Problems and Solutions

advertisement

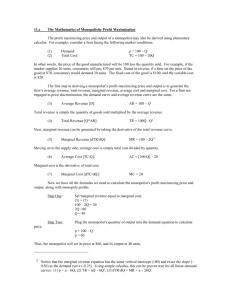

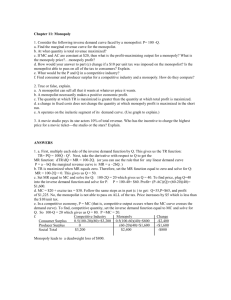

Problems and Solutions Microeconomic Theory – Monopoly and Market Power University of Zagreb Christopher Avery SESSIONS 1 and 2 (Monopoly Pricing) 1. Geometry of the Cost and Demand Functions in Monopoly Pricing Consider a monopolist facing linear demand P(Q) = 16 – Q. (a) Find the monopolist’s profit-maximizing choice of price and quantity if C(Q) = 8Q so that marginal cost is constant at 8. The monopolist maximizes Q P(Q) – C(Q) = 16Q – Q2 - 8Q. This has first-order condition 8 – 2Q = 0, Therefore the optimal quantity is Q* = 4, and optimal price is P(Q*) = 16 – 4 = 12. (b) Find the monopolist’s profit-maximizing choice of price and quantity if instead C(Q) = 2Q2. Note that this cost function yields exactly the same total cost as the original cost function C(Q) = 8Q for the monopolist’s optimal quantity in (a). Explain why the monopolist’s optimum quantity, however, is not the same in (a) and (b). Now the monopolist’s objective function is Π(Q) = 16Q – Q2 - 2 Q2 = 16Q - 3 Q2. This has first-order condition 16 = 6Q and yields solution Q* = 16 / 6 = 8 / 3. Although both cost functions C(Q) = 8Q and C(Q) = 2Q2 yield C(Q) = 32 at Q = 4, (the monopoly quantity from (a)) they are not identical in terms of marginal cost. In fact, MC(a) = 8, MC(b) = 4Q, so that MC is larger in (b) if Q > 2. That is, the cost function in (b) represents an increase in marginal cost from (a) for quantities near the optimum in (a). As a result, the monopoly solution in (b) involves a lower quantity than in (a). (c) Now return to the original cost function C(Q) = 8Q. Find the monopolist’s profitmaximizing choice of price and quantity if the demand function P(Q) = 16 – Q2 / 4. Note that this demand function yields exactly the same quantity as the original demand function P(Q) = 16 – Q for the monopolist’s optimal price in (a). Explain why the monopolist’s optimal price, however, is not the same in (a) and (c). Now the monopolist’s objective function is Π(Q) = 16Q – Q3 / 4 – 8 Q = 8Q – Q3 / 4. This has first-order condition 8 = 3Q2 / 4 and yields solution Q* = SQRT(32 / 3), which is approximately 3.27. Although both demand functions P(Q) = 16 – Q and P(Q) = 16 – Q2 / 4 yield P(Q) = 12 and Q = 4 (the monopoly quantity from (a)), they are not identical in terms of marginal revenue. MR(a) = 16 – 2Q, while MR(c) = 16 - 3Q2 / 4. Thus MR(c) > MR(a) if 2Q > 3Q2 / 4, which holds for Q < 8/3 – marginal revenue is higher for (b) than for (a) if Q < 8/3 and higher for (c) than for (a) if Q > 8/3. That is, the demand function in (c) represents an reduction in marginal revenue from (a) for quantities near the optimum in (a). As a result, the monopoly solution in (c) involves a lower quantity than in (a). 2. Elasticities and the Price-Cost Margin (adapted from MWG 12.B.2) Consider a monopolist with marginal cost c per unit produced with c > 0. The total demand is give by q(p) = αp-ε, where ε > 0. (a) Show that if ε < 1, then the monopolist’s optimal price is not well defined. Explain the nature of the demand function in this case and why this occurs. Rewriting p(q) = (q / α)-1/ε = (α / q)1/ε. The monopolist solves Max (q) Π(q) = qp(q) – c(q) = α1/ε q (ε -1) / ε – cq d Π / dq α1/ε [(ε -1) / ε] q = -1 / ε – c. If ε < 1, then both terms in d Π / dq are negative for q > 0, so in fact d Π / dq < 0, indicating that q = 0 is the optimum. But the odd part about this choice is that the with this demand function, p(q) → ∞ as q → 0. In fact, for q positive but very small, production costs c(q) are infinitesimal, but total revenue q p(q) = α1/ε q (ε -1) / ε actually becomes infinite since q (ε -1) / ε = 1 / q (1 - ε) / ε → ∞ as q → 0. Thus, the monopolist’s optimum for ε < 1 is to choose a very tiny quantity and charge an essentially infinite price. For this reason, the