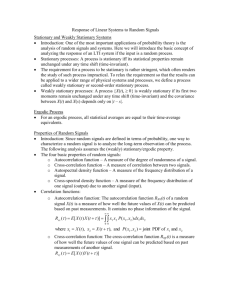

White Noise Processes

advertisement

White Noise Processes (Section 6.2)

Recall that covariance stationary processes

are time series, yt, such

1. E(yt) = μ for all t

2. Var(yt) = σ2 for all t, σ2 < ∞

3. Cov(yt,yt-τ) = γ(τ) for all t and τ

An example of a covariance stationary

process is an i.i.d. sequence. The “identical

distribution” property means that the series

has a constant mean and a constant variance.

The “independent” property means that

γ(1)=γ(2)=… = 0. [γ(0)=σ2]

Another example of a covariance stationary

process is a white noise process. A time

series yt is a white noise process if:

E(yt) = 0 for all t

Var(yt) = σ2 for all t, σ2 < ∞

Cov(yt,ys) = 0 if t ≠ s

That is, a white noise process is a serially

uncorrelated, zero-mean, constant and finite

variance process.

In this case we often write

yt ~ WN(0,σ2)

If yt ~ WN(0,σ2) then

γ(τ) = σ2 if τ = 0

= 0 if τ ≠ 0

ρ(τ), p(τ) = 1 if τ = 0

= 0 if τ ≠ 0

Note: Technically, an i.i.d. process (with a

finite variance) is a white noise process but a

white noise process is not necessarily an

i.i.d. process (since the y’s are not

necessarily identically distributed or

independent). However, for most of our

purposes we will use these two

interchangeably.

Note: In regression models we often assume

that the regression errors are zero-mean,

homoskedastic, and serially uncorrelated

random variables, i.e., they are white noise

errors.

In our study of the trend and seasonal

components, we assumed that the cyclical

component of the series was a white noise

process and, therefore, was unpredictable.

That was a convenient assumption at the

time.

We now want to allow the cyclical

component to be a serially correlated

process, since our graphs of the deviations

of our seasonally adjusted series from their

estimated trends indicate that these

deviations do not behave like white noise.

However, the white noise process will still

be very important to us: It forms the basic

building block for the construction of more

complicated time series.

More on this later.

Estimating the Autocorrelation Function

(Section 6.5)

Soon we will specify the class of models that we

will use for covariance stationary processes.

These models (ARMA and ARIMA models) are

built up from the white noise process. We will

use the estimated autocorrelation and partial

autocorrelation functions of the series to help us

select the particular model that we will estimate

to help us forecast the series.

How to estimate the autocorrelation function?

The principle we use is referred to in your

textbook as the analog principle. The analog

principle, which turns out to have a sound basis

in statistical theory, is to estimate population

moments by the analogous sample moment, i.e.,

replace expected values with analogous sample

averages.

For instance, since the yt’s are assumed to be

drawn from a distribution with the same

mean, μ, the analog principle directs us to

use the sample mean to estimate the

population mean:

1 T

̂ y t

T t 1

Similarly, to estimate

σ2 = Var(yt) = E[(yt-μ)2]

the analog principle directs us to replace the

expected value with the sample average, i.e.,

1 T

ˆ ( y t ˆ ) 2

T t 1

2

The autcorrelation function at displacement τ is

( )

E[( yt )( yt )]

E[( yt ) 2 ]

The analog principle directs us to estimate ρ(τ)

by using its sample analog:

1 T

[( y t ˆ )( y t ˆ )

T

ˆ ( ) t 1 T

1

( y t ˆ ) 2

T t 1

or, since the 1/T’s cancel,

T

[( y

t

t 1

T

(y

t 1

ˆ ( ),

ˆ )( yt ˆ )

t

ˆ ) 2

τ = 0,1,2,… is called the sample

autocorrelation function or the correlogram of

the series.

Notes –

1. The autocorrelation function and sample

autocorrelation function will always be equal to

one for τ = 0. For τ ≠ 0, the absolute values of

the autocorrelations will be less than one. (The

first statement is obvious from the formulas; the

second is true, but not obvious.)

