beals exercises

advertisement

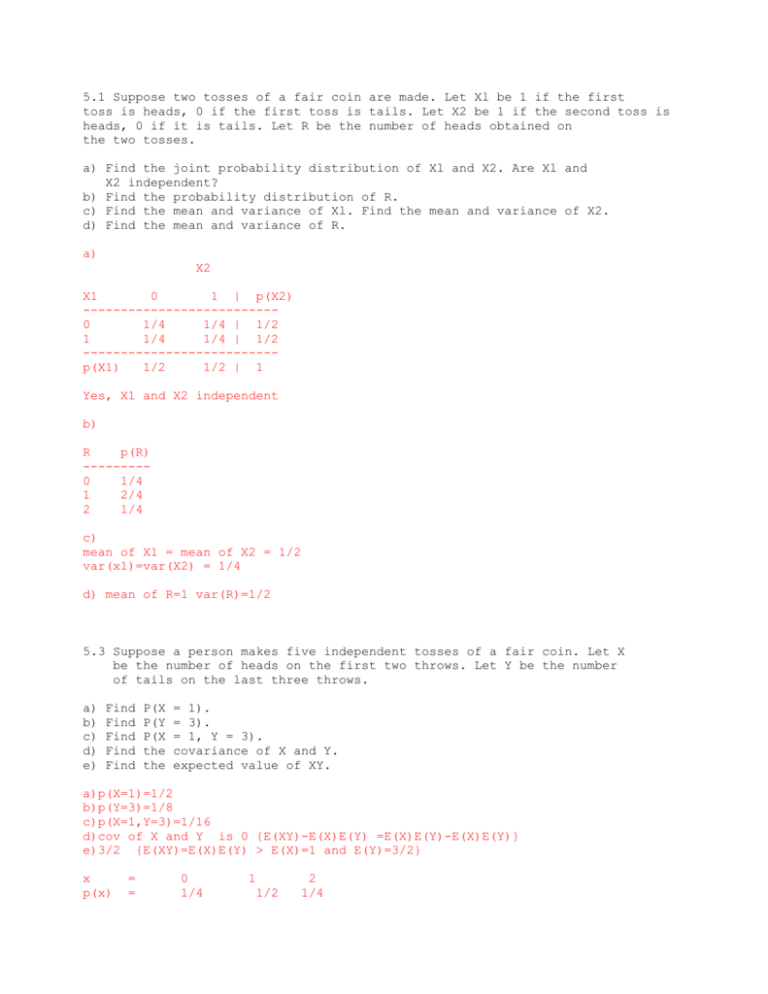

5.1 Suppose two tosses of a fair coin are made. Let Xl be 1 if the first

toss is heads, 0 if the first toss is tails. Let X2 be 1 if the second toss is

heads, 0 if it is tails. Let R be the number of heads obtained on

the two tosses.

a) Find the joint probability distribution of Xl and X2. Are Xl and

X2 independent?

b) Find the probability distribution of R.

c) Find the mean and variance of Xl. Find the mean and variance of X2.

d) Find the mean and variance of R.

a)

X2

X1

0

1 | p(X2)

-------------------------0

1/4

1/4 | 1/2

1

1/4

1/4 | 1/2

-------------------------p(X1)

1/2

1/2 | 1

Yes, X1 and X2 independent

b)

R

p(R)

--------0

1/4

1

2/4

2

1/4

c)

mean of X1 = mean of X2 = 1/2

var(x1)=var(X2) = 1/4

d) mean of R=1 var(R)=1/2

5.3 Suppose a person makes five independent tosses of a fair coin. Let X

be the number of heads on the first two throws. Let Y be the number

of tails on the last three throws.

a)

b)

c)

d)

e)

Find

Find

Find

Find

Find

P(X

P(Y

P(X

the

the

= 1).

= 3).

= 1, Y = 3).

covariance of X and Y.

expected value of XY.

a)p(X=1)=1/2

b)p(Y=3)=1/8

c)p(X=1,Y=3)=1/16

d)cov of X and Y is 0 {E(XY)-E(X)E(Y) =E(X)E(Y)-E(X)E(Y)}

e)3/2 {E(XY)=E(X)E(Y) > E(X)=1 and E(Y)=3/2}

x

p(x)

=

=

0

1/4

1

1/2

2

1/4

y

=

p(y) =

5.5

0

1/8

1

3/8

2

3/8

3

1/8

Let X represent the number that occurs when a green die is tossed

and Y the number that occurs when a red die is tossed.

a) Find the mean and variance of the random variable 2X - Y.

b) Find the mean and variance of the random variable X + 3Y - 5.

a) E(2X-Y) =3.5 var(2X-Y)=4var(X)+var(Y)

= 5*(sum((x^2)*p)-(3.5^2)) = 14.58333

b) E(X+3Y-5)=4*3.5 - 5=9

var(X+3Y-5)=var(X)+9*var(Y)=10*(sum((x^2)*p)-(3.5^2)) = 29.16667

5.9

A friend wants your advice. His aunt recently left him $1,000, which

he must invest in stocks chosen from a list of five. These five stocks

are in small companies, each located in a different part of the world

and each in a different industry. The rate of return from each stock

is safely regarded as a random variable independent of the returns

from the other stocks. The aunt apparently chose the five stocks

because they are all strangely similar in several respects: the present

price per share of each is $100, and a security analyst has assured

your friend that each stock has exactly the same expected annual

return per share, u, and each has the same variance of return, sigma^2.

The friend tells you that he is a risk averter; in other words, if

two portfolios have the same expected annual return, then he prefers

the one with smaller variance. Since each stock has the same return

and variance, he has tentatively decided to put all the money in

stock A. His broker, however, wants him to diversify by buying

2 shares of each stock.

a) If he buys 10 shares of stock A, what will be the mean and variance

of the annual return on his portfolio?

b) If he buys 2 shares of each stock, what will be the mean and

variance of the annual return on his portfolio?

c) Does it matter which portfolio he buys? If so, which should he

choose?

a) 10 * mu; 100* sigma^2

b) 10* mu; 20*sigma^2

c)Yes, buy 2 shares of each to reduce variance without reducing expected return