Midterm 2003 key

advertisement

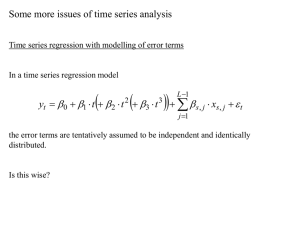

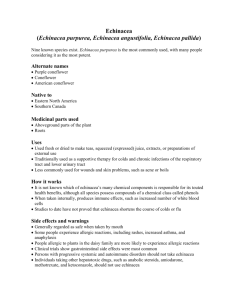

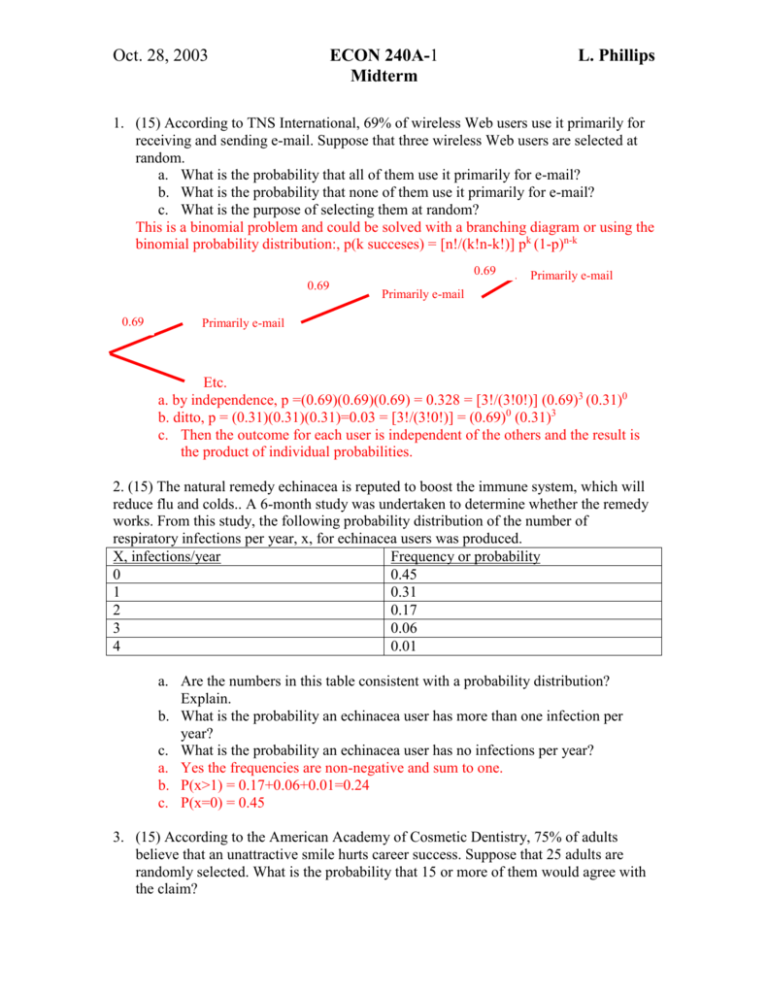

Oct. 28, 2003 ECON 240A-1 Midterm L. Phillips 1. (15) According to TNS International, 69% of wireless Web users use it primarily for receiving and sending e-mail. Suppose that three wireless Web users are selected at random. a. What is the probability that all of them use it primarily for e-mail? b. What is the probability that none of them use it primarily for e-mail? c. What is the purpose of selecting them at random? This is a binomial problem and could be solved with a branching diagram or using the binomial probability distribution:, p(k succeses) = [n!/(k!n-k!)] pk (1-p)n-k 0.69 0.69 0.69 Primarily e-mail Primarily e-mail Primarily e-mail Etc. a. by independence, p =(0.69)(0.69)(0.69) = 0.328 = [3!/(3!0!)] (0.69)3 (0.31)0 b. ditto, p = (0.31)(0.31)(0.31)=0.03 = [3!/(3!0!)] = (0.69)0 (0.31)3 c. Then the outcome for each user is independent of the others and the result is the product of individual probabilities. 2. (15) The natural remedy echinacea is reputed to boost the immune system, which will reduce flu and colds.. A 6-month study was undertaken to determine whether the remedy works. From this study, the following probability distribution of the number of respiratory infections per year, x, for echinacea users was produced. X, infections/year Frequency or probability 0 0.45 1 0.31 2 0.17 3 0.06 4 0.01 a. Are the numbers in this table consistent with a probability distribution? Explain. b. What is the probability an echinacea user has more than one infection per year? c. What is the probability an echinacea user has no infections per year? a. Yes the frequencies are non-negative and sum to one. b. P(x>1) = 0.17+0.06+0.01=0.24 c. P(x=0) = 0.45 3. (15) According to the American Academy of Cosmetic Dentistry, 75% of adults believe that an unattractive smile hurts career success. Suppose that 25 adults are randomly selected. What is the probability that 15 or more of them would agree with the claim? Oct. 28, 2003 ECON 240A-2 Midterm L. Phillips This problem can be solved using the Tables for the cumulative binomial probability distribution in the Appendix, or by using the normal approximation. From Table 1, p. B-5, for n = 25, p(success) = 0.75: p(k<=14) = 0.03, so p(k>14) = 0.97 since these probabilities must sum to one. Alternatively, using the normal approximation, with mean = n*p = 25*0.75 = 18.75. and variance = n*p*(1-p) = 25* 0.75 *0.25 = 4.6875, so the standard deviation is the square root of this number, i.e. 2.165. So the standardized normal variate, z, for k=15 is: z = (15 – 18.75) /2.165 = - 1.73. From Appendix B, Table 3, p. B-8, for the normal distribution, z = 1.73 has an area (probability) above the mean of 0.4582 so 0.5 minus 0.4582 = 0.04 is in the upper tail implying that p(z<-1.73) = 0.04 and so p(z>-1.73) = 0.96 = p(k>=15), close to the answer from Table 1. 4. (15) Suppose the amount of time teenagers spend weekly at part-time jobs is normally distributed with a standard deviation of 20 minutes. A random sample of 100 observations is drawn and the sample mean is computed as 125 minutes. Determine the 95% confidence interval estimate of the population mean. p(-1.96<z<1.96} = 0.95, where z = (125 – u)/(std.dev./10) = (125-u)/(20/10) = (125-u)/2, so p(-1.96<[125-u]/2<1.96)=0.95, or p(-3.92<125-u<3.92)=0.95, and subtracting 125 from all three parts of the inequality, p(-3.92-125<-u<3.92-125) or p(-128.92<-u<-121.08=.95 and multiplying all three parts of the inequality by minus one, changing the signs of the inequality, p(128.92>u>121.08) = 0.95. 