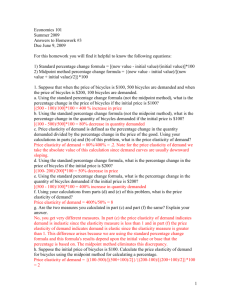

Economics 231W, Econometrics

advertisement

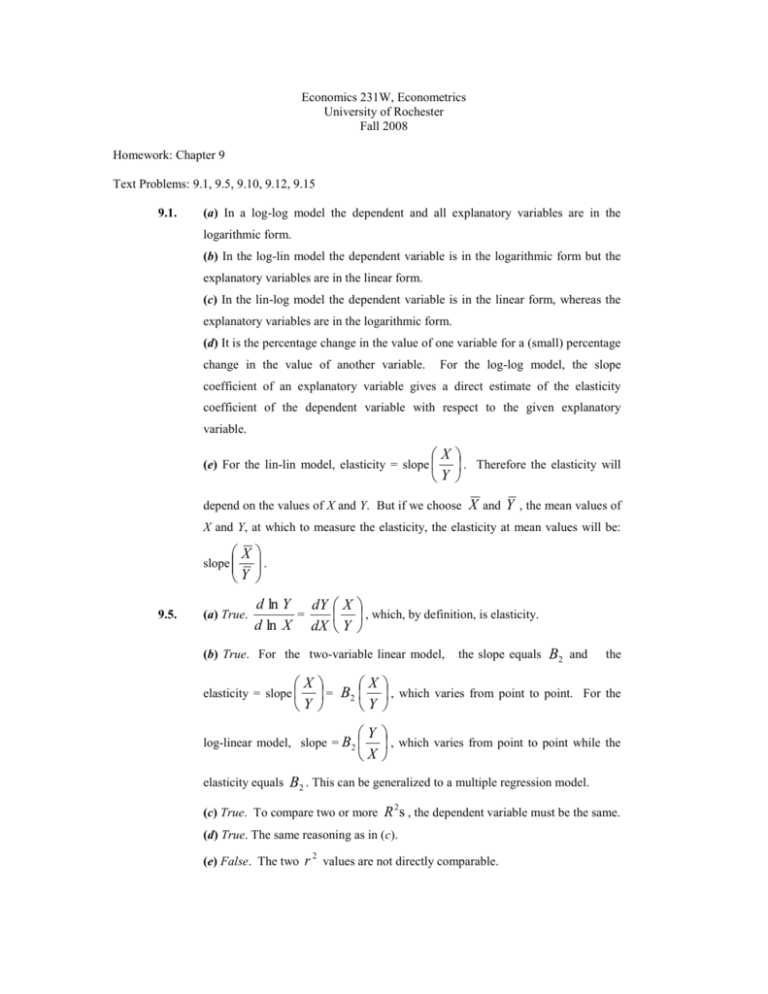

Economics 231W, Econometrics University of Rochester Fall 2008 Homework: Chapter 9 Text Problems: 9.1, 9.5, 9.10, 9.12, 9.15 9.1. (a) In a log-log model the dependent and all explanatory variables are in the logarithmic form. (b) In the log-lin model the dependent variable is in the logarithmic form but the explanatory variables are in the linear form. (c) In the lin-log model the dependent variable is in the linear form, whereas the explanatory variables are in the logarithmic form. (d) It is the percentage change in the value of one variable for a (small) percentage change in the value of another variable. For the log-log model, the slope coefficient of an explanatory variable gives a direct estimate of the elasticity coefficient of the dependent variable with respect to the given explanatory variable. X . Therefore the elasticity will Y (e) For the lin-lin model, elasticity = slope depend on the values of X and Y. But if we choose X and Y , the mean values of X and Y, at which to measure the elasticity, the elasticity at mean values will be: X Y 9.5. slope . (a) True. d ln Y dY X = , which, by definition, is elasticity. d ln X dX Y (b) True. For the two-variable linear model, X Y elasticity = slope B2 and the X = B2 Y , which varies from point to point. For the Y X , which varies from point to point while the log-linear model, slope = B 2 elasticity equals the slope equals B2 . This can be generalized to a multiple regression model. 2 (c) True. To compare two or more R s , the dependent variable must be the same. (d) True. The same reasoning as in (c). (e) False. The two r 2 values are not directly comparable. 9.10. (a) In Model A, the slope coefficient of -0.4795 suggests that if the price of coffee per pound goes up by a dollar, the average consumption of coffee per day goes down by about half a cup. In Model B, the slope coefficient of -0.2530 suggests that if the price of coffee per pound goes up by 1%, the average consumption of coffee per day goes down by about 0.25%. 1.11 = -0.2190 2.43 (b) Elasticity = -0.4795 (c) -0.2530 (d) The demand for coffee is price inelastic, since the absolute value of the two elasticity coefficients is less than 1. (e) Antilog (0.7774) = 2.1758. In Model B, if the price of coffee were $1, on average, people would drink approximately 2.2 cups of coffee per day. [Note: Keep in mind that ln(1) = 0]. (f) We cannot compare the two r 2 values directly, since the dependent variables in the two models are different. 9.12. (a) A priori, the coefficients of ln(Y / P) and ln BP should be positive and the coefficient of ln EX should be negative. The results meet the prior expectations. (b) Each partial slope coefficient is a partial elasticity, since it is a log-linear model. (c) As the 1,120 observations are quite a large number, we can use the normal distribution to test the null hypothesis. At the 5% level of significance, the critical (standardized normal) Z value is 1.96. Since, in absolute value, each estimated t coefficient exceeds 1.96, each estimated coefficient is statistically different from zero. (d) Use the F test. The author gives the F value as 1,151, which is highly statistically significant. So, reject the null hypothesis. 