CHAPTER 12

advertisement

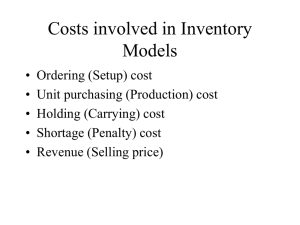

CHAPTER 12 DISCUSSION QUESTIONS 1. The advent of low-cost computing should not be seen as obviating the need for the ABC inventory classification scheme. Although the cost of computing has decreased considerably, the cost of data acquisition has not decreased in a similar fashion. Business organizations still have many items for which the cost of data acquisition for a “perpetual” inventory system is still considerably higher than the cost of the item. 2. The standard EOQ model assumes instantaneous delivery (delivery of the entire lot is made at one instant of time), whereas the Production Inventory Model assumes that delivery takes place at a constant rate over time. 3. Reasons for an organization to maintain inventory include: The decoupling function: inventory can be used to decouple stages in the production process within an organization inventory can be used to decouple the production process from instabilities or irregularities in supply of raw materials or labor inventory can be used to decouple the production process from unstable demand and thus (a) allow production scheduling to develop a “smoother” schedule, and (b) avoid shortages or stockouts Quantity discounts: inventory can be used to enable the organization to purchase goods in larger lot sizes and take advantage of quantity discounts A hedge against inflation: investing in inventory now assures one that the price will not increase 4. Costs that are associated with ordering and maintaining inventory include: Initial purchase cost of the item Holding cost (insurance, space, heat, light, security, warehouse personnel, etc.) Obsolescence or deterioration cost (particularly important in perishable goods or in a product that is undergoing rapid technological evolution) Ordering or setup cost (cost of forms, clerical processing, etc., or cost of machine setup) 5. The more important assumptions of the basic EOQ model are: Demand is known and constant over time. The lead time, that is, the time between the placement of the order and the receipt of the goods, is known and constant. The receipt of the inventory is instantaneous; i.e., the goods arrive in a single batch, at one instant in time. Chapter 12: Inventory Management 1 Quantity discounts are not possible. The only variable costs are the cost of setting up or placing an order and the cost of holding or storing inventory over time. If orders are placed at the right time, stockouts or shortages can be completely avoided. 6. The EOQ is relatively insensitive to small changes in demand or setup or carrying costs. If, for example, demand increases by 10%, EOQ will increase by approximately 5%. 9. A decrease in setup time decreases the cost per order, encourages more and smaller orders, and thus decreases the EOQ. 12. If per unit holding costs increase with increasing inventory, total inventory cost will increase; EOQ will decrease. 14. In a fixed-quantity inventory system, when the quantity on hand reaches the reorder point, an order is placed for the specified quantity. In a fixed-period inventory system, an order is placed at the end of the period. The quantity ordered is that needed to bring on-hand inventory up to a specified level. END-OF-CHAPTER PROBLEMS 12.2 He decides that the top 20% of the 10 items, based on a criterion of demand times cost per unit, should be A items. (In this example, the top 20% constitutes only 58% of the total inventory value, but in larger samples the value would probably