is to serve members by promoting the industry; developing standards; sponsoring research; representing member interests in government, legislative and regulatory issues; and providing management tools and educational programs. Their goal is to promote growth for the entire cabinet industry, offer a package of services designed to strengthen individual members, and to grow as an association. Currently, KCMA has over 360 members located in the United States and Canada who manufacture kitchen cabinets and bath vanities, countertop fabricators or supply goods and services to the industry. 1.3.2 American Furniture Manufacturers Association 1 Kitchen Cabinet Manufacturers Association 1899 Preston White Drive, Reston, VA 20191-5435 Tel: (703) 264-1690 | Fax: (703) 620-6530 3 It is very interesting to notice that office cabinet making seems to have closer relation with another area: furniture-making industry. The reason for this probably is that the owners always order the office cabinet with other furniture (desk, chair, etc.), thus it is more reasonable for the contractor to include the cabinet making as part of his furniture making establishment rather than only specialize in office cabinet making. On the other hand, currently it is also not very common for residential cabinet-maker to be involved in the office furniture supplying. There are many associations in the area of furniture and AFMA is one example. AFMA is the nation's largest trade organization for furniture manufacturers in the United States. The Association is dedicated to fostering the growth and development of the furniture industry and improving the effectiveness and efficiency of furniture manufacturing in the U.S. Cabinet is one of the furniture the manufacturers supply for the office buildings. 1.3.3 The Scientific Equipment and Furniture Association Similar with office cabinet making, the laboratory cabinet making is a small part in the supplying product of laboratory furniture and equipment manufacturer. An association called SEFA was organized in 1988 to meet the needs of designers, manufacturers and installers of scientific equipment and furniture. SEFA promotes and encourages quality and excellence in providing laboratory furniture and equipment and integration of people, pace and process to advance organizational goals and meets the needs of the users. The objective of the association is to become the organization of choice that enables and supports all involved parties in creating humane, safe and effective laboratory environments. Laboratory cabinet is characterized by the special requirements (fume, seal, etc.) for the environment. Thus it is even more integrated with the other furniture than office cabinet. 1.3.3 Cabinet Makers Association 4 As we will demonstrate in part 1.3, this industry is featured by large amount of small companies, correspondingly, Cabinet Makers Association is the organization formed by a group of cabinet shop owners. The goal of the CMA is: Provide a national voice and presence for the small cabinet shop Offer members the chance to network and communicate with other owners and managers of small cabinet shops Improve the standards of professionalism in the industry Improve the image of the small cabinet shop and professional wood-makers 1.3.4 Analysis Two features in this industry could be noticed from the survey on the associations in this area: First of all, the residential, office and laboratory cabinet-maker seems to be separated. This analysis could be supported to some extent by a report by FFINO. Although it is about the furniture market in UK, it could give us an overview about cabinet under the whole background of furniture industry: The sector is traditionally segmented into three markets - domestic, office and contract furniture/furnishings. The domestic market, as the name suggests, is concerned with the manufacture of furniture and furnishings for the home environment, from upholstered furniture, beds and soft furnishings, to kitchen, dining and occasional furniture. Of this market, 33% is accounted for by upholstered furniture, with sales of kitchen furniture at 24% and beds, bedding and bedrooms combined, accounting for some 29%. 5 Desks, tables and system furniture dominate the office market (48%) with seating (26%) and steel storage (16%), following at lower percentages. Screens and other office and storage furniture account for the remaining 10% of that market. The contract market provides furniture for public areas such as hotels, universities and airports but because of the lack of specific statistics on that market, we are unable to describe the percentages involved. Estimates place the domestic sector as accounting for approximately 58% of overall manufacturers’ sales in the UK, with the contract and office sectors taking some 29% and 13% respectively. As shown in Fig2, there are some residential cabinet makers more independent from furniture industry, while the lab cabinet and office cabinet are actually scattered in the wooden furniture industry. Woodmaking Industry Furniture Office Cabinet Residential Cabinet Lab Cabinet Fig2. Relation among industries We may notice that the same wood processing techniques and automations are required for residential and office cabinet making. As for human resources, we can refer to the definition of the work of “cabinet maker” by FFINO: produce and assemble component pieces of furniture items including dining room tables and chairs, cabinets, entertainment and wall units, chests of 6 drawers, lounge suites, office furniture, kitchen cupboards and benches. Most specialize in a certain range of furniture. The similarity of residential and office cabinet makes it reasonable for cabinet maker to conduct both works. Therefore, it might suggest that the office cabinet making is a potential market for residential cabinet maker by some mechanisms such as subcontracting from the office and laboratory furniture