Perfect competition and monopoly

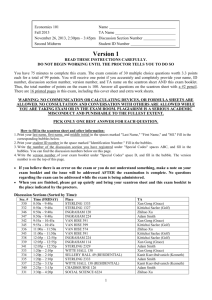

advertisement

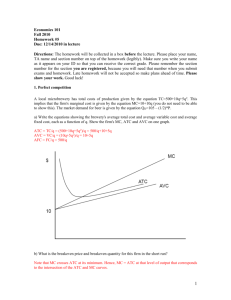

15. Firms, and monopoly Varian, Chapters 23, 24, and 25 The firm • The goal of a firm is to maximize profits • Taking as given – Necessary inputs – Costs of inputs – Price they can charge for a given quantity • We will ignore inputs for this course (Econ 102, or I/O will cover this) Standard theory • Intuition – Firm chooses a price, p, at which to sell, in order to maximize profits • Our approach today – The firm chooses a quantity, q, to sell – Inverse demand function is given p(q) Firm decision in the short run Max p(q)q – c(q) Revenue, R(q) = p(q)q Cost • Differentiate wrt q and set equal to zero: MR = MC p(q) + qp’(q) = c’(q) Revenue from extra unit sold Revenue lost on all sales due to price fall Marginal cost Perfect competition (many firms) Max p(q)q – c(q) Revenue, R(q) = p(q)q Cost • Perfect competition: p(q) = p p=MR = MC p + 0 = c’(q) Revenue from extra unit sold Firm is too small to affect price Marginal cost Pricing in the short run Perfect competition: • p = 20 • c(q) = 62.5+10q+0.1q2 • Find the firm’s profit-maximizing q Monopolist • p(q)= 50 - 0.1q • c(q) = 62.5+10q+0.1q2 • Find the firm’s profitmaximizing q Cost function definitions c(q) = 62.5+10q+0.1q2 • Fixed cost: the part of the cost function that does not depend on q • Variable cost: the part of the cost function that does depend on q • Total cost: FC+VC • Average total cost: (FC+VC)/q=c(q)/q How many firms will there be? p Perfect competition • In long run, competition forces profits to 0 – P = ATC(q) – P = MC(q) – C’(q) = C(q)/q ATC MC • Solve for q q How many firms will there be? p Perfect competition • Knowing q ATC – P = MC(q) – Q=D(P) – #firms = Q/q MC D(p) q The long run outcome Perfect competition: • D(P) = 600 - 20P • c(q) = 62.5+10q+0.1q2 • Find the long run q • Find the long run price, and # of firms Natural monopoly: • D(P) = 600 - 20P • c(q) = 640+10q+0.1q2 • What is q when MC=ATC? • How many firms will there be? Natural monopoly p • D(p)<q at p where MC=ATC • Happens when fixed cost high relative to ATC – marginal cost – inverse demand • Fixed cost can only be covered by p>MC MC D(p) q Monopolist • Natural monopolies – Electricity – Telephones – Software? • Monopoly can also be by government protection – Patented drugs • Imposed with violence – Snow-shovel contracts in Montreal Monopolist • No competition • Monopolist free to choose price – MR(q) no longer constant p – Single price: set MR(q) = MC(q) • More elaborate pricing schemes to follow – Price discrimination Monopoly pricing (no price discrimination) • Note: When demand is pm linear, so is marginal revenue • P = A – Bq • MR = A – 2Bq Profit MC MR qm Optimal quantity set by monopolist Demand Inefficiency of monopoly Dead weight loss pm Mark-up over Marginal cost MC Demand MR qm q* (Price) elasticity of demand • The elasticity of demand measures the percent change in demand per percent change in price: e = -(dq/q) / (dp/p) = -(p/q)*(dq/dp) < 0 Optimal mark-up formula p(q) + qp’(q) = c’(q) can be rearranged to make: p = MC / (1 – 1/|e|) This can be rearranged to yield: (p – MC)/MC = 1 / (|e| - 1) > 0 Demand elasticity p p Elasticity > 1 Constant elasticity of demand Elasticity = 1 Elasticity < 1 p = q -e q q p = a - bq Monopolist’s decision Natural monopoly: • D(P) = 600 - 20P • c(q) = 640+10q+0.1q2 • What q will monopolist choose? • What is their profit? • What is elasticity of demand at this price/quantity? Price discrimination • Idea is to charge a different price for different units of the good sold • What does “different units” mean • Purchased by different people – E.g., children, students, pensioners, military • Different amounts purchased by a given person – E.g., quantity discounts, entrance fees, etc. Three degrees of discrimination • First degree PD – Each consumer can be charged a different price for each unit she buys • Second degree PD – Prices can change with quantity purchased, but all consumers face the same schedule • Third