Looking for another relative Engel`s law

advertisement

Looking for another relative Engel’s law

Introduction

The Engel law concerning food expenditures remains an

important tool: for instance for the definition of poverty, or to

discuss the convergence of consumption structures between

nations or social classes.

The relative Engel law which is discussed here is related to Social

Interactions (related to social positioning of the agents within

their reference groups), proved with minimal hypotheses.

It allows to evaluate the influence of income distribution on

consumption structures (an influence which a direct analysis is

not able to evaluate).

Looking for another relative Engel’s law

Introduction

Engel's law is generally considered as being perfectly shown to

hold empirically, but without clear theoretical foundations.

Furthermore, its simplicity masks uncertainty about its real

meaning: for example, if needs are endogenous, especially with

respect to changes in income, then the intuitive grounds for the

law on the scarcity of goods are not clear.

Secondly, bias in estimating the law using survey data raises

problems about testing it empirically, usually done crosssectionally.

This test of Engel law on food consumption and of the

Duesenberry hypothesis on social interactions is based on an

aggregation of the endogeneity bias of cross-section estimates. It

involves no restriction on the specification of the relative income

effect.

Looking for another relative Engel’s law

Engel's law is portrayed in the literature as a stable

and timeless relationship between income

changes and certain types of household

consumption: food, clothing, housing and leisure.

The time dimension of the law was put forward

immediately following Engel's work, and refers to

the smaller overall spending levels by rich nations,

that are assumed to follow a universal, historical

trend. It contrasts with the law's empirical proofs

which are always based on cross-section surveys

of household spending.

Engel puts forward his law in his original research :

“The poorer an individual, a family or a people,

the greater the percentage of its income

dedicated to physical upkeep, with spending on

food being the most important”.

Looking for another relative Engel’s law

The law may generally be translated by the following

hypotheses:

1. A stable relationship exists between certain types of

consumption (spending on personal upkeep for Engel,

spending on clothes and housing, with a unity elasticity, as

well as spending on comfort goods for Wright) on the one

hand, and individuals' or households' standards of living on

the other hand (indeed, Engel was interested, in the first

place, in the link between individual and household

spending, using scales of equivalence).

2. The income-elasticities of these types of spending are ranked,

with spending on personal upkeep being lowest.

As Stigler has pointed out, these hypotheses constitute the

first theoretical generalisation in economics made on the

basis of individual budget data.

Looking for another relative Engel’s law:

Discussing the law

Three questions may be asked regarding the

law:

1. Are the population's needs given and

stable, or do they depend on the socioeconomic changes individuals may

experience? In particular, do they change

with household income?

Looking for another relative Engel’s law:

Discussing the law

2. Does Engel's hypothesis cover change in income and

spending over time (in which case the law would

hold over time and be longitudinal in explaining

consumer choices)? Or does the law just allow for

comparisons in consumption behaviour by

differentiated social groups (it would then be a

cross-sectional law, involving all the social

mechanisms which differentiate the choices of social

groups). The first case, the law would apply to a

society experiencing growth and development, a

typically 18th and 19th century concept. In the

second case, the law would correspond to the usual

tests, on cross-section data, of hypotheses relating to

ranked needs.

Looking for another relative Engel’s law:

Discussing the law

3. Should changes in living standards which

affect the whole of a social group, to

which the individual or household

belongs, be distinguished from personal

changes? In other words, is there a

relative dimension to Engel's and

Wright's laws which would prove the

existence of social interactions within

reference groups which are to be

defined?

1.The endogeneity of needs

To address these vast issues, I draw on two articles

(Gardes-Loisy, 1995; Gardes-Merrigan, JEBO 2007)

which examine empirically the development of French

and Canadian household needs, using surveys and

pseudo-panels of family budgets. The results, common

to both sets of data, indicate an income elasticity of

needs in the order of 0.5 and often more. These

levels hold both for comparisons between poor and rich

households within the same period, as for changes in

income over time. This strong dependence only

partially proves Easterlin's proposition, which assumes

that needs develop at the same pace as growth, thus

cancelling out any contribution to utility derived from

growth. But it demonstrates at least that needs are

endogenous to certain demand explanatory variables.