supplier. [i] The second feature is the fragment in this industry sector, as we will discuss in detail in the following part. 1.4 Fragment in this industry sector 1.4.1 Data from 1997 US Economic Census The total dollar value of business done for establishments was about $21 billion according to 1997 US economic census. Obviously the cabinet making industry, with a shipment value of $11 billion in 2001, count almost half of the business value in this industry sectors. The statistical data in the census, although also including other sectors within carpentry, could be a very good reference data source for us to understand the fragment in cabinet making industry. According to the report, the total number of employment in construction carpentry sector is 230409 and the number of establishment is 44858, the average employment in establishment is about 5, which obviously indicate small scaled establishments. The following two tables offered could give a more detailed view in this aspect: Table 1. Selected Statistics for Establishments with Payroll by Employment size class: (1997) Total Number of establishments Total number of employees 44858 230409 7 Establishments with 1 to 4 S 56547 employees Establishments with 5 to 9 7283 45526 employees Establishments with 10 to 3001 39221 19 employees Establishments with 20 to 1182 34116 49 employees Establishments with 50 to 323 21171 99 employees Establishments with 100 to 140 21259 249 employees Establishments with 250 to 26 8562 499 employees Establishments with 500 to 5 D 999 employees Establishments with 1000 1 D employees or more Table 2. Selected Statistics for Establishments with Payroll by Dollar Value of Business Done: (1997) Total Number of establishments Total number of employees 44858 230409 Establishments with value S S 8 of business done less than $25,000 Establishments with value S S of business done $25,000 to $49,999 Establishments with value S 12761 of business done $50,000 to $99,999 Establishments with value 14666 39813 of business done $100,000 to $249,999 Establishments with value 6690 30737 of business done $250,000 to $499,999 Establishments with value 3925 32230 of business done $500,000 to $999,999 Establishments with value 2481 of business 36733 done $1,000,000 to $ 2,490,000 Establishments with value 817 of business 24533 done $2,500,000 to $4,999,000 9 Establishments with value 304 of business 17758 done $5,000,000 to $9,999,000 Establishments with value 198 30239 of business $10,000,000 or more 1.4.2 Data from KCMA According to KCMA, the number of production personnel reported by its members ranges from 5 employees to 4,500 employees. Over half of the KCMA manufacturing members report fewer than 100 production employees; 35% of KCMA manufacturer members report 50 employees or less. The data sources indicate slightly different pattern (it shows up a bigger scale enterprise in KCMA data), a reasonable assumption is that the establishment is smaller unit: a company could have several establishments according to the definition of census, and the company with bigger size tend to register in the association. 1.4.3 International data According to the data from FFINTO (a UK furniture association), in terms of size and structure, the sector employs some 128,400 people in approximately 12,300 companies. Significantly, 75% of all businesses in the sector employ nine or fewer employees, whilst at the other end of the spectrum, about 300 organizations account for 45% of the total workforce. All these data sources show consistent pattern of the fragment in this industry: There exist some large scale companies 10 There are a number of small companies or self-employment stores. 2. Methodologies The goal of this report is to investigate the current IT application and the potential improvement in IT adoption. There are two kinds of IT adoptions in this industry to be concerned: Automation of design and manufacturing process: IT adoption within company Business process IT adoption: IT adoption among different companies Regarding the design and manufacturing automation, there are mature 3D modeling software and CNC technologies available. In this aspect, I would like to investigate the available technologies and its actual applications. The reasons accounting for this reality would be proposed. Regarding the wider business process, we are not looking inside a specific company; instead, we are investigating the potential IT adoption regarding the relation between this company and other companies within or across this industry. In this aspect, as Funstep describes, the data communication among manufacturers, suppliers, retailers, decorators and general contractors would be the basis for any IT adoption to integrate the business process. In order to investigate these two aspects, we need to understand the structure of this industry. For design and manufacturing automation, there are two important characteristics: First of all, most of the companies in this industry conduct design, manufacture and installation. That is to say, the integration in this direction is not a problem. If the company plans to adopt IT techniques, unlike the isolation of design & construction in building industry sectors, there is few barrier for it. Secondly, as any automation manufacturing techniques, CNC machines are expensive and very suitable for mass production; hence the size of a company matters. If a 11 company is of small size and only has limited production demand, it is not willing to adopt CNC techniques. For the IT adoption in the business process, the way a company doing business matters. For example, if a company directly does business with homeowner, then it probably does not need any IT techniques, given most homeowners are still not used to order things online. However, from a broader viewpoint, the supply chain linking manufacturers to the end customers involves different level of retailers and dealers. Information is exchanged