optimal price is not well defined. But the real problem is that the demand function is unrealistic – it assumes that demand goes to zero “too slowly” as price becomes infinite. (b) Assume that ε > 1. Derive the monopolist’s optimal price, quantity, and price-cost margin (pm – c) / pm. From above, d Π / dq α1/ε [(ε -1) / ε] q = -1 / ε – c. Setting this equal to 0, we find α1/ε [(ε -1) / ε] q c q 1/ε q* (FOC) OR OR -1 / ε = = = c, α1/ε [(ε -1) / ε], α [(ε -1) / cε] ε Now substitute in the formula p(q) = (q / α)-1/ε = (α / q)1/ε to find the optimal p. p* = (α / q*)1/ε = (ε -1) / c ε. The “price-cost margin” is given by (pm – c) / pm = c / (ε -1). Alternately, it is also possible to work with q(p) and solve for (FOC) for the optimal price, as follows. Max (p) Π(p) = αp1-ε – cα p-ε dΠ / dp = α [(1 – ε) p-ε + c ε p-(ε+1) ] = α p-ε-1 [(1 – ε) p + c ε ] So FOC for this problem has solution pm = c ε / (ε -1), corresponding to quantity qm = αpm-ε = α [c ε / (ε -1)] –ε, consistent with our earlier results. SESSIONS 3 and 4: (Price Discrimination) 3. Price Discrimination with Two Types of Consumers Adapted from MWG 12.B.7 Consider the widget market. The total demand for men is give by pm(qm) = 30 – qm and total demand for women is given by pw(qw) = 24 – 2qw. The cost of production is c = 4 per widget. (a) Suppose the widget market is competitive. Find the equilibrium price and quantity sold. A competitive market will set the same price for men and women with price equal to marginal cost = 4. Soving for the quantities for men and women that correspond to this price, we have qm = 30 – pm = 26, and similarly qw = (24 – pw) / 2 = 10, for total quantity of 36. (b) Suppose instead that firm A is a monopolist in the widget market. If it must charge the same price to both men and women, what is its profit-maximizing price? Under what conditions do both men and women consume a positive level of widgets in this solution? Now we definitely want to work in quantity as a function of price so that we can add the two demand curves: Qm(p) = 30 – pm; Qw(p) = 12 – pw / 2. So if price p < 24, both groups consume positive amounts. For this range of prices, we can simply add the two demand functions to get total demand: Qtotal(p) = 42 – 3p/2 if p < 24. However, if p > 20, only men consume widgets, so Qtotal(p) = Qm(p) = 30 – p if p > 24. Note that these two separate formulas give the same outcome Q = 6 at p = 24 where we switch from a regime of having both types buying to having only men buying the good. Note also that if we add the two demand functions for p > 24, we will be including negative consumption for women in the total demand, which does not make sense. Now, we have a two-part “kinked” demand curve for men and women with quantity as function of price. So we can solve for the monopolist optimum by deriving firstorder conditions, but we have to be careful about comparing the option of selling to both consumers or selling to neither group of consumers. PART 1: Both men and women consume positive amounts: Max Q(p) (p – c) = (42 – 3p/2) (p – 4) = 48 p – 3p2 / 2 – 168. Taking the derivative with respect to p yields the first-order condition 48 – 3p = 0, corresponding to optimum p* = 16. This price is in the given range p < 24, so in fact it must be the best choice of price so that both men and women will purchase the good – corresponding to quantity 18 (14 for men and 4 for women), revenue of 18 * 16 = 288 and profit of (16 – 4) * 18 = 216. PART 2: Only men consume positive amounts. Max Q(p) (p – c) = (30 – p) (p – 4) = 34 p – p2 – 120. This has first-order condition 34 – 2p = 0 or p* = 17. But that price does not meet the condition where only men are consuming (p > 24), so it cannot be the optimum. That is, FOC cannot hold for sales only to men in the range of prices (24 < p < 30) where only men purchase widgets. This indicates a boundary solution p = 24 as