Autocorrelation in Time Series

advertisement

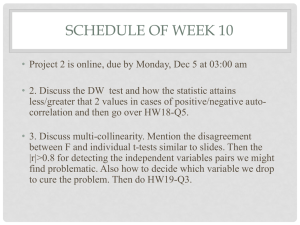

Autocorrelation in Time Series KNNL – Chapter 12 Issues in Autocorrelated Data • When error terms are correlated (not independent), problems occur when using ordinary least squares (OLS) estimates – Regression Coefficients are Unbiased, but not Minimum Variance – MSE underestimates s2 – Standard errors of regression coefficients based on OLS underestimate the true standard error – Inflated t and F statistics and artificially narrow confidence intervals Autocorrelated Errors (1st Order) t t 1 ut where ut uncorrelated disturbances (typically assumed to be normal) First-Order Model - I First-Order Autoregressive Model ( AR(1)) : Simple Regression: Yt 0 1 X t t t t 1 ut t 1,..., n autoregression parameter with 1 ut ~ N 0, s 2 and independent Generalizes to Multiple Regression: Yt 0 1 X t1 ... p 1 X t , p 1 t t t 1 ut t 1,..., n Properties of Errors (assumption regarding 1 for model consistency): s2 1 ~ N 0, 2 1 2 1 u2 E 2 E 1 E u2 0 s2 s2 2 s 2 s 1 s u2 s 2 1 1 2 2 2 2 2 s 2 Covariance: s 2 , 1 s 1 u2 , 1 s 2 s u2 , 1 s 2 0 1 2 2 Corrrelation: 2 , 1 s 2 , 1 s 2 s 1 2 s 2 1 2 s 2 s 2 1 2 1 2 2 First-Order Model - II In General: t t 1 ut t 2 ut 1 ut t 2 ut 1 ut ... s ut s 2 s 0 E t 0 s2 s 2s 2 2 2s s t s ut s s ut s s 1 2 s 0 s 0 s 0 2 2 ss 2 Covariance: s t , t s 1 2 Correlation: t , t s s s0 s0 1 2 1 2 s 2 σ 2 ε 1 2 1 n 1 n 2 n 3 AR(2) : t 1 t 1 2 t 2 ut n 1 n2 n 3 1 Even Higher or models can be fit as well. Test For Independence - Durbin-Watson Test Yt 0 1 X t1 ... p 1 X t , p 1 t t t 1 ut ut ~ NID 0, s 2 1 H 0 : 0 Errors are uncorrelated over time H A : 0 Positively correlated 1) Obtain Residuals from Regression 2) Compute Durbin-Watson Statistic (given below) 3) Obtain Critical Values from Table B.7, pp. 1330-1331 (R will provide a p-value) If DW d L p 1, n Reject H 0 n Test Statistic: DW e e 2 t 1 t t 2 If DW dU p 1, n Conclude H 0 n e t 1 2 t s 2 E t 0 E t t 1 1 2 n e e t 2 t t 1 2 s 2 e e 2 et et 1 2 e 2n 1 2 t 2 t 2 t 2 t 1 n n 2 t n 2 t 1 Under H 0 , expect DW 2 n 2 t Otherwise Inconclusive Autocorrelation - Remedial Measures • Determine whether a missing predictor variable can explain the autocorrelation in the errors • Include a linear (trend) term if the residuals show a consistent increasing or decreasing pattern • Include seasonal dummy variables if data are quarterly or monthly and residuals show cyclic behavior • Use transformed Variables that remove the (estimated) autocorrelation parameter (Cochrane-Orcutt and Hildreth-Lu Procedures) • Use First Differences • Estimated Generalized Least Squares Transformed Variables Suppose is known: Yt 0 1 X t t t t 1 ut Let Yt ' Yt Yt 1 0 1 X t t 0 1 X t 1 t 1 0 1 1 X t X t 1 t t 1 0 1 1 X t X t 1 ut Yt ' 0' 1' X t' ut (Standard Simple linear regression with independent errors) where: Yt ' Yt Yt 1 X t' X t X t 1 0' 0 1 1' 1 In Practice, we need to estimate with a sample based value r Yt ' Yt rYt 1 X t' X t rX t 1 ^ Fit: Y ' b0' b1' X ' and if errors are uncorrelated, back transform to: b0' Y b0 b1 X where: b0 1 r ^ s b0 s b0' 1 r b1 b1' s b1 s b1' Cochrane-Orcutt Method • Start by estimating in Model: t = t-1 + ut by regression through the origin for residuals (see below) • Fit transformed regression model (previous slide) • Check to see if new residuals are uncorrelated (DurbinWatson test), based on the transformed model • If uncorrelated, stop and keep current model • If correlated, repeat process with new estimate r based on current regression residuals from the original (back transformed) model n r e t 2 n e t 1 t e t 2 2 t 1 Hildreth-Lu and First Difference Methods • Hildreth-Lu Method – Find value of r (between 0 and 1) that minimizes the SSE for the transformed model by grid search – Apply the transformed analysis based on the estimated r • First Differences Method – Uses = 1 in transformed model (Yt’ = Yt – Yt-1 Xt’ = Xt – Xt-1 ) – Set b0’ = 0 and fits regression through origin of Y’ on X’ – When back-transforming: b0 Y b X ' 1 b1 b ' 1 Forecasting with Autocorrelated Errors Makes use of any of the 3 estimation techniques (C-O, H-L, First Differences): Yt 0 1 X t t t t 1 ut Yt 0 1 X t t 1 ut Yn 1 0 1 X n 1 n un 1 3 Elements: ^ 1. Expected Value: 0 1 X n 1 Estimated as Y n 1 b0 b1 X n 1 2. Multiple of period n Error Term: n Estimated as ren 3. Current disturbance un 1 ~ N 0, s 2 Forecast for period n 1 (note the notation is "Forecast", not F -distribution : ^ Fn 1 Y n 1 ren Standard Error of the Prediction (based on transformed model): ' X n 1 X ' 1 2 s pred MSE ' 1 n 2 n 1 X i' X ' i2 Approximate 95% PI: Fn 1 t 1 2 ; n 3 s pred (First Differences has n - 2 df)