among these stakeholders and it will be helpful to define some protocol for it. Furthermore, if such protocol exists, new IT adoptions to integrate the supply chain, such as e-business would become possible. In this sense, the information product model need to integrate information needed by all the stakeholders and should contain much more information than the geometry information alone. In this sense, we would need to understand the companies in the cabinet making industry as manufacturer, dealer, retailer, etc. It is a broader view than only focusing on the manufacturers. The classification in the first category overlaps with the second one. If a company is a small scale manufacture, it probably establishes business relationship directly with the customers. If a manufacturing company is of a large scale, it is more intended to have business relation with general contractor or dealers. In this case, the restructuring of the industry business relation will have influence on them. Most of the information collected in this paper falls in the first category, i.e, the inspection of the IT adoption inside the manufacturers. However, some discussion will be conducted regarding the second category, mainly about basis (product model) for the future IT adoption instead of proposing the concrete solutions. 12 3. Available Technology 3.1 Design and Manufacturing Automation 3.1.1 3D Modeling software There are different levels of 3D modeling software in this area. The lowest level in this area is just to show some photo-realistic rendering effects, while some “real” 3D modeling software is also available for cabinet-design and casework design. The high-end 3D software is quite advanced in this area. It can take care of designing, scheduling, nestling, cut-list, shop drawing, all the way to the G-code generation for CNC machines. Since the design and manufacture usually takes place in the same company, the information flow within encounters no problem. Even if the design and manufacturing process are separated, as we notice, the 3D software actually serves to integrate and deliver the information between them. 3.1.2 Cabinet Making CNC/CAM has been the dominant technique in wood processing industry. However, since these techniques are developed mainly to cater the requirements of wood processing industry, it features heavy duty and large processing capacity. One thing to notice is that CNC manufacturers are trying to provide more flexible solution for medium and small companies, but there is still some distance to go before it really become an acceptable solution for small companies. How to achieve flexibility while maintaining high production capability is still a hot topic in CNC machine development. 13 Another interesting effort of CNC makers is trying to develop techniques to integrate design and manufacture. That is to say, on the one side, 3D modeling software is trying to take care of the manufacturing process; on the other side, CNC makers are also trying to integrate the design with manufacturing process. In my opinion, this integration effort would be very effective and promising. A good example is SCM group’s netline project. It is a production line with software which, by interacting with the operator, with the software already present in the machine and with the electronic, is be the element which allows the integration of the machinery in the process. The scenario for this process is, at the moment the design information is validated, it is send to the Netline pilot modules. The modules distribute the information to the machine: The panel saw, having calculated the optimized cuts to be made, also produces labels with bar codes, to be read by the following machines, indicating the order in which the machining programs will be activated; The edge bander checks for the presence of the programs required to perform the process; The boring-routing centre processes the command programs for execution of the necessary boring and routing with optimized paths and also identifying the position of the workpieces. Afterwards the industrial accounting reports are generated regarding the consumption, time and malfunctions. 3.2 Product Model Development If we only look from a technical point of view, then the product model for cabinet making industry seems to be unnecessary. Since the design and manufacturing process of the cabinet is quite isolated, the information exchanged among the architect, cabinet maker and general 14 contractor is not very complicated. Although it will be good to have some product model integrate the information from cabinet makers with other sectors, it seems not to be very essential for cabinet making industry currently.2 However, as argued in part2, we need to look at it from a business viewpoint instead of restricting inside the manufacturing process. If we look at in this way, different business inside the cabinet industry share lots of information. FUNSTEP is such an approach to define protocol for furniture product data and project data. It “specifies an Application Protocol for Furniture Product Definition and Interior Design Project data definition, to be used predominantly in the relationship among manufacturers, suppliers, retailers, decorators and general users, in the scope of the furniture industry for decoration and furnishing projects. In terms of incorporated furniture sectors, the AP is focused on the kitchen and domestic furniture, extensible to cover the whole furniture domain.” Traditional approach Funstep approach 2 Obviously there does exist information exchange, like between manufacturer and general contractor. If there exists this model, it will make the communication more efficient, but I am just suspecting that it is the main motivation for developing the product model. I think the main motivation will be the supply chain integration within the industry. 