approach 70% to 80%.) He therefore rates items F3 and G2 as A items. The next 30% of the items are A2, C7, and D1; they represent 23% of the value and are categorized as B items. The remaining 50% of the items (items B8, E9, H2, I5, and J8) represent 19% of the value and become C items. Item A2 B8 C7 D1 E9 F3 G2 H2 I5 J8 12.3 12.4 2 Annual Demand 3,000 4,000 1,500 6,000 1,000 500 300 600 1,750 2,500 Cost ($) 50 12 45 10 20 500 1,500 20 10 5 Item Annual Demand Cost ($) E102 800 4.00 D23 1,200 8.00 D27 700 3.00 R02 1,000 2.00 R19 200 8.00 S107 500 6.00 S123 1,200 1.00 U11 800 7.00 U23 1,500 1.00 V75 1,500 4.00 700 20 35 7,000 010 . 700 2450 60 40.83 7,000 0.35 2,450 Demand Cost 150,000 48,000 67,500 60,000 20,000 250,000 450,000 12,000 17,500 12,500 Classification B C B B C A A C C C Demand Cost Classification 3,200 C 9,600 A 2,100 C 2,000 C 1,600 C 3,000 C 1,200 C 5,600 B 1,500 C 6,000 B 35 A items per day 41 B items per day 27% 16% 33% 17% Instructor’s Solutions Manual t/a Operations Management 7,000 0.55 3850 , 3850 120 32 12.5 EOQ 2100062.50 500 units 0.50 12.6 EOQ 28,00045 600 units 2 12.7 300 35 C items per day 108 items 28,00045 720,000 90,000 H H 720,000 H $8 90,000 12.8 (a) Economic Order Quantity (Holding cost = $5 per year): 2 DS 2 400 40 80 units H 5 Q (b) where: D = period demand, S = setup or order cost, H = holding cost Economic Order Quantity (Holding cost = $6 per year): 2 DS 2 400 40 73 units H 6 Q where: D = period demand, S = setup or order cost, H = holding cost 12.9 (a) Economic Order Quantity: Q (b) (c) (d) 2 DS 2 1,500 150 100 units H 45 where: D = period demand, S = setup or order cost, H = holding cost QH 100 45 $2,250.00 Holding cost 2 2 DS 1500 150 Order cost $2,250.00 Q 100 Reorder point: 1,500 units day 6 days 30 units Reorder point = demand during lead time 300 , units 12.10 Reorder point = demand during lead time 100 units day 21 days 2100 12.11 Reorder point = demand during lead time 500 units day 14 days 7,000 units 12.12 (a) Economic Order Quantity: Q (b) 2 DS 2 4,000 25 1491 . or 149 valves H 010 . 90 where: D = period demand, S = setup or order cost, H = holding cost Average inventory 74.5 valves Chapter 12: Inventory Management 3 (c) (d) Demand 4,000 26.8 or 27 orders EOQ 149 Assuming 250 business days per year, the optimal number of business days between orders is given by: Number of orders per year Optimal number of days (e) Total annual inventory cost Order cost holding cost (f) 12.13 (a) (c) (d) DS QH 4,000 25 149 01 . 90 Q 2 149 2 67114 . 670.50 $1,34164 . Note: Order and carrying costs are not equal due to rounding of the EOQ to a whole number. Reorder point = demand during lead time 16 units day 5 days 80 valves Economic Order Quantity: Q (b) 2 DS 2 5,000 30 77.46 or 78 units H 50 where: D = period demand, S = setup or order cost, H = holding cost 78 Average inventory 39 units 2 Demand 5,000 Number of orders per year 641 . or 64 orders EOQ 78 Assuming 250 business days per year, the optimal number of business days between orders is given by: Optimal number of days (e) 250 3.91 days 64 Total cost order cost holding cost (f) 250 1 9 days 27 4 DS QH 5,000 30 78 50 Q 2 78 2 1,923.02 1,950 $3,873.08 Note: Order and carrying costs are not equal due to rounding of the EOQ to a whole number. If an EOQ of 77.46 is used, the order and carrying costs calculate to $1,936.49 for a total cost of $3,872.98. Reorder point: Reorder point = demand during lead time 5,000 units 10 days 200 units 250 days This is not to say that we reorder when there are 200 units on hand (as there never are). The ROP indicates that orders are placed several cycles prior to their actual demand. 