Analysis of Financial Time Series

advertisement

KYIV SCHOOL OF ECONOMICS

Financial Econometrics (2nd part):

Introduction to Financial Time Series

May 2011

Instructor: Maksym Obrizan

Lecture notes I

# 3. This course assumes some basic

knowledge of time series econometrics but

the most important concepts will be (quickly)

reviewed

This lecture: very brief review of AR(p), and

applications of linear time series models

What is Financial Time Series?

# 2. Purposes of the short course:

(i) Review some theoretical models of financial

time series

(ii) Develop practical skills of applied financial

time series

Main Text: Analysis of Financial Time Series, by

Ruey Tsay (selected chapters)

Data: mostly US time series (the most liquid

market) but methods are applicable to

transition countries as well

# 4. Financial Time Series

Of course, financial time series analysis has to

incorporate uncertainty about asset returns

The most recent global crisis indicates that

pricing bubbles and inadequate risk

management are still present even in the

most (financially) developed markets.

# 5. Although, stock returns are often the focus

of financial theory other important financial

time series include:

In addition, some of these methods can be used

to study macroeconomic time series such as

GDP or its components

# 7. Basic concepts

Let

The sample mean is

# 6. Most financial studies use returns, instead of

prices of assets

Campbell, Lo and MacKinlay (1997) give two

reasons for this:

(i) return is a scale-free summary of

investment opportunity;

(ii) returns have more attractive statistical

properties than prices

# 8. The sample variance is

# 9. The third central moment measures the

symmetry of X with respect to its mean

(skewness)

# 10.

0.4

Skewed to the left

Standard normal

0.35

0.3

0.25

0.2

0.15

0.1

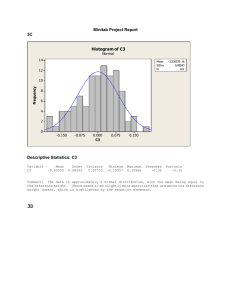

For figure on slide 10: Skewness is 0.007 for

standard normal and -0.839 for skewed to

the left

0.05

0

-25

-20

-15

-10

-5

0

5

0.4

4th

# 11. The

central moment measures the tail

behavior of X

# 12.

t with 1 df

Standard normal

0.35

0.3

0.25

0.2

Excess kurtosis K(x)-3 :

0.15

0.1

0.05

Kurtosis of Student t distrbution with 1 df is 3.43

on slide 12

0

-5

-4

-3

-2

-1

0

1

2

3

4

5

# 13. Skewness and Kurtosis in returns data

# 14. Stationarity –

Skewness

A time series {rt} is strictly stationary if

High excess kurtosis

A time series {rt} is weakly stationary if

In practice, high excess kurtosis means that the

distribution of returns tends to contain more

extreme values than the standard normal

In this course: weakly stationary time series

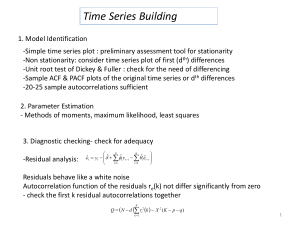

# 15. Linear time series

# 16. Quick review of autoregressive models

AR(p) model is

The mean

and the variance

Meaning: the past p values of rt-I (i=1,…,p) jointly

determine the conditional expectation of rt

given the past data

# 17. To identify the order p of AR(p) model in

practice one can use:

(i) PACF

(ii) information criteria (AIC)

# 18. The estimate

of the second

equation is called the lag-2 sample PACF of

rt .

Partial Autocorrelation Function (PACF):

Intuitively, for an AR(p) model the lag-p sample

PACF should not be zero but lag-j PACF

should be close to zero for all j>p.

# 19. Indeed, under certain regularity conditions

the sample PACF of an AR(p) process has

the following properties

# 20. Alternatively, we can use Akaike

Information Criterion for a Gaussian AR(k)

model

The second term is called the penalty function

for adding additional parameters

# 21. Monthly Value-Weighted Index Returns

# 23. Parameter Estimation

# 22. NOTES

# 24. Model checking: ACF

The sample autocorrelation of series {rt}

Notice:

is biased (but consistent)

estimate of

. However, if sample is

large then bias is not serious

Sample Autocorrelation Function (ACF)

# 26.

0.8

Sample Autocorrelation

# 25. After you fit the model obtain residual

series to check for remaining autocorrelation

Suggestion:

Also plot 95% confidence intervals

0.6

0.4

0.2

0

Graph to the left?

-0.2

Graph below?

0

2

4

6

8

10

Lag

12

14

16

Sample Autocorrelation Function (ACF)

# 28. Ljung-Box (1978) statistics –

# 27.

Sample Autocorrelation

0.8

0.6

0.4

0.2

In practice, the choice of m may affect the

performance of Q(m) statistics

Simulations suggest to set m to approx. ln(T)

0

-0.2

0

2

4

6

8

10

Lag

12

14

16

18

20

18

20

# 29. For an AR(p) model, the Ljung-Box

statistics Q(m) follows asymptotically a chisquared distribution with m-p degrees of

freedom

# 30. Implications

# 31. Forecasting: we are at time h and are

interested in forecasting {rh+b} where b>0

# 32. Multistep Ahead Forecast

Forecast often employs the minimum squared

error term loss function

This forecast can be obtained recursively

Important: for a stationary AR(p) model the long

term forecast converges to unconditional mean

(mean reversion) and the variance of forecast

error approaches the unconditional variance

# 33. NOTES

# 34. NOTES

# 35. Application: AR(2) model and business

cycles

Consider an AR(2) model

# 36. This equation can be re-written as the

second-order difference equation

where B is called back-shift operator such that

It can be shown that the ACF of a stationary

AR(2) model satisfies

Sometimes lag operator L is used instead of B

# 37. Corresponding to the difference equation

there is quadratic equation

# 38. If characteristic roots are complex numbers

(complex conjugate pair) then the ACF of

this series shows damping sine and cosine

waves

which can be solved for characteristic roots

For example, AR(2) model

Interesting case when

The graph is in the bottom left corner

Sample Autocorrelation Function (ACF)

1

# 39.

# 40. In business and economic applications

complex characteristic roots give rise to

business cycles

0.8

Sample Autocorrelation

0.6

For an AR(2) model on slide # 35 with a pair of

complex characteristic roots the average

length of the stochastic cycles is

0.4

0.2

0

-0.2

-0.4

-0.6

where the cosine inverse is stated in degrees

0

5

10

15

20

Lag

25

30

35

40

# 41. Illustration: US GNP seasonally adjusted

from QII.1947 to Q1.1991

Fit AR(3) model

Obtain a corresponding third-order difference

equation

# 43. Application: Seasonal Models

Quarterly earnings per share of a company may

exhibit cyclical or periodic behavior –

seasonal time series

# 42. Factor out as

For the second-order factor is then

1-0.87B-(-0.27)B2 =0 we have 0.872+4(-0.27)<0

The average length of the stochastic cycles is

# 44.

# 45. Seasonal differencing

# 46.

In general, for a time series with periodicity s:

# 47. Multiplicative Seasonal Models: The airline

model

# 48. Application to log series of Johnson and

Johnson

# 49.

# 50. Regression models with time series errors

Suppose, we are interested in term structure of

interest rates

# 51. If the error term is a white noise then the

LS method results in consistent estimates

# 52. Application to the US weekly interest rate

series:

r1t - 1-year Treasury constant maturity rate

r2t - 3-year Treasury constant maturity rate

Simple but inadequate model:

# 53. Developing a more adequate model

# 54. Cont’d

# 55. Fitting a linear regression model with time

series errors

# 56. NOTES