Economics of Distance Education

advertisement

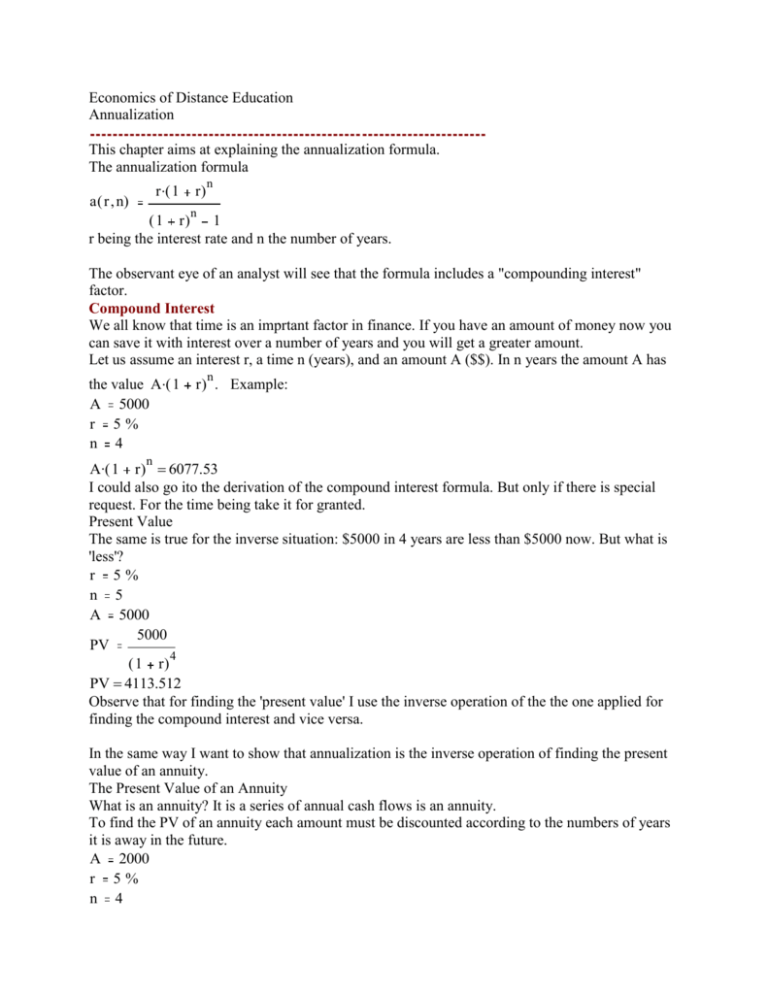

Economics of Distance Education Annualization This chapter aims at explaining the annualization formula. The annualization formula n r ( 1 r ) a ( r n) n ( 1 r) 1 r being the interest rate and n the number of years. The observant eye of an analyst will see that the formula includes a "compounding interest" factor. Compound Interest We all know that time is an imprtant factor in finance. If you have an amount of money now you can save it with interest over a number of years and you will get a greater amount. Let us assume an interest r, a time n (years), and an amount A ($$). In n years the amount A has n the value A( 1 r ) . Example: A 5000 r 5% n 4 n A( 1 r ) 6077.53 I could also go ito the derivation of the compound interest formula. But only if there is special request. For the time being take it for granted. Present Value The same is true for the inverse situation: $5000 in 4 years are less than $5000 now. But what is 'less'? r 5% n 5 A 5000 5000 PV 4 ( 1 r) PV 4113.512 Observe that for finding the 'present value' I use the inverse operation of the the one applied for finding the compound interest and vice versa. In the same way I want to show that annualization is the inverse operation of finding the present value of an annuity. The Present Value of an Annuity What is an annuity? It is a series of annual cash flows is an annuity. To find the PV of an annuity each amount must be discounted according to the numbers of years it is away in the future. A 2000 r 5% n 4 n A PV (1 r) n n= 1 PV 7091.9 This is a 'sum of a geometrical progression' which can be collapsed to: 1 1 n ( 1 r) PV A r Again take this for granted. To demonstrate it would require some algebra, certainly not beyond your reach but it would take some pages to prove. Nevertheless we can illustrate the equivalence of the two ways of representing PV by way of an example: n 4 A 2000 r 5% 1 1 (1 A r) n 7091.9 r You may calculate some other values to convince yourself. What does this mean? The present value of your annuity is less than the notional sum of the annual cash flow you would receive. You would receive each year 2000 over 4 years. Why would you receive less? Because you demand all your installments now. The banks loose the interest they could earn during the time your money is not yet due. In fact, if they would ignore the time factor and would pay you the full sum, you yourself could invest and get more that the sum of the annual amounts (i.e. the sum of 8000). Annualization Note that the above PV can be expressed in different ways. PV= 1 1 (1 r) n r (1 r) (1 n r) r 1 n (1 r) n 1 r ( 1 r ) Compare the last expression with the annualization formula: n r ( 1 r ) a ( r n) n ( 1 r) 1 The annualization formula is the inverse operation to calculating the present value of an annuity. The present vallue of an annuity tells you how much you should get if you ask to be paid off in exchange of giving up e.g. an additional pension scheme which would give you an annual stream of income of a certain amount over a certain time. The situation in the case of annualization is the inverse. n The idea is the following: by buying a machine you pay money for receiving a value over time. Here the analogy of the annuity. Normally, you do this by dividing the initial amount over the time (years) of usage. This gives the depreciation rate. But the depreciation rate ignores the time factor. It would be analogous to the situation where the present value of an annuity is equal to the sum of the annual instalments. Illustration Let us take the example on p.45 in Rumble's book. A 2000 r 4% n 4 Aa ( r n) 550.98 Aa ( r n) n 2203.92 This means the annualized ammount is to be compared with the depreciated value. It is slightly higher taking into account forgone interest. Both the depreciated value and the annualized value represent something like an annuity, i.e. a constant value flow. Adding the depreciated values gives you the initial sum of 2000, adding together the annualized amounts gives you a higher value: 2203.92 To illustrate our point that annualization is the inverse operation of taking the present value of a annuity we ask: how much would be needed to get an annuity of 550.98 over four years at an interest of 4%? This question is equivalent as asking for the present value of this annuity. r 0.04 A 550.98 n4 1 1 n ( 1 r) PV A r PV 2000 Summary We observe: Compounding a fixed amount is the inverse of calculating the present value of that amount. Annualizing is the inverse of finding the present value of an annual flow of an annuity (i.e. a constant amount over a number of years). Does this help to interpret anualization?