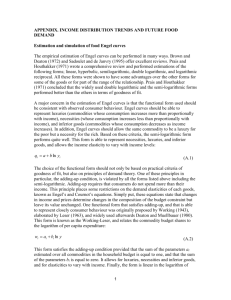

2.The endogeneity bias in crosssection estimations

When the parameters estimated from cross-section data differ from

those estimated using time-series data, then there may be an

endogeneity bias in at least one of the two estimations: for example,

the income elasticities of consumer spending on food are about 0.2

for cross-section data and 0.4 for time-series data in the

United States, and respectively 0.5 and 0.8 for Poland. Thus, a

forecast based on a survey estimation will significantly underestimate

changes in food consumption in both countries.

The explanation may lie in the improved quality of food, as Engel

points out in his second article. A way of calculating virtual consumer

prices and income elasticities of these prices is presented in Gardes et

al. (JBES, 2005). Applying this method to American and Polish data

yields elasticities of food price over relative income that are

significantly positive, with levels that are highly comparable

between the two countries: about unity in the United States

and 0.7 for Poland. This income-effect on food prices may be

explained by time constraints, which can be assumed to increase with

household income.

Relative Income Elasticity of Food Expenditures

PSID (U.S.)

Period

Polish panel

1987-90

Income Elasticity

CS

TS

CS

TS

Food at home

Food away from home

0.19

1.00

0.38

0.39

0.49

1.22

0.76

0.36

Direct Price Elasticity

1984-87

-0.19

-0.38

Elasticity of the Shadow (i) F.H. 1.00

Price Relative to Income(ii) F.A. –3.13

0.71

-4.78

Population Size

2430

Prices

by region and social category

3630

no

Reference: Gardes, Duncan, Gaubert and Starzec (JBES, 2005), Tables 1 and 2. Price elasticities are

calibrated, according to Frisch proposal, as minus half of the corresponding T.S. income elasticities.

1. Another relative Engel’s law: Simple

correlation

Table 1.

Correlation between Food Expenditures

and Relative Income

Survey

1987

0.496 0.495 0.444 0.668 0.526

Mean y

(my)

Specific y

(ys)

(0.036)

1988

(0.039)

1989

(0.034)

1990

(0.039)

average

(0.019)

11??? 0.499 0.443 0.551 0.506

(0.009)

(0.009)

(0.009)

(0.009)

(0.005)

Looking for another relative Engel’s law

Theory

Consider a model of consumption for individual h

at time t:

zht = Xht + uht with uht = h + ht

( 1)

Suppose that the estimation is performed on a

population H of individuals h = 1 to N, surveyed within

the whole population H (H H ). Sub-populations are

defined by crossing characteristics kj, j=1 to J such

that:Hi = {h H / kj(h)=cj(i) for all j} with cj(i)

taking all possible items or values for characteristics kj.

Hi is thus defined as Hi H.

Looking for another relative Engel’s law

Suppose that the first explanatory

variable is the logarithmic individual

income yh. The usual assumptions on the

distributions of income and specific

effects for individuals are made:

(H1) h Hi yh N(yi,2yi) and

h N(i,2i), i.i.d.,

with yi = E(yh|hHi), i = E(i |hH i) .

Looking for another relative Engel’s law

The average yi in Hi is computed by

regressing yh on the vector of characteristics K:

yHi = Kai + i so that yHi = 1/ni (hHi yh ) with ni

the number of individuals in Hi. So the distribution

of the empirical mean is: yHi N(yi,2yi/ni). The

specific income (which may be considered as the

relative income of individual h in its reference

population Hi ) is defined as ysh = yh - yHi so that

ysh N(0, 2yi - 2yi/ni).

By the same reasoning, Hi = 1/ni ( h )

and Hi N(i,2i /ni).

hH

i

A

V(y)

Looking for another relative Engel’s law

The covariance on individual data

between and some explanatory

variable y (here log-income or total

expenditures) can be decomposed into

the reference population components

and the true individual components:

A=E{(yh-Ey).( h-E)}

= E{ [(yHi-yi) + (yi-y) +ysh].[(Hi-i) +

i + h]}

Looking for another relative Engel’s law

This expression is shown in Appendix I to

reduce asymptotically to the sum of two of the

nine terms of its decomposition, so that

A/V(y)= = (b - w)panel

= p (b - w)

grouped data

+(1-p)

where p = V(YHi)/v(Y) and is the coefficient

resulting from the correlation between the specific

effect h of household h and its specific (relative)

income ysh: = ∂h/∂ysh.

