Calculator for Public-Private Investment Fund.

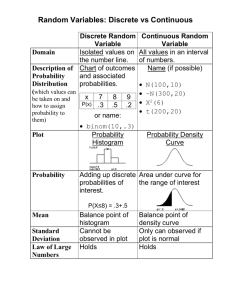

advertisement

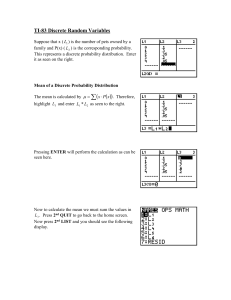

866 United Nations Plaza Suite 566 New York, NY 10017 Phone: +1 212 223 3552 Fax: +1 212 421 6608 info@egartech.com www.egartech.com MARK IOFFE Abstract. This article describes calculator for the Geithner public-private scheme to buy toxic assets. Principal problem for investor is to define whether it is good or bad investment, because nobody knows what assets are really worth because it depends on future events. We consider 2 stochastic models for future asset: discrete (Bernoulli) and continuous (log-normal). Using calculator we can calculate the value of P&L (Profit / Loss) for investor and FDIC (taxpayers) for different parameters values. Calculator for Public-Private Investment Fund. Enter the following variables: F-face value of pool residential mortgages ($ 100) L-leverage, debt-to equity ratio (6:1) = 7 S0-the highest bid from private sector k-percent that Treasure would provide (50%) Below, we will assume that k = 100%, since the impact of this magnitude is quite simple. S Thus, when the value of S0, the amount the investor would pay 0 , and FDIC pays the amount L S of S1 0 ( L 1) , which provides investors in the debt and that it should generally return. L In order to assess the value of P&L (Profit / Loss) for investor and FDIC (taxpayers), the only thing you need to know is the price of pool residential mortgages at the time of maturity S. Natural that it does not know anybody and everybody makes their judgments about this. We assume that this value is a random variable, which has the density distribution function p(S). Do not necessarily assume that the distribution is continuous, although the common sense assumption is more likely. In the case of a discrete distribution function p(S) will be described by using the Dirac function. At a known price S to find the value of P&L investor’s and FDIC’s simply. In the case where the S value of S exceeds the amount of debt S1 0 ( L 1) P&LI investor’s is L P & LIS S1 S S1 S0 S S0 L (1) In this case, it is clear that since we do not suppose the interest with which the FDIC provides debt, P&L FDIC is zero, ie New York 2010 1 866 United Nations Plaza Suite 566 New York, NY 10017 Phone: +1 212 223 3552 Fax: +1 212 421 6608 info@egartech.com www.egartech.com P & LFDIC S S1 0 (2) S0 ( L 1) , the investor will be able L to default, that is to lose the entire amount paid, and P&L investor’s is If the value of S does not exceed the amount of the debt S1 P & LIS S1 S0 L (3) Regarding the FDIC, then P&LFDIC in this case is equal to the remaining value of asset minus initial payment, i.e, P & LFDIC S S1 S S0 ( L 1) L (4) The average values of P&L investor’s and FDIC’s with known function p(S) can be calculated by the formula S E ( P & L ) ( s S 0 ) p( s )ds 0 L S1 I S1 E ( P & LFDIC ) ( s 0 S1 p(s)ds 0 S0 ( L 1)) p( s )ds L (5) Obviously, the integrals in formula (5) resemble the corresponding integrals used in the computation of Call and Put. The plan is therefore sometimes called "Geithner Put" Regarding mathematics, more precisely the arithmetic favored such large economists as Paul Krugman and Jeffrey Sachs. Interestingly, both authors consider the simplest discrete distribution, so-called Bernoulli distribution, there is a random variable that takes two different values with probabilities p1 and p2 = 1 - p1. Do Krugman p2 = p1 = 0.5, at Sachs p1 = 0.2, p2 = 0.8. In the general case Bernoulli distribution function p(s) equals p( s) p1 ( s A1 ) (1 p1 ) ( s A2 ) A1 A2 (6) Where (x) -Dirac function The constant A1 and A2 are equal: at Krugman A1 = 50, A2 = 150, at Saks A1 = 20, A2 = 100 From formulas (5) and (6) follows that for simple discrete