12.14 (a) Economic Order Quantity: Q 2 DS 2 1,200 25 50 units H 24 where: D = period demand, S = setup or order cost, H = holding cost 4 Instructor’s Solutions Manual t/a Operations Management (b) Total cost = order cost + holding cost DS QH Q 2 1,200 25 25 24 $1,500 25 2 1,200 25 40 24 $1,230 Q 40 : 40 2 1,200 25 50 24 $1,200 Q 50 : 50 2 1,200 25 60 24 $1,220 Q 60 : 60 2 1,200 25 100 24 $1,500 Q 100 : 100 2 For Q 25: For For For For As expected, small variations in order quantity will not have a significant effect on total costs. 12.15 (a) Total cost = order cost + holding cost DS QH Q 2 For Q 50 : 600 60 50 20 720 500 $1,220 50 2 (b) Economic Order Quantity: Q 2 DS 2 600 60 60 units H 20 where: D = period demand, S = setup or order cost, H = holding cost For Q 60 : 600 60 60 20 600 600 $1,200 60 2 (c) Reorder point: Reorder point = demand during lead time 600 units 10 days 24 units 250 days 12.16 Economic Order Quantity, noninstantaneous delivery: Q 2 DS H [1 ( d / p ) 2 10000 200 50 1.00 1 200 2309 .4 units where: D = period demand, S = setup or order cost, H = holding cost, d = daily demand rate, p = daily production rate 12.17 Economic Order Quantity, noninstantaneous delivery: Q Chapter 12: Inventory Management 2 DS H [1 ( d / p ) 2 8000 100 40 0.80 1 150 1651 .4 units 5 where: D = period demand, S = setup or order cost, H = holding cost, d = daily demand rate, p = daily production rate 12.18 (a) Economic Order Quantity, noninstantaneous delivery: Q (b) (c) (d) 2 DS H [1 ( d / p ) 2 10000 40 50 0.60 1 500 1217 .2 units where: D = period demand, S = setup or order cost, H = holding cost, d = daily demand rate, p = daily production rate d 50 I Q 1 1217 .2 1 1095 .5 units max 500 p D 10,000 8.22 Q 1,217 I D T. C. max H S 328.50 328.80 657.30 2 Q 12.19 Economic Order Quantity: Q 2 DS H where: D = period demand, S = setup or order cost, H = holding cost, P price/unit (a) Economic Order Quantity, standard price: Q 2 2,000 10 200 units 1 Total cost order cost holding cost purchase cost DS QH 2,000 10 200 1 PD 2,000 1 100 100 2,000 $2,200 Q 2 200 2 (b) Quantity Discount: Total cost order cost holding cost purchase cost DS QH 2,000 10 2,000 1 PD 2,000 0.75 Q 2 2,000 2 10 1,000 1,500 $2,510 Note: No, EOQ with 200 units and a total cost of $2,200 is better. 12.20 Under present price of $50.00 per unit, Economic Order Quantity: Q 2 DS H Q 2 1,000 40 80 units 0.25 50 where: D = period demand, S = setup or order cost, H = holding cost, P price/unit 6 Instructor’s Solutions Manual t/a Operations Management Total cost order cost holding cost purchase cost DS QH 1,000 40 80 0.25 50 PD 1,000 50 Q 2 80 2 500.00 500.00 50,000 $51,000 Under the quantity discount price reduction of 3%: Total cost order cost holding cost purchase cost DS QH 1,000 40 200 0.25 50 0.97 PD 1,000 50 0.97 Q 2 200 2 200.00 1212.50 48,500 $49,912.50 Therefore, the pumps should be ordered in batches of 200 units and the quantity discount taken. 12.21 Under present price of $7.00 per unit, Economic Order Quantity: Q 2 DS H Q 2 6,000 20 4781 . or 478 units 015 . 7 where: D = period demand, S = setup or order cost, H = holding cost, P price/unit Total cost order cost holding cost purchase cost DS QH 6,000 20 478 015 . 7 PD 7 6,000 Q 2 478 2 251.05 250.95 42,000 $42,502.00 Note: Order and carrying costs are not equal due to rounding of the EOQ to a whole number. Under the quantity discount price of $6.65 per unit: Total cost order cost holding cost purchase cost DS QH 6,000 20 3,000 015 . 