degree PD – Prices can’t vary with quantity, but can differ across consumers First degree PD • Outcome is Pareto efficient Profit of fully discriminating monopolist • Consumer earns no consumer surplus MC = c Profit of nondiscriminating monopolist Demand xm x* Entry fee • Alternative pricing mechanism: If you buy x units, you pay a total of T + cx With more than one consumer... ….charge a different entry fee to each ….but the same marginal price Profit from consumer A Profit from consumer B MC = c Demand x*A Consumer A MC = c Demand x*B Consumer B Entry fees as “two-part-tariffs” • Let A’s consumer surplus be TA and let B’s be TB . • Monopolist sets a pair of price schedules: Consumer A Consumer B RA = TA + cx RB = TB + cx Entry fees Price per unit = c Second degree PD • Suppose again there are two types of people – A-types and B-types • Half is A-type, half B-type • …but now we cannot tell who is who • Can the monopolist still capture some of the consumer surplus? Yes - airlines • All of it? No A problem of information…. TA • Best pricing policy: Offer two options: Option A: x*A for $(U+V+W)+cx*A Option B: x*B for $U+cx*B TB • But then A would choose option B A’s demand B’s demand V W U MC x*B – She gets surplus V from option B, and 0 from option A – Monopolist gets profit U x*A x R Option A Option B is better than option A for person A RA RB Option B x*B x*A x The monopolist can do a little better…. A’s demand • Option A’: x*A for $(U+W)+cx*A B’s demand • A will be happy to take this offer V W U – She gets a surplus of V – Monopolist gets profit U+W MC x*B x*A x …but it can do even better • Option A’’: x*A for $(U+W+DW)+cx*A • Option B’’ x’’B for $(U-DU)+cx’’B A’s demand DW B’s demand V MC • A still willing to take option A’’ over option B’’ • Profit up by DW-DU W U DU x’’B x*B x*A x …and the best it can do is? Gain from higher fees paid by A-types from further decreasing x+B A’s demand B’s demand V Loss from lost sales to B-types from further decreasing x+B • Stop when W U MC x+ B x*B x*A x = Should the monopolist bother selling to low-demand consumers? Going further, you lose more on the B-types than you gain on the A-types Going all the way to zero, you lose less on the B-types than you gain on the A-types YES: Sell to B-types NO: Sell only to A-types MC A B x+B MC x*A A B x x+B=0 x*A x 2nd degree price discrimination High type: • DH(P) = 100 - P Low type: • DH(P) = 70 – P • MC=10 • What bundles should the monopolist offer? • At what prices? 2nd degree price discrimination High type: • DH(P) = 100 - P Low type: • DH(P) = X – P • MC=10 • For what value of X will the monopolist not sell to low types? Outcome B-types • They buy less than the Pareto efficient quantity: x+B < x*B • They earn zero consumer surplus A-types • They buy the Pareto optimal amount, x*A • They earn positive consumer surplusFN – this is always what they could earn if they pretended to be B-types FN: Whenever x+B >0 Third degree price discrimination • Monopolist faces demand in two markets, A and B • Suppose marginal cost is constant, c • Then the monopolist just sets prices so that pA = c / (1 – 1/|eA|) pB = c / (1 – 1/|eB|) Some problems • Non-constant marginal cost? – Replace c above with c’(xA+xB) • What if demands are inter-dependent? – E.g., xA(pA,pB) and xB(pB,pA) • Applications – Peak-load pricing • A: Riding the metro in rush-hour • B: Riding off-peak – Children’s and adults’ ticket prices Bundling • Suppose a monopolist sells two (or more) goods • It might want to sell them together – that is, in a “bundle” • E.g.s – Software – Word, PowerPoint, Excel – Magazine subscriptions Software example Two types of consumer who have different valuations over two goods Consumer type Word processor Spreadsheet Type A 120 100 Type B 100 120 Assume marginal cost of production is zero Selling strategies Sell separately Bundle • Highest price to sell 2 word processors is 100 • Highest for spreadsheet is 100 • Can sell a bundle to each consumer for 220 • Sell two of each, for profit of 400 • Dispersion of prices falls with bundling • Total profit is 440