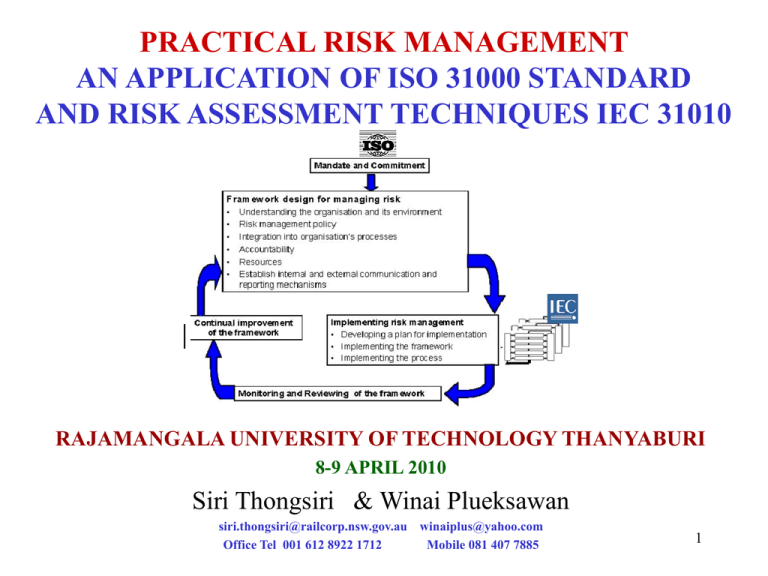

RISK MANAGEMENT

advertisement