15 4. Assessment of the current technology application As we discussed, facing with the available technology, whether or not to adopt it is determined by the scale of the company and the way it conducts business. 4.1 Design activity According to a survey conducted by the Kitchen and Bathroom Design News, most dealers agree that design software is becoming a must-have component of their business. The following factors are emphasized by the designers: Library and catalogues integrated in the software Get price calculated conveniently Automatically generate the order and the cut list. Scheduling Designers also come up with some trivial complaints: The software does not fit the company convention in trivial aspect, for example, paper size, template, etc. Designer need to contact the software company for training, updating, which is annoying when the representative does not have an enthusiastic attitude. In my understanding, the essential motivation for designers to use the design software is the disadvantage they will take in the competition without it. Thus even though the price of the professional cabinet design software is too high to accept for small cabinet shops (several thousands $), there is low price software developed to satisfy this market requirement. Some of them only have limited capability in helping designers, but they are still used because it has 16 become a must-have component. It became a social phenomena rather than a pure technical improvement. The information technology application in this phase could be summarized as following: It is common to use the software in design Many low level software is used REAL 3D modeling software is available but not popularly used 4.2 Manufacture Activity In contrast, there are more manufacture activities involving no new automation techniques. Many small cabinet shops are still using traditional method instead of well developed wood processing equipments. From the description of the job description on “cabinet worker” by FFINO in 2001 we may notice that a mixture of traditional work and new technology, and the former seems to be more important. We can infer from that at least in UK, the computerization of the whole industry is quite diverse. The job requirement is described as follows: Prepare drawings from specifications or determine job requirements by examining drawings and specifications. Produce working drawings, jigs, templates or prototypes for production assembly of products using computer technology. Mark out, cut and shape pieces using saws, chisels, planes, power tools and woodworking machines, including computerized machinery. …. The skills to be found within the industry range from use of CNC machines through to hand crafting pieces from traditional methods. Despite increased mechanization and use of complex IT driven solutions, many of the processes are still carried out by hand in all areas of the 17 industry… The manufacturing of Furniture and Furnishings is one of the few labour intensive industries where all the staff are skilled.” The most important reason for many small companies lagging behind this advanced technology is that they don’t need the huge capacity CNC machines offer. Since the investment on CNC machines excess their financial ability, and the capacity they provide excess their demand requirement, it is very understandable that they stick to their traditional techniques. They need more flexibility rather than capacity. After all, the excess capacity means the extra cost in storage and warehouse. In this sense, instead of saying the small work shops say no to advanced technology, we might say that the suitable technology is not developed yet. It is also important to notice that the manufacture activity happens after the design activity. Thus if there exists lots of design produced by low level software, it will not motivate the manufacturer to adopt the CNC techniques. The two things have influence on each other: the inaccessibility to CNC encourages the adoption of low-level design software; while the lack of motivation to buy CNC might also be resulted from the low-level design software, which could not produce the digital cutlist information. Additionally, it is interesting to notice that there are many people believing in the high quality of hand made cabinet (more than the proportion of owners who believe the sketches imply better quality). Quite a few cabinet shops are proud to claim their products are really hand made instead of computerized equipments. Although there will be on ongoing need for the traditional, high quality craft skills to accommodate both the specialist and restoration markets [FFINO], it will slow down the application of the automation if it becomes the popular viewpoint of both clients and cabinet shop owners. The information technology application in this phase could be summarized as following: 18 CNC technique is widely used by mass manufacturer Most small cabinet stores are still depending on the traditional techniques The upstream low-level design software is a disadvantageous factor for the application of automation techniques, Vice versa. 4.3 Other Information Technology For cabinet makers, the potential market for products can be significantly increased through the internet. Currently most small cabinet makers get contract directly from the general contractor or through the dealer. Through internet they could expand their market and build a smooth relationship with furniture supplier or directly with the customers. But this supply chain has not been built yet, and most of the cabinet maker use internet only for email and web page. 4.4 Survey Results and Summary A survey conducted by Georgia Tech clearly demonstrates the situation we described. This survey involved about 160 companies: about 80 of them are national large scales companies with high rank; while the rest are random small companies located in Georgia. We can clearly observe the characteristics described in the previous part: 1. Regarding design automation, 75% large scale companies and 49% small companies are using CAD. It seems that there is still some necessity to promote the design automation in this area. 2. Regarding CNC techniques, 64% large scale companies and 19% small companies are using CNC techniques. 