Practice Questions

advertisement

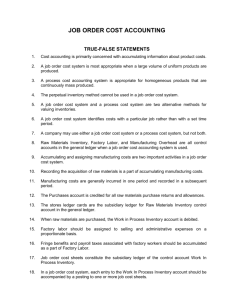

AMIS 212 Managerial Accounting This set of 20 questions, taken from prior examinations, covers topics in Chapters 1, 2, 3, and 4. The purpose of sample multiple choice questions is to acquaint you with the style and substance of typical exam questions over this material. Please be aware that: 1. multiple choice format questions are only one of many resources available to prepare for testing events – reading textbook chapters and working through chapter examples, studying the end-of-chapter review problem and accompanying solution, and reviewing assigned homework items and the published solutions may be more powerful methods to increase your understanding of the topics covered in the course. 2. the exam questions used this quarter will be similar but different from these example questions – understanding the main concepts in each chapter is critical to success on the testing events; remembering a sample question may be of some help but the format of a question on the same topic often differs rendering memory a distant second choice to understanding. The Questions: 6. Scheney Company uses the weighted-average method in its process costing system. The company's work in process inventory on March 31 consisted of 20,000 units. The units in the ending work in process inventory were 100% complete with respect to materials and 70% complete with respect to labor and overhead. If the cost per equivalent unit for March was $2.50 for materials and $4.75 for labor and overhead, the total cost in the March 31 work in process inventory was: A) $101,500. B) $116,500. C) $78,500. Exam #1 D) $145,000. Practice Questions Page 1 AMIS 212 Managerial Accounting Use the following to answer questions 8-10: Lund Company applies manufacturing overhead to jobs using a predetermined overhead rate of 75% of direct labor cost. Any under- or overapplied overhead cost is closed out to Cost of Goods Sold at the end of the month. During March, the following transactions were recorded by the company: Raw materials (all direct materials): Purchased during the month ...................................... Used in production .................................................... $27,000 $28,000 Labor: Direct labor hours worked during the month ............ Direct labor cost incurred .......................................... Indirect labor cost incurred........................................ 2,500 $20,000 $5,500 Manufacturing overhead costs incurred (total) ............... $17,000 Inventories: Raw materials (all direct) March 31 .......................... Work in process, March 1 ......................................... Work in process, March 31 ....................................... $7,500 $10,500 *$14,000 *contains $5,000 of direct labor cost 8. The balance on March 1 in the Raw Materials inventory account was: A) $6,500. B) $7,500. C) $9,500. D) $8,500. 9. The entry to dispose of the under- or overapplied overhead cost for the month would include: A) B) C) D) a credit of $2,000 to the Manufacturing Overhead account. a debit of $5,000 to the Manufacturing Overhead account. a credit of $2,000 to Cost of Goods Sold. a debit of $5,000 to the Cost of Goods Sold. 10. The Cost of Goods Manufactured for March was: A) $63,000. B) $61,500. C) $66,500. Exam #1 D) $59,500. Practice Questions Page 2 AMIS 212 Managerial Accounting Use the following to answer questions 11-14: Barker Corporation uses the weighted-average method in its process costing system. This month, the beginning inventory in the first processing department consisted of 300 units. The costs and percentage completion of these units in beginning inventory were: Percent Cost Complete 85% Materials costs ............. $7,400 55% Conversion costs .......... $4,900 A total of 9,100 units were started and 8,700 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month: Materials costs ........... Conversion costs ........ $240,300 $242,400 The ending inventory was 85% complete with respect to materials and 20% complete with respect to conversion costs. 