Heuristics and Biases Exercises

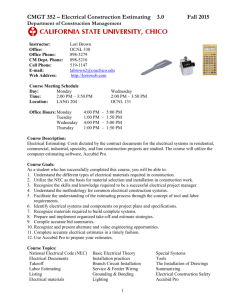

advertisement

Exercises (1) Identify the heuristics that decision-makers might use in making estimates in the situations listed below. Explain how biases might emanate from the use of these heuristics. (a) Members of an interview panel making estimates of the probability that a candidate would be a successful appointment. (b) A marketing manager of a company manufacturing computer peripherals making a forecast of the number of new orders that will be obtained next month. (c) A sales executive estimating the correlation between the sales of a product and advertising expenditure (d) A manager of an international construction company making an estimate of the risk of civil unrest in a country which was formerly part of the Soviet Union and where the company is considering making investments. (e) A company doctor estimating the degree of association between the exposure/non-exposure of workers to a chemical pollutant and the incidence of a particular respiratory illness among these workers. (f) The manager of a manufacturing company estimating the relative probability of (i) a strike at the company's Pittsburgh plant in the next year and (ii) the company experiencing a long-term loss of market share following a strike over pay at its Pittsburgh plant in the next year. (2) The employees of a leading mail-order computer software company are secretly thinking of breaking away to form their own rival company. This would require an investment of $3 million and the employees will make the decision largely on the basis of the net present value of this investment. To help them with their decision a risk analysis model has been formulated. Development of the model involved estimating a large number of probabilities including those set out below. Discuss the heuristics that the employees might have employed to estimate these probabilities and any biases which might have emanated from the use of these heuristics. (a) probability distributions for the size of the market (measured in total turnover) for each of the next five years — following the recent launch of a major new international software product, the employees have experienced a buoyant market over the last few months; (b) probability distributions of the market share that could be obtained by the new company in each of the next five years these distributions were obtained by first estimating a most likely value and then determining optimistic and pessimistic values; (c) the probability that magazine advertising costs would increase over the next five years — this was considered to be less likely than an increase in advertising costs resulting from increased costs of paper and an associated fall in the number of computer magazines.