Text - McGraw Hill Higher Education

advertisement

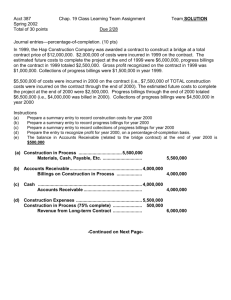

EXERCISES Exercise 5-1 Installment sales; alternative recognition methods LO5-1 LO5-3 On June 1, 2013, the Luttman and Dowd Company sold inventory to the Ushman Corporation for $400,000. Terms of the sale called for a down payment of $100,000 and four annual installments of $75,000 due on each June 1, beginning June 1, 2014. Each installment also will include interest on the unpaid balance applying an appropriate interest rate. The inventory cost Foster $150,000. The company uses the perpetual inventory system. Required: 1. Compute the amount of gross profit to be recognized from the installment sale in 2013, 2014, 2015, 2016, and 2017 using point of delivery revenue recognition. Ignore interest charges. 2. Repeat requirement 1 applying the installment sales method. 3. Repeat requirement 1 applying the cost recovery method. Exercise 5-2 Construction accounting; percentage-ofcompletion and completed contract methods LO5-5 The Ugenti Construction Company contracted to construct a warehouse building for $2,600,000. Construction began in 2013 and was completed in 2014. Data relating to the contract are summarized below: 2013 2014 Costs incurred during the year ................. $ 360,000 $1,650,000 Estimated costs to complete as of 12/31 .. 1,560,000 Billings during the year ........................... 430,000 2,170,000 Cash collections during the year .............. 320,000 2,280,000 Required: 1. Compute the amount of gross profit or loss to be recognized in 2013 and 2014 using the percentage-of-completion method. 2. Compute the amount of gross profit or loss to be recognized in 2013 and 2014 using the completed contract method. 3. Prepare a partial balance sheet to show how the information related to this contract would be presented at the end of 2013 using the percentage-of completion method. 4. Prepare a partial balance sheet to show how the information related to this contract would be presented at the end of 2013 using the completed contract method. Alternate Exercises and Problems © The McGraw-Hill Companies, Inc., 2013 5-1 Exercise 5-3 Percentage-ofcompletion method; loss projected on entire project LO5-5 On April 13, 2013, the Pagano Construction Company entered into a threeyear construction contract to build a mall for a price of $12,000,000. During 2013, costs of $3,000,000 were incurred with estimated costs of $6,000,000 yet to be incurred. Billings of $3,800,000 were sent and cash collected was $3,250,000. In 2014, costs incurred were $4,000,000 with remaining costs estimated to be $5,600,000. 2014 billings were $3,500,000 and $3,600,000 cash was collected. The project was completed in 2015 after additional costs of $5,800,000 were incurred. The company’s fiscal year-end is December 31. Arrow uses the percentage-of-completion method. Required: 1. Calculate the amount of gross profit or loss to be recognized in each of the three years. 2. Prepare journal entries for 2013 and 2014 to record the transactions described (credit “Various accounts” for construction costs incurred). 3. Prepare a partial balance sheet to show the presentation of the project as of December 31, 2013 and 2014. Exercise 5-4 Franchise sales; revenue recognition LO5-6 On November 15, 2013, the Coldstone Ice Cream Company entered into a franchise agreement with an individual. In exchange for an initial franchise fee of $25,000, Coldstone will provide initial services to the franchisee to include assistance in design and construction of the building, help in training employees, help in obtaining financing, and management advice over the first five years of the ten-year franchise agreement. 50% of the initial franchise fee is payable on November 15, 2013, with the remaining $12,500 payable in five equal annual installments beginning on November 15, 2014. These installments will include interest at an appropriate rate. The franchise opened for business on February 15, 2014. Required: Assume that the initial services to be performed by Coldstone subsequent to November 15, 2013, are substantial and that collectibility of the installment receivable is reasonably certain. Substantial performance of the initial services is deemed to have occurred when the franchise opened. Prepare the necessary journal entries for the following dates (ignoring interest charges): 1. November 15, 2013, and 2. February 15, 2014. © The McGraw-Hill Companies, Inc., 2013 5-2 Intermediate Accounting, 7/e Exercise 5-5 Evaluating efficiency of asset management The year 2013 income statement of Garret & Sons Music Company reported net sales of $10 million, cost of goods sold of $6 million, and net income of $1 million. The following table shows the company's comparative balance sheets for 2013 and 2012: LO5-7 ($ in 000s) Assets: Cash............................................................... Accounts receivable ...................................... Inventory ....................................................... Property, plant, and equipment (net) ............. Total assets ............................................... Liabilities and Shareholders’ Equity: Current liabilities .......................................... Notes payable ................................................ Paid-in capital ............................................... Retained earnings .......................................... Total liabilities and shareholders equity ... 2013 $ 240 800 850 2,600 $4,490 2012 $ 280 600 700 2,520 $4,100 $ 720 600 2,000 1,170 $4,490 $ 650 1,000 2,000 450 $4,100 Some industry averages for the company’s line of business are: _______________________________________ inventory turnover 6 times average collection period 28 days asset turnover 2 times _______________________________________ Required: Assess Garret & Son's asset management relative to its industry. Alternate Exercises and Problems © The McGraw-Hill Companies, Inc., 2013 5-3 Exercise 5-6 Profitability ratios The following condensed information Manufacturing, Inc. for 2013 and 2012: was reported by Sanders ($ in 000s) LO5-7 Income statement information: Net sales Net income Balance Sheet information: Current assets ........................................... Property, plant, and equipment (net) ........ Total assets ............................................ Current liabilities ..................................... Long-term liabilities ................................. Paid-in capital .......................................... Retained earnings ..................................... Liabilities and shareholders’ equity ...... 