distribution, provided that A1 <S1 <A2 the average values of P&L FDIC’s and the investor’s is: New York 2010 2 866 United Nations Plaza Suite 566 New York, NY 10017 Phone: +1 212 223 3552 Fax: +1 212 421 6608 info@egartech.com www.egartech.com E ( P & LI ) ( A2 S 0 ) p 2 E ( P & LFDIC ) ( A1 S0 p1 L S0 ( L 1)) p1 L (7) Since the value of P&L are random, in addition to their average values is meaningful to compute standard deviation, which characterize the volatility. Respective values of variance for a discrete distribution can be calculated by the formulas L 1 2 2 ( P & LI ) ( A2 S 0 ) p1 p 2 L S 2 ( P & LFDIC ) ( A1 0 ( L 1)) 2 p1 p 2 L (8) Let's call the above model Krugman-Sachs model. Input data to the model are: A1, A2, p1, S0, and L. Outputs are the average , standard deviation and break-even value. Break-even value can be calculated from equation E ( P & LI ) ( A2 S 0 ) p 2 S0 p1 0 L (9) Apparently, discrete above described model is not sufficiently realistic and adequately describes the future value of Asset. A more realistic model is presented with a continuous distribution, which will choose a log-normal distribution. This model is appropriate to name the model BlackSholes. Unlike discrete distribution, discussed above, which is determined by three parameters: A1, A2, p1, this distribution depends on two parameters: average value and standard deviation. Assume that the average value of the log-normal distribution, equal to E0, and the standard deviation equals to σ. Thus, the random variable S is S e 1 N (ln(E0 ) 2 , ) 2 (10) where 1 N ( Ln( E 0 ) 2 , ) -normal, gauss variant with density of distribution pG(s) : 2 pG ( s) 1 2 s e 1 2 2 1 ( Ln ( s ) Ln ( E0 ) 2 ) 2 2 New York 2010 3 866 United Nations Plaza Suite 566 New York, NY 10017 Phone: +1 212 223 3552 Fax: +1 212 421 6608 info@egartech.com www.egartech.com (11) Average value and standard deviation of discrete variant equals: E ( S D ) p1 A1 p 2 A2 2 ( S D ) ( A1 A2 ) 2 p1 p 2 (12) Average value and standard deviation of log-normal variant equals E ( S C ) E0 2 ( S C ) E02 (e 1) 2 (13) With the known parameters of the discrete distribution the parameters of log-normal distribution can be calculated by the formulas: E0 E (S D ) Ln(1 2 (S D ) E 02 ) (14) In accordance with (5) the average values of P&L investor and FDIC in this case can be calculated by the formula: E ( P & LI ) ( s S 0 ) pG ( s)ds S1 S1 E ( P & LFDIC ) ( s 0 S0 L S1 p G ( s )ds 0 S0 ( L 1)) pG ( s )ds L (15) Consider the indefinite integral (a, b, , , s) (as b) 1 2 s e 1 2 2 ( Ln ( s ) ) 2 ds (16) New York 2010 4 866 United Nations Plaza Suite 566 New York, NY 10017 Phone: +1 212 223 3552 Fax: +1 212 421 6608 info@egartech.com www.egartech.com It is easy to see that this integral equals (a, b, , , s ) ae Ln( s ) u Lp (u ) 1 2 u e 1 2 2 1 x2 2 Lp (u ) bLp (u ) dx (17) Using (a, b, , , s) the average values of P&L FDIC and the investor can be calculated by the formulas: 1 1 E ( P & LI ) (1, S 0 , Ln( E 0 ) 2 , , ) (1, S 0 , Ln( E0 ) 2 , , S1 ) 2 2 S0 1 1 ( (0,1, Ln( E 0 ) 2 , , S1 ) (0,1, Ln( E0 ) 2 , ,0)) L 2 2 S S 1 1 E ( P & LFDIC ) (1, 0 ( L 1), Ln( E0 ) 2 , , S1 ) (1, 0 ( L 1), Ln( E 0 ) 2 , ,0) L 2 L 2 1 2 (1, S 0 , Ln( E0 ) , , ) E0 2 S0 1 (1, ( L 1), Ln( E0 ) 2 , ,0) 0 L 2 (18) Break-even value can be calculated from equation E ( P & LI ) 0 This equation must be solved on the value of S0. In contrast to the discrete model discussed above, where it was necessary to solve a linear equation, in this case the equation is nonlinear, and it can be solved only numerically. We used the method of half division. Considered above models were implemented in the attached spreadsheet. The spreadsheet allows an investor to analyze various scenarios and the characteristics associated with the Geithner plan. New York 2010 5