2. The summation in the numerator of the

sample autocorrelation function begin with

t = τ + 1 (rather than t = 1). {Why? Consider,

e.g., the sample autocorrelation at displacement

1. If it started at t = 1, what would we use for y0,

since our sample begins at y1?}

3. The summation in the numerator of the τ-th

sample autocorrelation coefficient is the sum of

T- τ terms, but we divide the sum by T to

compute the “average”. This is partly justified

by statistical theory and partly a matter of

convenience. For large values of T- τ whether

we divide by T or T- τ will have no practical

effect.

The Sample Autocorrelation Function for a

White Noise Process –

Suppose that yt is a white noise process (i.e.,

yt is a zero-mean, constant variance, and

serially uncorrelated process).

We know that the population autocorrelation

function, ρ(τ), will be zero for all nonzero τ.

What will the sample autocorrelation

function look like?

For large samples,

ˆ ( ) ~ N (0,1/ T )

or, equivalently,

T ˆ ( ) ~ N (0,1)

This result means that if yt is a white noise

process then for 95% of the realizations of this

time series ˆ ( ) should lie in the interval

[2 / T ,2 / T ] for any given τ.

That is, for a white noise process, 95% of the

time ˆ ( ) will lie within the two-standard error

band around 0, [2 / T ,2 / T ] .

{The “2” comes in because it is approximately

the 97.5 percentile of the N(0,1) distribution; the

square root of T comes in because it is the

standard deviation of rho-hat.}

This result allows us to check whether a

particular displacement has a statistically

significant sample autocorrelation.

For example, if ˆ (1) 2 / T then we would

likely conclude that the evidence of first-order

autocorrelation appears to be too strong for the

series to be a white noise series.

However, it is not reasonable to say that you

will reject the white noise hypothesis if any

of the rho-hats falls outside of the twostandard error band around zero.

Why not? Because even if the series is a

white noise series, we expect some of the

sample autocorrelations to fall outside that

band – the band was constructed so that

most of the sample autocorrelations would

typically fall within the band if the time

series is a realization of a white noise

process.

A better way to conduct a general test of the

null hypothesis of a zero autocorrelation

function (i.e., white noise) against the

alternative of a nonzero autocorrelation

function is to conduct a Q-test.

Under the null hypothesis that yt is a white

noise process, the Box-Pierce Q-statistic

m

QBP T ˆ 2 ( ) ~ 2 (m)

1

for large T.

So, we reject the joint hypothesis

H0: ρ(1)=0,…,ρ(m)=0

against the alternative that at least one of

ρ(1),…,ρ(m) is nonzero at the 5% (10%,

1%) test size if QBP is greater than the 95th

percentile (90th percentile, 99th percentile) of

the χ2(m) distribution.

How to choose m?

Suppose, for example, we set m = 10 and it

turns out that there is autocorrelation in the

series but it is primarily due to

autocorrelation at displacements larger than

10. Then, we are likely to incorrectly

conclude that our series is the realization of

a white noise process.

On the other hand, if, for example we set

m = 50 and there is autocorrelation in the

series but only because of autocorrelation at

displacements 1,2, and 3, we are likely to

incorrectly conclude that our series is a

white noise process.

So, selecting m is a balance of two

competing concerns. Practice has suggested

that a reasonable rule of thumb is to select

m = T1/2.

The Ljung-Box Q-Statistic

The Box-Pierce Q-Statistic has a χ2(m)

distribution provided that the sample is

sufficiently large.

It turns out that this approximation does not

work very well for “moderate” sample sizes.

The Ljung-Box Q-Statistic makes an

adustment to the B-P statistic to make it

work better in finite sample settings without

affecting its performance in large samples.

m

QLB T (T 2) ˆ 2 ( ) /(T ) ~ 2 (m)

1

The Q-statistic reported in EViews is the

Ljung-Box statistic.

Estimating the Partial Autocorrelation

Function

The partial a.c. function p(1), p(2),… is

estimated through a sequence of

“autoregressions” p(1):

Regress yt on 1, yt-1: ˆ0 , ˆ1

pˆ (1) ˆ1

p(2):

Regress yt on 1, yt-1, yt-2 : ˆ0 , ˆ1, ˆ2

pˆ (2) ˆ2

and so on.