Answers to Homework 1

advertisement

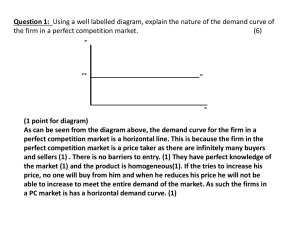

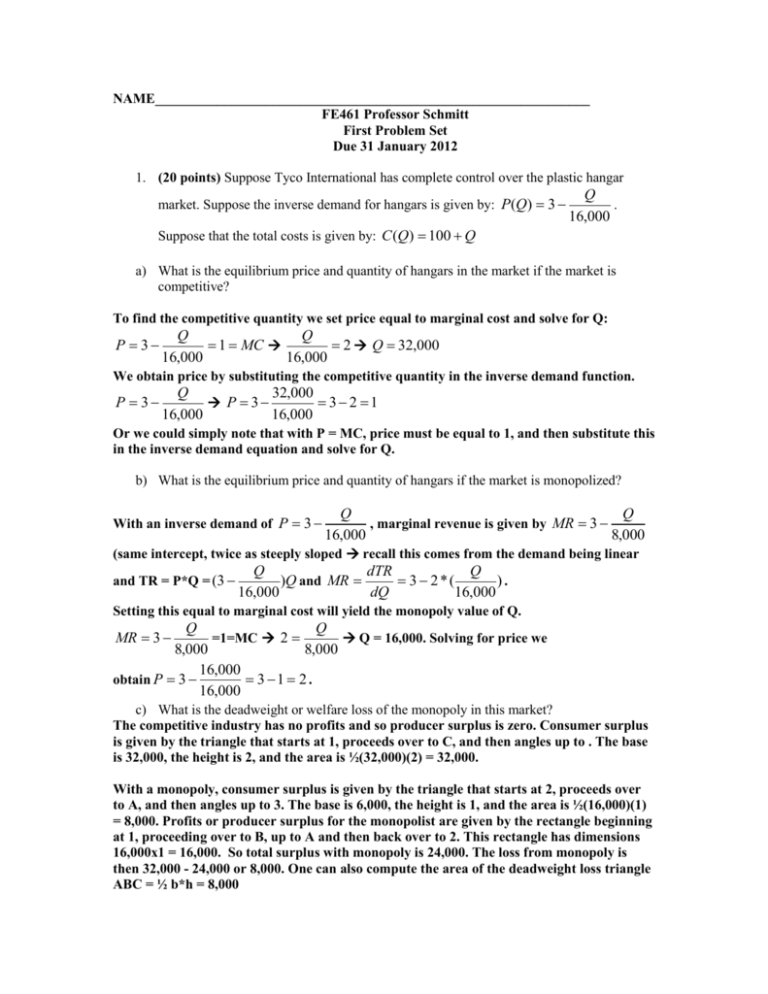

NAME_______________________________________________________________ FE461 Professor Schmitt First Problem Set Due 31 January 2012 1. (20 points) Suppose Tyco International has complete control over the plastic hangar market. Suppose the inverse demand for hangars is given by: P(Q) 3 Q . 16,000 Suppose that the total costs is given by: C (Q) 100 Q a) What is the equilibrium price and quantity of hangars in the market if the market is competitive? To find the competitive quantity we set price equal to marginal cost and solve for Q: P 3 Q Q 1 MC 2 Q 32,000 16,000 16,000 We obtain price by substituting the competitive quantity in the inverse demand function. P 3 32,000 Q P 3 3 2 1 16,000 16,000 Or we could simply note that with P = MC, price must be equal to 1, and then substitute this in the inverse demand equation and solve for Q. b) What is the equilibrium price and quantity of hangars if the market is monopolized? With an inverse demand of P 3 Q Q , marginal revenue is given by MR 3 16,000 8,000 (same intercept, twice as steeply sloped recall this comes from the demand being linear and TR = P*Q = (3 dTR Q Q 3 2*( ). )Q and MR dQ 16,000 16,000 Setting this equal to marginal cost will yield the monopoly value of Q. Q Q =1=MC 2 Q = 16,000. Solving for price we 8,000 8,000 16,000 obtain P 3 3 1 2 . 16,000 MR 3 c) What is the deadweight or welfare loss of the monopoly in this market? The competitive industry has no profits and so producer surplus is zero. Consumer surplus is given by the triangle that starts at 1, proceeds over to C, and then angles up to . The base is 32,000, the height is 2, and the area is ½(32,000)(2) = 32,000. With a monopoly, consumer surplus is given by the triangle that starts at 2, proceeds over to A, and then angles up to 3. The base is 6,000, the height is 1, and the area is ½(16,000)(1) = 8,000. Profits or producer surplus for the monopolist are given by the rectangle beginning at 1, proceeding over to B, up to A and then back over to 2. This rectangle has dimensions 16,000x1 = 16,000. So total surplus with monopoly is 24,000. The loss from monopoly is then 32,000 - 24,000 or 8,000. One can also compute the area of the deadweight loss triangle ABC = ½ b*h = 8,000 The following diagram will be useful for this problem. Price 3 Pmon = 2 A PPC B =1 C 16,000 32,000 MR=3-Q/8,000 D = 3 – Q/16,000 48,000 Q 2. (20 points) Use the following tables to answer questions about market concentration and market power: Firm Daimler Chrysler Mazda Mitsubishi Subaru BMW Hundai Mercedes Volkswagen Suzuki General Motors Ford Motor Company Toyota Honda Nissan Other (Fringe Firms) Market Share 0.087 0.019 0.026 0.013 0.018 0.026 0.017 0.049 0.002 0.281 0.228 0.101 0.071 0.041 0.021 Firm Disney Dreamworks Fox MGM/UA Miramax New Line Paramount Sony Universal Warner Other (Fringe Firms) Market Share 0.147 0.103 0.097 0.013 0.063 0.052 0.105 0.088 0.145 0.119 0.068 a) Use the information above to calculate the concentration of