the optimal price for the monopolist in this range of outcomes. At p = 24, the monopolist sells 6 units to men and none to women, for a profit of 6 * (24 – 4) = 120, but this is not as large a profit as the price identified above, p = 16. That is, with these particular demand functions, it is optimal to sell to both consumers with p* = 16 and total quantity 18. (c) If firm A has produced total level of output X, what is the welfare maximizing way to distribute it among men and women (with the goal of maximizing Marshallian aggregate surplus)? Here, the goal should be to distribute quantity X to the men and women who have highest value for it. That means that at the margin, the last man and last woman who consume the good should have the same value for it. Thus, the optimal division among men and women satisfies Pm(qm) = pw(qw) And qm + qw = X. This yields two equations in two unknowns, so it should be straightforward to identify a unique solution. First, OR 30 – qm = 24 – 2qw qm = 6 + 2qw. This already indicates an element of the solution. The first six units produced should be distributed to men. Intuitively since six men value units at 24 or more per unit, but no woman values a unit at more than 24, the first six units should be distributed to men. Second, OR qm + q w = X qm = X – qw . Assuming that total units produced X > 6, this means that we have two equations that characterize the optimal distribution of units: Qm = 6 + 2qw Qm = X – q w Substituting the second equation into the first, we have Qm = 6 + 2(X – Qm) OR 3 Qm = 6 + 2X OR Qm = 2 + 2X / 3, and therefore Qw = X/3 – 2 for X > 6. Note that with X = 18, the optimal quantity in (b), these formulas indicate that it is socially optimal to divide this quantity by giving 14 units to men and 4 units to women, exactly matching the result in (b). (d) Suppose that firm A is allowed to charge different prices to men and women. What prices does it charge? Now it’s easiest to solve the problem by computing marginal revenues for each group separately. Since men have pm(qm) = 30 – qm, Revenue(men) MR(men) = 30 qm – qm2 = 30 – 2 qm. Since women have pw(qw) = 24 – 2qw, Revenue(women) MR(women) = 24 qw – 2qw2 = 24 – 4 qw. With constant MC = 4, the optimal price discriminating scheme sets MR(men) = MR(women) = MC = 4, so qm = 13, qw = 5, implying pm = 17, pw = 14. This actually indicates an identical quantity to the non-discriminating outcome in part (b), but at the same time, an inefficient distribution (from the perspective of social surplus) since men get fewer units than in the outcome in (b). (e) Now consider the same problem but with marginal cost c = 20. What is the monopolist’s optimal quantity and price under this assumption? It is simplest to repeat the analysis from (b) but with the new value for c. PART 1: Both men and women consume positive amounts: Max Q(p) (p – c) = (42 – 3p/2) (p – 20) = 66 p – 3p2 / 2 – 672. Taking the derivative with respect to p yields the first-order condition 72 – 3p = 0, corresponding to optimum p* = 24. At p* = 24, men consume 6 units and women consume 0 for a total of 6. Total profit is given by Q(p* - MC) = 6 (24 – 20) = 24. PART 2: Only men consume positive amounts. Max Q(p) (p – c) = (30 – p) (p – 20) = 50 p – p2 – 600. This has first-order condition 50 – 2p = 0 or p* = 25, corresponding to q = 5, all consumed by men, with profit 5 * (30 – 25) = 25. Comparing these two possible optimal outcomes, the monopolist does best to set p * = 25 and q* = 5, with only men purchasing widgets. (f) What is the price-discrminating outcome with c = 20, as in (e)? Does price discrimination increase social surplus in this case? From part (d), MR(men) MR(women) = 30 – 2 qm. = 24 – 4 qw. With MC = 5, the optimal price discriminating scheme sets qm = 5 and qw = 1, so that MR = 20 for each group. The outcome is identical to that for men in (e) when price discrimination was not allowed, but is a clear improvement for women, who can now enjoy some consumer surplus since some women value widgets at more than their cost (20) of production. 