Introduction

advertisement

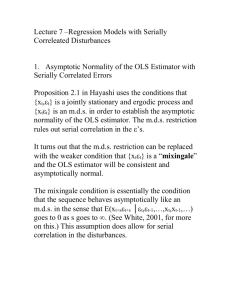

Lecture 1 – Introduction

(Reference – Chapter 1, Hayashi)

This final part of your core training in

econometrics will introduce you to a

variety of topics that are relevant for

regression analysis involving time

series data.

Time series data arise in virtually

every area of applied economic

research, making up nearly all of the

data that we study in macroeconomics

and financial economics.

More comprehensive and advanced

treatments of time series analysis are

provided in Economics 674 and

Statistics 551.

Begin by recalling the assumptions

that define the classical linear

regression model.

The Classical Normal Linear

Regression Model:

Let

Xi = [x1i … xki], i = 1,…,n

be a collection of kdimensional random vectors

X = the nxk random matrix

whose i-th row is Xi.

Assume that the random

variables y1,…,yn are related

to X1,…,Xn according to:

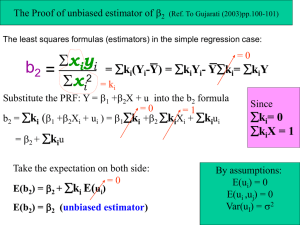

• A.1. (Linearity)

yi = β1x1i + … + βkxki + εi , i = 1,…,n

where β1,…, βk are constants

• A.2. (Strict Exogeneity)

E[εi │X ] = 0, i = 1,…,n

• A.3. (No Multicollinearity)

Prob(rank(X) = k) = 1

• A.4. (Spherical Disturbances)

A.4.1.(Conditional Homoskedasticity)

E[εi2 │X ] = σ2 > 0 , i = 1,…,n

A.4.2. (Serially Uncorrelated Errors)

E[εiεj │X ] = 0, i,j= 1,…,n, i≠j

A.4.3. (Normally Distributed Errors),

εi│X ~ N(0, σ2) , i = 1,…,n

Under these assumptions,the

ˆ

OLS estimator of β, ,

• is unbiased

• exists and is unique

• has variance σ2(X’X)-1

• is conditionally normally

distributed

• is the BUE of β

• is the MLE of β

In addition,

ˆ ) / se(ˆ )

(

ti = i

~ t(n-k)

i

i

where

se(ˆi ) ˆ 2 [( X ' X ) 1 ]ii

,

ˆ 2 SSR /( n k )

if Rβ = r, where R is qxk and r is qx1

then

F=

2

ˆ

ˆ

-1

-1

ˆ

{(R -r)’[R(X’X) R’] (R -)/q}/

~ F(q,n-k)

That is, the “OLS” t-statistic is drawn from a tdistribution and the “OLS” F-statistic is drawn

from an F-distribution, providing the basis for

the application of classical hypothesis test

procedures and the construction of confidence

intervals/regions.

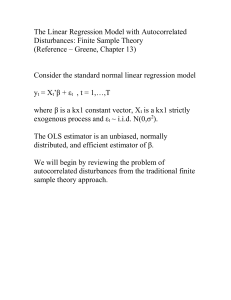

We will assume throughout this

course that assumptions A.1 and A.3

hold. However, we will relax

assumptions A.2 and A.4.

Note: With regard to A.1, nonlinear

models, e.g., threshold models, play

an increasingly important role in the

analysis of economic time series.

Nonlinear time series models are

considered in Economics 674.

The assumptions that the errors are

serially uncorrelated and conditionally

homoskedastic are often implausible in

regressions with time series data.

Instead, it is typically the case that the

errors are positively autocorrelated and it

is often the case, particularly in

applications with financial time series

data, that they are conditionally

heteroskedastic.

Suppose we relax A.4.1 and/or A.4.2 but

retain all of the other assumptions. We

replace these assumptions with:

E(εε’) = σ2Ω, Ω a p.d. nxn matrix

How do the properities of the OLS

estimator and the t and F statistics

change?

Under these assumptions the OLS

estimator of β,

• is unbiased ---- YES

• exists and is unique ---- YES

• has variance σ2(X’X)-1--- NO

• is conditionally normally

distributed --- YES, if the ε’s are

normally distributed

• is the BUE of β ---- NO

• is the MLE of β ---- NO

In addition,

ti = (ˆi i ) / se(ˆi ) ~ t(n-k) ---- NO

where

se(ˆi ) ˆ 2 [( X ' X ) 1 ]ii

2

, ˆ SSR /( n k )

and

if Rβ = r, where R is qxk and r is qx1

then

F=

{(R ˆ -r)’[R(X’X)-1R’]-1(R ˆ -r)/q}/ ˆ 2

~ F(q,n-k) --- NO

The OLS estimator is still unbiased, but it

does not have any optimality properties, and

inference based on the OLS t and F statistics

as though they were drawn from t and F

distributions is not valid.