19 3. Regarding the interface between design and manufacture automation, only 48% large scale companies and 17% small companies are using CAD data to generate machine instruction. That is to say, there are 18% large and 2% small companies are not fully taking use of the capability of available 3D software. 4. The flexibility pressure detected by large companies is higher than small ones. As stated in the report, “Traditionally, wood furniture makers established a more or less regular sequence of cutting through the production facilities by product or wood species. The productions schedule would then go to sales representatives who would, in turn, sell the product that was about to be made. Cutting were sized to support demand forecasts for a two to four month period, the mix of products for which the wood was cut was based upon historic variations…It also yielded the high labor productivity that accompanied large batch style production processes. In the current climate, however, using the large cutting strategy to drive manufacturing production is incompatible with the demands for increased flexibility that stem from growth in product collections with dissimilar pieces as well as for quicker deliveries. ….The wood furniture manufactures in the Sunderland survey found the shift to smaller and more frequent cutting strategies a challenge to keeping costs down. To respond, companies are redesigning production facilities to reduce the distance parts need to travel and the time for setup of runs…. While automation has helped to offset increases in operating expenses and materials, it has also increased the fixed-asset base and excess capacity of the furniture industry. Furthermore, few manufacturers have adopted multi-shift operations to maximize the use of automated production strategies” How to solve this problem might be a challenge for both the CNC technique developers and the companies. If more flexible CNC machine and optimized solution can be 20 developed and proposed to cabinet makers, we can expect more and more companies to shift to the application of automation technique.3 5. As proposed in the report, another way to address the flexible customer demands is to look outside a single company. Instead of concerning how the manufacturers deal with flexible demands, another way is to industrial-widely promote the shift from small independent retailers to mass merchants and national chains. If the demand is aggregated the flexible problem will be solved from its root. In this case, the product model for communication within the supply chain would be of extreme importance. National Large Companies: Flexibility Pressure Shorter Run Demands, Flexible Production 98 Quick shipment or Just in Time Delivery 95 Product Customization 80 Introduce More products more frequently 67 National Large Companies planning to use Information Technology Data collection device 69 Personal Computers on the shop floor 60 Software for scheduling , inventory and purchasing 80 Internet Service 54 National Large Companies: Manufacturing Production Technology CAD/CAE 75 CNC 64 CAD data to Generate machine instruction 48 3 It should be noticed that this kind of flexibility problem is not very serious for companies who work for the general contractor. Again, the way they conduct business matters. I agree the comments for my last assignment suggesting sorting out the companies by working for general contractors or retailers and homeowners. 21 Manufacturing Cells 47 Computer Integrated Manufacturing 45 Auto Material Handling 35 Rapid Prototyping 16 Automated In process inspection 11 Small companies in Georgia: Flexibility Pressure Shorter Run Demands, Flexible Production 76 Quick shipment or Just in Time Delivery 58 Product Customization 72 Introduce More products more frequently 21 Small companies in Georgia: planning to use Information Technology Data collection device 17 Personal Computers on the shop floor 18 Software for scheduling , inventory and purchasing 32 Internet Service 25 Small companies in Georgia: Manufacturing Production Technology CAD/CAE 49 CNC 19 CAD data to Generate machine instruction 17 Manufacturing Cells 13 Computer Integrated Manufacturing 11 Auto Material Handling 9 Rapid Prototyping 8 Automated In process inspection 6 22 5. Manufacturer Solution In this part the process within the manufacturer is discussed. The analysis would focus on the process within the company rather than the supply chain business process within the industry. 5.1 Activities The companies in cabinet sector might be involved into one of or combinations of the following activities. Case design Cabinet Design Cabinet Assembly Part Manufacture Wood Processing 5.2 Roles People involved in the activities include the following: Owner Cabinet designer Cabinet builder Cabinet main parts supplier (door, drawer, panel) Cabinet auxiliary parts supplier (finishing, lighting, etc) Wood product supplier CNC router machine supplier 23 5.3 Generic Models The most important thing might be: the cabinet making process is more independent and isolated from the whole construction process. The cabinet making process has the following characteristics: Cabinets are installed after the building has been built; therefore the on-site installation work has little to do with other majors. Although the physical room size affects the cabinet size, there are less conflict between cabinet maker and architect or other majors. Therefore, the cabinet making process is more independent of the construction process. The relation between general contractor and cabinet maker is more like customer-supplier relationship rather than the more complicated relation with other