4. Domestic Monopoly and Exports Consider a firm that has a domestic monopoly and that also exports goods for sale in a competitive world market. The firm chooses two quantities: y for the domestic market and z for the world market. Its total cost is C(Q) = F + Q2/4, where Q = y + z and F is a known constant. Suppose that the price in the local market is given by p(y) = 80 – y, while the price in the world market is equal to 30. (Since the world market is competitive, this firm’s choice of z will not affect the world price.) (a) Assume that the firm’s profit-maximizing choice (y*, z*) has both y* > 0 and z* > 0. Use the first-order conditions for profit-maximization to identify y* and z*. The profit maximization problem is Max y (80 – y) + z * 30 – F – (y + z)2/4 This produces two first-order conditions, one from differentiating with respect to y and one from differentiating with respect to z: 80 – 2y – (y+z) / 2 = 0 30 – (y+z) / 2 = 0. At an interior solution with both y* > 0 and z* > 0, both first-order conditions hold. The second equation identifies the value for Q = (y + z*) = 60. Then substituting this into the first equation, we can identify the specific values for y and z. That is, y* = 25 and z* = 35. (b) What is the optimal choice of z if y* = 0 (i.e. if the firm only produces on the world market)? If y* = 0, then the first-order condition 30 – (y+z) / 2 = 0 identifies the optimal value for z. Specifically z* = 60. Note that at y* = 0, z* = 60, MC = (y + z) / 2 = 30, which is equal to the marginal revenue on the world market. (c) What is the optimal choice of y if z* = 0 (i.e. if the firm only produces on the domestic market)? If z* = 0, then the first-order condition 80 – 2y - (y+z) / 2 = 0 identifies the optimal value for y. Specifically y* = 32. Note that at y* = 32, z* = 0, MC = (y + z) / 2 = 16, while marginal revenue in the domestic market equals 80 – 2y* = 16, so these quantities equate MR and MC on the domestic market. (d) Compare the firm’s profits for the production plans you identified in (a), (b), and (c). Explain in words why the firm increases its profits by selling in both markets. Profit = Total Revenue – Total Cost In (a): y* = 25, z* = 35, and domestic price = 55. Total revenue = 25 * 55 + 35 * 30 = 2425. Total cost = F + (25 + 35)2/4 = 900 + F. In (b): y* = 0, z* = 60. Total revenue = 60 * 30 = 1800. Total cost = F + (25 + 35)2/4 = 900 + F. In (c), y* = 32, z* = 0, and domestic price = 48. Total revenue = 32 * 64 = 1536. Total cost = F + (32)2/4 = 256 + F. Thus, total profit = 1525 – F in (a), 900 – F in (b), and 1280 – F in (c). Comparing (a) and (b), the firm produces the same total quantity in each case and thus has the same production costs in each case. However, the firm increases its total revenue and total profits by selling units on the domestic market until the point where MR(domestic) = 30, the world price. That is, the firm increases profits from (b) to (a) because it can sell units on the domestic market at prices greater than 30. Comparing (a) and (c), the firm sells more units on the domestic market in (c) and achieves a higher profit on the domestic market in (c). However, the firm gains in two ways by selling on the world market in (a). First, the firm prefers to sell units 26 to 32 on the world market, as it does in (a), because its marginal revenue is 30 per unit in the world market, but less than that in the domestic market. Second, the firm can achieve additional profits by producing units 33 to 60 and selling them on the world market at a price greater than marginal cost. (e) Explain in words how the monopolist’s maximization problem is analogous to a consumer problem with quasilinear utility. In this problem, the