2013 2012 $7,200 360 $6,800 408 $ 800 2,100 $2,900 $ 250 950 1,000 700 $2,900 $ 750 1,950 $2,700 $ 400 750 1,000 550 $2,700 Required: 1. Determine the following ratios for 2013: a. profit margin on sales b. return on assets c. return on shareholders’ equity 2. Calculate the DuPont framework for Sanders for 2013. 3. Determine the amount of dividends paid to shareholders during 2013. © The McGraw-Hill Companies, Inc., 2013 5-4 Intermediate Accounting, 7/e Exercise 5-7 Uncertain consideration Addendum Mohan Consultants provided Fisher Construction with assistance with implementing various cost-savings initiatives. Mohan’s contract specifies that it will receive a flat rate of $30,000 and an additional $10,000 if Fisher reaches a pre-specified target amount of cost savings. Mohan estimates that there is a 35% chance that Fisher will achieve the cost savings target. Mohan accounts for this arrangement under the ASU. Required: 1. Assuming Mohan uses a probability-weighted transaction price, calculate the amount of the transaction price. 2. Assuming Mohan uses the most likely value as the transaction price, calculate the amount of the transaction price. 3. Assuming Mohan is trying to apply the revenue recognition rules most appropriately, do you think the company is more likely to use the probabilityweighted amount or the most likely value? Briefly explain your answer. 4. Assume that Mohan provides a plan for Fisher, but Fisher is responsible for implementing it. Also assume that Mohan delivers the plan in the first quarter of the year, but Fisher will be implementing the plan and determining total cost savings over the entire year. Should Mohan recognize the entire transaction price when it delivers the plan? Briefly explain your reasoning. Alternate Exercises and Problems © The McGraw-Hill Companies, Inc., 2013 5-5 PROBLEMS Problem 5-1 Installment sales; alternative recognition methods LO5-1 LO5-3 On October 31, 2013, the Dionne Company sold merchandise to the Parker Corporation for $800,000. Terms of the sale called for a down payment of $200,000 and three annual installments of $200,000 due on each October 31, beginning October 31, 2014. Each installment also will include interest on the unpaid balance applying an appropriate interest rate. The book value of the merchandise on Dionne’s books on the date of sale was $400,000. The perpetual inventory system is used. The company’s fiscal year end is December 31. Required: 1. Prepare a table showing the amount of gross profit to be recognized in each of the four years of the installment sale applying each of the following methods: a. Point of delivery revenue recognition. b. Installment sales method. c. Cost recovery method. 2. Prepare journal entries for each of the four years applying the three revenue recognition methods listed in requirement 1. Ignore interest charges. 3. Prepare a partial balance sheet as of the end of 2013 and 2014 listing the items related to the installment sale applying each of the three methods listed in requirement 1. © The McGraw-Hill Companies, Inc., 2013 5-6 Intermediate Accounting, 7/e Problem 5-2 Percentage-ofcompletion method In the year 2013, the Malinkrodt Construction Company entered into a contract to construct a road for Dade County for $15,000,000. The road was completed in 2015. Information related to the contract is as follows: LO5-5 2013 2014 2015 Costs incurred during the year ............ $4,000,000 $4,800,000 $4,200,000 Estimated costs to complete as of year-end .......................................... 8,000,000 4,000,000 Billings during the year ...................... 3,500,000 5,000,000 6,500,000 Cash collections during the year ......... 2,800,000 5,600,000 6,600,000 Malinkrodt uses the percentage-of-completion method of accounting for long-term construction contracts. Required: 1. Calculate the amount of gross profit to be recognized in each of the three years. 2. Prepare all necessary journal entries for each of the years (credit “Various accounts” for construction costs incurred). 3. Prepare a partial balance sheet for 2013 and 2014 showing any items related to the contract. 4. Calculate the amount of gross profit to be recognized in each of the three years assuming the following costs incurred and costs to complete information: 2013 2014 2015 Costs incurred during the year ............ $4,000,000 $4,200,000 $7,200,000 Estimated costs to complete as of year-end .......................................... 8,000,000 7,100,000 - Alternate Exercises and Problems © The McGraw-Hill Companies, Inc., 2013 5-7 P 5–3 Upfront fees, separate performance obligations Addendum Skinny Zone is a health club that offers members various gym services. SZ accounts reports under the ASU. Required: 1. Assume SZ offers a deal whereby enrolling in a new membership also entitles the member to receive a voucher redeemable for 35 percent off a year’s worth of premium yoga classes. A new membership costs $500, and a year’s worth of premium yoga costs an additional $400. SZ estimates that approximately 25 percent of the vouchers will be redeemed. SZ offers a 15 percent discount on all courses as part of its seasonal promotion strategy. a. Identify the distinct performance obligations in the new member deal. b. Allocate the contract price to the distinct performance obligations. c. Prepare the journal entry to recognize revenue for the sale of a new membership. Clearly identify revenue or unearned revenue associated with each distinct performance obligation. 2. Assume SZ offers a “Slimzone” coupon book with 40 pre-paid visits over the next year. SZ has learned that Slimzone purchasers make an average of 30 visits before the coupon book expires. A customer purchases a Slimzone book by paying $400 in advance, and for any additional visit over 40 during the year after the book is purchased, the customer can pay a $12 fee visitation fee. Depending on the season, SZ typically charges between $10 and $14 to non-members who wish to work out on a single day. a. Identify the distinct performance obligations in the Slimzone member deal. b. Allocate the contract price to the distinct performance obligations. c. Prepare the journal entry to recognize revenue for the sale of a new Slimzone book. When will SZ recognize revenue associated with people using its Slimzone plans? © The McGraw-Hill Companies, Inc., 2013 5-8 Intermediate Accounting, 7/e