SG - Fakulteta za matematiko in fiziko

advertisement

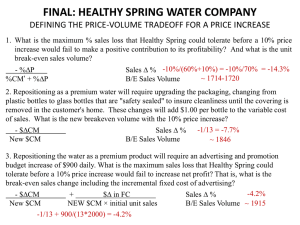

Laurent MORTREUIL - Financial division Jérôme BRUN - Market risk modelling 14 October 2011, Ljubljana, Fakulteta za matematiko in fiziko Basel II.5 : The regulators' reply to the limits of Value-at-Risk during the crisis C2 | Basel II.5 - the reply to VaR weaknesses 14 Oct 2011 | P.1 Introduction – What is a bank ? A bank is a financial institution that serves as a financial intermediary. As such, it is an organized community of persons, serving financial needs of people, communities and organisations. Banks face a number of risks in order to conduct their business, and how well these risks are managed and understood is a key driver behind profitability, and how much capital a bank is required to hold. Some of the main risks faced by banks include: Counterpartry risk: risk of loss arising from a borrower who does not make payments as promised. Liquidity risk: risk that a given security or asset cannot be traded quickly enough in the market to prevent a loss (or make the required profit). Market risk: risk that the value of a portfolio, either an investment portfolio or a trading portfolio, will decrease due to the change in value of the market risk factors. Operational risk: risk arising from execution of a company's business functions. Reputational risk: a type of risk related to the trustworthiness of business. The capital requirement is a bank regulation, which sets a framework on how banks and depository institutions must handle their capital. The categorization of assets and capital is highly standardized so that it can be risk weighted C2 | Basel II.5 - the reply to VaR weaknesses 14 Oct 2011 | P.2 Introduction – Relationship v/s transactionship Credit is the trust which allows one party to provide resources to another party where that second party does not reimburse the first party immediately (thereby generating a debt), but instead arranges either to repay or return those resources (or other materials of equal value) at a later date. Movements of financial capital are normally dependent on either credit or equity transfers. Credit is in turn dependent on the reputation or creditworthiness of the entity which takes responsibility for the funds. Credit is also traded in financial markets. Banking is at the crossroad of Time and Numbers It is based on Human Behaviors, therefore depending on Expectations, Uncertainties, Statistics. In order to make decisions, bankers rely on calculus, made possible by the development of Information Technologies, but based on strong mathematical assumptions which are often taken for granted. This is only sustainable if it is secured by regulation, and pedagogy, and if the purpose of the Institution is well preserved : serving the financial needs for the common good and the full development of the persons. C2 | Basel II.5 - the reply to VaR weaknesses 14 Oct 2011 | P.3 Introduction – what models for capital markets ? Since the 1990s, large flow of mathematicians to the trading floors • Roughly 100 students per year are trained specifically for mathematical finance in Paris Trigger : development of option market • With their 1973 paper on the pricing of simple call/put options, Black & Scholes launched option pricing theory • Option pricing is used for complex products with no observable price in the market • Expectations are taken under the risk-neutral probability, which differs from the historical/physical probability: model parameters implied from today prices of observable products Here we look at internal models • developped by banks to compute risk-indicators reflecting a global risk for the bank portfolio • Work under historical/physical probability: model parameters implied from historical series of prices of observable products Not be confused with other models • Forecasts • Trading Strategies (automats) • Etc. C2 | Basel II.5 - the reply to VaR weaknesses 14 Oct 2011 | P.4 A reminder on credit risk : issuer risk vs. counterparty risk Basel II.5 only deals with market risk, with an emphasis on issuer risk Issuer risk is the credit risk of • … the issuers of the bonds we hold • … the underlying issuer of the CDSs where we buy/sell protection Counterparty risk (RDC) is the credit risk of our counterparts for OTC derivatives • RDC is addressed by Basel III: CVA, VaR on EEPE, etc. Example: • hold a bond issued by XYZ, or buy CDS protection on XYZ: issuer risk • IR swap facing XYZ: counterparty risk C2 | Basel II.5 - the reply to VaR weaknesses 14 Oct 2011 | P.5 Regulatory context Up to now, RWA for market risk is based on VaR only The 2007-2009 crisis highlighted weaknesses of VaR July 2009: Basel Committee recommends new package capital charges = Basel II.5 • 3 new internal models added to VaR: Stressed VaR, IRC, CRM July 2010: European Parliament votes the 3rd Capital Requirements Directive = CRD3 • CRD 3 = “traders” compensation + transcription of Basel requirements • To be implemented before Q4 2011 C2 | Basel II.5 - the reply to VaR weaknesses 14 Oct 2011 | P.6 A reminder on VaR Perimeter = Trading Book Computation of the 1-day 99% VaR • Definition :1-day loss that is exceeded only in 1% of the days, i.e. « 2.5 » times per year (250 days) • SG uses historical approach: ▫ Apply to market parameters the 250 1-day shocks observed over the past year ▫ Compute the 250 P&L generated by these shocks VaR is the average between 2nd and 3rd worst • Other banks use parametric approach (« Monte-Carlo VaR ») ▫ Shocks on market parameters are generated from a model Link between VaR, Capital and RWA • Regulator requires 