subcontractors. (Actually many cabinet makers work directly for individual customers) The installation of the cabinets happens after the buildings are built, therefore little collaboration is needed. The cabinet makers are independent of the virtual organization of the construction project. The main process of cabinet making is fabrication and factory assembly instead of design and installation. The main value added process is fabrication and assembly, which is NOT onsite work. Before the process is automated, the fabrication costs most of the repetitive labor work; therefore it is both valuable and possible to automate the fabrication process. As manufacturers, the cabinet makers are driven by the wood making industry. On the whole, the fabrication of wood is the main value-added process of the wood processing. Since they are in-factory, repetitive, and labor-intensive work, this process is doomed to be automated. Other activities are centered around and driven by the fabrication process, thus currently the design, scheduling, finishing processes are all computerized. 24 There are numerous variations in the product delivery process. In order to simplify the problem, I think typically there are two kinds of tasks cabinet makers faced: one is to both design and manufacture the product for the owner, while another is to manufacture the product according to the owner’s design. The latter is part of the former, but we need to examine the interface between the owner’s design and the cabinet maker, that is to say, the information technology the cabinet maker use is influenced by the technology the owner used to generate the design. The detailed process differed from company to company, but the generic processes to solve the problem are same. The following process model might be more close to the process of the large-scale company, but the basic information flow process is represented. In this traditional picture, the process within the company is design-detailing-fabricatingdeliver. It can be purely hand-made, or it might contain some extent of automation. Order & Billing Timber Aquire order Design Nestling and Cuttinglist Shop Draw ing Fabrication Accessories Scheduling Prof itable? Fabricated Timber Finished timber Cabinet Deliver to site Assembly Finishing As for the information exchange, it is important to realize that although the process looks similar, the type of information exchanged for different kinds of companies are differentiated. When the company is doing business directly with homeowner, it obtains the information about the project in a traditional way. If we assume that it also orders accessories from some suppliers with some well-established business relation, we might say the product model would not help it a lot. However, if it makes business with some dealers or if there involves some decorators, it is 25 very helpful to make the exchanged information digital and communicable for different stakeholders. 5.4 Barrier and Readiness of Production Automation 5.4.1 Human Resources What kind of human resources are needed for our production automation and further IT adoption? Ideal Pattern Fill in the gap Cabinet Skilled in operating CNC New entry requirement; Maker machine Familiar with computer and internet CNC Training program Put traditional labor in assembly or other labor intensive position Hold some traditional skills Designer Skilled in using 3D software Training in 3D software and CNC Understand the CNC process. The software is easy to use. manufacturer process Manager Take full use of business Training in factory manufacture opportunity brought by process and e-commerce Internet 26 Understand the manufacturer theory and apply them to this area Through training programs the human resource will be ready for the pattern shift. There are programs offered by universities for cabinet design and CNC operation certificate. These programs prepare highly qualified new generation labors for the industry. High-end 3D software companies provide more practical training programs for cabinet industry. For example, Cabinet Vision Company offers a couple of 8-hours courses for 3D software, schedule, CNC manufacture, and so on. Currently large cabinetmakers have adopted CNC techniques therefore they only need to improve their skills or update to new techniques. This training program would not take too much both in time and money. The challenge for them probably is the management - how to shift to a real modern factory pattern and apply the new operation research and management method into this industry. For small cabinetmakers, the needed human resources for pattern shifting are mainly manufacture labor. As we have seen, the training for CNC operation is neither expensive nor time consuming. Although it is difficult for some current employer to learn new computer skills, they could shift to more labor-intensive position – assembly. In summary, human resource doesn’t constitute a barrier for cabinet industry to shift to the ideal pattern, but the reorganization from a work shop into a modern factory means more than 27 labor training: how to apply modern management and factory manufacture experience into this industry is an important topic. Research needs to be conducted in this direction. 5.4.2 Investment Cost The CNC machinery manufacturers are decreasing their price in order to make them flexible and affordable for cabinetmakers. There are some small-scale routers at the price of several thousands dollars. But we need to consider the additional cost coming along with the production automation, for example, the dust collection system and bigger working area, etc. The "must have" investment with CNC technique will be the high end 3D software. It costs no more than $10,000, accounting for a small part in CNC investment, but it really helps automate the whole process. Any investment on CNC technique without high end 3D software is potentially wasting money. There is some funding available by Government or the CNC routers to help small and medium companies adopt automation technology. 