9.15. (a) 1̂ = 0.0130 + 0.0000833 X i Yi t = (17.206) (5.683) r 2 = 0.8015 The slope coefficient gives the rate of change in mean (1 / Y) per unit change in X. (b) dY B2 dX ( B1 B2 X i ) 2 At the mean value of X, X = 38.9, this derivative is -0.3146. (c) Elasticity = dY X dX Y . At X = 38.9 and Y = 63.9, this elasticity coefficient is -0.1915. (d) 1 Ŷi = 55.4871 + 112.1797 Xi t = (17.409) (4.245) r 2 = 0.6925 (e) No, because the dependent variables in the two models are different. (f) Unless we know what Y and X stand for, it is difficult to say which model is better. Other Problems: 1. For each of the following scenarios write out the functional form of the regression model you would use. a. Suppose X is the price of apples and Y is the quantity of apples and you want to calculate the own price elasticity. lnYi = B1 + B2lnXi + ui b. Suppose X represents expenditures on pollution reduction and Y represents the level of emissions, (which will never fall all the way to zero). Yi = B1 + B2(1/Xi) + ui c. Suppose you want to calculate the compound growth rate of income, Y. lnYi = B1 + B2t + ui d. Suppose you think the growth rate of income, X, has an effect on the level of the stock market, Y. Yi = B1 + B2lnXi + ui e. Suppose X is the quantity of labor and Y is the quantity of capital and you want to calculate the elasticity of substitution between capital and labor. lnYi = B1 + B2lnXi + ui 2. Use the data “Wage and Experience” which contains information on the wage, educational attainment (number of years of education) and experience (number of years on the job) for 526 individuals, from the course website. a. Use OLS to estimate the regression equation and report the results in the appropriate format: wagei b1 b2 edu b3 exp i b4 exp i2 ei SUMMARY OUTPUT Regression Statistics Multiple R R Square Adjusted R Square Standard Error Observations 0.519 0.269 0.265 3.166 526 ANOVA df Regression Residual Total Intercept Education Experience Experience^2 b. 3 522 525 SS 1927.877 5232.538 7160.414 Coefficients -3.965 0.595 0.268 -0.005 Standard Error 0.752 0.053 0.037 0.001 MS 642.626 10.024 t Stat -5.271 11.228 7.271 -5.611 F 64.109 Significance F 0.000 Pvalue 0.000 0.000 0.000 0.000 Interpret the regression results. Each additional year of education increases the average hourly wage by $0.60. Each additional year on the job increase the average hourly wage by $0.27. A one unit increase in experience squared decreases the average hourly wage by less than $0.01 c. Set up and test the appropriate hypothesis to determine if exp 2 statistically significant at the 1% level (two-sided)? The t-critical value is 2.576 therefore reject H0 d. Set up and test the joint hypothesis that all slope coefficients are equal to zero at the 5% level of significance. F-critical value is 2.60, therefore reject H0 e. At what value of exp does additional experience actually lower the predicted wage? wagei b1 b2 edu b3 exp i b4 exp i2 ei Take the derivative with respect to exp and set equal to zero. Solve for exp. wage b3 2b4 exp 0 exp exp 0.268 26.8 2 * 0.005 Which means that after 26.8 years experience has a negative impact on wage.