IRS explains when school`s graduate level tuition

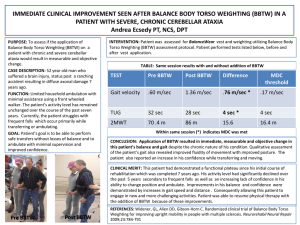

advertisement

IRS explains when school's graduate level tuition waivers to its employees are excludable Legal Advice Issued by Field Attorneys 20103901F In Field Advice, IRS has advised that an educational institution's graduate level tuition waivers weren't excludable under Code Sec. 117(d) unless the employees were graduate students working as research or teaching assistants. However, graduate level tuition waivers were excludable under Code Sec. 127 up to $5,250 per year, if the program met certain requirements. Further, the tuition waivers which exceeded the Code Sec. 127 limitations might be excludable under Code Sec. 132 if the courses were part of an educational assistance program and the tuition would be deductible under Code Sec. 162 (trade or business expenses) if the employees paid it themselves. Background on qualified tuition reduction. Under Code Sec. 117(d), qualified tuition reductions for employees of educational institutions are excluded from the recipient's gross income. A qualified tuition reduction is the amount of tuition reduction provided to an employee of an educational organization for below-graduate-level education (not services) at that or a similar institution, for the employee (whether active, retired, or disabled), or the employee's spouse or dependent children. The exclusion for tuition reduction is, however, limited to undergraduate level courses, except that the exclusion for graduate level tuition reduction is available in the case of an individual who is a graduate student at an educational organization and who is engaged in teaching or research activities for such organization. (Code Sec. 117(d)(5)) Background on employer-provided educational assistance. Under Code Sec. 127, an employee may exclude educational assistance provided under an employer's qualified educational assistance program, up to an annual maximum of $5,250. The education received need not be job-related. Educational assistance means the employer's payment for or provision of tuition, fees, books, supplies and equipment under an educational assistance program, including amounts for graduate-level courses. It doesn't include meals, lodging, transportation, or tools or supplies (other than textbooks) that may be retained after the course ends. Both Code Sec. 127 and Code Sec. 117 (qualified tuition reduction) can be applied to exclude from an employee's income funds paid out for an employee's education, and tuition waived for an employee of an educational institution. Code Sec. 127(c)(6) states that the Code Sec. 127 employer-provided educational assistance provisions aren't to be construed to affect the deduction or inclusion in income of amounts which are paid or incurred, or received as reimbursement under Code Sec. 117 , Code Sec. 162 or Code Sec. 212 (production of income expenses). (Reg. § 1.127-1(c)) Observation: Unless Congress acts, the provisions of the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA, PL 107-16), other than those made permanent or extended by subsequent legislation, sunset and won't apply to tax years beginning after 2010. Accordingly, the exclusion for employer-provided educational assistance under Code Sec. 127 ends after 2010 (as does the rule that allowed an exclusion for graduate level education). Background on working condition fringe benefits. Expenses paid by an employer for education or training provided to the employee that aren't excludable under Code Sec. 127 can only be excluded from income if they qualify as a working condition fringe benefit. (Code Sec. 132(j)(8)) A working condition fringe benefit is any property or services provided to an employee to the extent that, if the employee had paid for it, the payment would be allowable as a deduction under Code Sec. 162 or Code Sec. 167 (depreciation). (Code Sec. 132(d)) Generally, expenditures for education are deductible under Code Sec. 162 if the education: (1) maintains or improves skills required by an individual in his employment, trade or business; or (2) meets the express requirements of the individual's employer, law or regulations, status or rate of compensation. A fringe benefit isn't excludable under Code Sec. 132 if another Code section expressly provides rules for the treatment of the benefit. (Code Sec. 132(l)) Facts. Educational Institution (School) adopted a Graduate and Post Graduate Tuition Benefits Program (Program) which offered faculty, regular, full-time staff and limited service employees the opportunity to advance their personal and professional development by providing tuition assistance for courses, including several graduate level courses. After one year of full-time employment, the employee could receive a waiver benefit of 50% of the cost of tuition. After two years of continuous full-time employment, the employee could receive a waiver benefit of 100% of the cost of tuition. An employee receiving graduate level tuition waivers had to complete an Employee Waiver Contract which stipulated that he would reimburse School if he left its employment within one year of completion of the graduate coursework. Field Advice's conclusion. The Field Advice concluded that, under Code Sec. 127(a), graduate level tuition waivers provided by School to its employees were excludable in an amount of up to $5,250 per calendar year if the tuition waivers were provided as part of an educational assistance program described in Code Sec. 127(b). Any tuition waiver or reduction provided in excess of this amount was a taxable fringe benefit for income tax purposes, unless the education was necessary for the employee to maintain or acquire skills necessary for their current employment or the education met an express requirement by their employer, law or regulations, status or rate of compensation and thus would qualify as a deductible business expense under Code Sec. 162 if the employee had paid the tuition himself. The Field Advice reasoned that qualified tuition reductions under Code Sec. 117(d) can't be excludable as working condition fringe benefit under Code Sec. 132 because Code Sec. 132(l) precludes working condition fringe benefit treatment for any fringe benefit the taxability of which is expressly governed by another Code section. However, Code Sec. 117(d) didn't apply in this particular case because it only applies only to qualified tuition reductions—which doesn't include arrangements that provides for education at the graduate level. The Field Advice determined that amounts that exceed the $5,250 per year dollar cap of Code Sec. 127 can be deducted as a working condition fringe as long as the educational assistance meets the requirements of Code Sec. 127 and would qualify as a working condition fringe under Code Sec. 132. While Code Sec. 132 cannot be used to exclude graduate level tuition reductions that fail the requirements of Code Sec. 117(d) and Code Sec. 127, educational assistance (including graduate level classes) that would qualify for exclusion under Code Sec. 127 but for the statutory cap of $5,250 can be excluded as a working condition fringe if the assistance meets the requirements of Code Sec. 127 and Code Sec. 132.