Breakeven Analysis

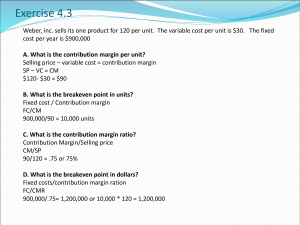

advertisement

KHSS/ AL/ PA/ Costing (VI) Breakeven Analy./Oct03 Costing (VI) Breakeven Analysis Part I : Background 1.1 Definition of Breakeven Analysis Breakeven analysis is also known as cost-volume-profit analysis. It is the study of the relationship between selling prices, sales volumes, fixed costs, variable costs and profits at various levels of activity. 1.2 Application of breakeven analysis Breakeven analysis can be used to determine a company’s breakeven point (BEP). Breakeven point is a level of activity at which the total revenue is equal to the total costs. At this level, the company makes no profit. With reference to the breakeven point, the managers can set their sales goals and target profits. 1.3 Assumption of breakeven analysis The model of breakeven analysis is developed on the following assumptions: Relevance range—It is assumed that a company is operating within a relevant range. The relevant range is the range of an activity over which the fixed cost will remain fixed in total and the variable cost per unit will remain constant. Fixed costs—Total fixed costs are assumed to be constant in total. Fixed costs per unit will decrease with the increasing number of units produced. Variable costs—Variable costs per unit are assumed to be constant. Total variable costs will increase with the increasing number of units produced. Sales revenue ---Sales revenue per unit is assumed to be constant and the total revenue will increase with the increasing number of units produced. These assumptions are illustrated in the following diagrams: Costs ($) Total Costs Variable costs Fixed costs Sales (Units) Total cost/ Revenue ($) Sales Revenue Profit Total costs Sales (units) BEP 687289642/ P.1 out of 4 KHSS/ AL/ PA/ Costing (VI) Breakeven Analy./Oct03 Part II : Breakeven Analysis 2.1 Breakeven point Breakeven point is the level of activity at which the company makes neither profit nor loss. It is also the activity level at which the total contribution is equal to the total fixed costs. Contribution is defined as the excess of sales revenue over the variable costs. The following diagram illustrates the definition of contribution. Profit Sales revenue Contribution Fixed costs Variable costs Formulas for breakeven analysis. Breakeven point in units = Fixed costs / Contribution per unit Breakeven point in units = Contribution required to break even Contribution per unit Sales revenue at breakeven point = Contribution required to break even Contribution per unit X Selling price Sales revenue at breakeven point = Contribution required to break even Contribution to sales ratio 2.2 Example 1 Selling price per unit-- $12 Variable cost per unit -- $3 Fixed costs-- $45,000 You are required to compute the breakeven point. Breakeven point in units = Fixed costs / Contribution per unit = Sales revenue at breakeven point = 687289642/ P.2 out of 4 KHSS/ AL/ PA/ Costing (VI) Breakeven Analy./Oct03 Alternative method Contribution to sales ratio = Sales revenue at breakeven point = Contribution required to break even Contribution to sales ratio = Breakeven point units = 2.3 Target Profit No. of units at target profit = Fixed costs + Target Contribution per unit Profit 2.3.1 Example 2 Selling price per unit --$12 Variable cost per unit -- $3 Fixed costs-- $45,000 Target profit-- $18,000 You are required to compute the sales volume required to achieve the target profit. Fixed costs + Target Profit No. of units at target profit = Contribution per unit Required sales revenue = Alternative method Required sales revenue = Fixed costs+target profit/Contribution to sales ratio = Units sold at target profit = 2.4 Margin of safety Margin of safety is a measure of amount by which the sales may decrease before a company suffers a loss. This can be expressed as a number of units or a percentage of sales. 2.4.1 Example 3 The breakeven sales level is at 5,000 units. The company sets the target profit at $18,000 and the budgeted sales level at 7,000 units. You are required to calculate the margin of safety in units and express it as a percentage of the budgeted sales revenue. Margin of safety = Budgeted sales level – breakeven sales level = 687289642/ P.3 out of 4 KHSS/ AL/ PA/ Costing (VI) Breakeven Analy./Oct03 Margin of safety = The margin of safety indicates that the actual sales can ______________units or __________ from the budgeted level before losses are incurred. 2.5 Changes in components of breakeven analysis The following example demonstrates the effects of the changes in different components of breakeven analysis. 2.5.1 Example 4 Selling price per unit --$12 Variable cost per unit --$3 Fixed costs-- $45,000 Current profit-- $18,000 If the change in selling price is raised from $12 to $13, the minimum volume of sales required to maintain the current profit will be: (Fixed costs + Current profit) / Contribution per unit = If the fixed costs fall by $5,000 but the variable costs rise to $4 per unit, the minimum volume of sales required to maintain the current profit will be: (Fixed cost + Current profit)/ Contribution per unit = 2.6 Limitations of breakeven analysis Breakeven analysis assumes that fixed costs, variable costs and sales revenue behave in a linear manner. However, some overhead costs may be stepped in nature rather than remain constant. The previously straight sales revenue line and total cost line tend to curve beyond a certain level of production. As a result, a lower selling price is set to stimulate further sales and lower variable costs can be obtained due to mass production. It is assumed that all production is sold. The breakeven chart does not take the changes in stock level into account. Breakeven analysis can provide vital information for small and relatively simple companies that produce large volume of the same product. It is not so useful for the companies producing multiple products. Its applications tend to be limited especially in those jobbing companies where each item produced is different. Homework Exercises: Q.35-6A, Q.35-8A, Q.35-9A, Q.35-11A, Q.35-12A, Q.35-13A, Q35-14A, Q.35-16A, Q.35-17A Classwork Exercises: Q.35-5, Q.35-7, Q.35-10, Q.35-15, Q.35-18 687289642/ P.4 out of 4