the top 4 firms in each industry. Which is more concentrated based on your analysis? auto C4 = .281 + .228 + .101 + .087 = 0.697 C4movie = .147 + .145 + .119 +.105 = 0.516 Automobile – higher C4 b) Using the alternative measure of market concentration, the Herfindahl-Hirshman Index which industry is more concentrated? (For Fringe firms you can IGNORE these in your calculation, this does not mean 1 firms has 2.1% and 6.8% market share but that MANY firms together have 2.1% and 6.8% market share. HHIauto = .2812 + .2282 + .1012 + .0712 + …+ .0182 + .0172 + .0132 = .1603 (note other omitted because these “fringe” firms are small and have a very small percentage of the market) 1,603 HHImovie = .1472 + .1452 + .1192 +.1052 + … + .0632 + .0522 + .0132 = .1024 1,024 3. (20 points) We defined the Lerner index LI 1 1 , where the absolute value of the price elasticity of demand. We also showed (through profit maximization of a monopolist) that LI P MC . Use these relationships to show that the LI can never P exceed 1. What does this imply is the minimum demand elasticity we should observe for a monopolist? We can write the Lerner index as follows First note that prices and marginal costs are always positive. Then note that a profit maximizing firm will only operate at a point where P MC . This means that the ratio MC/P is always less than one which means than L is always less than one and greater than zero. Given that L is 1 it is clear than 1 for a monopolist. In particular, 4. (20 points) The Q & H Company produces a number of products including shampoo, qS, and toothpaste qT. Suppose the cost functions for these products are given by C (q S ,0) 4 q S2 C (0, qT ) 4 qT C (q S , qT ) 7 q s2 qT a) Does the production of shampoo exhibit economies of scale? Explain your reasoning. 4 q s2 qs AC 2 1 S 2 1? MC 2q s qs 2 2 1 q s2 2 4 q s2 The production of shampoo exhibits economies of scale up until 2 units of output. After that, the production of shampoo exhibits diseconomies of scale. b) Does the production of toothpaste exhibit economies of scale? Explain your reasoning. 4 qT S AC MC qT 1 8 qT 2 1? 2 qT Yes, it does exhibit economies of scale. c) Are there economies of scope associated with producing shampoo and toothpaste? Explain your reasoning. Yes. No matter what combination, it will always be $1 less expensive to make the products. Notice that C(qs,qT) is $1 less than C(qs,0) + C(0,qT). Note as the quantities become larger, this $1 difference, as a percentage of total costs, becomes somewhat trivial. 5. (20 points) Let a firm’s total cost function be TC 800 8q 8q 2 . Find the range of production characterized by economies of scale (that is, for q < #). To find the output where MES sets in, we can look for the level of q where AC = MC. 800/q + 8 + 8q = 8 + 16q ; 8q = 800/q; q=10 Alternatively, you can take the first derivative of the AC function and set it equal to zero to see where it reaches a minimum. The result will yield the same answer: q=10. Economies of scale occur from q = 0 to q = 10. After q = 10, the firm experiences diseconomies of scale.