6.65 PD 6,000 6.65 Q 2 3,000 2 40.00 1,496.25 39,900 $41,436.25 Therefore, the new policy, with a total cost of $41,436.25, is preferable. 12.22 Economic Order Quantity: Q 2 DS H where: D = period demand, S = setup or order cost, H = holding cost, P price/unit (a) Economic Order Quantity, standard price: Q Chapter 12: Inventory Management 2 45 10 30 units 0.05 20 7 Total cost order cost holding cost purchase cost DS QH 45 10 30 0.05 20 PD 45 20 Q 2 30 2 15 15 900 $930 (b) Quantity Discount, 75 units or more. Economic Order Quantity, discount over 75 units: Q 2 45 10 3119 . or 31 units 0.05 18.50 Because EOQ = 31 and a discount is given only on orders of 75 or more, we must calculate the total cost using a 75-unit order quantity: Total cost order cost holding cost purchase cost DS QH 45 10 75 0.05 18.50 PD 45 18.50 Q 2 75 2 6 34.69 832.50 $873.19 (c) Quantity Discount, 100 units or more; Economic Order Quantity, discount over 100 units: Q 2 45 10 3381 . or 34 units 0.05 15.75 EOQ = 34 and a discount is given only on orders of 100 or more, thus we must calculate the total cost using a 100-unit order quantity. Calculate total cost using 100 as order quantity: Total cost order cost holding cost purchase cost DS QH 45 10 100 0.05 15.75 PD 45 15.75 Q 2 100 2 4.5 39.38 708.75 $752.63 Based purely upon cost, the decision should be made to order in quantities of 100, for a total cost of $752.63. It should be noted, however, that an order quantity of 100 implies that an order will be placed roughly every two years. When orders are placed that infrequently, obsolescence may become a problem. 12.23 Economic Order Quantity: Q 2 DS H where: D = period demand, S = setup or order cost, H = holding cost, P price/unit (a) Order quantity 9 sheets or less, unit price = $18.00 Q 8 2 100 45 50 units 0.20 18 Instructor’s Solutions Manual t/a Operations Management Total cost order cost holding cost purchase cost DS QH 100 45 50 0.20 18 PD 18 100 Q 2 50 2 90 90 1,800 $1,980 see note at end of problem re. actual price (b) Order quantity 10 to 50 sheets: unit price = $17.50 Q 2 100 45 50.7 units or 51 units 0.20 17.50 Total cost order cost holding cost purchase cost DS QH 100 45 51 0.20 17.50 PD 17.50 100 Q 2 51 2 88.23 89.25 1750.00 1927.48 (c) Note: Order and carrying costs are not equal due to rounding the EOQ to a whole number. See note at end of problem regarding price. Order quantity more than 50 sheets: unit price = $17.25 Q 2 100 45 511 . units or 51 units 0.20 17.25 Total cost order cost holding cost purchase cost DS QH 100 45 51 0.20 17.25 PD 17.25 100 Q 2 51 2 88.24 87.98 1,725.00 $1,90122 . Therefore, order 51 units. Note: Order and carrying costs are not equal due to rounding of the EOQ to a whole number. Important Note: Calculations of total cost under (a) and (b) are actually inappropriate because the original assumptions as to lot size would not be satisfied by the calculated EOQs. 12.24 D 700 12 , H 5 , S 50 Allen 1–499 500–999 1000+ $16.00 $15.50 $15.00 Baker 1–399 400–799 800+ $16.10 $15.60 $15.10 Q 2 DS 28,40050 409.88 410 H 5 Vendor: Allen at 410, TC Chapter 12: Inventory Management 410 8,400 5 50 8,40016 $136,449.36 2 410 9 at 500, TC 500 8,400 5 50 8,40015.5 $132,290 2 500 at 1000, TC 1,000 8,400 5 50 8,40015 $128,920 BEST 2 1,000 Vendor: Baker 410 8,400 5 50 8,40015.60 $133,089.39 2 410 800 8,400 5 50 8,4001510 at 800, TC . $129,365 2 800 at 410, TC 10 Instructor’s Solutions Manual t/a Operations Management