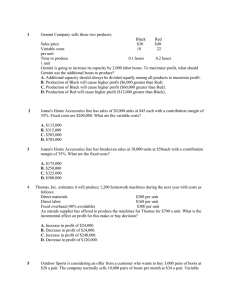

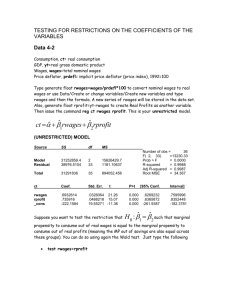

Unit Cost

advertisement

Chapter 3 Solutions 3-21 (a) (b) (c) (d) (e) (f) Manufacturing Selling Distribution General and administrative Manufacturing Research and development (g) (h) (i) (j) (k) (l) Marketing General and administrative Manufacturing General and administrative After-sales Selling 3-22 (a) (b) (c) (d) (e) (f) Indirect Direct Direct Indirect Direct Indirect* (g) (h) (i) (j) (k) (l) Indirect Indirect Direct Indirect Direct Indirect * This overtime premium is not paid for every unit of output. It is paid only for those units that are produced beyond the regular working hours. Even though it is paid to workers working with their hands in the production process, conventionally, this is treated as manufacturing support cost and not as direct labor cost. 3-23 (a) (b) (c) (d) (e) (f) Unit-related Batch-related Product-sustaining Business-sustaining Unit-related Batch-related (g) (h) (i) (j) (k) (l) Product-sustaining Business-sustaining Unit- or batch-related Unit -or batch-related Business-sustaining Product-sustaining 3-28 Cost of fabric used in dresses Total direct material cost Wages of dressmakers Wages of dress designers Total Direct labor cost Wages of employee who repairs the shop's pattern machines Cost of electricity used in the pattern department Depreciation on pattern machines and sewing machines Cost of insurance for the production employees Rent for the building* Total manufacturing support cost Wages of sales personnel Rent for the building** Total selling costs Cost of new sign in front of retail shop Cost of advertisements Cost of hiring a plane and a pilot Total marketing costs Wages of designers who experiment Total R&D costs Salary of the owner's secretary Rent for the building*** Total general and administrative costs Total costs: Cost classification Direct material cost $60,000 $60,000 Direct labor cost Direct labor cost $5,000 $4,000 $9,000 Manufacturing support $2,000 Manufacturing support Manufacturing support 200 Manufacturing support Manufacturing support 10,000 2,000 3,000 $17,200 Selling costs Selling costs $ 1,000 1,500 $2,500 Marketing costs $ 400 Marketing costs Marketing costs 800 1,400 $2,600 R&D costs $3,000 General & Administrative costs General & Administrative costs $1,200 $3,000 1,500 $2,700 $97,000 * Since, only one floor (out of the two available floors) is used for manufacturing, consider 1/2 of $6000 (i.e. $3,000) as rent for housing production related activities. ** Since, one half of the first floor is used (which amounts to 1/4 of the building), take 1/4($6,000) = $1,500 as selling cost *** Using the same logic as above, since 1/4 of the building is used for administration, administration portion of the rent is $1,500 b) Unit related costs Cost of fabric + Wages of dress makers + wages of dress designers = $60,000+5000+4000= $ 69,000 (Since the design is custom (according to the data in the problem), I am treating it as unit related activity) Batch related costs Wages of sales personnel = $1,000 Product sustaining costs Cost of electricity in pattern dept. + wages of designers experimenting with new designs = $200+$3000 = $3,200 Business sustaining costs include all other costs not listed above = $ 23,800 Problems outside the textbook 1. Understanding manufacturing and selling costs Osborne Company’s monthly budget includes fixed manufacturing overhead costs of $72,000 and fixed selling costs of $48,000. Management expects that each month the company will produce and sell 12,000 calculators, the firm’s only product. Estimated unit costs are as follows: Cost Item Direct materials Direct labor Variable manufacturing support Fixed manufacturing support Variable selling Fixed selling Unit Cost $32 20 15 6 3 4 Compute the following amounts: 1. Estimated conversion cost per unit. 2. Estimated prime cost per unit. 3. Estimated variable cost per unit. 4. Estimated total cost of operations when the firm plans to produce 12,000 units and sell 12,000 units. 1. Conversion cost per unit = direct labor + total manufacturing overhead per unit = $20 + $15 + $6 = $41 per unit = $52 per unit 2. Prime cost per unit = direct material + direct labor = $32 + $20 3. Total variable cost per unit = direct material + direct labor + variable manufacturing support + variable selling cost = 4. $32 + $20 + $15 + $3 = $70 per unit Total cost for 12,000 units of production and 12,000 units of sales are determined as follows: Direct Material (12,000 units × $32) Direct Labor (12,000 units × $20) $384,000 240,000 Manufacturing Support: Variable (12,000 units × $15) Fixed 180,000 72,000 Selling costs: Variable Fixed Total (12,000 units × $3) 36,000 48,000 $960,000 2. Learning to estimate future support costs: XYZ Company has estimated the following relationship between its manufacturing support cost and the drivers influencing the support cost. Support cost = $100 (number of setups) + $2,000 (number of products) + $15 (number of direct labor hours) + $ 25(number of machine hours). The expected activity levels for the months of September and October follow: September October Number of setups Number of products 100 140 3 4 Number of direct labor hours 2000 3000 Number of machine hours 4000 5500 Estimate the manufacturing support cost for September and October: Estimated cost for September = $100 (100) + $2,000 (3) + $15 (2000) + $25 (4000) = $10,000 + $6,000 + $ 30,000 + $ 100,000 = $ 146,000 Estimated cost for October = $ 100 (140) + $2,000 (4) + $15 (3,000) + $25 (5,500) = $ 14,000 + $8,000 + $ 45,000 + $ 137,500 = $ 204,500