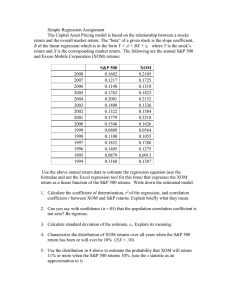

53exam2

advertisement

name______________________________ Math 53 – Financial Mathematics April 18, 2007 Exam 2 Take this exam when and where you like. There is no time limit. You may use calculators, computers, and any references that you prepared yourself or that existed before the exam was handed out, but you may not consult with anyone other than the instructor. You may use this paper, your own paper, or both. It isn’t necessary to turn in scratch paper. Return this exam to class, to my office, or to the MATH/STAT department office by 10:30 on Wednesday, April 25, 2007. This exam has 5 numbered problems on 7 numbered pages. It is never necessary to reduce your answer to a number. An explicit formula (that is, all numbers with no variable or function names) is always sufficient, if it’s correct and can actually be evaluated. The standard normal cdf, (x), can be part of an explicit formula. (Of course, you can usually be more confident of your answer if you reduce it to a number.) 1. Assume that a stock price S(t) (for t ≥ 0) follows a Geometric Brownian Motion process with underlying parameters and , and that S(0) = S0. Derive the formula for the expected value of S(T): E S (T ) S0 e 1 2 T 2 . Use any method, and explain all steps. You can assume that the following definite integral formula is correct: x 1 2 exp 1 2 x 2 Bx C dx 1 exp B 2 C . 2 1 2. A certain contingent claim promises the following payment at time T: $30 if S (T ) $120 V (T ) 0 if S (T ) $120 where S(T) is a stock price governed by a GBM with underlying parameters and and initial value S0. Both the $30 amount and the $120 amount are in actual dollars and are measured at time T. So, if you translate these amounts into present values or flat dollar amounts, you’ll need a factor of exp(-rT). For this exercise, assume that exp(-rT) = 5/6. (If you don’t use flat dollars, assume that there is a fixed, universal, interest rate r. You can still assume that r and T are such that exp(-rT) = 5/6.) This is a European-style claim, which means that all payments are at time T; there is no provision for early exercise. Also, this company pays no dividends. Derive a Black-Scholes-like formula for V(0), the market price of this claim at time 0. 2 3. Consider this simple model of a stock price at times t=0 and t=1: At t=0, the stock price is S0 = 40. At t=1, it is either S2 = 55 or S1 = 35. 55 40 The time interval is too short for interest to matter. 35 (a) What are the market probabilities (= risk-neutral probabilities = martingale probabilities) associated with the two branches? (b) At time t1, a certain option contract is worth V2 = 10 if the stock price is 55, and is worth V1 = 0 if the stock price is 35. Assuming no arbitrage opportunities, what is the price of the option at time t=0 ? (Hint: Not 6.) (c) The Acme Brokerage Research Department thinks that your answer to part (b) is wrong. Their experts say that the correct price of the option is actually 6. Accordingly, Acme offers to buy from you any reasonable number of option contracts for 5.99, or sell to you any reasonable number of option contracts for 6.01, all at time t=0. At time 0 your stockbroker will allow you to buy or sell any number of shares at 40. Find a way to trade in cash, shares of stock, and options that will make you very rich, with no risk of loss. 3 4. Here’s a grid describing a binomial-tree stock price model. 44 40 36 48.4 39.6 53.24 43.56 35.64 32.4 29.16 t=0 t=1/3 t=2/3 t=1 (For this problem, please ignore interest. Or, assume r = 0. Or, use flat dollars. Or, assume that all amounts are expressed as present values.) (a) What are the market probabilities for the two branches starting form the initial node? (b) Calculate the market probabilities for all of the branches. (That’s just the individual branches, not complete paths through the tree.) (c) One time step is Δt = 1/3 year. Define L(t) = ln ( S(t) ) and R(0, t) = L(t) – L(0) as usual. Given the grid model, what is the variance of R(0, 1/3) ? (Assume the market probabilities.) (problem continues…) 4 (problem continues…) (d) What is the variance (2) of the process described in the grid, per year? (e) What is the volatility () in yearly units (that is, yr-1/2 for ) ? (f) Design a grid exactly like the one shown, but with different prices attached to the nodes, and with all of these properties: --- Initial price is $40 --- Market probabilities on all branches are ½ --- Assuming the market probabilities, the volatility of the process is exactly 0.20 in yearly units. (That is, = 0.20 yr-1/2. Equivalently, 2 = 0.04 yr-1. ) 5 5. Returns from three stocks --- XOM, JBLU, and LUV --- have the correlation 11 12 13 1 matrix 21 22 23 and the expected return vector 2 . 31 32 33 3 (a) Your client has chosen a positive number , and wants you to find a vector x with coordinates x1, x2, and x3 that maxims ( x ) = Tx - (1/2) xTx = ( 1x1 + … + 3x3) – (1/2) x x i j ij i, j subject to the condition that x1 + x2 + x3 = 1. Derive a formula for the optimal vector x in terms of , , . (It is not necessary that the xi’s be non-negative. Assume that -1 exists.) (problem continues…) 6 (problem continues…) (b) The covariance matrix is actually as follows. Covariances (yearly) xom jblu luv xom 0.044253 0.003573 -0.001110 jblu 0.003573 0.059154 0.050192 luv -0.001110 0.050192 0.181433 But you can’t complete your solution to your client’s problem because you don’t know and the client won’t tell you . On the other hand, you do know the client’s present portfolio: It is 50% XOM, 40% JBLU, 10% LUV. Assuming that the client arrived at this distribution by solving the same problem you have, but with actual values of and , what can you say about ? Derive a formula for in terms of the known values of x and . You don’t need to reduce the answer to numbers, although you may do so if you like. (The numbers are just there to make the problem more concrete.) You’ll find out that you can’t get an unambiguous value of , but you may find a formula in terms of a few arbitrary scale factors. (end of exam) 7