unit 2 revision slides

advertisement

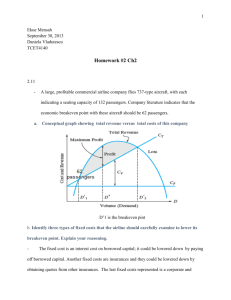

Hairdressing Unit 2- Revision Please watch this video Write down all the costs you can think of when running a barber shop. http://barberconnect.co.uk (video on homepage) What is a cost? http://www.salonsdirect.com What is a cost? TASK- Imagine a new Hairdressers is going to open in Wickford • Electricity bills • Shelving and shop fittings, • Staff wages • Cleaning materials, • A sign for the shop • Hairdryers • Clippers • Gel . Please list the start-up costs and Running costs this hairdresser may have. Start-up costs Running costs What is Revenue? Discuss; What ways do Hairdressers earn revenue? What items do they sell? Which of the below is revenue for a Hairdresser? Staff wages Advertising Cutting clients hair Task- Are the items fixed or variable costs? Rent Electricity Item Razor Blades Shampoo Shampoo Barber Chairs Staff wages Razor Blades Staff wages Fixed Costs (Does not changed Variable Costs (Changes based based on how you produce) Rent Barber Chairs on how much you produce) Task Super Cutz various clients hair in their shops. Below are the estimated monthly costs if they cut 400 clients hair. Total fixed costs = £100,000 Variable costs = £1 per haircut a) Work out the fixed costs, variable costs and total costs below 400 clients Variable Costs Fixed Costs Total Costs £ £ £ TASK- Supercutz cut clients hair through a walk in service. The price of a haircut £12. The business has cut 850 clients hair last month. Work out the total revenue Supercutz receive from cutting hair? Type in your answer in the box £ Show your workings TASK- Give the correct formula for calculating profit. Please drag and drop the correct items into the formula. Revenue Fixed Costs Profit Number of Sales Expenditure Inflows Variable Costs Match the keywords to the definitions Total costs = Revenue = Profit = revenue – expenditure Payments number of sales x price per unit receipts Gross profit = gross profit – expenditure Cash inflows are often called… Cash outflows are often called… Net profit = fixed costs + variable costs revenue – cost of sales TASK – complete the Profit and Loss account below. This is based on Supercutz in Basildon Revenue is £10,000 per month from cutting hair and selling hair products Cost of sales (directly linked to cutting hair) is £1000 per month Income from Sales Cost of Sales Gross Profit Salaries are £2,500 per month Rent is £2,400 per month Expenses Salaries Rent Net Profit COSTS REVENUES £ £ What is the difference between Gross Profit and Net Profit? Identify two ways Hairdresser can improve its Net Profit in 2012? Please type your answers What is breakeven? Add the items onto the graph correctly Label the diagram below. Drag and drop all items. Please put the on the breakeven point Loss Fixed Costs Profit Variable costs Margin of safety Total Revenue Add the items onto the graph correctly Label the diagram below. Drag and drop all items. Please put Total Revenue the on the breakeven point Profit Loss Margin of safety Task- How many units do I need to sell to breakeven? Variable costs Fixed Costs Add the items onto the graph correctly Label the diagram below. Drag and drop all items. Please put Total Revenue the on the breakeven point Profit Loss Margin of safety TASK-What is the total revenue if the business sells 1000 units? Variable costs Fixed Costs Task How many Haircuts would Supercutz need to cut to breakeven? (cover costs) £ Selling Price £10 Variable cost per Unit 50p Fixed Costs £100,000 Type your answer in the box Why is it important for Supercutz to know their Break-even point? Breakeven is important because Importance of Breakeven analysis to business when planning success It is needed to identify and track costs (both fixed and variable costs) It is needed to highlight • It can help businesses the margin of safety identify where they can change their costs, for example, buying cheaper materials or finding a cheaper supplier CASHFLOW FORECASTING TASK-Which of the items above are cash inflows? Please drag and drop them below Electricity bill Monthly rent Haircuts Staff wages L'Oreal shampoo sales Telephone bill Share Capital Which of the items above are cash inflows? Please drag and drop them below Please work complete the cashflow table below 2012. 2013 January (£) February (£) March (£) Total Receipts 120,000 125,000 115,000 130,000 50,000 Total Payments 90,000 Net inflow/outfl ow Receiptspayments 30,000 Opening Balance 150,000 Closing balance of January 180,000 Closing Balance 180,000 Add net cashflow to your closing balance) BUDGETING Why is it important that a hairdresser budgets? Considers its …. What items could a hairdresser own? (Asset) Own (ASSET) for a short amount of time? (current asset) Own for a short long amount of time? (Long term liabilities) Who could a hairdresser owe money to? (Liability) Own for a short amount of time? Own for a short long amount of time? Balance sheet What items could a Barber own? ASSETS LIABILITIES - What the business OWNS to others including current liabilities and long term liabilities -What the business OWES to others including current liabilities and long term liabilities Balance sheet ADD in TASK