monopolist’s profit function is simply equal to Domestic Revenue + World Revenue – Cost of Production. Further, domestic revenue is a concave (quadratic) function of domestic quantity whereas world revenue is a linear function of world quantity. In economic terms, domestic revenue involves decreasing returns / decreasing marginal utility, whereas world revenue involves constant returns as a function of quantity. Ignoring the costs of production, these two revenue terms combine to produce a profit function that is identical in form to a quasilinear utility function with two goods for a consumer maximization problem. As in the consumer problem, the solution to the monopolist’s problem takes the following form: 1. Produce in the domestic market so long as MR(domestic) > MR(world). 2. Once MR(domestic) = MR(world), then produce in the world market. The only distinction between the monopolist problem and the consumer problem with quasilinear utility is the “stopping point”. The consumer is limited by the budget constraint and the optimal solution corresponds to continual purchasing until the budget is exhausted. The monopolist is limited by the cost function and the optimal solution is determined by the point where MR = MC. Note that MR is (weakly) decreasing in quantity produced, while MC is increasing in quantity produced, so the point where MR = MC is indeed an optimum for profits. (f) For what values of F can the firm operate profitably? What is the firm’s average total cost as a function of F? As computed in (d), the firm’s profit with y* = 25, z* = 35 is equal to 1525 – F. Thus, the firm can operate profitably if F < 1525. Total cost is 900 + F and total quantity is 60, so ATC = (900 + F) / 60 = 15 + (F/60). (g) Identify a range of values for F such that (1) the firm makes a profit with y*, z* > 0; and (2) the firm’s average total cost is greater than 30, the price in the world market. Could the firm be accused of "dumping" its product on the world market when F is in this range of values and it sells in both markets? ATC is greater than 30 if F/60 > 15, or F > 900. Thus, both conditions hold if 900 < F < 1525. In this range of values, the firm may appear to be “dumping” its product on the world market because it is producing units and selling them at price below ATC. However, the real inefficiency here is that the firm is artificially reducing quantity on the domestic market, where price = 55 is much greater than the price on the world market (and “dumping” is an artifact of that behavior). SESSION 5: Oligopoly 5. Cournot vs. Monopoly. First solve MWG 12.C.9. b) Consider Cournot competition between two firms with different cost functions. Firm 1 has cost function c1(q1) = q12 / 2, while firm 2 has cost function c2(q2) = c q2, where and c are known constants. Market demand remains p(Q) = A - BQ, where Q is total quantity, q1 + q2. What are the first-order conditions for the optimal quantities chosen by firms 1 and 2 in this case? (b) Firm 1 solves: Max p(Q)q1 c(q1 ) ( A Bq1 Bq 2 )q1 12 q12 Aq1 Bq12 Bq1q2 12 q12 q1 So the FOC (interior solution) is: A 2 Bq1* Bq 2 q1* 0 A Bq 2 2B This represents firm 1’s best response function – it tells us what firm 1 would do given any quantity produced by firm 2. q1* Firm 2 solves the maximization problem: Max p(Q)q2 c(q2 ) ( A Bq1 Bq 2 )q2 cq2 Aq2 Bq 22 Bq1q2 cq2 q2 Giving the FOC (interior solution): A Bq1 2 Bq 2 c 0 q2* A Bq1 c 2B [Note: you are not asked to solve for the equilibrium, just to find the first order conditions.] (c) Suppose that firm 1 would produce a larger quantity as a monopolist than firm 2 would produce as a monopolist. Is it possible that the total quantity produced by the two firms in Cournot competition would be greater than firm 2's monopoly quantity, but less than firm 1's monopoly quantity? Use the first-order conditions from part (b) and for firm 1 as a monopolist to explain