Four Ways to Calculate IFF

advertisement

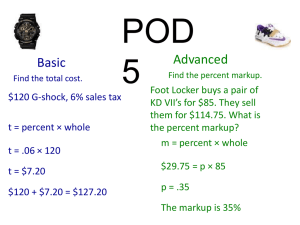

Ways to Calculate GSA’s Industrial Funding Fee (IFF) • Divide the original unit price by one (1) minus the IFF rate (e.g., 1 – 0.0075 = 0.9925) to establish the contract price. For example, if the original price of $198.50 is divided by .9925 , the selling price will be $200. If the contractor makes a sale at the $200 price, the contractor will pay a $1.50 IFF. Then $200 minus $1.50 will equal $198.50, which is the original fair and reasonable price calculated based on the firm’s commercial practice. • Multiply the original unit price by 1.007557 to establish the contract price. One divided by one (1) minus the IFF rate (1 – 0.0075 = 0.9925) is equal to 1.007557 (with a small rounding error), so the result from multiplying by 1.007557 is equal to the result from dividing the selling price by one (1) minus the IFF rate. • Adjust the discount used to calculate the selling price by subtracting 0.75 percent and then adding 0.75 percent of the original discount. For example, if the original discount is 5.0 percent, subtract 0.75 percent from the 5.0 percent (5.0% - .75% = 4.25%); calculate .75 percent of 5.0 percent (.0075 * .05 = .000375 or .0375 percent); add the results of the two calculations (4.25% + .0375% = 4.2875%). The adjusted discount rate is 4.2875 percent. The parties normally agree on a rounded discount rate (e.g., 4.3 percent or 4.29 percent). • Adjust only the base discount as shown above when multiple discounts may or may not apply to a particular acquisition. Never adjust a prompt payment discount. GTPAC – June 2006