Handout 1 - CA Sri Lanka

advertisement

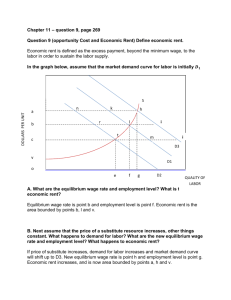

Class 3 Factor Markets refers to the markets where services of the factors of production are bought and sold Labor Markets Capital Markets The markets for raw materials The market for management and entrepreneurial resources. The demand for and supply of factors Rent Wages Interest Economic profit The demand for a factor is derived (Indirect) There is demand for land because there is demand for rice. The supply of factors of production Depends on the system of property rights The toil trouble involved in the work (Depends on the leisure preference) In the free market (no government intervention and trade union pressure) the price of the factors of production are dependent on supply and demand. Output determination commodity pricing Income distribution factor pricing Two types of income distribution Functional distribution of income (Micro) Personal distribution of income (Macro) Each factor is paid on the basis of the function performed by it. Land owners – Rent Workers – Wage Suppliers of financial capital – interest Entrepreneurs – profit. Two main theories of factor price determination Supply Demand Theory The marginal productivity theory of factor demand When wages increase Labor increases This suggests that an individual firm pays a factor on the basis of its Marginal product MR = MC However, there are other factors. A rupee spent on labor cannot be spent on capital Therefore firms have to choose their best option. This it the law of EQUI-MARGINAL RETURN Commercial Rent – Payment for the use of property Economic Rent – Is the reward for the uses of the services of the land. The Supply of the land is perfectly inelastic because the quantity available is fixed and determined by nature. Supply has no influence in the determining of rent. Demand is the only determinant of rent Perfectly inelastic – so as demand increases/decreases rent will increase/decrease. Economic Rent offers no incentive system. Since Land is a gift of nature , any payment received by the owner is called PURE or ECONOMIC RENT Labor Unions try to increase wages in 3 ways They try to increase the demand for labor by increasing productivity By advertising union made products By lobbying for the restriction of imports Increase wage by restricting the supply of labor High initiation fees Long apprenticeships Require that firms higher only union workers. Increase wages by bargaining with employees Threats of strikes Go slow campaigns. The wage rate refers to the earning per hour of labor. The wage rate divide by the price index gives the “Real Wage Rate” The level of real wages depends on the productivity of labor Real wages are higher The greater the amount of capital available (hedge fund managers) The more technology available (scientists) The availability of natural resources (oil) By adding each firms demand for labor we get the Market demand for labor The market supply for labor depends on the Size of the population The proportion of the population in the labor force The state of the economy The level of real wages Competitive equilibrium real wage rate is determined by the intersection of the market demand and supply curves. Then the firm hires labor until the MR = the wage rate You give me Rs 2000 today and in a year I will give you Rs 500 as interest and the original Rs.2000 (500/2000)*100 = 25% Bank interest is 8% So my economic profit is (25-8) = 17% Banks sets Savings rates and Borrowing rates – and the bank keeps the difference as revenue. Rate of Interest = Interest *100 Principal Profit is a return on entrepreneurial ability or a reward for risk taking. Economic role of profits Profits as a signal to a resource owner Profits are economics signals letting people know to enter markets or in cases of losses to leave markets. Profits are motive for efficiency Gives incentive to firms to reduce cost Profits as reward The prospect of earning rewards are the driving force behind development Innovation Profit is the prime mover of capitalistic economies.