Suppose, however, that the matrix Ω

is known. Then the GLS estimator of

β, ̂GLS ,

• is unbiased

• exists and is unique

• has variance σ2(X’ Ω-1 X)-1

• is conditionally normally

distributed

• is the BUE of β

• is the MLE of β

In addition,

ti = (ˆGLS , i i ) / se(ˆGLS , i ) ~ t(n-k)

where

se(ˆGLS , i ) ˆ 2 [( X ' 1 X ) 1 ]ii , ˆ 2 SSR /( n k )

and

if Rβ = r, where R is qxk and r is qx1

then

F=

2

-1

-1

-1

ˆ

(R ̂ -r)’[R(X’Ω X) R’] (R ̂ -r)/(q/ )

~ F(q,n-k)

GLS

GLS

That is, the “GLS” t-statistic is drawn

from a t-distribution and the “GLS” Fstatistic is drawn from an F-distribution,

providing the basis for the application of

classical hypothesis test procedures and

the construction of confidence

intervals/regions.

But, what if Ω is unknown, which would

be the typical situation in practice? We

could replace it with an estimate, ̂ , to

construct the FGLS estimator of β, ̂ F GLS ,

and the corresponding t and F statistics.

What can we say about the properties of

the FGLS estimator?

• is unbiased --- NO

• exists and is unique --- NO (depends

on how we estimate Ω)

• has variance σ2(X’ Ω -1X)-1 --- NO

• is conditionally normally distributed -- NO

• is the BUE of β --- NO

• is the MLE of β --- NO

In addition,

ti = ( ˆ F GLS , i i ) / se( ˆ F GLS , i ) ~ t(n-k)--- NO

where

ˆ 1 X ) 1 ]

se( ˆ F GLS , i ) ˆ 2 [( X '

ii ,

ˆ 2 SSR /( n k )

and

if Rβ = r, where R is qxk and r is qx1

then

F=

{(R ̂ -r)’[R(X’

F GLS

̂

-1

X)-1R’]-1(R ̂ -r)/q}/ ˆ

2

F GLS

~ F(q,n-k) --- NO

That is, the “FGLS” t-statistic is not

drawn from a t-distribution and the

“FGLS” F-statistic is not drawn from an

F-distribution.

So, it appears that if the errors are

heteroskedastic or serial correlated and

we have incomplete information about

the form of the heteroskedasticity or

serial correlation (i.e., Ω is unknown),

we are in a very bad situation.

• The OLS estimator is unbiased, the

FGLS is biased; neither has any

optimal properties

• Neither the OLS nor FGLS

estimators can be used as the basis

for constructing valid hypothesis tests

or confidence intervals!

Now, suppose we relax A.2 (strict

exogeneity). This assumption is rarely

plausible in time series regressions

because the i-th observation of the

dependent variable y will frequently be

correlated with observations i+1,i+2,…

of the explanatory variables, X:

lagged dependent variables (yi = β1 +

β2xi + β3yi-1 + εi)

feedback effects between x and y (xi

is determined by yi-1)

Instead, the best we might hope for is

that the x’s are predetermined:

E(εi │x11,…,xk1,…, x1i,…,xki) = 0, all i

In this case, the OLS estimator of β,

•

•

•

•

is unbiased ---- NO

exists and is unique ---- YES

has variance σ2(X’X)-1--- NO

is normally distributed --- YES, but

…

• is the BUE of β ---- NO

• is the MLE of β ---- NO

In addition,

ti = (ˆi i ) / se(ˆi ) ~ t(n-k) ---- NO

where

se(ˆi ) ˆ 2 [( X ' X ) 1 ]ii , ˆ 2 SSR /( n k )

if Rβ = r, where R is qxk and r is qx1

then

2

-1

-1

ˆ

ˆ

ˆ

F = {(R -r)’[R(X’X) R’] (R -r)/q}/

~ F(q,n-k) --- NO

So, the OLS estimator is not unbiased,

does not retain any optimality properties,

and inference based on the OLS t and F

statistics are not longer valid.

This is an even worse situation than

when A.4 fails since, in that case, at least

OLS is unbiased.

Summary –

In time series regressions A.2 and /or

A.4 are often implausible assumptions.

When these assumptions fail, the OLS

estimator may or may not be unbiased

(depending upon whether A.2 is or is not

correct). The OLS t and F statistics will

not be valid starting points for testing or

interval construction.

If A.4 fails but A.2 holds, the GLS

procedure provides a simple solution to

this problem, but relies on our knowing

more about the variance of the error

vector than is reasonable in most

applications. That is, GLS will generally

not be a feasible approach. The FGLS

estimator is a biased estimator and the

FGLS t and F statistics will not be valid

starting points for hypothesis testing or

interval construction.

This would seem to leave us in a very bad

position! However, there is a way around

these problems - Formulate an alternative

set of assumptions that will

accommodate weakening of assumptions

A.2 and A.4 to allow for predetermined

(rather than strictly exogenous)

regressors and for non-spherical

disturbances

allow us to apply asymptotic distribution

theory to construct estimation and test

procedures that will have desirable

properties in applications with

sufficiently large sample sizes.

Note: In Econ 671 you were introduced to

the application of asymptotic distribution

theory to study large sample properties of

OLS and FGLS under a particular set of

assumptions. However those assumptions

are not adequate for our purposes. We will

formulate a set of assumptions that turn out

to be more useful in time series regressions.