11. The cost per equivalent unit for materials for the month in the first processing department is closest to: A) $25.56 B) $26.35 C) $25.85 D) $26.65 12. How many units are in ending work in process inventory in the first processing department at the end of the month? A) 700 B) 900 C) 400 D) 8,800 13. What are the equivalent units for conversion costs for the month in the first processing department? A) 8,840 B) 8,700 C) 9,400 D) 140 14. The total cost transferred from the first processing department to the next processing department during the month is closest to: A) $475,227 B) $495,000 C) $482,700 Exam #1 D) $513,466 Practice Questions Page 3 AMIS 212 Managerial Accounting 15. The property taxes on the factory building for a manufacturer would be an example of: Prime Cost A) B) C) D) Conversion Cost Yes No Yes No Yes No No Yes 16. Parsons Co. uses a predetermined overhead rate based on direct labor hours to apply manufacturing overhead to jobs. Last year Parsons incurred $250,000 in actual manufacturing overhead cost. The Manufacturing Overhead account showed that overhead was overapplied in the amount of $12,000 for the year. If the predetermined overhead rate was $8.00 per direct labor hour, how many hours were worked during the year? A) 29,750 hours B) 30,250 hours C) 31,250 hours D) 32,750 hours 17. In a job-order cost system, the application of manufacturing overhead usually would be recorded as a debit to: A) Finished Goods inventory. B) Cost of Goods Sold. C) Work in Process inventory. D) Manufacturing Overhead. Use the following to answer question 19: Cory Company produces refrigerators. Each refrigerator contains a small thermostat that costs $5. During June, 600 thermostats were drawn from the supply room and installed in refrigerators that were in the production process. Seventy percent of these units were completed and transferred into finished goods warehouses. Of the units completed, twenty percent were still unsold at the end of the month. There were no beginning inventories. 19. The cost of thermostats in work in process at the end of the month would be: A) $900. B) $2,400. C) $2,100. D) $3,000. 23. The process of ensuring that the plan is being followed is called: A) directing. B) decision making. C) controlling. D) planning. 24. In a job order cost system using predetermined manufacturing overhead rates, indirect materials issued into production usually are recorded as an increase in: A) Finished Goods inventory. B) Raw Materials inventory. C) Manufacturing Overhead. D) Work in Process inventory. 25. During the month of July, McElroy Company's direct labor cost totaled $36,000 and direct labor cost was 60% of prime cost. If total manufacturing costs during July were $85,000, the manufacturing overhead was: Exam #1 Practice Questions Page 4 AMIS 212 A) $24,000. Managerial Accounting B) $60,000. C) $25,000. D) $49,000. 26. Equivalent units for a process costing system using the weighted-average method would be equal to: A) units started during the period plus equivalent units in the ending work in process inventory. B) units completed during the period plus equivalent units in the ending work in process inventory. C) units completed during the period less equivalent units in the beginning inventory, plus equivalent units in the ending work in process inventory. D) units completed during the period and transferred out. 30. The Collins Company uses predetermined overhead rates to apply manufacturing overhead to jobs. The predetermined overhead rate is based on materials cost in Dept. A and on machine hours in Dept. B. At the beginning of the year, the company made the following estimates: Materials cost ..................... Manufacturing overhead ........ Direct labor hours................... Machine hours ........................ Dept A Dept B $65,000 $42,000 91,000 48,000 8,000 10,000 3,000 12,000 What predetermined overhead rates would be used in Dept A and Dept B, respectively? A) 140% and $4.80 B) 71% and $4.80 C) 71% and $4.00 D) 140% and $4.00 32. A company should use process costing, rather than job order costing, if: A) the product is composed of mass-produced homogeneous units. B) the product goes through several steps of production. C) production is only partially completed during the accounting period. D) the product is manufactured in batches only as orders are received. 34. Last month a manufacturing company had the following operating results: What was the cost of goods manufactured for the month? A) $492,000 B) $455,000 C) $429,000 D) $442,000 35. Stover Company uses the weighted-average method in its process costing system. Information concerning Department A for the month of June follows: Exam #1 Practice Questions Page 5 AMIS 212 Managerial Accounting Units 17,000 82,000 85,000 14,000 Work in process, beginning ....... Started in June ............................ Units completed ......................... Work in process, ending............. Materials Costs $12,800 69,700 Ending WIP is 100% complete as to materials and 60% complete as to conversion. The cost per equivalent unit for materials costs is closest to: A) $0.89. B) $0.97. C) $1.01. Exam #1 D) $0.83. Practice Questions Page 6 AMIS 212 Managerial Accounting The Answers: 6. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 19. 23. 24. 25. 26. 30. 32. 34. 35. B D A D D A A A D D C A C C C B D A C D Exam #1 Practice Questions Page 7