Thomas Lux - Global Systems Dynamics and Policy

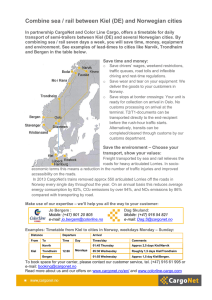

advertisement

Agent-Based Modelling and Economic Policy: Some Examples Thomas Lux Chair of Monetary Economics and International Finance CAU Kiel & Research Area “Financial Markets and Macroeconomic Activity” Kiel Institute for the World Economy Email: lux@bwl.uni-kiel.de, http://www.bwl.uni-kiel.de/vwlinstitute/gwrp/team/lux.html If we restrict ourselves to models which can be solved analytically, we will be modeling for our mutual entertainment, not to maximize explanatory or predictive power.“ HARRY M. MARKOWITZ, Nobel Laureate in Economics “.. Macro activity is essentially the result of the interactions between agents..” (Economist James Ramsey, 1996) Evidence for Success of Agent-Based Modelling? Areas outside Economics ABMs are the dominating new paradigm for modelling traffic flows ABMs are standard tool in epidemics research (with good coincidence of results between agent-based micro models and phenomenological macro models) Apparently, great interest in the U.S. Military and Homeland Security department... (modelling of combat, dispersed terrorist activity, impact of attacks on population etc.) Evidence for Success of Agent-Based Modelling? Appetizers from Our Research* Artificial Financial Markets: Explanation of the Stylized Facts of financial markets from interaction of heterogeneous investors Macro: Formation of animal spirits: Modelling of a process of social opinion formation, estimation of the model and use for forecasting Human behavior in economic decision problems: Replication and explanation of subjects‘ behavior in lab experiments via artificial agents (Work in progress: Interbank market) * partially from EU-STREP “Complex Markets” * Partly funded by EU-STREP Complex Markets Illustration I: The remarkable statistics of financial markets The important universal facts Returns are always bell-shaped, quite symmetric, but non-Normal Universal non-Gaussian behavior of large returns with scaling coefficient ~ -3 (risk management! No correlations in raw data, but long-lasting correlations in higher moments (fluctuations): hyperbolic decay of ACFs with universal parameter … Until recently: no trace of behavioral explanation Agent-Based Explanation different types of traders: "noise traders" and "fundamentalists" noise traders rely on: charts (price trend) and flows (behavior of others) - > mimetic contagion, herding traders compare profits gained by noise traders and fundamentalists and switch to the more successful group. External input: changes of fundamental factor Stylized Facts as Emergent Phenomena of Multi-Agent Systems Interacting Agent Hypothesis: dynamics of asset returns arise endogenously from the trading process, market interactions magnify and transform exogenous news into fat tailed returns with clustered volatility It suffices to take what we see in the market (e.g., chartist/fundamentalist behavior) -> mix of centripedal and centrifugal that can generate outcome undistinguishable from market statistics Artificial market German DAX Exchange rate DEM-$ returns = ln(pt) – ln(pt-1) Threshold for stability (in firstorder approx.) Example of the Dynamics: returns and simultaneous development of the fraction of chartists, z. The broken line indicates the critical value at which a loss of stability occurs. simple microscopic models generate surprisingly realistic market statistics (which are hard to explain by traditional models) qualitative features are robust with respect to the details of the artificial markets (e.g., simple straegies vs. artificially intelligent traders) towards policy: Use as test bed for market regulations (transaction tax, short selling constraints...) Simulated returns from market with artificially intelligent agents Example II: Empirical Animal Spirits Background and Motivation Survey data are mostly used to forecast key economic quantities (GDP, IP, stock prices), but are seldomly treated as endogenous variables What drives expectations expressed in surveys? Rational expectations vs. animal spirits RE tests typically negative, recent revival of interest in animal spirits (Akerlof and Shiller) Research question: Can we identify animal spirits at work? Can we identify the influence of social interaction on opinion formation? ____________________________________________________________________________________________________________________________________________________________ Thomas Lux Department of Economics University of Kiel Application II: Macro Sentiment ZEW Index of Economic Sentiment, 1991 – 2006, Monthly data, index = #positive - # negative, ca. 350 respondents ____________________________________________________________________________________________________________________________________________________________ Thomas Lux Department of Economics University of Kiel A Canonical Interaction Model à la Weidlich Two opinions, strategies etc: + and – A fixed number of agents: 2N Agents switch between groups according to some transition probabilities w↓ and w↑ v: frequency of switches, U: function that governs switches α 0, α1: parameters w v * exp(U ) w v * exp( U ) U 0 1x n n x 2N Sentiment index ____________________________________________________________________________________________________________________________________________________________ Thomas Lux Department of Economics University of Kiel Model and Conclusions opinion dynamics with social interaction + possible influence of external information estimation possible: econometric model motivated by agent-based model evidence for social interaction effects in ZEW index, no significant bias, slow development (v small) limited evidence of interaction with macro data interaction effects are dominant part of the model we can identify the formation of animal spirits and track their development 95% confidence interval from period-by-period predictions of model of opinion dynamics ____________________________________________________________________________________________________________________________________________________________ Thomas Lux Department of Economics University of Kiel Observation Xs, approximated by sharp Normal distr. Time interval [s, s+1] Predictive density at t+1 ____________________________________________________________________________________________________________________________________________________________ Thomas Lux Department of Economics University of Kiel Example III: Economic Behavior in Laboratory Experiments Subjects have to forecast the price in a market with many producers Subjects manage to arrive at the equilibrium price with some experience, but fluctuations remain surprisingly high Neither learning by representative agent nor heterogeneous beliefs with two groups explains all features of the experiments Research question: Can we replicate the experiments with y popolation of artificially intelligent agents? Yes, we can (in all respects) ____________________________________________________________________________________________________________________________________________________________ Thomas Lux Department of Economics University of Kiel RE prices, RE variance: 0.25 The setting: a = 13.8, b = 1.5, Var[εt] = Var[ηt/b] = 0.25, K = 6 subjects, varying slope parameter λ Illustration of experimental setting Experiments GA simulations Indication for appropriate models of human behavior Degree of heterogeneity of subjects, both in experiments (grey) and computer simulations (blue), averaged over 1,000 runs, Broken line: “rationality” prediction of economic theory Conclusions: Benefits of ABMs in Economics Bottom-up approach taking into account observed behavioral micro characteristics of agents Reality check/validation of ABMs via macro output Easy to combine with insights form other fields > socio-economic models, econo-environmental models Modularity: different levels can be chosen for different purposes: industry, single market, realfinancial sector, economy-wide ABM