5. (15) The University of California’s share, in percent, of California General Fund expenditure is plotted against a time index (t=0 is 1968-69, t=35 is 2003-04) in Figure 5.1 below. A linear trend line was used to fit this data, with parameter estimates and goodness of fit appearing on the chart. The Excel regression output appears in Figure 5.1. A plot of actual, fitted, and residual from Eviews is displayed in Figure 5.2 a. Do you think this trend-line is very useful for predicting UC’s budget share for the next fiscal year, 2004-05? Explain. b. How would you interpret the fitted parameter 0.0682? c. How much do you think UC’s share of the pie (budget share) might shrink in ten years, i.e. by 2013-14? d. Is this linear trend model of UC’s Budget Share statistically significant? Explain. e. Are any of the assumptions underlying ordinary least squares violated? a. No. This model captures the long run trend but not the shorter run cycle: conceptual general time series model: time series = trend + cycle + seasonal + random. There is no seasonal since this is annual data, and the error term in the regression model is consequently capturing cycle plus random since only trend is explicitly modeled. b. It is the fitted UC budget share in 1968-69, i,e. at t=0, y(0) =0.0682. Oct. 28, 2003 ECON 240A-3 Midterm L. Phillips c. Relying on the regression estimate of the slope of –0.0008, ten times this would mean a decline of about 0.8 of one percent in budget share, down to about 3%. d. Yes, the F-statistic of 115.8 is large and highly significant. The t-statistic for the estimate of the slope is also large, -10.76, and highly significant. For this bivariate regression, the square of this t-statistic is the F-statistic. e. From Figure 5.2, the estimated residual is autocorrelated, so the assumption that the errors are independent, i.e. E[e(i)e(j)] = 0 is violated. Figure 5.1: Linear Trend Fit to UC’s Share of California General Fund Expenditures University of California's Share of State General Fund Expenditure 8.00% 7.00% 6.00% Percent 5.00% 4.00% 3.00% y = -0.0008x + 0.0682 R2 = 0.773 2.00% 1.00% 0.00% 0 5 10 15 20 Year( 0 = 1968-69) 25 30 35 40 Oct. 28, 2003 ECON 240A-4 Midterm L. Phillips Table 5.1: Regression Results from the Linear Trend Model of UC’s Budget Share SUMMARY OUTPUT Regression Statistics Multiple R 0.879206 R Square 0.773003 Adjusted R Square 0.766326 Standard Error 0.004834 Observations 36 ANOVA df Regression Residual Total Intercept X Variable 1 SS MS F Significance F 1 0.002706 0.002706 115.781431 1.729E-12 34 0.000795 2.34E-05 35 0.003501 Coefficients Standard Error t Stat 0.068168 0.001578 43.1858 -0.00083 7.76E-05 -10.7602 P-value Lower 95% Upper 95% Lower 95.0% Upper 95.0% 2.7345E-31 0.064959709 0.071375 0.06495971 0.07137538 1.729E-12 -0.000992206 -0.00068 -0.00099221 -0.000677 F igure 5. 2: Actual, F itted and Residual-Linear T rend Model of UC's Budget Share 8 7 6 5 4 1.0 3 0.5 0.0 -0.5 -1.0 -1.5 70 75 80 Residual 85 90 Actual 95 00 Fitted