your answer. As a monopolist, firm 1 would choose quantity by maximizing profits: 2 2 Max 1 p(q1 )q1 c1 (q1 ) Aq1 Bq1 12 q1 q1 So the FOC (interior solution) is: A 2 Bq1* q1* 0 q1* A 2B Note that this corresponds to q1* in Cournot, where q2 = 0. Using the first-order conditions from part (b) and substituting for firm 1’s Cournot quantity: A Bq 2 Bq 2 ( 2 B)q 2 ( B)q 2 A A q2 2B 2B 2B 2B 2B 2B Because of the additional term in the sum, this total Cournot quantity is greater than firm 1’s monopoly quantity. And since we are told to assume that firm 1’s monopoly quantity is bigger than firm 2’s monopoly quantity, it must be the case that the total Cournot quantity is greater than either firm would produce as a monopolist (you could also show this by solving for Firm 2’s monopoly quantity, (Ac)/2B, and then showing that q1+q2 = (A–Bq1–c)/2B + q1 is larger than firm 2’s monopoly quantity). q1 q 2 3. Differentiated Products Duopoly Firms 1 and 2 produce differentiated products. Let q1 be the quantity produced by firm 1, and q2 be the quantity produced by firm 2. Let p1 and p2 be the prices of the two products. Inverse demand for each good is given by: p1 = 1 – q1 + z q2 p2 = 1 – q2 + z q1 For simplicity, assume that each firm has zero marginal cost and no fixed costs. In this question, you are asked to apply the logic of the Cournot duopoly model to analyze the competition between these two firms. a) Under what circumstances are goods 1 & 2 substitutes? Under what circumstances are they complements? b) Suppose that each firm takes the quantity produced by the other firm as given and chooses its own quantity in order to maximize its profit. Derive each firm’s best response function. What are the equilibrium quantities and prices in this model? c) Solve the two inverse demand curves above for q1(p1, p2) and q2(p1, p2). Your answer should look like q1(p1, p2) = a – b p1 + c p2 and q2(p1, p2) = d – f p2 + g p1, where you supply the values of a, b, c, d, f, and g. d) Now, suppose that each firm takes the price set by the other firm as given and chooses its own price in order to maximize its profit. Derive each firm’s best response function (which gives the price it charges as a function of the other firm’s price). What are the equilibrium prices and quantities in this model? e) Compare the equilibrium prices and quantities under quantity competition (part b) and price competition (part d). Which type of competition results in higher prices? Which results in higher quantities? f) Relate your answer in part e to the difference between Cournot and Bertrand competition when products are homogeneous. hi 0 . However, we don’t have Hicksian p j demand functions here, and there’s no good way to get them. So instead, we can define substitutes based on willingness to pay: if the willingness to pay for good i is positively related to the quantity of good j, then the goods are complements. Using this definition, and the fact that the inverse demand functions represent willingness to pay, we get that the goods are substitutes if z < 0, and complements if z > 0. (a) The definition of substitutes is that Using the results from the later parts of the problem, you should find that z = -1 implies perfect substitutes, and z = 0 implies completely unrelated (or heterogenous) goods. (b) Again notice that the two firms are identical, so we can solve the optimization problem for one firm and then use symmetry to find the solution: Max p1 (q1 , q2 )q1 c1 (q1 ) q1 q12 zq1q2 q1 Giving the FOC (interior solution): 1 2q1 zq 2 0 1 zq 2 2 This is firm 1’s best response function. By symmetry, firm 2’s BRF is: 1 zq1 q2* 2 You can now plug one BRF into the other to solve. Or, you can use this often-quicker symmetry strategy: using the fact that q1*=q2*, so you can change the q2 in firm 1’s BRF to a q1* and quickly solve for the optimal quantities (note that you can only do this after taking the first-order conditions). 