Looking for another relative Engel’s law

(i) plim (hH ph.1Hi.(yHi-Eyi).(Hii))=plim (ihHi ph.(yHi-Eyi).(Hi-i))

=iplim pHi.plim (yHi-Eyi).plim

(Hi-i) =0 as plimyHi=Eyi=yi.

(ii) plim (hH ph.(yHi-yi).i)=ipi.plim

((yHi-Eyi).i))(Supii)ipi.plim (yHiEyi)=0.

Looking for another relative Engel’s law

Thus, this coefficient and its

standard error can be computed in

terms of the difference between the

estimates of on individual and

grouped data in the between and

within dimensions:

(h/ysh) =

{(b - w)panel - p.(b - w)grouped data}

Looking for another relative Engel’s law

Table 2. Income Elasticities and Relative

Income Effects

Food at Home

Food Away

Polish Panel

PSID

PSID

-0.1753

-0.0646

0.0202

σ

(0.0151)

(0.0097)

(0.0137)

Student for

11.60

2.09

Relative income Elasticity

0.655

0.532

1.36

1.616

Looking for another relative Engel’s law

Results

For food away, /ys is significantly positive,

which indicates that relatively rich households

have a greater budget share of food away

from home than the relatively poor. This is

another Engel law which describes the

relationship between food expenditure and

the household income measured relatively to

the consumption and income distribution of

its social class.

Looking for another relative Engel’s law

/ys are negative and significant for food at home,

both in US and Poland. It indicates a negative

Duesenberry effect on food at home consumption: a

household h which is relatively poor in its reference

population P2 (i.e. a household having a negative

specific income ysh) have a greater food budget share,

as a share of its income, than a relatively rich

household-belonging to another reference population

P1-which has the same total income and similar control

variables.

It should be noted that the relative income elasticity

for food at home is similar in both countries, contrary

to the income elasticities which are much greater for

Polish consumers, as would be expected.

A relative rich household and a relative

poor

Looking for another relative Engel’s law

The relative income elasticities for food at

home are greater than the between

elasticities, which indicates that these two

types of elasticity do not measure exactly the

same effects: the cross-section effect of

income differences does indeed contain

relative income effects, but they also contain

the influence of long term changes in the

average income of the reference populations

which may be recovered by comparing

relative income coefficients and the total

cross-section coefficients.

Section 3. The price effect of relative income changes:

Substitution effects between domestic activities and

market substitutes

The complete price for food at home and food away

from home depends on the opportunity cost for both

consumptions, so that it imparts a substitution

effect. This substitution is analyzed more generally

to compare the budget share for service in the U.S.

and in Europe.

Suppose that the complete price writes:

i = pmi + ti.

(5)

Optimal allocation of time for food

consumption

Opportunity cost for time:

ω = k(ymin/Tl) and ymin=K(Zh)yhβ

=> El(ω/y) = β ~ 0.6 if Tl is exogenous.

Consequence: ti = (pmi/){β/El(i/y) -1}

=> El (Tl/y) = - β

Micro-simulation of food budget share

Change of the French Food budget share for US

inequality:

dwfood = (∂w/∂ln i).El(i/y).dyr/yr = -0.74%

∂w/∂ln i=El(w/i).w = -0.49x0.146

(price-elasticity –O.49 computed by pairing family expenditures and Time use surveys)

El(i/y) = 0.5 (JBES, 2005)

dyr/yr = ln(4.76/3.87) = 0.207

4.76=(D9-D1)/D1 in the US

3.87=(D9-D1)/D1 in France

Change of the US Food budget share with French inequality:

dwfood = +1.22%

Conclusion

The estimation of the existence of Social Interactions is based on

the endogeneity bias, i.e. on the influence of permanent latent

variables on the household’s relative income (defined as its total

influence minus the common influence to all households

pertaining to the same reference group).

It does not correspond to the overall correlation between relative

income and consumption.

H

h\H

Wh = α + βyh + Zhγ + uh

|

|

Latent Variables