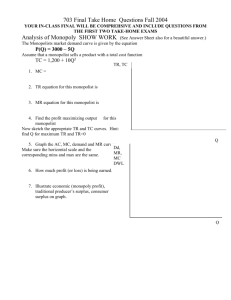

Economics 11

advertisement

Chapter 11: Monopoly 1. Consider the following inverse demand curve faced by a monopolist: P= 100 -Q. a. Find the marginal revenue curve for the monopolist. b. At what quantity is total revenue maximized? c. If MC and AC are constant at $20, then what is the profit-maximizing output for a monopoly? What is the monopoly price?…monopoly profit? d. How would your answer to part (c) change if a $10 per unit tax was imposed on the monopolist? Is the monopolist able to pass on all of the tax to consumers? Explain. e. What would be the P and Q in a competitive industry? f. Find consumer and producer surplus for a competitive industry and a monopoly. How do they compare? 2. True or false, explain. a. A monopolist can sell all that it wants at whatever price it wants. b. A monopolist necessarily makes a positive economic profit. c. The quantity at which TR is maximized is greater than the quantity at which total profit is maximized. d. a change in fixed costs does not change the quantity at which monopoly profit is maximized in the short run. e. A operates on the inelastic segment of its demand curve. (Use graph to explain.) 3. A movie studio pays its star actors 10% of total revenue. Who has the incentive to charge the highest price for a movie ticket---the studio or the stars? Explain. ANSWERS 1. a. First, multiply each side of the inverse demand function by Q. This gives us the TR function: TR= PQ = 100Q - Q2. Next, take the derivative with respect to Q to get the MR function: dTR/dQ = MR = 100-2Q. (or you can use the rule that for any linear demand curve P = a – bQ the marginal revenue curve is MR = a –2bQ. ) b. TR is maximized when MR equals zero. Therefore, set the MR function equal to zero and solve for Q: MR = 100-2Q = 0. This gives us Q = 50. c. Set MR equal to MC and solve for Q: 100-2Q = 20 which gives us Q = 40. To find price, plug Q=40 into the inverse demand function and solve for P. P = 100-40= $60. Profit= (P-AC)(Q)=(60-20)(40)= $1,600. d. MC = $20 + excise tax = $30. Follow the same steps as in part (c ) to get: Q=35,P=$65, and profit of $1,225. No, the monopolist is not able to pass on ALL of the tax. Price increases by $5 which is less than the $10/unit tax. e. In a competitive economy, P = MC (that is, competitive output occurs where the MC curve crosses the demand curve). To find, competitive quantity, set the inverse demand function equal to MC and solve for Q. So 100-Q = 20 which gives us Q = 80. P =MC = 20. f. Competitive Industry Monopoly Change Consumer Surplus 0.5(100-20)(80)=$3,200 0.5(100-60)(40)=$800 -$2,400 Producer Surplus 0 (60-20)(40)=$1,600 +$1,600 Social Total $3,200 $2,400 -$800 Monopoly leads to a deadweight loss of $800. 2a. False. A monopolist faces a downward-slopping demand curve. Hence, an increase in price means a drop in quantity sold. 2b. False. If the short-run AC curve lies everywhere above the demand curve, then the monopolist will incur losses. (NOTE: If the AC curve lies everywhere above the demand curve, the monopolist may still be able to make a positive profit by engaging in perfect-price discrimination). 2c. This is true as long as MC is positive. Profits are maximized at the quantity where MR=MC, and if MC is greater than zero, then so must MR>0. On the other hand, TR is maximized at the quantity where MR=0. This quantity is necessarily greater than the profit-maximizing quantity (as long as MC>0). 2d. True. a change in fixed costs does not change MC and therefore does not change the Q at which MR equals MC. 2e. False. A monopolist operates on the elastic segment ( e >1) of its demand curve. The elastic segment of its demand curve corresponds to MR > 0, and since profits are maximized at MR = MC and MC > 0 it follows that MR > 0 at the quantity the monopolist produces. If the monopolist was operating in the region of MR < 0 (that is, where e < 1), then it could increase TR by raising price. As it raises price, quantity demanded falls and therefore TC falls (firm is producing fewer units). With TR rising and TC falling then profit must be rising. 3. The movie stars would want to maximize TR since their payments equal 0.1TR, whereas the studio desires to maximize profit. The quantity at which TR is maximized is greater than the quantity at which profit is maximized (see 2c), and therefore the price would be lower at this TR-maximizing Q. $/unit 2e. With MC > 0, then MR>0 by profit maximization (MR =MC). absolute value of e > 1 │e│ = 1 │e│ < 1 D MR Quantity