1 zq1* q1* 2 * 2q1 1 zq1* q1* 1 q2* 2 z Now plug these quantities into the inverse demand functions to find equilibrium prices: 1 z 2 z 1 z p1 1 2 z 2 z 2 z 2 z 2 z 1 p1* p2* 2 z [Note: whenever you use any shortcut, just make sure you have provided everything the question asked for. In this case, you could have solved for equilibrium quantities and prices without ever writing down firm 2’s best response function, but the question explicitly asks for this.] q1* (c) We are asked to convert the two inverse demand functions into demand functions. So rearrange each equation and then plug one into the other: q1 1 zq 2 p1 and q2 1 zq1 p2 q1 1 z (1 zq1 p2 ) p1 q1 1 z z 2 q1 zp 2 p1 (1 z 2 )q1 1 z zp 2 p1 1 z 1 z p1 p2 2 2 1 z 1 z 1 z2 And of course, by symmetry: 1 z 1 z q2 ( p1 , p2 ) p2 p1 2 2 1 z 1 z 1 z2 q1 ( p1 , p2 ) (d) The strategy looks very similar to part (a), except now we will write profits as q(p)p instead of p(q)q, and we will maximize with respect to p. Consider firm 1: 1 z 1 z Max q1 ( p1 , p2 ) p1 p1 p12 p2 p1 2 2 p1 1 z 1 z 1 z2 The FOC (interior solution) is: 1 z 2 z p1 p2 0 2 2 1 z 1 z 1 z2 1 z zp 2 2 p1 1 z zp 2 2 This gives firm 1’s best response function. By symmetry, firm 2’s BRF is: 1 z zp1 p2* 2 Now let’s use the fact that p1*=p2* in equilibrium (again by symmetry) to solve firm 1’s BRF for p1*: 1 z zp1* * p1 2 * 2 p1 1 z zp1* p1* 1 z p2* 2 z Now substitute in to the demand functions to find equilibrium quantities. Before doing that, let’s simplify the demand functions by recognizing that p1*=p2*: p1* q1* ( p1* ) 1 z 1 z * 1 z 1 z 1 1 1 p1 1 2 2 2 1 z 1 z 1 z 2 z 1 z 2 z (1 z )( 2 z ) And by symmetry: q2* 1 (1 z )( 2 z ) (e) First let’s compare prices. Prices under quantity competition will be higher than prices under price competition if: 1 1 z 2 z 2 z 2 z 2 2z z z 2 0 z 2 This will always be true for values of z between -1 and 1 (Note: if you do not restrict the values of z, you have to be careful. If z > 2 or -2 < z < -1, then when you try to cross multiply, the sign flips. (But also note, if z>1, then you will get a negative quantity under quantity competition, which doesn’t make sense.) If z=0, ie the two goods are completely unrelated or heterogenous, then both sides of this equation are equal. If z = -1, we get the Cournot and Bertrand results for the case where the firms produce the same exact product. Now let’s compare quantities. Quantities under quantity competition will be lower than quantities under price competition if: 1 1 2 z (1 z )( 2 z ) 2 z z2 2 z z2 0 This will always be true for values of z between 0 and 1. If z=0, ie the two goods are completely unrelated or heterogenous, then both sides of this equation are equal. If z = -1, we get the Cournot and Bertrand results for the case where the firms produce the same exact product. (f) When we considered the Cournot and Bertrand models of duopoly (with two perfectly homogenous – i.e. identical products), we saw that under the Bertrand model, in which firms compete on price, firms end up producing the fully competitive quantities and prices are driven down to the efficient level p=MC. Under Cournot competition, in which firms compete on quantity, quantities are lower and prices higher than the optimal level. This problem shows that similar results hold when we consider two goods that are partially, but not perfectly homogenous: price competition gives a solution closer to the Pareto optimal solution than does quantity competition. The more complementary or substitutable the two goods are, the more the Bertrand and Cournot models diverge. When goods are very heterogenous, the differences between the Bertrand and Cournot models become small (and if we consider two completely unrelated goods, both models provide exactly the same result, which corresponds to each firm having a monopoly in its product market).