5.5. Case study for CNC machinery adoption 5.5.1 Current situation Assume a cabinet shop with 13 employees working with traditional skills. The dollar value of business done is about $0.7 million per year, and the added value is about $0.4 million. The payroll for the employee is about $0.25 million/year4. The employee components are as follows: 1 owner (work as designer at the same time) 1 secretary + apprentice 4 The salary for the people in this industry is pretty low. All data sources consistently show that the average payroll for people in this industry is around $20,000, even lower. 28 1 designer 10 workers Currently they design cabinet by hand drawing and use saws, chisels and planes to fabricate the cabinet. The workflow is pretty much unorganized. Customers always complain about the time extension of their orders. Recently the market requirement is increasing quickly, so even though the every one is overworking the owner has to turn down some orders. The workshop is 3600 square feet. The working environment is dirty and dusty. Employees are injured by saw or dado blade from time to time. 5.5.2 IT Adoption Plan 5.5.2.1 New Process The manufacture and design process is organized as Fig3. The more detailed process related with the interface between software and CNC is shown as following (most of wooden parts are fabricated by in house CNC machine): Kitchen designed in Cabnetwar e Parts List developed for entired job Parts produced from sheet material run through CNC link, which develops machining instructions for each part Cabnetware Enabler nests parts onto sheets and combines part machines into one program per sheet Program downloated to Router and nested parts cut and machined on router 5.2.2.2 Equipment list Key equipment list 29 Name Quantity Specification Router 1 SCM RouTech 240 Edgebander 2 Holz-Her Panel Saw 1 Altendorf Elmo 3 Sliding Point to Point Driller 1 SCM Sander 1 SCM Sandya 10 widebelt Grinder 1 Weima Dust Collecting 1 DISA Design Software 1 Cabnetware Computer 2 system It is estimated that a larger workspace, 10000 square feet, is needed. Considering all this factors, the direct investment will be about $500,000. 5.5.2.3 Training plan & learning curve After the adoption of CNC techniques, the employees will be decreased to 10 as follows: 1 owner (work as designer at the same time) 1 secretary + apprentice 30 7 workers 1 Machine repairman and maintenance of the system All the employees will take part in different kind of training programs. The owner and a foreman will attend the 3-day training program offered by Cabentwork, while all the employees will attend CNC operation-training program offered by AWPL in Georgia Tech. The training cost will be around $15,000. The training time is about one week, but altogether we expect one month to adapt to the new working process and skills. 5.5.3 Evaluation 5.5.3.1 Investment The added value per year before the adoption of CNC techniques is $0.4 million (57% value adding compared to the total value). The profit after subtracting the salary is $0.15 million. After the adoption of CNC techniques, the expected value of business done per year will be $1.1 million, while the gross profit per year will be $0.7 million (64% value adding compared to the total value due to the saving in the material). The profit after subtracting the salary will be $0.5million. Every year we expect $0.5-$0.15=0.35 million more profit. The time cost to get the investment back is 1.5 years. 5.5.3.2 Performance The product performance will be improved by the CNC application. Better fitness of door and cabinet, and the more precise drilling will be achieved through the CNC application. 31 5.5.3.3 Working Environment The working environment becomes factory looking, clean and neat. No more dust. Injury accident will be decreased. Workers are more satisfied with the environment. 5.5.3.4 Long run performance In the long run, the cabinet store could consider explore their potential market by joining the Internet supply chain. There are lots of e-business services trying to link the manufactures with customers directly. The company can also benefit from ordering parts and accessories on line with digital description information. 5.5.3.4 Summary It is shown that as long as the demand is not uncertain and flexible, it is quite reasonable for even small size companies to shift to production automation. We can infer that if a company works for the general contractor and has more stable demand, it would be driven to production automation. 6. Industrial-wide Framework Target Plan & Potential Efficiency 6.1 Demand Aggregation As we have argued, what prohibits the production automation is the uncertain and unstable demand. If we can aggregate these demands together and integrate the supply chain, then flexible demand from small retailers and homeowners would be replaced by aggregated demand suitable for production automation. The basis for solving this problem is to develop communicable product and project protocol so that information can be fluently flowing in the process. No matter how we try to 32 restructure the supply chain, a communicable, digital product model is the basis for the reformation. 