The Linear Trend Model

advertisement

Lecture 7 –Regression Models with Serially

Correleated Disturbances

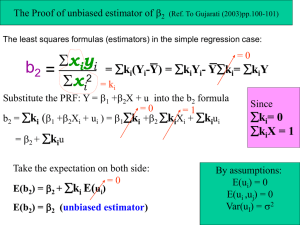

1. Asymptotic Normality of the OLS Estimator with

Serially Correlated Errors

Proposition 2.1 in Hayashi uses the conditions that

{xt,t} is a jointly stationary and ergodic process and

{xtt} is an m.d.s. in order to establish the asymptotic

normality of the OLS estimator. The m.d.s. restriction

rules out serial correlation in the ’s.

It turns out that the m.d.s. restriction can be replaced

with the weaker condition that {xtt} is a “mixingale”

and the OLS estimator will be consistent and

asymptotically normal.

The mixingale condition is essentially the condition

that the sequence behaves asymptotically like an

m.d.s. in the sense that E(xt+st+s │t,t-1,…,xt,xt-1,…)

goes to 0 as s goes to ∞. (See White, 2001, for more

on this.) This assumption does allow for serial

correlation in the disturbances.

However, if the disturbances are serially correlated,

then the orthogonality condition (A.3) will, for

example, rule out lagged dependent variables among

the regressors:

yt = β0 + β1yt-1 + εt and εt = ρεt-1 + ut , ut ~ i.i.d.

In this case, yt-1 will correlated with εt because both

are determined by εt-1.

2.

The GLS and FGLS Estimator

In the linear regression model with strictly exogenous

regressors and heteroskedastic or serially correlated,

normally-distributed disturbances, the GLS estimator

is the BUE, MLE, and efficient estimator of the ’s.

What are the large sample properties of the GLS

estimator in time series regressions?

If we assume that the regressors are predetermined

but not necessarily strictly exogenous, then in general

the GLS estimator will be inconsistent!

The idea –

Suppose that we have a linear model with a single

regressor, which is predetermined, so that E(t │

xt, xt-1,…) = 0 for all t.

Let var(1,…,T) = 2ΩT

Suppose, that ΩT is known for each T.

Let CTCT’ = ΩT-1

Now, recall that GLS amounts to transforming the

original model to:

~

yt ~

xt ~t

where

~

yt ct1 y1 ct 2 y2 ... ctT yT

~

xt ct1 x1 ct 2 x2 ... ctT xT

~t ct1 1 ct 2 2 ... ctT T

then fitting the model by OLS. But note that unless x

is strictly exogenous,

E(~

xt ~t ) 0

and the GLS estimator will be inconsistent!

Note: The GLS will be consistent and asymptotically

superior to OLS in the important special case where

the disturbances follow a “finite-order autoregressive

process.” However, unless the regressors are strictly

exogenous, the FGLS estimator will be inconsistent

regardless of the form of the error process. We will

return to this case in the next section of the course.

3. The Linear Trend Model

A commonly encountered time series regression

model is the linear trend model –

yt = 0 + 1t + t

where t is a zero-mean, covariance stationary

process. That is, yt is the sum of a deterministic linear

trend and a stationary process. In this case, we say

that yt is a trend stationary process.

This is a very simple and appealing way to think

about many trending economic time series, like the

log of real GDP.

In this case, it is natural to consider estimating the

linear trend:

the estimated trend function, ˆ ˆ t , provides

us with an estimate of the long-run path of yt

the residuals, ˆ y ˆ ˆ t , provide us with an

estimate of the short-run or cyclical

behavior of yt

0

t

t

0

1

1

we can use the residuals in regression

models that require stationary variables

If t is an i.i.d. N(0,2) process, then for any fixed

sample size T, this model satifies all of the

assumptions of the classical normal linear regression

model: linearity, strictly exogenous regressors, no

multicollinearity, spherical normal disturbances. OLS

is the BUE and MLE of the ’s; the simple OLS t and

F statistics can be applied in the “usual” way.

If t is i.i.d. (0,2), the OLS estimator is consistent,

asymptotically normal, and asymptotically efficient.

The simple OLS t and F statistics can be applied in

the “usual” way, though the justification will be

asymptotic (since the disturbances are not assumed to

be normal). (More on this shortly.)

Suppose that t is a serially correlated, stationary

process. Now we are in the situation of the linear

regression model with strictly exogenous regressors

and non-spherical disturbances, which we discussed

on the first day of this part of the course. (See the

notes to Lecture 1.)

There is a very interesting fact about the asymptotic

behavior of the OLS estimator of the linear trend

model with serially correlated disturbances: The OLS

estimator is asymptotically equivalent to the GLS

(and FGLS) estimator of the ’s! There is no

asymptotic gain to knowing the form of the serial

correlation and taking it into account with regard to

estimating and drawing inferences about the ’s. (See

Grenander and Rosenblatt, 1957. The OLS estimator

of the linear trend model is consistent, asymptotically

normal, and asymptotically efficient. Standard OLS t

and F test, which assume spherical disturbances, can

be applied and will be valid asymptotically.