10-day VaR ~ (square root of 10) x (1-day VaR) • capital requirement = 10-day VaR x multiplier (>3, bank-specific, fixed by regulator) • RWA « RDM » = capital requirement x 12.5 Bottom line matters: • Realised P&L should be worse than VaR only 2-3 times per year • Multiplier directly impacted by number of breaches C2 | Basel II.5 - the reply to VaR weaknesses 14 Oct 2011 | P.7 VaR weaknesses and Basel reply Hard facts: too many VaR breaches • >20 for many banks in 2008 Weakness #1: Pro-cyclicality • VaR is small after a quiet year, high after a volatile year Stressed VaR (Shocks taken on a fixed, stressed period) Weakness #2: Impact of sudden defaults is not captured IRC (Incremental Risk Charge) + CRM (Comprehensive Risks Measure, specifically for exotic credit) C2 | Basel II.5 - the reply to VaR weaknesses 14 Oct 2011 | P.8 Perimeters impacted Before Q4 2011 Book without specific risk Book with specific risk (credit and equity) From Q4 2011 Book without specific risk Credit book Equity book “Securitisation” (= all tranches except correl) Correlation trading portfolio (CDO + CDS) Other credit (bonds and CDSs on corpo / fin / sov issuers) Standardised approach CRM IRC VaR x [3+] VaR x [3+] Stressed VaR x [4] C2 | Basel II.5 - the reply to VaR weaknesses 14 Oct 2011 | P.9 Stressed VaR Stressed VaR = VaR “calibrated to historical data from a period of significant financial stress” • Stress period must be “relevant to the firm’s portfolio” • Fixed period (to be updated yearly) • Typically : 2009 Very similar to VaR • Same risk horizon (10 days), severity (99%), perimeter, multiplier (x5) • Same computation, only the period for shock changes: 2007 2008 2009 Chosen 250 SVaR shocks 2010 2011 250 VaR shocks 01/10/2011 Portfolio / Market C2 | Basel II.5 - the reply to VaR weaknesses 14 Oct 2011 | P.10 10 IRC & CRM – general principles Capture P&L impact of rating migration and default • Longer horizon : 1-year risk horizon • High severity: 99,9% confidence level • 1 day VaR to be breached 2-3 times per year, IRC to be breached every millenium Perimeter • CRM Correlation trading portfolio: ▫ CDOs on corporate portfolios ▫ CDSs used as hedge • IRC All vanilla credit ▫ Bonds and CDS on corporates, financial and Sovereigns ▫ except CDSs used to hedge CDOs ! Risks covered • IRC & CRM: migration and default • CRM: also captures volatility of spreads, recovery rates, and credit correlations CRM impact subject to floor = 8% of standardized approach C2 | Basel II.5 - the reply to VaR weaknesses 14 Oct 2011 | P.11 11 IRC & CRM – focus on methodology Start with scenarios of correlated migrations on the 2000+ issuers in book • 99.9% = severity (every 1000 scenarios) need large number of scenarios ~1 million(vs. 250 for VaR) • Transition matrix gives probabilities of migrating or defaulting over 1y, as a function of current rating • Model ensures that migrations (and defaults) are correlated In each scenario, get migration or default for each issuer • E.g. : Peugeot: AAA, Renault: AAAA, Ford: BBDefault, etc. • Migrations are translated into spread moves, generating P&L • Names defaulting have a P&L equal to their Jump-to-Default • Need to reprice full credit perimeter for each of the 1 million scenarios ! ▫ In practice, we avoid full repricing via the use of sensitivities CRM specificities (for CDOs and their hedge) • Market moves are added to spread moves resulting from migrations. • These market moves must account for correlation between “credit” and market ▫ Expect spread widening in scenarios with many downgrades/defaults C2 | Basel II.5 - the reply to VaR weaknesses 14 Oct 2011 | P.12 12 IRC & CRM – illustration Focus on scenario 1 (red, downgrade) Final spread move in IRC results only from the migration from AA to BBB over the year Higher spread move in CRM, as the move coming migration is combined with the move of the BBB spreads C2 | Basel II.5 - the reply to VaR weaknesses 14 Oct 2011 | P.13 13 Summary of all internal models for market risk Perimeter Captured risk Model VaR Trading book All market risks Historical VaR (shocks over past year) SVaR Trading book All market risks Risk Severity Multiplier Prohorizon cyclical ? 10 days 99% [3+] Yes Historical VaR 10 days (shocks over “worst” year) 99% [3+] No Vanilla credit book Rating migration & Default Correlated migrations & defaults 1 year 99.9% 1 No CRM Exotic credit books Rating migration Correlated migrations & Dynamics for credit market parameters 1 year 99.9% 1 No IRC & Default & all market risks C2 | Basel II.5 - the reply to VaR weaknesses 14 Oct 2011 14 | P.14 Conclusion A revolution for the industry • RWA “market risk” x4 • Total RWA (incl. “operational risk” & “counterparty risk”) x1.5 Competitive distortion • US banks benefit from a 6-month delay on the implementation • Asian banks not concerned ? • Hedge funds (and brokers) will not be impacted Incentive at industry level to reshape their business model • Shift towards equity, IRD, FX, commos (but beware of liquidity ratio) • Alternatively, focus on activities eligible to regulatory banking book (govies…) ? C2 | Basel II.5 - the reply to VaR weaknesses 14 Oct 2011 | P.15 Conclusion Regulations tend to make our environment safer It also puts a burden on the service that society expects from financial institutions. But it will not ensure security without a dual change of perspective : • Humility versus figures and numbers (by understanding the limits of their relevance) • Personal commitment of all the actors (from providers to consummers) to use finance as a tool and not a goal ... C2 | Basel II.5 - the reply to VaR weaknesses 14 Oct 2011 | P.16