6.2 Ideal Design and Fabrication process Supposing the demand is efficiently aggregated, the following process would become the ideal process for a manufacturer: Generating design information by 3D modeling software Generating scheduling information, cutting list, nestling, G code The information is ready for CNC machine to manufacturer Automatic painting and CNC signing Assembly Order & Billing Timber Aquire order Design Nestling, Cuttingliust, G-code Fabrication Accessories Scheduling Prof itable? Fabricated Timber Finished timber Cabinet Deliver to site Assembly Finishing Effectiveness Effectiveness is reflected in computerized scheduling and nestling. There are several aspects on this improved effectiveness: The computerized algorithm is more reliable than the experience of people 33 The precision and determined operating time of machine provides basis for better optimization When changes are made, it is much easier for computerized algorithm to adjust the modifications. Efficiency Time is saved in the automatic process. The ADWL director, Karl B introduced that the process of making 12 chairs by CNC machines are 20 times faster than the hand made process. But the efficiency could be improved further because currently they are not using 3D design software therefore they generate nestling and G-code by hand. This is only part of the time saving. If we look the process as “flow” instead of “transformation”: including the waiting time before operation caused by the variation of the arriving process of the materials. A machine with speed ns is better than n people with speed s in the aspect of adapting to the variability of the arrival process. Furthermore, the efficiency of the system could be optimized by the Queue theory. The time efficiency of the system (operation time + waiting time) could be highly improved. The industrialization of the wood processing system is inevitable. Performance First of all, the application of 3D software will achieve better visualization. Therefore the communication between the owner and the designers will be improved. This will serve as the basis for the improvement of customer satisfaction. Secondly, the product performance will be improved in the aspect of fitness because of the better precision of each part. Cabinet makers have been complained about the problem of fitness of cabinet door. This problem will be solved by the digital techniques. 34 Additionally, the working environment of this industry would be highly improved. The dusty and dangerous environments would be replaced by clean and neat factory conditions. 6.3 Summary To summarize the ideal picture, I think the production automation technique has been mature and efficient, provided that demand can be aggregated over the industry. Currently we see three kinds of companies: companies working for general contractors; companies working for retailers and companies working for homeowners. This category overlap with the size of the company, as we can imagine, the companies working directly for homeowner might be of smallest size. However, in the complicated market reality, one company might deal with different kinds of demand at the same time. The demand from general contractor is more stable; the demands from retailers are shifting from stable to unstable because the retailers succeed in shifting their risks to manufacturer; the demand from homeowner, of course, would be the most unstable one. In this case, the application of automation techniques, is not necessary the best choice. However, if the demand can be aggregated through the restructuring of the supply chain, then the flexibility would not be as serious as what they face currently. If that is the case, then I expect the company to be aggregated to big companies and shift to mass manufacturer patterns, as many other industries experience. If this industrialization process goes smoothly, then the small companies are doomed to give up their business or shift to the following pattern: Special traditional skills for customers who prefer hand-made crafts Shift to assemble cabinet instead of fabricate 35 Small scale automatic fabrication plus assembly. The profit will more depend on assembly because it is hard for small store to compete with mass-manufacturers as the automatic techniques goes more and more mature. But before we make any prediction, we need to really understand the nature of the demands and the mechanism to aggregate them. If this aggregation can not take place recently, then I expect those small companies would survive with their traditional skills for they might be better solution addressing the flexible demands than any available automation solutions. 7. Next Step to Take There are two ways to promote the IT adoption within this industry: Solution1: Develop automation techniques to address the problem of flexibility. CNC router developers are working on this problem. Solution2: Solve the flexibility problem from its root: aggregate the demand. This calls for the industrial wide collaboration. A shared product model protocol would serve as the basis to promote all kinds of collaboration within this industry. Therefore, the reasonable step to take from our viewpoint is to develop product model for this industry to serve as the basis for any IT adoption in business restructuring. However, different from the technical collaboration, we need to really understand the business relations within the supply chain. The information flowing through the chain would not be very complicate, but does need to be extracted in a way that is really useful for all the stakeholders. 5 5 FUNSTEP is taking such an approach. 36 Reference 1. Industry Summary, 1997 US Economic Census 2. Carpentry, 1997 US Economic Census 3. http://www.woodweb.com 4. http://www.ecabinetsystems.com 5. http://www.furniture-info.com/1320.htm 6. http://www.siskiyouproducts.com/ 7. http://www.kcma.org/index.html 8. http://www.woodbin.com 9. Cruising the electronic highway, Daina Darzin, www.kitchen-and-bath-design.com 10. http://www.cabinetvision.com/products/solidpro.htm 11. http://www.2020design.com/index.asp 12. http://www.wooddesign.bc.ca/stats.htm/ Canada statistics data 13. http://www.ffinto.org/intbmarking.htm/ England statistics data 14. http://www.cabinetmakers.org/ 15. http://www.afma4u.org/search/index.htm 16. http://www.sefalabfurn.com/ Lab 17. http://www2.uninova.pt/funstep 18. http://www.woodbin.com/articles/primer.htm 19. Nancy Green Leign, Current Conditions and Future Prospects of the U.S. Woodworking Industry, AWPL report. 20. FUNSTEP, ISO standard 37